Time Warner Cable is offering mobile phone providers a solution to their clogged wireless networks — clog ours instead!

Time Warner Cable is offering mobile phone providers a solution to their clogged wireless networks — clog ours instead!

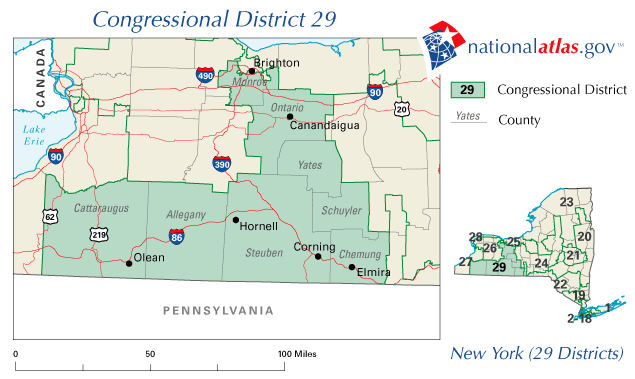

Business Week notes the cable company has been aggressively pitching its broadband network to cell phone companies in New York City, which can be used to transport cell phone calls and mobile data between cell towers and the providers’ operations centers. The “backhaul” network cell phone companies rely on to move calls and data between the cell tower nearest you and your provider’s distribution network is often the source of the worst bottlenecks, especially when those networks are connected by standard copper telephone wiring, as many still are.

The more customers sharing a low capacity copper line, the slower your data speeds and greater the chance for dropped calls. Although some providers have expanded their fiber capacity to reach busy cell towers, many more are still stuck with copper… until now.

Time Warner Cable’s offer to offload clogged cell phone networks onto the cable company’s broadband backbone has become extraordinarily profitable to the nation’s second largest cable operator.

In fact, it has become Time Warner Cable’s fastest-growing business after revenue tripled last year, Craig Collins, senior vice president of business services told Business Week.

We are talking $3.6 billion dollars in revenue in 2012 from wireless carriers alone, according to researcher GeoResults, Inc.

“Backhaul is a growth play that we are pursuing aggressively,” Collins said. “These mobile players want to get the bandwidth they need at a cost-effective price and our structure allows them to get that pretty seamlessly.”

U.S. smartphone use has grown almost 700 percent in four years, according to the U.S. Federal Communications Commission. Mobile-data volume is more than doubling annually as people use devices like the iPhone, BlackBerry and Google Inc.’s new Nexus One to send photos, watch videos and surf the Web. When networks jam, consumers face dropped calls and may find they can’t access Web pages or TV, analysts said.

The coming "exaflood" doesn't seem to worry Time Warner Cable, except when profits from consumers are at stake

Apparently the “exaflood” scare theory that suggests broadband networks are becoming hopelessly clogged does not apply to Time Warner Cable, because the company easily found plenty of free bandwidth in metropolitan New York City to profit from wireless phone traffic.

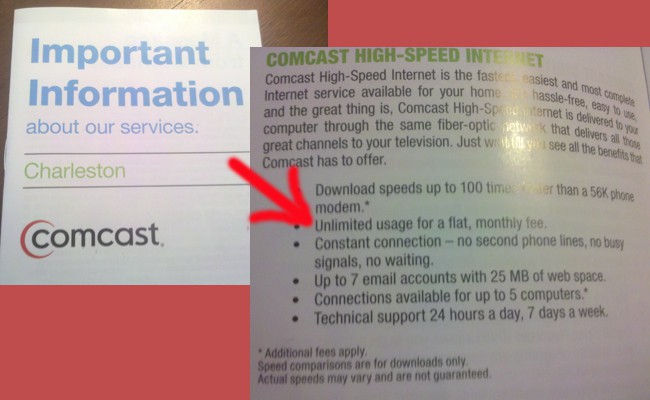

Not to be outdone, Comcast expects $1 billion from the wireless backhaul gravy train over time, according to its February 3rd conference call with investors. Comcast is in a unique position to help ease congestion in San Francisco, where the cable operator provides service to some of the same customers who wander the city with Apple iPhones on AT&T’s overclogged Bay Area network.

Time Warner Cable CEO Glenn Britt doesn’t want to limit the potential revenue to just the wireless big boys — he wants to offer service to carriers large and small:

While Time Warner Cable declined to specify if AT&T, the lone U.S. carrier for the iPhone, is a customer, the New York- based cable company says it wants to sign carriers large and small. Chief Executive Officer Glenn Britt alluded to AT&T’s extra iPhone traffic in a December conference call.

“They want to get that into a cable as fast as they can,” Britt said, referring to overloads. His company began leasing backhaul in 2008 and posted $26 million in sales last year, less than 1 percent of the company’s total sales. Collins declined to give a forecast for 2010.

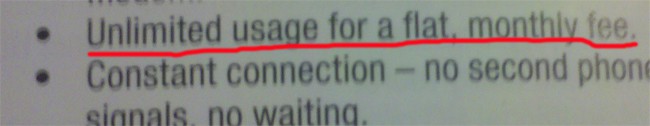

All this, of course, comes ironically to those Time Warner Cable customers who were subjected to Internet Overcharging experiments from Time Warner Cable just about one year ago. Apparently, the exaflood only applies to consumers who face enormous broadband pricing increases and/or usage limits because of “overburdened” broadband networks.

Not so overburdened that the company can’t make room for billions in new earnings from cell phone companies, of course.

[flv width=”640″ height=”500″]http://www.phillipdampier.com/video/Bloomberg Moffett Says ATT May Need Cable to Ease Network Jams 3-8-10.flv[/flv]

[Video Fixed!] Craig Moffett discusses wireless smartphone data usage trends and Time Warner Cable’s involvement in transporting mobile phone and data across its cable broadband network (5 minutes)

Subscribe

Subscribe