If you thought AT&T Mobile Insurance would bring you peace of mind if your expensive smartphone is ever lost, stolen, or damaged, think again.

If you thought AT&T Mobile Insurance would bring you peace of mind if your expensive smartphone is ever lost, stolen, or damaged, think again.

The wireless carrier and its partner Asurion have nine pages of sneaky terms and conditions that give the two companies a myriad of reasons to deny insurance claims and leave you with nothing after paying your $6.99 monthly insurance premium.

The Los Angeles Times reports one customer – Marianna Yarovskaya – learned this the hard way when she purchased AT&T’s insurance to cover her new iPhone 5S she bought before taking a trip to Indonesia. Sure enough, her new phone was swiped right out of her hotel room. Yarovskaya’s disappointment only got worse when her insurance claim was denied not once, or twice, but three times.

An Asurion representative explained to Yarovskaya her insurance claim was rejected because she was outside of AT&T’s network when she completed the last steps of her online registration for AT&T’s insurance. It turned out AT&T Insurance is worthless if customers enroll while using a Wi-Fi connection or any other service provider other than AT&T’s wireless data network.

“This is crazy,” Yarovskaya said. “They are saying that if you travel, the insurance becomes worthless.”

A careful review of the nine pages of barely penetrable terms and conditions unearthed the “tricks and traps” Asurion used to walk away from Yarovskaya’s claim.

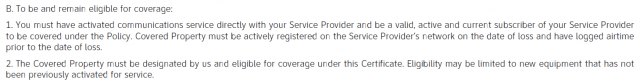

On page six, AT&T and Asurion insist that “covered property must be actively registered on the service provider’s network on the date of loss and have logged airtime prior to the date of loss.”

To ordinary people, that would suggest that Yarovskaya would be covered as soon as she purchased and activated her new AT&T iPhone and service while in a Los Angeles AT&T store. That act left her “actively registered” as an AT&T customer. Asurion also specifies their insurance coverage territory is “worldwide,” which would indicate insured phones are covered wherever they are lost, stolen, or damaged.

But then there is pesky page eight — the “definitions” page, where Asurion gets to define the meaning of various English words and phrases as it sees fit.

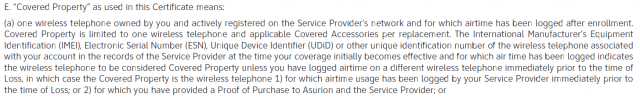

Asurion’s definition of “covered property” is a device “actively registered on the service provider’s network and for which airtime has been logged after enrollment.”

When the Times asked Bettie Colombo, an Asurian spokeswoman, what that meant, she explained phones are not insured until the customer performs some wireless activity on AT&T’s network after signing up for coverage.

Translation: You have to do something on your carrier’s wireless network after coverage begins for coverage to begin.

Translation: You have to do something on your carrier’s wireless network after coverage begins for coverage to begin.

If you are roaming, traveling overseas, or you use your phone with Wi-Fi and AT&T doesn’t see the device on its network after signing up for insurance, you are not covered. The language is so broad, it could also be interpreted to mean you have to be actively registered on an AT&T cell tower at the time of loss or damage or Asurion could walk away for that reason as well.

An insurance underwriter tells Stop the Cap! the real intent of this clause is to protect Asurion from customers signing up for insurance -after- losing or damaging their phone and then immediately filing an insurance claim. As a protection measure, the insurer wants to confirm it is insuring a working phone actually possessed by the owner before activating coverage. If customers registered for insurance on other devices or networks, AT&T wouldn’t have direct, absolute confirmation the customer is insuring a working phone. But most customers are unaware of this requirement, and if a claim arrives shortly after a customer signs up for coverage, insurance adjusters tend to be extra suspicious.

AT&T is staying out of the insurance dispute and declined to comment, leaving Yarovskaya with a $6.99 premium payment and $650 in replacement costs to buy a new phone.

The Times‘ opinion about the merits of AT&T’s insurance? “Buy it at your own peril.”

[flv]http://www.phillipdampier.com/video/ATT Mobile Insurance phone service 3-4-14.flv[/flv]

AT&T makes it look easy to sign up for device insurance, but navigating through the claims process and nine pages of terms and conditions leave a lot of room to deny your claim. (2:02)

Subscribe

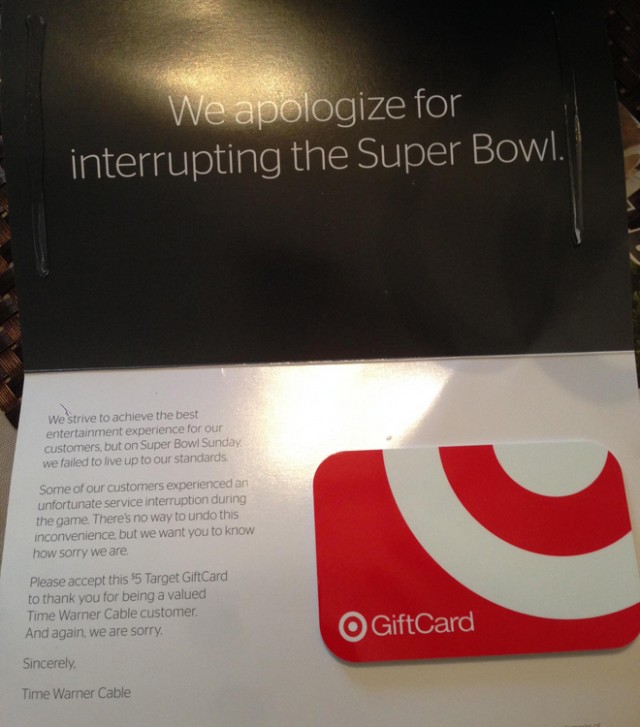

Subscribe As a result of Time Warner Cable’s final agreement with Viacom that put to bed last summer’s dispute with CBS, Time Warner Cable agreed to a nationwide launch of Viacom’s premium movie network EPIX. The network will arrive in subscribers’ homes on March 18.

As a result of Time Warner Cable’s final agreement with Viacom that put to bed last summer’s dispute with CBS, Time Warner Cable agreed to a nationwide launch of Viacom’s premium movie network EPIX. The network will arrive in subscribers’ homes on March 18. Should regulators bless the coupling of Comcast and Time Warner Cable, some TWC customers will not be invited to the wedding.

Should regulators bless the coupling of Comcast and Time Warner Cable, some TWC customers will not be invited to the wedding.

Since 2002, New York Tax Law has required mobile phone companies to collect and pay sales taxes on the full amount of the monthly access charges for their calling plans. For example, when a customer pays Sprint a fixed monthly charge of $39.99 for 450 minutes of mobile calling time, the law requires Sprint to collect and pay sales taxes on the entire $39.99. According to the Attorney General’s complaint, starting in 2005, Sprint illegally failed to collect and pay New York sales taxes on an arbitrarily set portion of its revenue from these fixed monthly access charges.

Since 2002, New York Tax Law has required mobile phone companies to collect and pay sales taxes on the full amount of the monthly access charges for their calling plans. For example, when a customer pays Sprint a fixed monthly charge of $39.99 for 450 minutes of mobile calling time, the law requires Sprint to collect and pay sales taxes on the entire $39.99. According to the Attorney General’s complaint, starting in 2005, Sprint illegally failed to collect and pay New York sales taxes on an arbitrarily set portion of its revenue from these fixed monthly access charges.