Denmark’s TDC telephone company is so confident about their network upgrades, they are ready to guarantee customers will get the broadband speeds advertised, or their money back and a commitment to fix the problem.

Denmark’s TDC telephone company is so confident about their network upgrades, they are ready to guarantee customers will get the broadband speeds advertised, or their money back and a commitment to fix the problem.

Most phone companies selling DSL service have always had to qualify their speed marketing claims with words like “up to” because customers further away from central switching offices or remote hubs won’t necessarily get the speeds on offer. The further away a customer lives from a telephone company facility, the slower the speeds on copper-based networks. Total network capacity can also create problems during peak usage periods, but not for TDC, which says it has a network robust enough to handle demand.

TDC’s Guaranteed Speed Tiers (US$):

TDC’s Guaranteed Speed Tiers (US$):

- Basic: 20/2Mbps $47

- Enhanced: 30/5Mbps $49.50

- Superior: 40/10Mbps $53

- Extreme: 50/10Mbps $55

“With this initiative we want [to show] how communication to broadband customers can be further improved,” said Rene Brochner, director of TDC’s residential service division. “With the new products we now offer we guarantee that the speed is always [as advertised]. For example, the 40Mbps/10Mbps speed is always 40Mbps/10Mbps.”

Two-thirds of Denmark will be upgraded to 20/2Mbps service by the middle of this year, with another 750,000 households qualified for 50Mbps service because of TDC’s investment in fiber and pair bonding. Next year, TDC will add Vectoring technology, which will improve speeds on existing copper lines to as much as 100Mbps.

Subscribe

Subscribe While you wait by the mailbox for your next Time Warner Cable rate hike notice, retired CEO Glenn Britt just deposited another $4.3 million in his personal bank account after selling another 30,000 shares of the Time Warner Cable stock he received as part of his lucrative compensation package. Just last month, he dumped 129,600 shares for a cool $17.3 million.

While you wait by the mailbox for your next Time Warner Cable rate hike notice, retired CEO Glenn Britt just deposited another $4.3 million in his personal bank account after selling another 30,000 shares of the Time Warner Cable stock he received as part of his lucrative compensation package. Just last month, he dumped 129,600 shares for a cool $17.3 million.

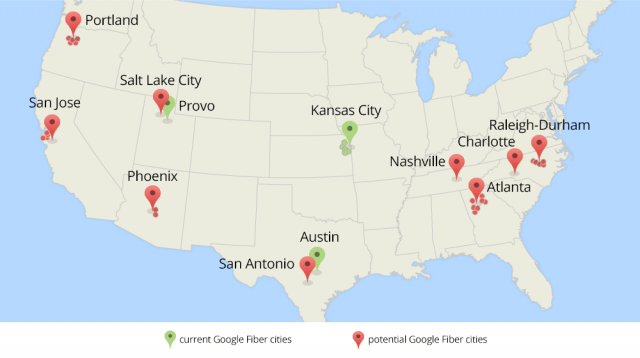

Now that we’ve learned a lot from our Google Fiber projects in

Now that we’ve learned a lot from our Google Fiber projects in  Bright House Networks’ long standing relationship with Time Warner Cable — which negotiated programming deals on behalf of the smaller cable operator with operations in the south — may come to an end with an approval of a merger between Comcast and Time Warner. That could make Bright House a prime candidate for a takeover.

Bright House Networks’ long standing relationship with Time Warner Cable — which negotiated programming deals on behalf of the smaller cable operator with operations in the south — may come to an end with an approval of a merger between Comcast and Time Warner. That could make Bright House a prime candidate for a takeover. Charter is almost certain to buy at least some of the three million Time Warner Cable customers Comcast intends to cast-off if it wins regulator approval of its buyout deal. But Team Charter has assembled enough financing to go much farther than that.

Charter is almost certain to buy at least some of the three million Time Warner Cable customers Comcast intends to cast-off if it wins regulator approval of its buyout deal. But Team Charter has assembled enough financing to go much farther than that. Cox, like Cablevision, has been closely controlled by its founding family for years, so rumors of sales of one or both have never come to fruition. But with the merger announcement of Comcast and Time Warner Cable, Wall Street pressure to consolidate is growing by the day. There is talk that if Comcast succeeds in its buyout effort, even satellite providers like DirecTV and DISH are likely to seek a merger. Even Cablevision, which serves suburban New York City may finally feel enough pressure to sell.

Cox, like Cablevision, has been closely controlled by its founding family for years, so rumors of sales of one or both have never come to fruition. But with the merger announcement of Comcast and Time Warner Cable, Wall Street pressure to consolidate is growing by the day. There is talk that if Comcast succeeds in its buyout effort, even satellite providers like DirecTV and DISH are likely to seek a merger. Even Cablevision, which serves suburban New York City may finally feel enough pressure to sell.