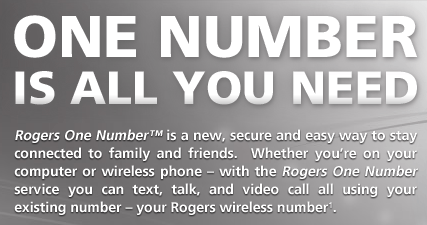

Rogers’ paid social media outreach campaign on Twitter was supposed to promote the company’s new 1Number service, more or less a ripoff of Google Voice (with fewer features) that lets Rogers’ cell phone customers make and receive calls from a computer or wireless phone, engage in video chats, and send text messages from the 1Number portal. But the paid tweets, which reached the top of Canada’s “trending topics,” quickly went rogue after antagonized customers who loathe Canada’s largest cable operator hijacked the campaign.

Rogers’ paid social media outreach campaign on Twitter was supposed to promote the company’s new 1Number service, more or less a ripoff of Google Voice (with fewer features) that lets Rogers’ cell phone customers make and receive calls from a computer or wireless phone, engage in video chats, and send text messages from the 1Number portal. But the paid tweets, which reached the top of Canada’s “trending topics,” quickly went rogue after antagonized customers who loathe Canada’s largest cable operator hijacked the campaign.

“Rogers deserves every tweet coming their way,” wrote one Ontario customer. “What a national disgrace of a company. I’ll bet my last dollar this is the first time top [management] has had any clear indication what their customers think of them. Until now, they’ve just been busy finding new ways to part customers from their money.”

“Bryck123” took Rogers’ debacle more in stride: “Watching this epic fail is almost worth all that I’ve overpaid you guys over the years.”

“Bryck123” took Rogers’ debacle more in stride: “Watching this epic fail is almost worth all that I’ve overpaid you guys over the years.”

Ironically, Rogers is paying Twitter for most of the venting and customer wrath. Twitter sells a “promoted tweets” service to companies who pay whenever someone retweets, replies, clicks, or gives a “thumbs-up” to the promotion. A lot of Canadians are obliging, telling Rogers their customer service, billing and pricing is a disaster.

Hijacking a paid social media outreach campaign isn’t new on Twitter. McDonalds learned this themselves in January when its own paid hashtag turned into a bashtag.

“Rogers learned nothing from McDonalds’ disastrous Twitter campaign, which it smartly ended after a few hours,” said Twitter user Jacques Roglet. “Rogers has been carrying on for days, and so have their customers.”

Roglet says Rogers’ mistake was trying to use Twitter as a way to reach younger customers with a one-way advertising campaign. Twitter was designed for two way (or more) communication, and Rogers showed no interest in establishing a dialogue with their customers.

In an effort to turn consumer lemons into lemonade, a small army of Rogers’ social media representatives are reaching out to complaining customers to address sometimes long-standing problems and concerns. Customers threatening to leave Rogers behind are winning special customer retention deals that slash rates or deliver larger broadband usage allowances for the same money. But it may be too late for some.

“I think if there is some true Canadian identity, something shared by Canadians from all walks of life, it might be the common experience of having your money and time stolen by Roger’s criminal syndicate,” shared Michael To.

But things may not be that great elsewhere.

“I went through Bell, Rogers and Telus over the course of 12 years,” shared one reader of the Globe and Mail. “‘Bad service’ doesn’t describe it adequately – ‘absolute contempt for my humanity’ better describes it – every one of the them viewed me as a muppet to be abused, exploited and soaked as much as possible.”

[Thanks to Stop the Cap! reader Damian who alerted us.]

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Welcome to Rogers One Number.flv[/flv]

Rogers produced this video introducing customers to its 1Number service. (2 minutes)

Subscribe

Subscribe