Frustration at Frontier Communications doesn’t stop with customers. Employees are also speaking out about the company’s inability to manage their growing acquisitions and offer good service to customers. Others are confused about major company priorities and initiatives that suddenly get dropped, and customer service representatives feel like they are cheating customers selling them products and services that are better in name only.

Frustration at Frontier Communications doesn’t stop with customers. Employees are also speaking out about the company’s inability to manage their growing acquisitions and offer good service to customers. Others are confused about major company priorities and initiatives that suddenly get dropped, and customer service representatives feel like they are cheating customers selling them products and services that are better in name only.

Three employees this month provided unsolicited letters asking Stop the Cap! to publicize the problems at Frontier because their managers are not listening and they want corporate management to step in and make necessary changes.

“Sally” (we have chosen pseudonyms to protect the authors’ identities) is a customer service representative at a major Frontier call center in Florida. She is saddened by the company’s “Wells Fargo” culture — pushing customers to buy products and services they don’t need just to make their sales numbers.

“Frontier has been pushing us hard to sell customers on our Frontier Secure suite of products, which adds anything from $5 to $25 to your bill and is supposed to protect you from identity theft, damaged devices, viruses, and provide technical support for your electronics,” Sally tells Stop the Cap! “Unfortunately, it sounds much better than it actually is because there are so many exclusions and restrictions. I’ve heard complaints from customers who bought into the program thinking it would protect their home computer, but then after a lightning strike did its damage, it turns out Frontier doesn’t cover “home-made” computers which means anything other than a computer you buy in a store and never upgrade.”

Sally recounts stories about her managers pushing Frontier Secure at every opportunity, because the profits that come from providing services many customers will never use are astounding.

Frontier has a plain jane blog.

“They even push us to sell virus protection on tablets and smartphones like the iPhone, which is generally ridiculous,” Sally wrote. “What is horrifying to me is that the people most likely to say yes to our sales pitches are our elderly customers who have simple landlines and we’re not even sure they have a computer to protect. But they like the identity protection, which is supposed to monitor your credit and cancel your credit cards if your identity is stolen. What we don’t tell you is you can do most of that yourself for free and if you call a bank to report identify theft, they can notify every bank to either put a hold on your credit or reissue new cards. It costs nothing.”

Sally says Frontier’s “Premium Technical Support” often relies on employees Googling for instruction manuals and then reading them back to customers. That service starts at $12.99 a month.

“Instead of selling people better internet access or more reliable phone service, we’ve gone into gimmicks and it’s embarrassing,” reports Sally.

“Jim” is a former Verizon senior technician who is now working for Frontier Communications in Texas. He says he spends several hours a day navigating confusion between Verizon’s long-standing processes for managing network issues and his new supervisors who are dealing with Frontier’s completely different corporate culture.

“If you ever wondered why it takes so long to get something done with Frontier, I can tell you — it’s the bureaucracy and a culture clash between the two companies,” writes Jim. “Working for Verizon’s wireline division was already stressful over the years because they were not investing very much in wired services and we’d learn to manage that by hoarding things and trying to keep issues as local as possible, but Frontier is a giant headache. When a customer needs something from us, often we cannot give the customer a good estimate of when he or she will get what they need because we don’t know ourselves. But we are told to ‘be optimistic’ or ‘be vague’ which is why there are a lot of broken deadlines or disappointments. They never tell us to lie, but we cannot level with customers either because many will bolt to Time Warner Cable or Charter if we told them the God honest truth. We have business and residential customers promised certain broadband performance by sales that we cannot give them because they are not FiOS-enabled. If you were promised 75Mbps and got 6Mbps, you’d start shopping around, too.”

“If you ever wondered why it takes so long to get something done with Frontier, I can tell you — it’s the bureaucracy and a culture clash between the two companies,” writes Jim. “Working for Verizon’s wireline division was already stressful over the years because they were not investing very much in wired services and we’d learn to manage that by hoarding things and trying to keep issues as local as possible, but Frontier is a giant headache. When a customer needs something from us, often we cannot give the customer a good estimate of when he or she will get what they need because we don’t know ourselves. But we are told to ‘be optimistic’ or ‘be vague’ which is why there are a lot of broken deadlines or disappointments. They never tell us to lie, but we cannot level with customers either because many will bolt to Time Warner Cable or Charter if we told them the God honest truth. We have business and residential customers promised certain broadband performance by sales that we cannot give them because they are not FiOS-enabled. If you were promised 75Mbps and got 6Mbps, you’d start shopping around, too.”

Jim writes the cutover between Verizon and Frontier would have gone much smoother if the company culture of “not in my job description” was not so pervasive.

Who cares if the fine print is in English.

“Frontier was given old data from Verizon because we haven’t spent serious money on certifying the accuracy of our databases in years and nobody bothered to verify it before acting on it, and that is why a lot of customers lost their service,” writes Jim. “Verizon is at fault here too because when you work at a giant company like this you learn the company culture is to know your job responsibilities and don’t exceed them. Frontier people seem to be more flexible to a point, but they are also real good at avoiding getting caught holding the bag when something goes wrong, so important tasks or ongoing problems can be neglected because nobody wants to get the blame or feel like they are exposed when management shows up wondering why things aren’t working right.”

“It can be a career and promotion death sentence to be someone willing to stick their neck out and solve problems if your manager or their manager doesn’t like what you’ve done, actually helped create the problem you are trying to solve, or if you are perceived as ‘too negative.'”

Paul, a Frontier Communications employee in the mid-Atlantic region, echoes Jim’s concerns that managers don’t really appreciate hearing criticism. Paul is one of the many workers tasked with keeping Frontier’s website and e-commerce functions up and running. A former Verizon worker, Paul has been shocked by the ineptness of management that has resulted in some serious embarrassments at Frontier.

Frontier’s website is unique among significantly sized telecom companies because one cannot actually place an online order for service or even provide accurate speed and pricing information because the company gave up on trying to make sure those features were reliable. Paul reports managers were warned about the functionality problems but refused to listen.

“[They tell] employees to take ownership of issues, yet when we try to do that very thing we are overruled and our opinions are discounted at every turn,” writes Paul. “Prior to the very first rollout of [Frontier’s redesigned] website I informed [management] that the site had severe performance issues, but was told […] I needed to keep my opinions to myself and the vice president decided to launch the site anyway.”

As a result, Frontier’s website crashed and remained offline and/or disabled for a week, reports Paul.

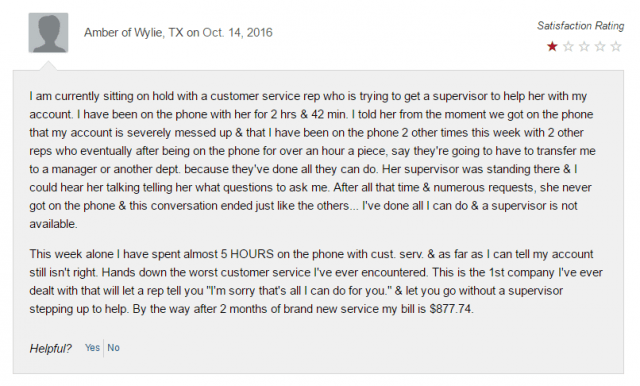

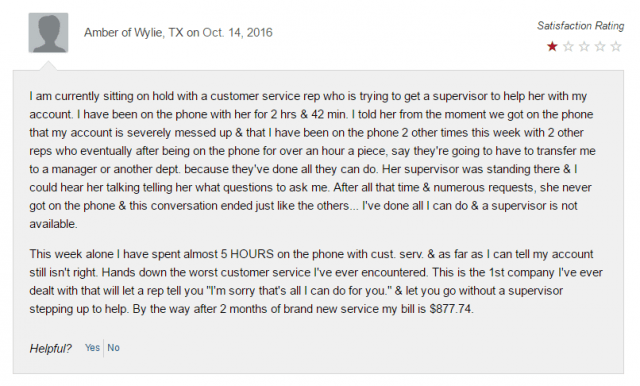

Another satisfied customer in Texas?

Out of the blue “priorities” also suddenly arise that require workers to scramble, with less than excellent results. One day, managers told the software team there was an urgent need to launch Spanish language functionality for the website. But because of the rush, employees not well-versed in the language produced a Spanish-language website that has been derided by customers for its frequent use of “Spanglish” and lack of professionalism.

“They pushed Spanish language very hard and told us that it HAD to be in production before the April 1st cutover with Verizon because of the high frequency of Verizon customers that were used to this feature,” writes Paul. “Once we put it out there, every time there is an issue with Spanish on our site they tell us that it’s only one percent of traffic so they aren’t all the that concerned with it. Then when there is an issue with it they ask us why we didn’t test it. But they refused to give us the needed time to test it because they just wanted to push it out the door and move on to the next project.”

Paul also echoes what Sally in Florida is concerned about — a lack of integrity in Frontier’s marketing department.

“I have never worked for a more unethical company and I used to work for Verizon so that is saying something,” writes Paul. “[Frontier charges] customers for ‘Digital Phone Service,’ but it’s really just copper facilities. They call it “Digital” because it is working out of a digital switch. They change verbiage to make something sound better than what it really is. They say we have a 100% U.S.-based company but then hire IT folks overseas to do some of the work. They spend more money on sponsoring football teams than they do upgrading equipment and infrastructure.”

Charter Communications has announced price changes and new fees for existing Time Warner Cable customers that will take effect Dec. 15, 2016:

Charter Communications has announced price changes and new fees for existing Time Warner Cable customers that will take effect Dec. 15, 2016:

Subscribe

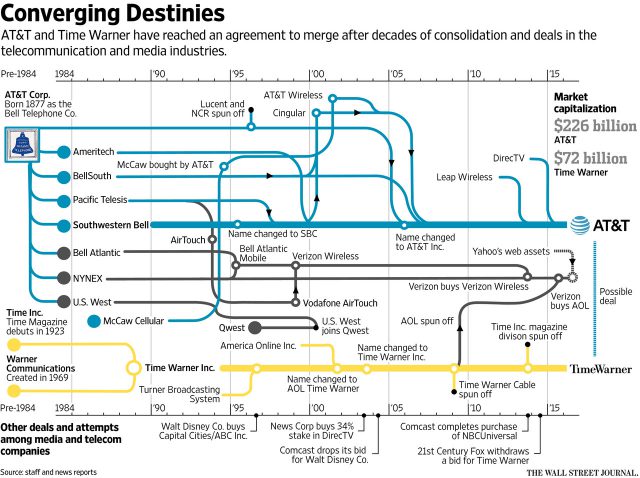

Subscribe It was a busy weekend for AT&T’s Randall Stephenson and Time Warner (Entertainment)’s Jeff Bewkes, culminating in an announcement from AT&T it was acquiring Time Warner

It was a busy weekend for AT&T’s Randall Stephenson and Time Warner (Entertainment)’s Jeff Bewkes, culminating in an announcement from AT&T it was acquiring Time Warner

Several Arizona residents have reported receiving e-mail allegedly from Cox Communications requiring customers to update or upgrade their account, but in reality, the e-mail comes from a group of fraudsters trying to commit identity theft. The Pima County Sheriff’s Office has sent an open warning alerting cable customers in Arizona and beyond that if you receive an e-mail claiming you need to update or upgrade your account, disregard it, especially if it carries a deadline that warns your service will be disconnected if you don’t respond within a matter of days.

Several Arizona residents have reported receiving e-mail allegedly from Cox Communications requiring customers to update or upgrade their account, but in reality, the e-mail comes from a group of fraudsters trying to commit identity theft. The Pima County Sheriff’s Office has sent an open warning alerting cable customers in Arizona and beyond that if you receive an e-mail claiming you need to update or upgrade your account, disregard it, especially if it carries a deadline that warns your service will be disconnected if you don’t respond within a matter of days. Charter Communications is taking a hard line against extending promotional pricing for Time Warner Cable and Bright House Networks customers and Wall Street predicts a major exodus of customers as a result.

Charter Communications is taking a hard line against extending promotional pricing for Time Warner Cable and Bright House Networks customers and Wall Street predicts a major exodus of customers as a result.

Frustration at Frontier Communications doesn’t stop with customers. Employees are also speaking out about the company’s inability to manage their growing acquisitions and offer good service to customers. Others are confused about major company priorities and initiatives that suddenly get dropped, and customer service representatives feel like they are cheating customers selling them products and services that are better in name only.

Frustration at Frontier Communications doesn’t stop with customers. Employees are also speaking out about the company’s inability to manage their growing acquisitions and offer good service to customers. Others are confused about major company priorities and initiatives that suddenly get dropped, and customer service representatives feel like they are cheating customers selling them products and services that are better in name only.

“If you ever wondered why it takes so long to get something done with Frontier, I can tell you — it’s the bureaucracy and a culture clash between the two companies,” writes Jim. “Working for Verizon’s wireline division was already stressful over the years because they were not investing very much in wired services and we’d learn to manage that by hoarding things and trying to keep issues as local as possible, but Frontier is a giant headache. When a customer needs something from us, often we cannot give the customer a good estimate of when he or she will get what they need because we don’t know ourselves. But we are told to ‘be optimistic’ or ‘be vague’ which is why there are a lot of broken deadlines or disappointments. They never tell us to lie, but we cannot level with customers either because many will bolt to Time Warner Cable or Charter if we told them the God honest truth. We have business and residential customers promised certain broadband performance by sales that we cannot give them because they are not FiOS-enabled. If you were promised 75Mbps and got 6Mbps, you’d start shopping around, too.”

“If you ever wondered why it takes so long to get something done with Frontier, I can tell you — it’s the bureaucracy and a culture clash between the two companies,” writes Jim. “Working for Verizon’s wireline division was already stressful over the years because they were not investing very much in wired services and we’d learn to manage that by hoarding things and trying to keep issues as local as possible, but Frontier is a giant headache. When a customer needs something from us, often we cannot give the customer a good estimate of when he or she will get what they need because we don’t know ourselves. But we are told to ‘be optimistic’ or ‘be vague’ which is why there are a lot of broken deadlines or disappointments. They never tell us to lie, but we cannot level with customers either because many will bolt to Time Warner Cable or Charter if we told them the God honest truth. We have business and residential customers promised certain broadband performance by sales that we cannot give them because they are not FiOS-enabled. If you were promised 75Mbps and got 6Mbps, you’d start shopping around, too.”