Verizon has introduced a two-year price guarantee offer and a free broadband speed upgrade for new customers signing up for FiOS Internet, TV and voice service before April 19.

Verizon has introduced a two-year price guarantee offer and a free broadband speed upgrade for new customers signing up for FiOS Internet, TV and voice service before April 19.

It’s the latest marketing salvo fired against Verizon’s cable competitors with the hope customers will cut cable’s cord and switch to FiOS.

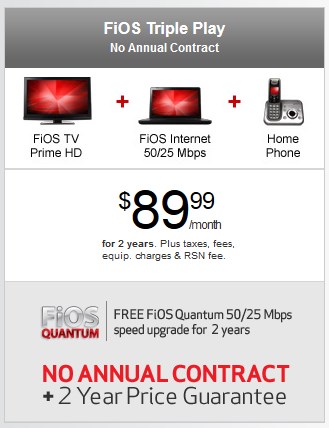

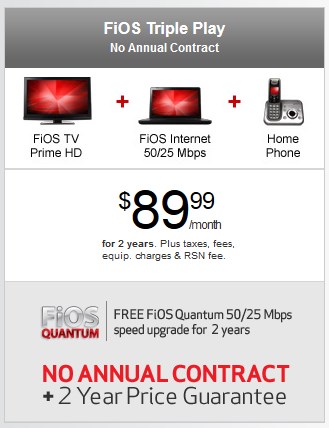

All new customers will receive a two-year price guarantee with a triple play package costing as little as $89.99 a month. The offers also include a free upgrade to FiOS Quantum 50/25Mbps Internet; FiOS TV Prime HD with more than 215 channels (more than 55 in HD); and FiOS Digital Voice home phone service with unlimited nationwide calling. As a further incentive, customers who choose a two-year agreement also receive a $250 Visa prepaid card. New customers who order online receive an extra $10 per month savings. Those ordering service from Verizon’s website will have the $49.99 activation fee waived.

Such aggressive promotions are not new for Verizon or its cable competition. The best prices are often reserved for new customers.

Former Time Warner Cable CEO Glenn Britt reflected last fall on the competitive environment between cable and phone companies and noted loyal, long-term customers don’t typically benefit much from pricing competition.

“The current form of competition in this entire sector is essentially focused on promotional pricing, which allows customers who jump from provider to provider to get the best deal,” said Britt.

“The current form of competition in this entire sector is essentially focused on promotional pricing, which allows customers who jump from provider to provider to get the best deal,” said Britt.

In an effort to control customers hopping back and forth between the cable and phone company (known as ‘subscriber churn’ in the industry), Verizon’s marketing is now trying to convince customers they won’t have to shop around for a better deal over the next two years, but aren’t restricted by a contract with termination penalties either.

“We’re responding to feedback from prospective customers who told us they want to switch to FiOS for the faster speed, greater reliability and clearer images, but they struggle with the notion of signing up for a multiyear contract,” said Mike Ritter, chief marketing officer for the consumer and mass business unit of Verizon. “We’ve also heard from prospective customers that they want price assurance when they switch providers. Our offer gives new customers the peace of mind to know their base rate will not change for two years. With no contract, and a two-year price guarantee, new customers can switch to FiOS with confidence.”

Verizon also provides evidence that broadband speed does matter. At of the end of 2013, 46 percent of all Verizon FiOS customers upgraded to FiOS Quantum speeds ranging from 50/25 to 500/100Mbps. Verizon says video streaming, multiplayer gaming, and uploading photos to social media sites are all contributing to consumer demand for faster Internet speeds. FiOS broadband remains the company’s grand jewel with 6.1 million subscribers. Around 5.3 million customers are signed up for FiOS TV.

At the end of last year, Verizon had 6.1 million FiOS Internet subscribers and 5.3 million FiOS TV customers.

Verizon’s new FiOS promotions (for new customers only):

- Online with no annual contract: $89.99 per month for two years, free FiOS Quantum 50/25Mbps upgrade for two years and a two-year price guarantee.

- Online with a two-year agreement: $89.99 per month for two years, free FiOS Quantum 50/25Mbps upgrade for two years, two-year price guarantee and a $250 Visa prepaid card.

- Offline order (purchased through any means other than online) with no annual contract: $99.99 per month for two years, free FiOS Quantum 50/25Mbps upgrade for two years, and a two-year price guarantee.

- Offline order with a two-year agreement: $99.99 per month for two years, free FiOS Quantum 50/25Mbps upgrade for two years, two-year price guarantee and a $250 Visa prepaid card.

[flv]http://www.phillipdampier.com/video/Verizon FiOS Internet 2-2014.mp4[/flv]

Verizon argues America needs fiber to the home service to meet the needs of the digital economy. “It’s time to take fiber optics to the last mile,” says the video. That’s fine news for 18 million households that can today buy fiber optic FiOS service, but Verizon indefinitely suspended further expansion of its fiber network in 2010. (3:30)

Comcast offers the X1 throughout its service area and is distributing Pace and Arris set-top boxes that include a DVR that can record six channels at once. Later on, Comcast will upgrade X1 customers to a cloud-based platform, dubbed internally as “X2.”

Comcast offers the X1 throughout its service area and is distributing Pace and Arris set-top boxes that include a DVR that can record six channels at once. Later on, Comcast will upgrade X1 customers to a cloud-based platform, dubbed internally as “X2.”

Subscribe

Subscribe The U.S. Department of Labor has

The U.S. Department of Labor has

Marwan Fawaz: Spent a year in a leadership role at Motorola Mobility/Motorola Home Division. He has the distinction of serving as an executive at two bankrupt cable operators: Charter Communications and Adelphia. Charter eventually emerged from bankruptcy, Adelphia did not and two members of its founding family are spending 15 years in the Allenwood federal prison, convicted of wire and securities fraud. Charter’s press release says Fawaz would be a valued addition to the board because he has “a deep understanding of the cable television industry”;

Marwan Fawaz: Spent a year in a leadership role at Motorola Mobility/Motorola Home Division. He has the distinction of serving as an executive at two bankrupt cable operators: Charter Communications and Adelphia. Charter eventually emerged from bankruptcy, Adelphia did not and two members of its founding family are spending 15 years in the Allenwood federal prison, convicted of wire and securities fraud. Charter’s press release says Fawaz would be a valued addition to the board because he has “a deep understanding of the cable television industry”; “If Time Warner Cable management refuses to negotiate on reasonable terms, we believe Charter will likely secure the votes required to win a proxy fight,” said Jonathan Chaplin, a research analyst with New Street Telco.

“If Time Warner Cable management refuses to negotiate on reasonable terms, we believe Charter will likely secure the votes required to win a proxy fight,” said Jonathan Chaplin, a research analyst with New Street Telco. Verizon has introduced a two-year price guarantee offer and a free broadband speed upgrade for new customers

Verizon has introduced a two-year price guarantee offer and a free broadband speed upgrade for new customers  “The current form of competition in this entire sector is essentially focused on promotional pricing, which allows customers who jump from provider to provider to get the best deal,” said Britt.

“The current form of competition in this entire sector is essentially focused on promotional pricing, which allows customers who jump from provider to provider to get the best deal,” said Britt.