Time Warner Cable today recommitted itself to providing unlimited broadband service to any customer that wants it, promising customers they won’t be forced into a tiered usage plan as long as Time Warner Cable remains an independent company.

Time Warner Cable today recommitted itself to providing unlimited broadband service to any customer that wants it, promising customers they won’t be forced into a tiered usage plan as long as Time Warner Cable remains an independent company.

“We have no intention of abandoning an unlimited product we think that something that customers value and are willing to pay for,” said Time Warner Cable CEO Robert Marcus. “The way we’ve approached usage-based pricing is to offer it as an option for customers who prefer to pay less because they tend to use less. And we’ve made those available at 5 gigabytes per month and 30 gigabytes per month levels.”

Marcus told Wall Street analysts on an afternoon conference call that the average Time Warner Cable customer now generates 35GB of traffic per month, and that a significant percentage of light users might realize some savings choosing a 30GB optional usage plan. But Marcus also admitted that few do.

Marcus

“I think that’s a testament to the value they place on unlimited,” said Marcus.

Marcus’ decision to stay away from compulsory usage-capped Internet was questioned by Marci Ryvicker from Wells Fargo Securities, LLC., a Wall Street investment firm. Ryvicker tied the growth of online video consumption to the implementation of usage caps as way of protecting video revenue and regaining money lost from lost cable television subscriptions.

“I guess the underlying question is do you think you can monetize the pipe enough through high-speed data pricing to offset video decline,” asked Ryvicker.

“We haven’t really viewed usage-based pricing quite the way you’re postulating,” responded Marcus. “I think there’s a separate question as to whether or not we have the ability to offset video declines with [broadband]. I think it’s fair to say we’re very bullish on the high-speed data business and think we can continue to grow it based on both subscriber volume and incremental ARPU per [broadband] customer.”

Marcus added that Time Warner can continue to boost revenue by raising broadband prices and encouraging customers to upgrade to faster speed tiers at a higher price.

Comcast has a very different philosophy about usage caps — it embraces them. Comcast continues to test mandatory usage caps in several markets, leading to howls of complaints from customers and bill shock. One customer complained their cable bill frightens them every time they receive it, not knowing how much Comcast would charge them for that month of service. The family’s last cable bill, including Internet, exceeded $560, primarily due to Comcast’s overlimit usage fees. Comcast has also received complaints about its usage meter’s accuracy, but the company adamantly bills customers according to the readings of their meter.

“I’ll tell you what really isn’t fair,” wrote one customer. “That is that in ‘test markets’ like mine, Atlanta, we have the 300GB [cap] enforced with the penalty overage charge and we pay the SAME rates as people in other markets that aren’t yet one of the ‘test markets.’

Most analysts expect Comcast will eventually roll out usage caps to all of its customers, including any it acquires from Time Warner Cable. Customers cannot choose an unlimited use option in Comcast’s usage cap test markets.

Subscribe

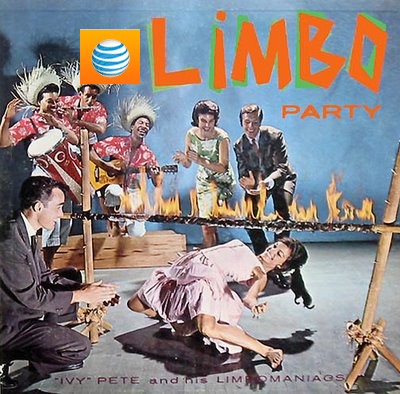

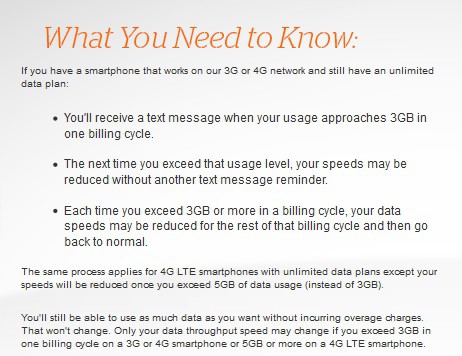

Subscribe The Federal Trade Commission today filed a lawsuit against AT&T for its practice of subjecting grandfathered unlimited data customers to speed throttles that dramatically cut speeds up to 90 percent after customers use more than 3GB of data on AT&T’s 3G network or 5GB on its 4G network. Thus far, according to the FTC, AT&T has throttled at least 3.5 million unique customers a total of more than 25 million times.

The Federal Trade Commission today filed a lawsuit against AT&T for its practice of subjecting grandfathered unlimited data customers to speed throttles that dramatically cut speeds up to 90 percent after customers use more than 3GB of data on AT&T’s 3G network or 5GB on its 4G network. Thus far, according to the FTC, AT&T has throttled at least 3.5 million unique customers a total of more than 25 million times.

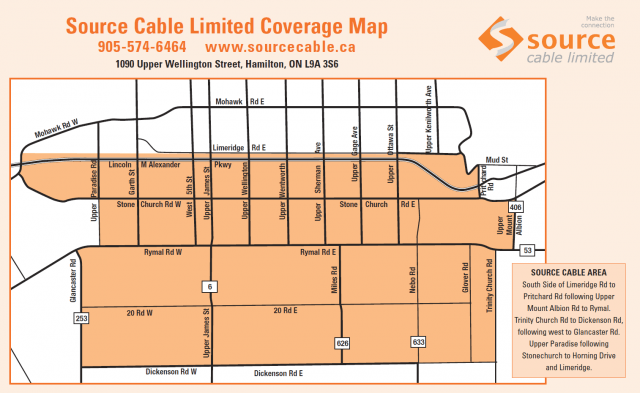

Rogers Communications will acquire Hamilton, Ont.-area independent Source Cable in a quiet $160-million deal.

Rogers Communications will acquire Hamilton, Ont.-area independent Source Cable in a quiet $160-million deal.

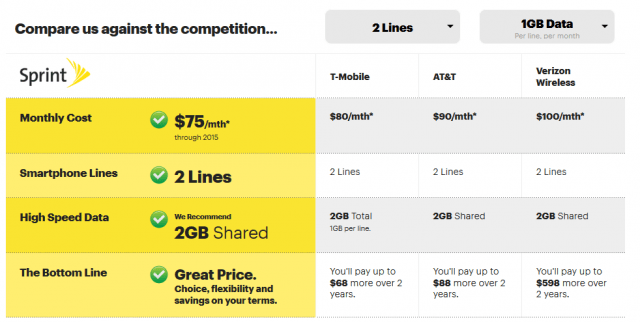

If your family budget cannot handle a $200 monthly cell phone bill from AT&T or Verizon and you can keep your data usage to around 1GB, Sprint has a deal for you.

If your family budget cannot handle a $200 monthly cell phone bill from AT&T or Verizon and you can keep your data usage to around 1GB, Sprint has a deal for you.