Consumers are increasingly cutting down their cable packages to keep their monthly bill down

Cable television customers have finally reached their limit. For years, annual rate increases well in excess of inflation have annoyed customers, but beyond complaining, few actually dropped service. That has begun to change as the economy, consumer debt, job fears, and other expenses have finally provoked customers to begin paring back on their cable package.

According to research from Centris, a consumer research organization, a virtual ceiling of tolerance for cable rate increases appears to have been reached for many subscribers. Although consumers are not dropping cable en masse, they are not simply accepting a higher bill either. They are dropping services from their cable package. In 2008 and 2009, premium movie channels and pay per view suffered most from customer downgrades. Consumers with multiple premium movie channels started by dropping one or two of them, and their use of pay per view service also dropped. As the financial impact of the recession wore on, the next round of rate increases caused additional erosion — by late 2009 many consumers discontinued all of their premium services.

The goal? To reduce or at least maintain a consistent monthly bill. The average amount consumers are paying for digital cable dropped from $79 a month in the third quarter of 2008 to $70 in the third quarter of 2009. That decline didn’t come from discounts from the industry — it came from dropping channels and services. In 2010, consumers are still pruning away, now impacting digital basic cable and smaller add-ons like sports and movie tiers. They are also phoning their provider threatening to cancel service altogether if additional discounts cannot be found. Cable operators, not surprisingly, have managed to find plenty of savings for consumers who ask and stand their ground, ready to walk away from cable.

The cable industry has sought to promote bundled services as an anti-erosion measure. It’s much harder to walk away from a provider supplying your television, Internet, and phone service, especially if they lock you into a multi-year service agreement with a cancellation fee. The savings promoted from bundled services come largely as a result of steeper price increases on standalone products and services, manufacturing “added value” for so-called “triple play” packages.

Some customers have divorced from pay television service altogether, deciding relentless price increases and the 500 channel universe shoveled in their direction just isn’t worth the price. For many American families, however, such drastic cord cutting would border on traumatic, and they haven’t managed such a drastic step.

Luckily, a growing number of consumers have discovered taking the Luddite approach to television entertainment isn’t a requirement any longer.

Cutting the Cord With Online Viewing

With the growing penetration of fast broadband service in homes across the country, online video has rapidly become one of the most popular online services, particularly when it’s available for free. The benefits don’t stop at the cost — programming catalogs are becoming increasingly deep and diverse allowing fans to watch entire seasons of shows on-demand, with a limited commercial load. A consumer looking for something to watch might easily find more entertainment online than wading through hundreds of cable channels of niche and re-purposed programming (and program length commercials).

Cable companies are well aware of the trend towards online video. First considered part-curiosity, part-piracy, today online video is provided by the major American networks, cable programmers, independent filmmakers, YouTube, and of course, Hulu. It isn’t just for those torrent sites anymore. And there is plenty of room for online video to grow.

The industry uses research companies like Centris to carefully track subscriber trends. They want to be out in front of any sea change in viewing practices that could impact their business model and their revenue, and avoid repeating the mistakes others made in ignoring a potential threat for too long.

Wall Street is well aware of the potential threat as well.

Craig Moffett, a cable industry analyst with Sanford C. Bernstein is among the most prominent trend-watchers for the cable industry. He sees some warning signs for the future.

Craig Moffett, a cable industry analyst with Sanford C. Bernstein is among the most prominent trend-watchers for the cable industry. He sees some warning signs for the future.

“Still no evidence of cord-cutting, but as prices spiral higher, the stresses on the system are unquestionably growing,” Moffett said.

So far, the cable industry has decided the best way to fight potential losses is to get into the game themselves on their terms. Comcast and Time Warner Cable, the nation’s largest cable operators, are launching their TV Everywhere concepts, which provide their broadband customers with online access to a myriad of cable programming, on demand, and currently for free. The catch? You must be a verified, current pay television customer. If you want to watch a basic cable show, you need a basic cable subscription. Want to watch Bill Maher online? You can, assuming you are a verified HBO premium television subscriber.

Comcast’s system is already up and running. Time Warner Cable is expected to roll out their system sometime this year.

The industry is even selling the public they applaud the online video experience as a win for customers. Time Warner Cable president and CEO Glenn Britt said, “TV Everywhere is an all-around win for those of us who love television. It will give our customers more control over content and allow them greater access to programs they are already paying for, while enhancing the distributors’ and networks’ robust business model that encourages the creation of great content.”

He didn’t say it also protects Time Warner Cable’s flank from cord-cutting. Lose the cable subscription and your access to online cable programming goes with it.

But the question remains, is that enough to protect cable television revenue?

The answer might be no.

[flv width=”400″ height=”380″]http://www.phillipdampier.com/video/Bloomberg Invasion of the Cable Killers 9-15-09.flv[/flv]

Bloomberg News reported on ‘The Invasion of the Cable Killers’ — new hardware that lets you bypass cable, back on September 15, 2009. (2 minutes)

The Coming Online Viewing War: The Players Assemble

Who owns and controls programming ultimately controls the distribution of it. Time Warner Cable took several shots at Fox a few weeks ago when threatened with the loss of Fox programming over a contract dispute. Alex Dudley, spokesman for Time Warner Cable, told NY1 viewers much of Fox’s programming is available online for the taking, so even if the network was thrown off the cable company’s lineup, viewers could simply bypass the dispute and watch online… for free. His message – the dollar value Fox places on its programming is diminished when it gives it away for free online.

The fact so much of network programming is available online for free is part of the dispute over how much cable operators should pay to carry networks on their cable systems. When the industry passes along those carriage fees to consumers, will that be the last straw for some who will drop their cable subscription and simply watch everything online?

“They’re the ones who are going to resist these price increases that the programmers are trying to push,” said Dudley. “One need look no further than the music industry for an example of what happens when consumers feel taken advantage of by an entire industry.”

Dudley’s remark is more telling than he realizes. The cable industry is well aware of what happened when the music and newspaper industry ignored nascent challenges to their business models like piracy or free access to their content. To cable operators, the music and newspaper industries’ online experiences are lessons to be learned and not repeated. The music industry waited too long to crack down on piracy and lost pricing power as consumers simply stole what they rationalized was overpriced. The newspaper industry failed to erect pay walls to control access to their content, and newspaper subscribers dropped print subscriptions to read everything online for free. Cable industry control of content and distribution is key to protecting their business model for pay television. More on that in a moment.

Now two other parties want to be heard on this matter — consumer electronics manufacturers and advertisers.

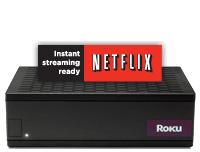

The Roku box is popular among Netflix subscribers who want to stream TV shows and movies to their television sets

This week, Advertising Age is running a story on the implications of cord-cutting.

The magazine takes note that online viewing doesn’t require a computer any longer. Samsung, Boxee, Apple TV, and even Microsoft, manufacturer of the XBox, are now selling devices that bypass cable television and grab online video for users, often for free.

Netflix has already managed that for a monthly fee, and is rolling out service on all sorts of devices, from a set top box that streams content from the web to your television to video game consoles, and now even builds-in the service to some televisions and Blu-Ray DVD players. Microsoft’s XBox Live service could be germinating a cable television service of its own, as it seeks to license content from programmers starting with Disney’s ESPN.

All of these services, along with traditional laptop or home computer viewing, could evolve into formidable challengers for the pay television industry. Oh, and some new televisions on offer at this year’s Consumer Electronics Show build in support for Skype, a Voice Over IP telephone service, so phone revenue could be at risk as well.

Advertising Age believes this could be one of the entertainment industry’s biggest business battles of the next few years as millions, if not billions of dollars are at stake.

For the moment, the public face of the debate is a combination of downplaying its potential impact while the players quietly position themselves and their assets for the fight certain to come.

Both Dudley and Britt at Time Warner Cable call the potential trend towards online viewing interesting, but not much of a threat at the moment.

“We see some interesting stuff out there, but right now people are watching more TV than ever; cable-cutting is largely on the fringe,” said Dudley.

“A lot of manufacturers have come out and made announcements, but I don’t think they really are in a position to erode the pay-TV subscriptions that the cable industry has today,” said Park Associates research analyst Jayant Dafari.

“For many people, cable works just fine; the quality is great; the DVR functionality is great; the only gripe they have is that they’re paying for it,” Boxee’s founder and CEO Avner Ronen told Advertising Age. But “there is a growing generation out there where the whole definition of entertainment is changing, and their main source of entertainment is the internet.”

[flv]http://www.phillipdampier.com/video/CNBC Wii At the Movies 1-13-10.flv[/flv]

CNBC covered last week’s announcement of a partnership between Nintendo and Netflix to provide Netflix on the popular Nintendo Wii, in this exclusive interview with Reed Hastings, chairman and CEO of Netflix and Reggie Fils-Aime, Nintendo of America president & COO (January 13, 2010 – 5 minutes)

‘If It Becomes A Problem, We’ll Just Cut Them Off‘

The cable industry is in a comfortable position to leverage its control over programming and distribution to ultimately limit any competitive threat from online viewing. In addition to mega-deals like Comcast’s acquisition of content-rich NBC-Universal (a partner in Hulu), the cable industry owns, controls, or can leverage carriage of its cable lineup contingent on programmers not giving away too much for free. Advertising Age:

One tech exec, who asked not to be named, predicted that the minute cable operators start to feel the disruption, they will clamp down and use their market power to keep TV and films from seeping into next-generation devices. They’re already putting the squeeze on networks; any free distribution is an argument for lower cable distribution fees.

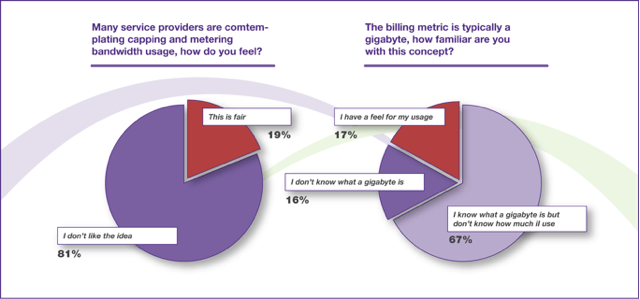

Stop the Cap! is also a player in this struggle, because a key component of the cable industry’s control of programming is the means it is distributed to consumers, and cable modem service representss one half of the duopoly most Americans find when shopping for broadband. One potential strategy to eliminating the cord-cutting option is to enact Internet Overcharging schemes like usage limits and consumption billing that effectively makes it impractical for a consumer to “switch” to broadband for all of their online viewing. Switching to the other half of the duopoly may not be an alternative. As online video projects like TV Everywhere will also be available to telco TV partners who wish to participate, there is every incentive to also limit video consumption on Verizon’s FiOS or AT&T’s U-verse systems.

Effective competition against entrenched players in the marketplace is impossible if those players control the content, the means of its distribution, and the ability to cut you off if you watch too much or switch to an independent competitor.

But this is history repeating itself. Many of the same players and interests followed the same protectionist path against another competitor – satellite television. It took strong regulatory policy from Washington to force a fair and level playing ground for an industry that didn’t want to sell content to its competitors, overcharged for access, and kept effective competition at bay for years, all while happily increasing rates for beleaguered consumers.

Here we go again.

Providers have a love-hate relationship with fiber optics. When confronted with a competitor rebuilding their network to provide fiber to customer homes, many providers lampoon and mock fiber’s capabilities, claiming it’s more light than substance. But when a provider itself wants to do fiber on the cheap, which means not actually providing true fiber-to-the-home service, they’ll bandy about marketing slogans like “100% fiber optic network” or “advanced fiber network.” Fiber is better, and those who have it want to promote it. Those that don’t want to pretend they do.

Providers have a love-hate relationship with fiber optics. When confronted with a competitor rebuilding their network to provide fiber to customer homes, many providers lampoon and mock fiber’s capabilities, claiming it’s more light than substance. But when a provider itself wants to do fiber on the cheap, which means not actually providing true fiber-to-the-home service, they’ll bandy about marketing slogans like “100% fiber optic network” or “advanced fiber network.” Fiber is better, and those who have it want to promote it. Those that don’t want to pretend they do.

Subscribe

Subscribe