The sleepy deep south isn’t often a battleground for an all-out broadband competition war, but Ridgeland, Miss.-based C Spire, a regional cell phone company with fiber broadband aspirations, has gotten too big for its britches and Comcast is preparing to demonstrate its size and resources can run even a home state provider into the ground.

The sleepy deep south isn’t often a battleground for an all-out broadband competition war, but Ridgeland, Miss.-based C Spire, a regional cell phone company with fiber broadband aspirations, has gotten too big for its britches and Comcast is preparing to demonstrate its size and resources can run even a home state provider into the ground.

C Spire is building a statewide fiber-to-the-home network, city by city, on its pre-existing fiber backbone which extends to C Spire’s cell towers across the Magnolia State. As the fiber network expands, talk of doing something in a “Mississippi Minute” will be a thing of the past as C Spire prepares to deliver gigabit broadband speeds far in excess of what competitors like Comcast, AT&T and Cable One are prepared to offer.

Communities already on the construction list include: Batesville, Clinton, Corinth, Hattiesburg, Horn Lake, McComb, Quitman, Ridgeland and Starkville.

But C Spire’s network caught the attention of Comcast earlier this month when it announced Jackson, the state capital, was going to get fiber service.

C Spire is following Google Fiber’s model, attempting to get enough residents in a neighborhood to pre-register with a refundable $10 deposit. Online pre-registration for the service began in Jackson last month, and several hundred residents applied even before the fiber network expansion was announced, ready to tell Comcast to take a hike.

Jackson neighborhoods that reach sign-up levels set by C Spire will be the first to get the new generation of fiber services, the company says.

“Gigabit infrastructure can create a new economic reality for the city of Jackson,” Duane O’Neill, president & CEO of the 2,100-member Greater Jackson Chamber Partnership, told the Mississippi Business Journal. “In the handful of U.S. cities where this infrastructure is deployed and widely available, it has generated thousands of jobs, millions of dollars of new investment, boosted home values and improved the overall quality of life.”

C Spire’s plans could cost Comcast a significant number of cable customers across Mississippi, and it isn’t taking that lightly.

C Spire’s plans could cost Comcast a significant number of cable customers across Mississippi, and it isn’t taking that lightly.

Departing from its usual tradition of focusing new technology on large northeastern cities, Comcast will begin saturating Jackson with its Wi-Fi hotspot service, starting with 200 public hotspots slated for launch before the end of this year. The company only had a handful of Wi-Fi hotspots in Jackson before. Jackson will also get significant cable service upgrades, including the introduction of a new “smart home” service, a cloud-based service integrating Comcast’s cable, Internet, and home-security.

Comcast says it has plans to turn Jackson into a “truly connected city,” and if that means competitively disconnecting C Spire from its nascent fiber customer base, all the better.“This is the kind of threat that would frighten competitors,” said industry observer Jeff Kagan. “Comcast can be a heavy-duty competitor when they want to be. So why is Jackson and other Mississippi cities getting this kind of attention from Comcast and C Spire? I think it’s a matter of competition and C Spire’s aggressive move in the state of Mississippi played a role in the Comcast decision to turn up the heat.”

Kagan also expects Comcast will cut prices to undercut C Spire. That would be consistent with Comcast’s customer retention policies that dramatically lower rates for customers threatening to leave. Rate-cutting will benefit consumers, but if Comcast engages in below-cost predatory pricing, those savings will be short-lived.

“It’s starting to look like that old nursery rhyme, Jack and the Beanstalk,” said Kagan. “Watch out Jack, the Giant is waking up.”

If that battle becomes cut-throat, C Spire’s fiber aspirations may end up nothing more than pipe dreams if the company retreats, deciding it cannot survive in a battle with Comcast, the Giant of all cable companies.

Subscribe

Subscribe YouTube will earn as much as $6 billion this year from the increasing number of ads that accompany videos on the world’s busiest website. It could earn even more charging consumers a subscription fee to get rid of them.

YouTube will earn as much as $6 billion this year from the increasing number of ads that accompany videos on the world’s busiest website. It could earn even more charging consumers a subscription fee to get rid of them. American Airlines left passengers stewing for more than three hours on board a flight from LAX to London before finally returning to the gate. The reason? A passenger reported a functioning Wi-Fi hotspot labeled “Al Quida Free Terror Nettwork” and complained to a flight attendant.

American Airlines left passengers stewing for more than three hours on board a flight from LAX to London before finally returning to the gate. The reason? A passenger reported a functioning Wi-Fi hotspot labeled “Al Quida Free Terror Nettwork” and complained to a flight attendant. The Federal Communications Commission announced Friday it will

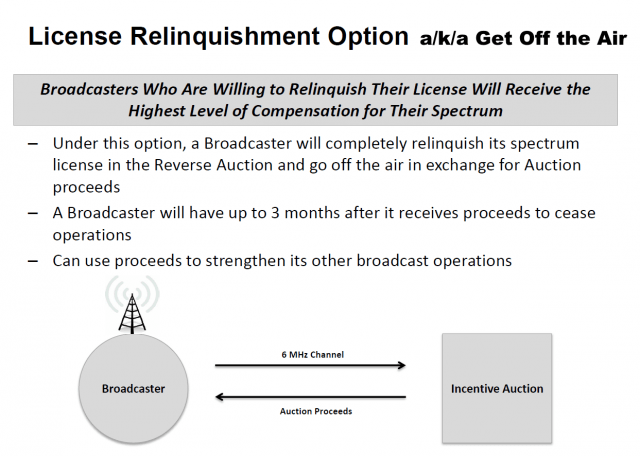

The Federal Communications Commission announced Friday it will  There is so much money to be made buying and selling the public airwaves — at least twice as much as broadcasters originally anticipated– spectrum speculators have also jumped on board, snapping up low power television station construction permits and existing stations with hopes of selling them off the air in return for millions in compensation. Wireless customers are effectively footing the bill for the auction as wireless companies bid for the additional spectrum. Television stations will receive 85% of the proceeds, the FCC will keep 15%.

There is so much money to be made buying and selling the public airwaves — at least twice as much as broadcasters originally anticipated– spectrum speculators have also jumped on board, snapping up low power television station construction permits and existing stations with hopes of selling them off the air in return for millions in compensation. Wireless customers are effectively footing the bill for the auction as wireless companies bid for the additional spectrum. Television stations will receive 85% of the proceeds, the FCC will keep 15%. Major network-affiliated or owned stations in major cities are unlikely to take the deal. But in medium and smaller-sized markets where conglomerates own and operate most television stations, there is a greater chance some will be closed down, moved to a lower channel, or transferred to a digital sub-channel of a co-owned-and-operated station in the same city. The most likely targets for shutdown will be independent, CW and MyNetworkTV affiliates. In smaller cities, multiple network affiliates owned by one company could be combined, relinquishing one or more channels in return for tens of millions in cash compensation.

Major network-affiliated or owned stations in major cities are unlikely to take the deal. But in medium and smaller-sized markets where conglomerates own and operate most television stations, there is a greater chance some will be closed down, moved to a lower channel, or transferred to a digital sub-channel of a co-owned-and-operated station in the same city. The most likely targets for shutdown will be independent, CW and MyNetworkTV affiliates. In smaller cities, multiple network affiliates owned by one company could be combined, relinquishing one or more channels in return for tens of millions in cash compensation. Rogers Communications will acquire Hamilton, Ont.-area independent Source Cable in a quiet $160-million deal.

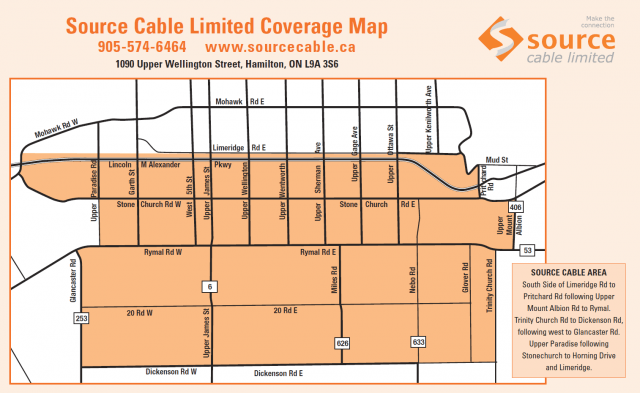

Rogers Communications will acquire Hamilton, Ont.-area independent Source Cable in a quiet $160-million deal.