Washington State Attorney General Bob Ferguson filed a $100 million lawsuit today against Comcast Corporation in King County Superior Court, alleging the company’s own documents show a pattern of illegally deceiving customers to fatten their bottom line by tens of millions of dollars.

Washington State Attorney General Bob Ferguson filed a $100 million lawsuit today against Comcast Corporation in King County Superior Court, alleging the company’s own documents show a pattern of illegally deceiving customers to fatten their bottom line by tens of millions of dollars.

The lawsuit claims Comcast violated Washington’s Consumer Protection Act (CPA) at least 1.8 million times as the cable operator misrepresented what is covered under its “Service Protection Plan,” improperly charged customers service call fees when they should have been free, and violated customer privacy by engaging in improper credit screening.

At least 500,000 Washington residents are victims of Comcast’s deceptive acts, the lawsuit alleges.

“This case is a classic example of a big corporation deceiving its customers for financial gain,” Ferguson said. “I won’t allow Comcast to continue to put profits above customers — and the law.”

Ferguson

Comcast routinely claims its $4.99/mo “comprehensive” service plan covered the cost of all service calls, including those related to inside wiring, customer-owned equipment connected to Comcast services and on-site education about products. That is, unless a customer wanted the wiring hidden by installing it inside a wall, which the majority of customers want. A so-called “wall fish” is not covered by Comcast’s plan, even though 75% of the time, Comcast representatives told state investigators the plan did cover all inside wiring.

It turns out many other things are not covered by Comcast’s “comprehensive” plan, including consumer-owned equipment troubleshooting and repairs involving cable jumpers, splitters, and other types of connectors. Some customers were billed for an entire service call if an excluded item happened to be checked by a Comcast technician. Ferguson claims Comcast does all it can to keep the fine print revealing the exclusions away from customers. Comcast does not offer customers enrolling in the plan a printed terms and conditions brochure or point to one on its website. Customers must dig around Comcast’s website to find the terms on their own. Just enrolling in the plan automatically gives Comcast a customer’s consent to whatever terms and conditions are in effect at the time.

Comcast also has a habit of charging Washington customers for trouble-related service calls that should have been free, the lawsuit alleges.

Comcast’s so-called “Customer Guarantee” promises that the company “won’t charge you for a service visit that results from a Comcast equipment or network problem.” Comcast discloses no limitations on this guarantee. But state investigators discovered Comcast routinely charged thousands of customers for service calls involving Comcast’s own equipment or service problems. Customers were also billed for service calls involving defective Comcast-supplied HDMI and component cables, cable cards, and installations of drop amplifiers, commonly installed to resolve a signal problem when Comcast’s network is not functioning properly.

Comcast allegedly facilitated the service call charges until approximately June 2015 by encouraging technicians to use a service call “fix code” that permitted Comcast to “add service charges to a normally not charged fix code.” That allowed technicians to properly track Comcast’s own network troubles yet still charge customers to roll a truck to their home, even when the service call should have been free.

Comcast allegedly facilitated the service call charges until approximately June 2015 by encouraging technicians to use a service call “fix code” that permitted Comcast to “add service charges to a normally not charged fix code.” That allowed technicians to properly track Comcast’s own network troubles yet still charge customers to roll a truck to their home, even when the service call should have been free.

Finally, as many as 6,000 Washington residents saw their credit scores drop after Comcast engaged in improper credit screening, causing a “hard pull” on credit reports which can negatively impact credit scores, at least temporarily.

Comcast requires an equipment deposit, but it is usually waived for customers with an adequate credit score. But the AG’s office uncovered at least 6,000 occasions where customers paid an equipment deposit, despite their high credit score. Ferguson’s office claims this indicates either:

- customers “opted out” of a credit check and paid the deposit instead to avoid a credit score hit appearing on their credit report, only to have Comcast run one anyway; or

- customers were forced to pay the deposit despite their high credit score, contrary to Comcast’s policy.

The case is the first in the nation of this size and scope, and comes after Ferguson spent more than a year trying to work with Comcast. Ferguson said he was not satisfied with Comcast’s response and filed the lawsuit.

For violating Washington’s Consumer Protection Act, the Attorney General’s Office is seeking:

- More than $73 million in restitution to pay back Service Protection Plan subscriber payments;

- Full restitution for all service calls that applied an improper resolution code, estimated to be at least $1 million;

- Removing improper credit checks from the credit reports of more than 6,000 customers;

- Up to $2,000 per violation of the Consumer Protection Act; and

- Broad injunctive relief, including requiring Comcast to clearly disclose the limitations of its Service Protection Plan in advertising and through its representatives, correct improper service codes that should not be chargeable and implement a compliance procedure for improper customer credit checks.

Subscribe

Subscribe

This time, Apple sought money from the cable companies, not the other way around. Cable operators were told they would need to pay $10 a month per subscriber to Apple, with no guarantee that fee would not increase in the future. Just as concerning was Apple’s insistence that subscriber authentication would require customers to use their Apple IDs, a departure from the cable industry’s push to adopt TV Everywhere, where customers could unlock streaming video from any cable network simply by logging in with the username and password they set up with their pay TV provider. Apple was also characteristically secretive about their user interface and left cable industry executives flummoxed when they asked Apple to sketch out what the service would look like on a napkin. An Apple official would only respond that their interface would be great and “better than anything you’ve ever had.” The fact Apple refused to answer the question did not go unnoticed.

This time, Apple sought money from the cable companies, not the other way around. Cable operators were told they would need to pay $10 a month per subscriber to Apple, with no guarantee that fee would not increase in the future. Just as concerning was Apple’s insistence that subscriber authentication would require customers to use their Apple IDs, a departure from the cable industry’s push to adopt TV Everywhere, where customers could unlock streaming video from any cable network simply by logging in with the username and password they set up with their pay TV provider. Apple was also characteristically secretive about their user interface and left cable industry executives flummoxed when they asked Apple to sketch out what the service would look like on a napkin. An Apple official would only respond that their interface would be great and “better than anything you’ve ever had.” The fact Apple refused to answer the question did not go unnoticed.

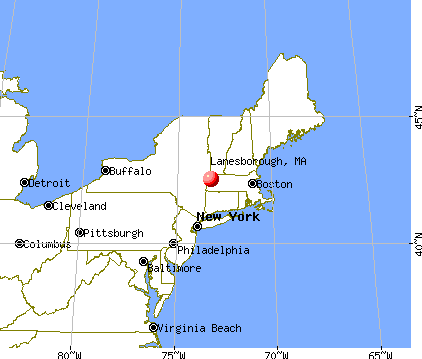

It is hard to imagine there are still cable systems serving customers with nothing more than a slim lineup of standard definition cable television channels in 2016, but not if you live in three Berkshire towns over the New York-Massachusetts border where Charter Communications will finally introduce HD television and internet service starting next week.

It is hard to imagine there are still cable systems serving customers with nothing more than a slim lineup of standard definition cable television channels in 2016, but not if you live in three Berkshire towns over the New York-Massachusetts border where Charter Communications will finally introduce HD television and internet service starting next week. On a morning conference call with Wall Street analysts, Comcast continues to misrepresent its vision of broadband usage caps and usage-based billing, claiming customer preferences echoed through Comcast’s performance in the marketplace will tell the company what is “best for consumers,” and guide Comcast how to realize the most value for shareholders.

On a morning conference call with Wall Street analysts, Comcast continues to misrepresent its vision of broadband usage caps and usage-based billing, claiming customer preferences echoed through Comcast’s performance in the marketplace will tell the company what is “best for consumers,” and guide Comcast how to realize the most value for shareholders.

If Comcast was seriously interested in what its customers think about its usage cap trial, it need only review the FCC’s complaint database. According to a Freedom of Information Law request from The Wall Street Journal,

If Comcast was seriously interested in what its customers think about its usage cap trial, it need only review the FCC’s complaint database. According to a Freedom of Information Law request from The Wall Street Journal,  Verizon Communications is taking the New York Public Service Commission to court over the regulator’s ruling that $8 million in property tax refunds rebated to the phone company through a tax certiorari proceeding should be spent on improving Verizon’s service quality in the state.

Verizon Communications is taking the New York Public Service Commission to court over the regulator’s ruling that $8 million in property tax refunds rebated to the phone company through a tax certiorari proceeding should be spent on improving Verizon’s service quality in the state. Verizon calls the regulator’s demands arbitrary and unwarranted confiscation of its property.

Verizon calls the regulator’s demands arbitrary and unwarranted confiscation of its property.