Windstream Holdings, Inc. filed bankruptcy this afternoon, citing its inability to cover $5.8 billion in outstanding debt.

Windstream Holdings, Inc. filed bankruptcy this afternoon, citing its inability to cover $5.8 billion in outstanding debt.

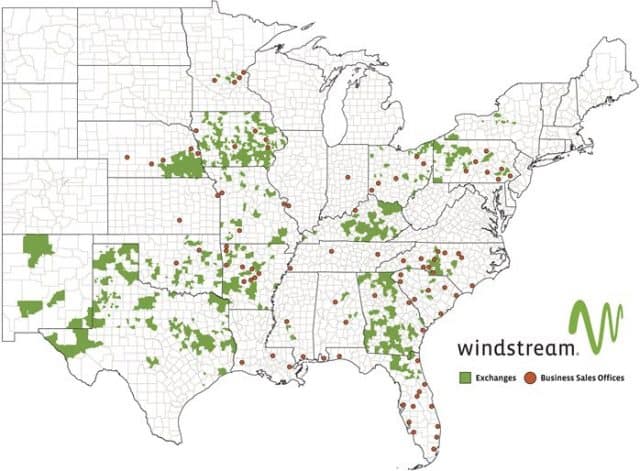

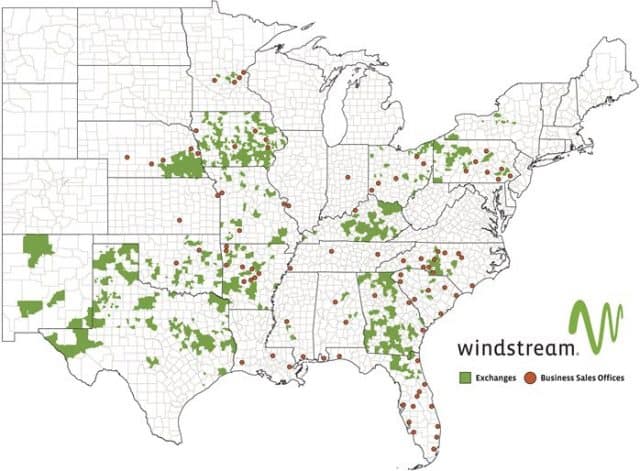

The independent phone company, which provides legacy landline and broadband service to around 1.4 million customers in 18 states, filed voluntary to reorganize under Chapter 11 of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the Southern District of New York, citing a judge’s decision almost two weeks ago that the company defaulted on its obligations.

“Following a comprehensive review of our options, including an appeal, the Board of Directors and management team determined that filing for voluntary Chapter 11 protection is a necessary step to address the financial impact of Judge Furman’s decision and the impact it would have on consumers and businesses across the states in which we operate,” said Tony Thomas, president and chief executive officer of Windstream. “Taking this proactive step will ensure that Windstream has access to the capital and resources we need to continue building on Windstream’s strong operational momentum while we engage in constructive discussions with our creditors regarding the terms of a consensual plan of reorganization.”

Windstream received a commitment from Citigroup Global Markets Inc. for $1 billion in debtor-in-possession (“DIP”) financing. Assuming a bankruptcy judge approves of the arrangement, Windstream claims this stop-gap financing will allow it to run its current business as usual.

Windstream provides residential service in 18 states including: Alabama, Arkansas, Florida, Georgia, Iowa, Kentucky, Minnesota, Mississippi, Missouri, Nebraska, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, South Carolina and Texas.

The company claims it was forced into bankruptcy after a judge found Windstream’s attempt in 2015 to shift its valuable fiber optic network assets off its own books into a sheltered real estate investment trust (REIT) named Uniti Group violated the rights of bondholders which hold some of Windstream’s debt. Those debts are backed, in part, by the valuable fiber optic assets Windstream had spun them off to a new entity. In fact, Uniti’s fiber optic assets are essential to Windstream’s viability. The phone company has the exclusive right to use Uniti’s fiber assets and two-thirds of Uniti’s revenue comes from Windstream, making the two companies inseparable.

Windstream’s bankruptcy is a concern to investors of both companies because it will allow Windstream to renegotiate the terms of its contract with its fiber partner. Windstream customers are equally concerned because the phone company needs Uniti’s network to manage its broadband service.

The judge’s decision on Feb. 15 to declare the arrangement inappropriate was reportedly a shock to the investor community, which has made money buying repackaged corporate debt in the form of bonds for years. Corporations have issued bonds to retire older debt, while giving investors a piece of the action. Since investors are making money, they typically do not complain too loudly about the persistence of corporate debt, frequently repackaged in new bonds. As a result, companies can hold onto more cash used to pay shareholder dividends and executive compensation instead of permanently retiring debt.

Aurelius, a hedge fund, is making some of its money scrutinizing these arrangements looking for contract violations such as the Uniti spinoff. When it finds one, it takes a stake in the company and then threatens to sue as a harmed investor. Based on the judge’s decision, Aurelius won a judgment that will effectively empty the pockets of many of the bondholders and investors that could lose a lot of their investments because of the bankruptcy. If the hedge fund is going to actively seek other questionable arrangements or violations of bondholders’ rights at other companies, it could cause an earthquake in an investment community that has quietly conspired with companies to generate transactions that enrich investors while allowing companies to carry more debt.

Customers could end up covering some of the costs of today’s bankruptcy filing if Windstream files a plan with the Bankruptcy Court promising to raise prices to help it demonstrate ongoing viability.

Windstream’s Thomas complained the phone company is little more than a victim of a predatory hedge fund out to enrich itself at the expense of others.

“The company believes that Aurelius engaged in predatory market manipulation to advance its own financial position through credit default swaps at the expense of many thousands of shareholders, lenders, employees, customers, vendors and business partners,” Thomas said. “Windstream stands by its decision to defend itself and try to block Aurelius’ tactics in court. The time is well-past for regulators to carefully examine the ramifications of an unregulated credit default swap marketplace.”

Subscribe

Subscribe

Windstream Holdings, Inc.

Windstream Holdings, Inc.

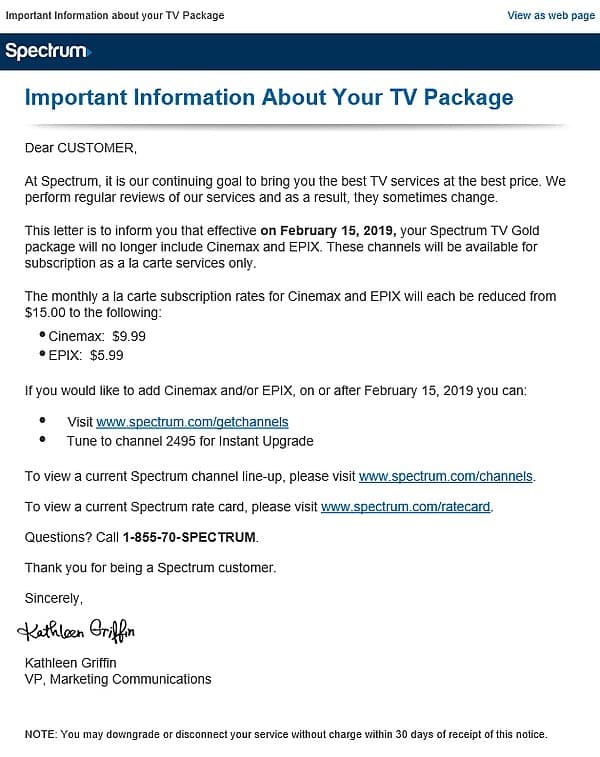

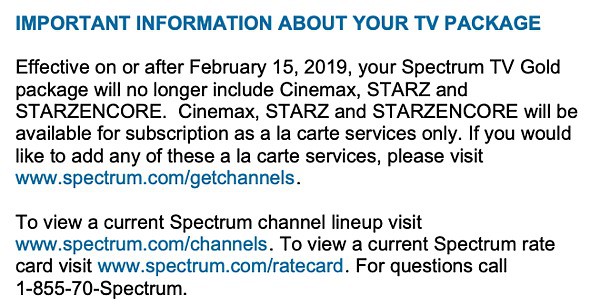

Spectrum cable television customers with Silver or Gold tiers will find two premium channels have disappeared from channel lineups, with no corresponding decrease in rates.

Spectrum cable television customers with Silver or Gold tiers will find two premium channels have disappeared from channel lineups, with no corresponding decrease in rates.

Spectrum Silver (includes TV Select — add $20 a month)

Spectrum Silver (includes TV Select — add $20 a month) Spectrum Gold (includes TV Select and TV Silver — add $40 a month)

Spectrum Gold (includes TV Select and TV Silver — add $40 a month)

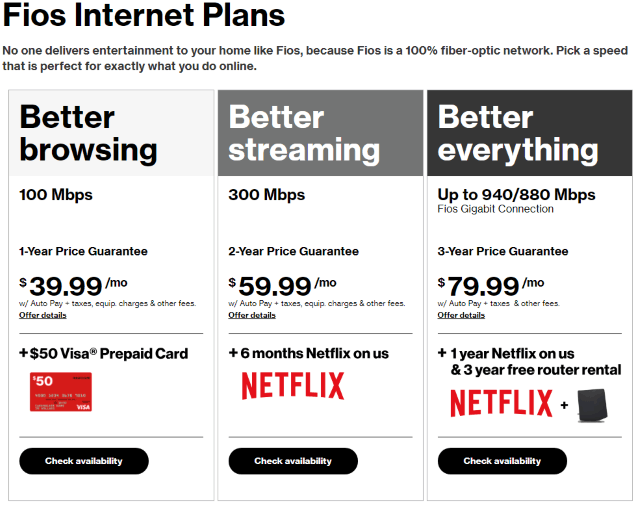

Those new or existing customers looking for faster internet-only service can choose the 300 Mbps plan for $20 more — $59.99 a month, pricelocked for two years. This plan includes six months of Netflix Premium, which supports Ultra High Definition (UHD/4K) streaming and allows up to four devices to stream at the same time. This is a $15.99/month value. These prices do not include the $12/month router charge, fees or taxes.

Those new or existing customers looking for faster internet-only service can choose the 300 Mbps plan for $20 more — $59.99 a month, pricelocked for two years. This plan includes six months of Netflix Premium, which supports Ultra High Definition (UHD/4K) streaming and allows up to four devices to stream at the same time. This is a $15.99/month value. These prices do not include the $12/month router charge, fees or taxes.