Plateau Wireless customers can expect to be eventually herded to Verizon Wireless’ all or nothing plans as early as 2013.

Verizon Wireless this week announced the acquisition of another regional wireless carrier — Plateau Wireless — formerly owned by the Eastern New Mexico Rural Telephone Cooperative. At risk are the co-op’s innovative and inexpensive calling and unlimited smartphone data plans for customers in communities like Roswell, Carlsbad, Artesia, and Hobbs.

Verizon’s purchase includes the co-op’s cellular, PCS, and AWS wireless spectrum that covers more than 26,000 square miles in eastern New Mexico.

“We are excited to expand our presence and coverage in rural New Mexico and to welcome Plateau Wireless’ customers to the nation’s most reliable network. We believe the strength of our network enables people to live better and stronger lives,” said Andres Irlando, president of Verizon Wireless’ southwest region.

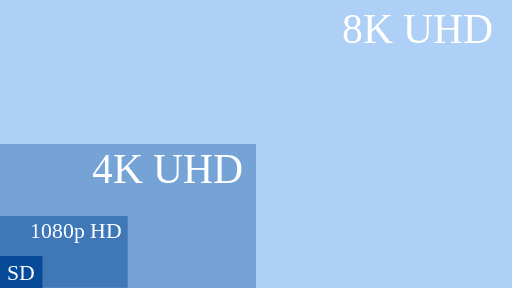

Customers’ bank accounts may not have the strength to withstand the pricing and technology changes Verizon has in store as early as 2013. Plateau’s current GSM network will be dismantled as Verizon converts the network to CDMA for voice service and EV-DO (3G) and LTE (4G) for data services, leaving customers’ current smartphones and handsets useless. Verizon has not said whether it will provide free replacement equipment to Plateau customers at the time of the network conversion.

More importantly, Plateau Wireless’ current service plans, which include numerous options for customers on tight budgets — are destined for the scrap heap as the company unleashes its all-or-nothing contract service plans.

The most important service at risk is Plateau’s unlimited data plan. The company charges customers $29.99 a month for unlimited smartphone data when inside Plateau’s home coverage area. Customers on family plans have an even better deal. They can extend unlimited data to every other phone on the account for a flat additional fee of $10/month. For just under $40 a month total, four family members each with their own smartphones or other wireless devices can have unlimited data when bundled with a calling plan starting at $19.99 a month ($9.99 for each additional line).

The same data plan under Verizon Wireless’ Share Everything Plan costs $220 a month for four phones, but it is not unlimited. All four users have to share a collective allowance of just 2GB of data per month.

Remember when your cell phone company offered you calling plans that fit your budget instead of their desired bottom line? Plateau Wireless still does, for the moment:

All Plateau Wireless Plans are eligible for the Family Plan and Data Features. Unlimited text messaging is $4.95 a month. Carryover of unused minutes to future months and free loyal customer minutes available.

| Home Minutes | Unlimited Night & Weekends |

Unlimited Mobile-to-Mobile |

Call Forward | 3-Way Calling | Voice Mail | Additional Details | Price | |

|---|---|---|---|---|---|---|---|---|

| Local 200 | 200 | $19.95 | ||||||

| Local 300 | 300 | 300 min | $29.95 | |||||

| Local 1000 | 1000 | $39.95 | ||||||

| Local 1300 | 1300 | $59.95 | ||||||

| Local 1700 | 1700 | $79.95 | ||||||

| Local 2000 | 2000 | $99.95 | ||||||

| Local Gold | UNLIMITED | $99.00 |

Plateau Wireless’ customers will have to decide for themselves whether Verizon’s acquisition is good or bad news for them.

Earlier this month, the Federal Communications Commission awarded nearly $9.5 million to Plateau to expand 3G and 4G service in central and southeastern New Mexico over the next three years. Verizon Wireless can use the funds to effectively expand their network in the area at taxpayer expense.

Subscribe

Subscribe