Otero

When a former labor leader suddenly starts advocating for the interests of AT&T and other super-sized telecommunications companies, even as AT&T’s unionized work force prepared to strike, the smell of Big Telecom money and influence permeates the air.

Jack Otero, identified in the Des Moines Register as “a former member of the AFL-CIO Executive Council and past national president of the AFL-CIO’s Labor Council for Latin American Advancement,” penned a particularly suspicious love letter to deregulation that might as well have been written by AT&T’s director of government relations:

[…]Industries — like broadband Internet — are thriving and creating innovations. Tossing a regulatory grenade into these businesses could wreck markets that create value for consumers and jobs for workers.

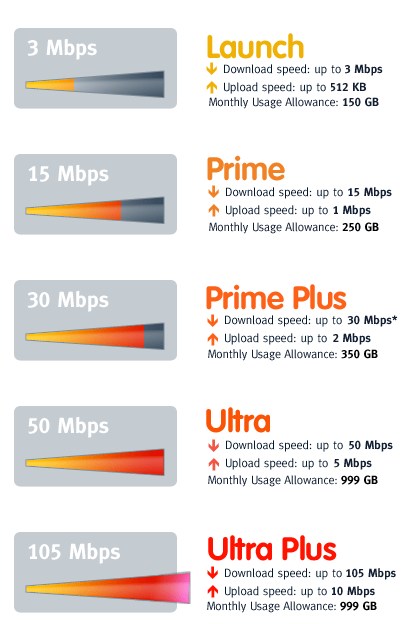

The United States is one of the most wired nations in the world. More than 95 percent of households have access to at least one wireline broadband provider, and the vast majority can connect at speeds exceeding 100 Mbps. And monthly packages start as low as $15. That means more families can go online to improve their job skills, look for work or help the kids with their school assignments.

More choices and higher speeds — the signs of a vibrant market — are the product of private investment, not public dollars. Internet service providers have invested over $250 billion in the last four years alone. This has created roughly half a million jobs laying fiber-optic and coaxial cable.

But some squeaky wheels are demanding heavy-handed regulations that would move our broadband Internet to the European model, where taxpayers have to subsidize outdated networks with slow speeds. Some want broadband providers to be required to lease their networks to competitors at discounted prices — as they do in Europe. But lawmakers in both parties agree that this policy, tried in the 1996 Telecommunications Act, failed miserably.

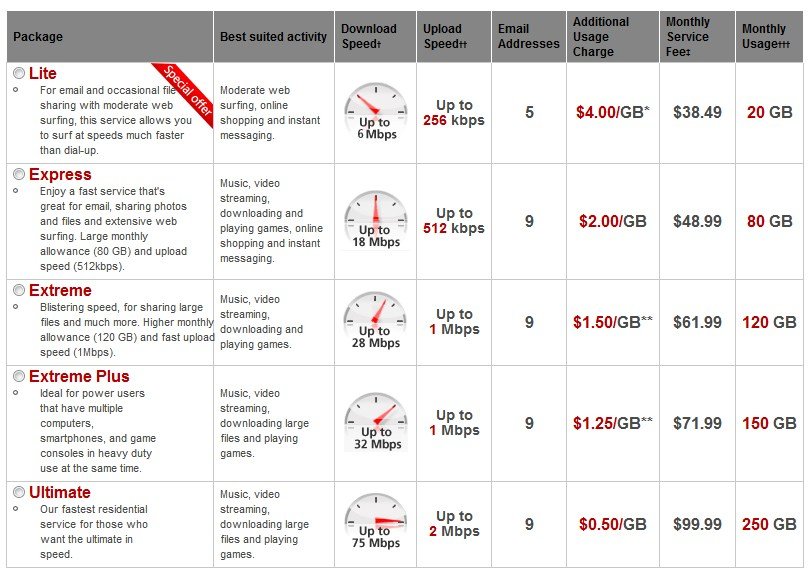

Others argue that broadband Internet providers should not be able to impose a small surcharge on the tiny percentage (less than 1 percent) of consumers who download hundreds of movies and tens of thousands of songs every month — effectively the data usage of a business. They say these fees discriminate against online video companies like Netflix. But that’s silly. More than 99 percent of users can watch plenty of Apple TV or Netflix without approaching the lowest data allotment. Without tiered pricing plans, the rest of us would have to underwrite these super-users.

Okay then.

Otero’s Fantasy World of Broadband sounds great, only it does not exist for the vast majority of Americans. Are most of us able to connect at speeds exceeding 100Mbps?

If you happen to live in a community served by a publicly-owned broadband provider Otero effectively dismisses, you can almost take this fact for granted.

Some of America’s most advanced telecommunications providers are actually owned by the public they serve in dozens of communities small and large. EPB Fiber, Greenlight, Fibrant, Lafayette’s LUS Fiber, among others, deliver super-fast upload and download speeds at very reasonable prices while the giant phone and cable companies offer less service for more money.

Some of America’s most advanced telecommunications providers are actually owned by the public they serve in dozens of communities small and large. EPB Fiber, Greenlight, Fibrant, Lafayette’s LUS Fiber, among others, deliver super-fast upload and download speeds at very reasonable prices while the giant phone and cable companies offer less service for more money.

The only major telecommunications company with a wide deployment of fiber-to-the-home service is Verizon Communications.

You cannot easily buy residential 100Mbps service from Time Warner Cable, AT&T, CenturyLink, Frontier, FairPoint, or a myriad of other telecom companies at any price, unless you purchase an obscenely expensive business account. From the rest, 100Mbps service typically sets you back $100 a month.

Otero’s quote of affordable $15 broadband is not easy to come by either. It usually requires the customer to qualify for food stamps or certain welfare programs, have a family with school-age children, a perfect payment history, and no recent record of subscribing to broadband service at the regular price.

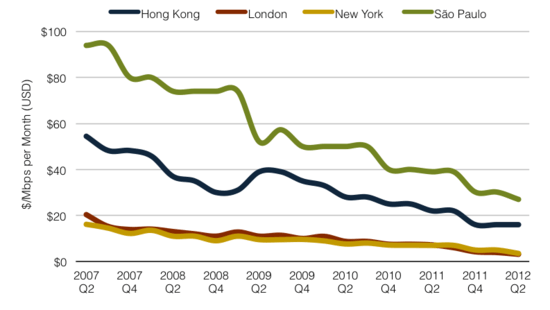

The only people who believe America is the home of a vibrant market for broadband service are paid employees of telecom companies, paid-off politicians, or their sock-puppet friends and organizations who more often than not receive substantial contributions from phone or cable companies. The fact is, the United States endures a home broadband duopoly in most communities — one cable and one phone company. They charge roughly the same rates for a level of service that Europe and Asia left behind years ago. Broadband prices keep going up here, going down there.

Simply put, Mr. Otero and actual reality have yet to meet. Consider his nonsensical diatribe about the impact of the “heavy-handed” 1996 Telecommunications Act, actually a festival of mindless deregulation that resulted in sweeping consolidation in the telecommunications and broadcasting business and higher prices for consumers.

Otero is upset that big companies like AT&T and Verizon originally had to open up their networks in the early 1990s to independent Internet Service Providers who purchased wholesale access at fair (yet profitable) prices. Those fledgling ISPs developed and marketed third-party Internet service based on those open network rates. Remember the days when you could choose your ISP from a whole host of providers? In some markets, this tradition carried forward with DSL service, but for most it would not last.

The telecommunications industry managed to successfully lobby the government and federal regulators to change the rules. Phone companies did not appreciate the fact they had to open their networks for fair access while cable operators did not. So in 2005, the FCC allowed both to control their broadband networks like third world despots. Competitors were effectively not allowed. Wholesale access, where available, was priced at rates that usually guaranteed few ISPs would ever undercut the cable or phone company’s own broadband product.

The lawmakers who believed open networks represented awful policy were almost entirely corporate-friendly or recipients of enormous campaign contributions from the telecom companies themselves.

So which market is actually on the road to failure?

The LCLAA couldn’t do enough to help AT&T swallow up competitor T-Mobile USA.

The American broadband business model is a firmly established duopoly that charges some of the world’s highest prices and has rapidly fallen behind those “failures” in Europe.

In the United Kingdom, BT — the national phone company, is required to sell access at the wholesale rates Otero dismisses as bad policy. As a result, UK consumers have a greater choice of service providers, and at speeds that are increasingly outpacing the United States. Nationally backed fiber to the home networks in eastern Europe and the Baltic states have already blown past the average speeds Americans can affordably buy from the cable company.

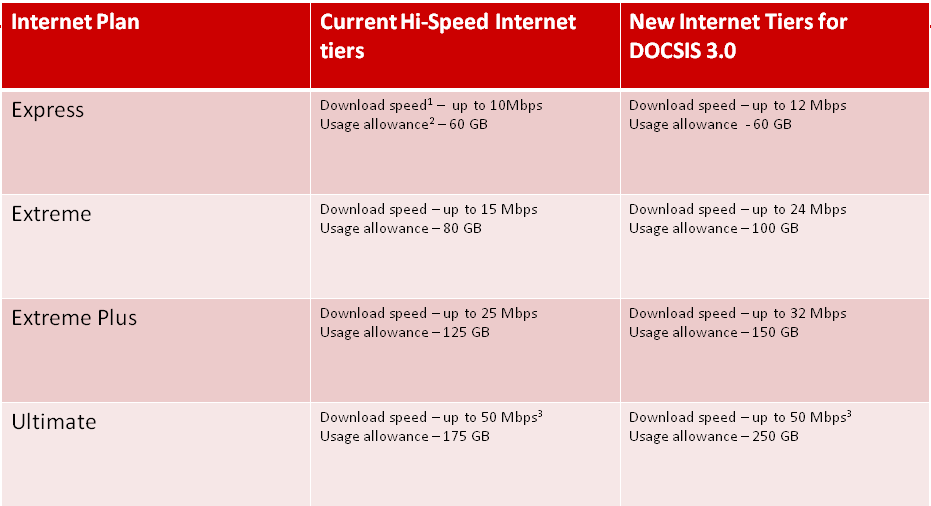

Even Canada requires Bell, the dominant phone company, to open its network to independent ISPs selling DSL service. Without this, Canadians would rarely have a chance to find a service provider offering unlimited, flat rate service.

Otero’s final, and most-tired argument is that data caps force “average” users to subsidize “heavy” users. In fact, as Stop the Cap! reported this week, that fallacy can be safely flushed away when you consider the largest ISPs pay, on average, just $1 per month per subscriber for usage, and that price is dropping fast. The only thing being subsidized here is the telecom “dollar-a-holler” fund, paid to various mouthpiece organizations who deliver the industry’s talking points without looking too obvious.

The Des Moines Register omitted the rest of Mr. Otero’s industry connections. We’re always here to help at Stop the Cap!, so here is what the newspaper forgot:

- Mr. Otero is a board member of Directors of the U.S. Hispanic Leadership Institute (USHLI), a group funded in part by AT&T and Verizon;

- He is the past president of the Labor Council for Latin American Advancement, a group that enthusiastically supported the anti-competitive merger of AT&T and T-Mobile USA;

Mr. Otero has a side hobby of penning nearly identical editorials with largely these same broadband talking points. One wonders what might motivate him into writing letters to the Des Moines Register, the Lexington Herald-Leader, the Gainesville Sun, the Star-Banner, and the Ledger-Inquirer.

Otero may have a case for plagiarism, if he chooses to pursue it, against Mr. Roger Campos, president of the Minority Business RoundTable (the top cable lobbyist, the National Cable & Telecommunications Association is labeled an MBRT “strategic partner” on their website). Campos uses some of the exact same talking points in his own “roundtable” of letters to the editor sent to newspapers all over the place, including the Ventura County Star, the Leaf Chronicle, and the Daily Herald.

America’s worst-rated cable company is facing an apparent customer backlash on two fronts — its introduction of usage caps and at least one disgruntled unidentified citizen who mailed Mediacom a white powdery substance that forced a temporary closure of one hospital and left two Mediacom employees and two Washington County, N.C. sheriff’s deputies quarantined Wednesday.

America’s worst-rated cable company is facing an apparent customer backlash on two fronts — its introduction of usage caps and at least one disgruntled unidentified citizen who mailed Mediacom a white powdery substance that forced a temporary closure of one hospital and left two Mediacom employees and two Washington County, N.C. sheriff’s deputies quarantined Wednesday. In fact, the largest costs Mediacom faced included:

In fact, the largest costs Mediacom faced included:

Subscribe

Subscribe