CableLabs has published a new specification for the DOCSIS 3.1 cable broadband platform that will support <1 ms latency, optimal for online gaming and virtual reality.

CableLabs has published a new specification for the DOCSIS 3.1 cable broadband platform that will support <1 ms latency, optimal for online gaming and virtual reality.

The new specification, dubbed low-latency DOCSIS (LLD), costs little to implement with a simple software upgrade, but some cable companies plan to charge customers nearly $15 a month more to enable the extra performance.

VR needs incredibly low latency between head movement and the delivery of new pixels to your eyes, or you start to feel nauseated. To move the PC out of the home, we need to make the communications over the cable network be a millisecond or less round trip. But our DOCSIS® technology at the time could not deliver that.

So, we pivoted again. Since 2016, CableLabs DOCSIS architects Greg White and Karthik Sundaresan have been focused on revolutionizing DOCSIS technology to support sub-1ms latency. Although VR is still struggling to gain widespread adoption, that low and reliable DOCSIS latency will be a boon to gamers in the short term and will enable split rendering of VR and augmented reality (AR) in the longer term. The specifications for Low Latency DOCSIS (as a software upgrade to existing DOCSIS 3.1 equipment) have been released, and we’re working with the equipment suppliers to get this out into the market and to realize the gains of a somewhat torturous innovation journey.

Your provider may already have LLD capability — the updates were pushed to cable operators in two stages, one in January and the most recent update in April. It will be up to each cable company to decide if and when to enable the feature. Additionally, low latency is only possible if the path between your provider and the gaming server has the capability of delivering it. Cable companies may need to invite some gaming platforms, such as 비트코인 카지노, to place servers inside their networks to assure the best possible performance.

Cable operators are already conceptualizing LLD as a revenue booster. Cox Communications is already testing a low-latency gaming add-on with customers in Arizona, for which it charges an extra $14.99 a month. But reports from customers using it suggest it is not a true implementation of LLD. Instead, many users claim it is just an enhanced traffic routing scheme to reduce latency using already available technology.

A Cox representative stressed the service does not violate any net neutrality standards.

“This service does not increase the speed of any traffic, and it doesn’t prioritize gaming traffic ahead of other traffic on our network,” said CoxJimR on the DSL Reports Cox forum. “The focus is around improving gaming performance when it leaves our network and goes over the public internet, like a Gamer Private Network. No customer’s experience is degraded as a result of any customers purchasing Cox Elite Gamer service as an add-on to their internet service.”

CableLabs is treating LLD as a part of its “10G” initiative, expected to upgrade broadband speeds up to 10 Gbps. Among the next upgrades likely to be published is full duplex DOCSIS, which will allow cable operators to provide the same upload and download speeds.

Subscribe

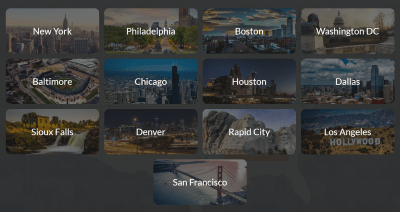

Subscribe Locast, the not-for-profit cooperative that has successfully streamed local, over the air stations without running afoul of copyright law and attorneys, has announced a big expansion into the cities of Los Angeles, San Francisco, Sioux Falls and Rapid City (South Dakota).

Locast, the not-for-profit cooperative that has successfully streamed local, over the air stations without running afoul of copyright law and attorneys, has announced a big expansion into the cities of Los Angeles, San Francisco, Sioux Falls and Rapid City (South Dakota). Before 1976, under two Supreme Court decisions, any company or organization could receive an over-the-air broadcast signal and retransmit it to households in that broadcaster’s market without receiving permission (a copyright license) from the broadcaster. Then, in 1976, Congress passed a law overturning the Supreme Court decisions and making it a copyright violation to retransmit a local broadcast signal without a copyright license. This is why cable and satellite operators, when retransmitting a broadcast signal, either must operate under a statutory “compulsory” copyright license, or receive permission from the broadcaster.

Before 1976, under two Supreme Court decisions, any company or organization could receive an over-the-air broadcast signal and retransmit it to households in that broadcaster’s market without receiving permission (a copyright license) from the broadcaster. Then, in 1976, Congress passed a law overturning the Supreme Court decisions and making it a copyright violation to retransmit a local broadcast signal without a copyright license. This is why cable and satellite operators, when retransmitting a broadcast signal, either must operate under a statutory “compulsory” copyright license, or receive permission from the broadcaster. (Reuters) – T-Mobile US Inc is preparing an alternative plan if a deal to sell wireless assets to Dish Network Corp falls through, according to two sources familiar with the matter.

(Reuters) – T-Mobile US Inc is preparing an alternative plan if a deal to sell wireless assets to Dish Network Corp falls through, according to two sources familiar with the matter.

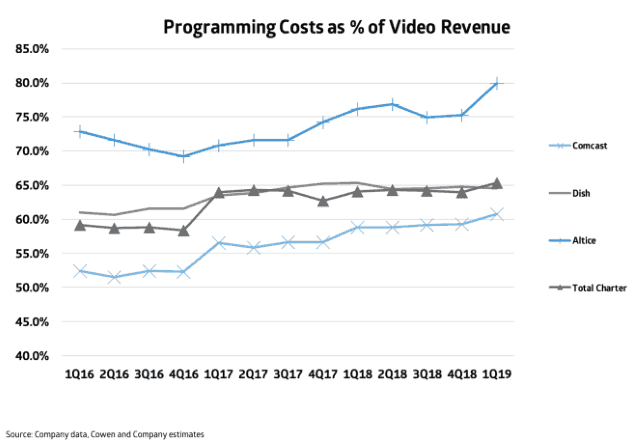

Altice USA, which divides about 3.3 million cable TV subscribers between Optimum/Cablevision and Suddenlink, says it paid $682.4 million for cable TV programming during the first quarter of 2019. That amounts to 67% of the company’s total video revenue. If Altice offered complaining customers a 40-50% break on cable television, it would lose money. Cable operators already temporarily give up a significant chunk of video revenue from new customer promotions, which discount offerings for the first year or two of service. Many operators consider any video promotion to be a loss leader these days, because programming costs are exploding, particularly for some local, over-the-air network affiliated stations that are now commanding as much as $3-5 a month per subscriber for each station.

Altice USA, which divides about 3.3 million cable TV subscribers between Optimum/Cablevision and Suddenlink, says it paid $682.4 million for cable TV programming during the first quarter of 2019. That amounts to 67% of the company’s total video revenue. If Altice offered complaining customers a 40-50% break on cable television, it would lose money. Cable operators already temporarily give up a significant chunk of video revenue from new customer promotions, which discount offerings for the first year or two of service. Many operators consider any video promotion to be a loss leader these days, because programming costs are exploding, particularly for some local, over-the-air network affiliated stations that are now commanding as much as $3-5 a month per subscriber for each station. Discovery Networks has signed a new contract with streaming TV service fuboTV that will bring 13 more channels to its lineups and allow subscribers to access on-demand content from Discovery’s suite of networks.

Discovery Networks has signed a new contract with streaming TV service fuboTV that will bring 13 more channels to its lineups and allow subscribers to access on-demand content from Discovery’s suite of networks.