Savannah, Ga.

The very idea that a city would get involved in selling better broadband service to its residents has sparked a coordinated campaign to sully municipally owned providers and color the results of an ongoing study to determine if Savannah, Ga. is getting the kind of internet access it needs.

While the city and county continue their Broadband Fiber-Optic Feasibility Study and survey residents about incumbent providers including AT&T, Comcast, and Hargray Communications, an organized pressure campaign coordinated by the Chatham County GOP is well underway to undermine any idea the city should compete against the three dominant local internet providers.

“The purpose of this study is to examine how we are currently served with broadband infrastructure, particularly focused on the services available to our community residents, anchor institutions, businesses, and key services like public safety, health and education,” a Savannah city spokesperson told Stop the Cap!

The city’s goal is to: “confirm that residents, anchor institutions and businesses have access to the services they need and that those services are competitively priced.” Incumbent providers are betting the answer to that question will likely be no and have started early opposition to discourage the city from attempting to build its own broadband network. Comcast and AT&T have apparently teamed up with the local Chatham County GOP to defend current providers in suspiciously similar-sounding letters to the editor.

Consider two examples.

About a month ago, Stephen Plunk, executive secretary of the Chatham County Republican Party, liberally sprinkled talking points provided by outside think tanks in an editorial published by the Savannah Morning News:

The Savannah Morning News published this ominous illustration adjacent to a guest editorial from a Chatham County GOP official opposing public broadband.

Only 6,000 residents in Chatham County, out of about 280,000, do not have access to wired internet of any sort. About 90 percent of Savannah residents can choose from two or more wired internet service providers . The city’s current residential providers offer speeds up to 105 mbps, and its 12 business providers offer speeds that are generally between 100 mbps and one gigabit.

Private providers also are making big new investments here. Last year, Hargray Communications announced a plan to offer one gigabit speeds to Lowcountry customers. In March, Comcast announced its intention to offer 10-gigabit speeds to city businesses. Last month, AT&T said it also will begin offering superfast capacity.

Next, let’s look at whether a city should provide service directly to customers. Or, is it wise? To determine that, the city council must ask itself whether it wants to go down the path of Marietta, which ran its own internet company several years ago but was forced to sell that network at a loss when it failed to turn a profit year after year. Marietta’s mayor eventually admitted the city never should have become an ISP. There are government ISPs that do make a profit every year, but they are rare. Chattanooga’s government-run system is often touted as a model, but the city received more than $100 million from the federal government to get its system started.

This morning, Mary Flanders, chairwoman of the Chatham County GOP wrote essentially the same things in an “opposing views” piece published by the Connect Savannah weekly newspaper (and at least cited some of her sources):

They should proceed carefully. Cautionary tales about municipal broadband networks abound.

Consider the situation in Marietta, the sprawling suburb northwest of Atlanta. Marietta started its own municipal network that stretched along a 210-mile long route. After spending $35 million to build out the network, Marietta earned a grand total of 180 customers.

The then-Mayor said the city couldn’t keep pace with the expenses associated with the constant flood of technology upgrades required to manage a broadband network. The city ultimately sold the network in 2004 for a $20 million loss.

Pacific Research Institute, in a report on municipal broadband, found that “Mariettans had decided that they would rather take a $20.33 million loss than continue to subsidize a municipal telecom venture that was sucking their city dry.”

Marietta may be relatively close to home, but it’s not the only example. Provo, Utah spent $40 million to build its network, only to sell it to Google Fiber for the princely sum of $1. In Groton, Connecticut, taxpayers lost $38 million.

City leaders need to consider the downside risk to municipal services if and when the broadband network fails to attract customers and generate case. The shortfall has to be made up somewhere. Where will the money come from? Tax hikes?

Budget cuts to basic services or to the police or fire department? Try explaining that to voters come election time, especially if the crime rate is on the rise.

According to Kelly McCutcheon, President of the Georgia Public Policy Foundation, typically the consultants are the only ones who come out good on these deals. It would be a bitter pill to swallow by Savannah citizens and city leaders alike.

Let’s dig into some of the specifics on Internet needs in Savannah. Of the 280,000 residents in Chatham County, only 6,000 residents do not have access to wired Internet of any kind. About 90% of Savannah residents can choose from two or more wired Internet service providers (ISPs).

The city’s current residential providers offer speeds up to 105 mbps, and its twelve business providers offer speeds that are generally between 100 mbps and one gigabit, which is considered to be very speedy in the Internet world.

Private providers also are making big new investments in the area. Last year, Hargray Communications announced a plan to offer one gigabit speeds to Lowcountry customers. In March, Comcast announced its intention to offer 10-gigabit speeds to city businesses. Last month, AT&T said it also would begin offering incredibly fast capacity to Savannah entrepreneurs.

On track to be profitable by 2006, local politics forced an early sale of the community fiber network that was succeeding.

Most of these talking points have been debunked by Stop the Cap! over our nine-year history. The examples of municipal broadband failures are so few and far between, we’ve come to recognize them, and many of the shop worn examples provided by the Chatham County Republicans are more than five years old.

In Groton, Conn., the emergence of a municipal provider inspired network upgrades and more competition from Comcast while the phone company Southern New England Telephone (later AT&T and today Frontier Communications) did everything possible to keep the publicly owned provider from offering phone services to customers. In the end, Comcast undercut the municipal provider and AT&T’s deployment of U-verse created problems for the then-rosy revenue projections the municipal provider was depending on to recoup its original construction costs. The network was sold five years ago to a private provider and customers still appreciate the quality of the original network today run by Thames Valley Communications, which rates four out of five stars while its competitors Frontier and Comcast rate two. It would be wrong to assume today’s municipal broadband providers have not learned important lessons and now account for incumbents responding to competition with heavily discounted rate retention plans for customers threatening to leave, as well as network upgrades. Revenue projections have become more conservative, both to deal with unexpected construction costs and the revenue likely to be earned in light of cut-rate plans from the competition. But many customers make the switch anyway, persuaded by the quality and reliability of superior fiber networks, rate stability, and a more responsive level of customer service.

The networks in Provo, Utah and Marietta, Ga., are examples of what happens when politicians opposed to the concept of municipal broadband intentionally meddle with them in an effort to prove an ideological argument or to help move along a pre-conceived sale of publicly owned infrastructure to private companies.

The networks in Provo, Utah and Marietta, Ga., are examples of what happens when politicians opposed to the concept of municipal broadband intentionally meddle with them in an effort to prove an ideological argument or to help move along a pre-conceived sale of publicly owned infrastructure to private companies.

In Provo, the fiber to the home network was built and quickly hamstrung by a Utah state law that forbade the city from selling broadband service to the public. Instead, it had to sell wholesale access to private companies it had to attract, who in turn would provide service to the public. Imagine a marketing campaign for a new provider that required customers to deal with two unfamiliar providers just to sign up.

Christopher Mitchell, who studies municipal networks and advocates for community involvement in broadband, wrote a year ago iProvo was facing serious challenges primarily because politicians and industry lobbyists got in the way:

“Industry lobbyists convinced Utah legislators to restrict local authority over municipal networks to ‘protect’ taxpayers and that argument is still frequently used today by groups opposing local internet choice. The law does not actually revoke local authority to invest in networks, it monkeys around with how local governments can finance the networks and requires that municipalities use the wholesale-only model rather than offering services directly.

“However, the debt-financed citywide wholesale-only model has proven to be the riskiest approach of municipal networks. Building a municipal fiber network where the city can ensure a high level of service is hard and can be a challenge to make work financially. Trying to do that while having less control over quality of service and splitting revenues with 3rd parties is much harder.”

Marietta’s experience with municipal broadband failed only because a new mayor unilaterally declared it an ideological failure and sold the network at a loss for political reasons. We covered that debacle ourselves back in 2012:

In Marietta, the public broadband “collapse” was one-part political intrigue and two-parts media myth.

Marietta FiberNet was never built as a fiber-to-the-home service for residential customers. Instead, it was created as an institutional and business-only fiber network, primarily for the benefit of large companies in northern Cobb County and parts of Atlanta. The Atlanta-Journal Constitution reported on July 29, 2004 that Marietta FiberNet “lost” $24 million and then sold out at a loss to avoid any further losses. But in fact, the sloppy journalist simply calculated the “loss” by subtracting the construction costs from the sale price, completely ignoring the revenue the network was generating for several years to pay off the costs to build the network.

In reality, Marietta FiberNet had been generating positive earnings every year since 2001 and was fully on track to be in the black by the first quarter of 2006.

So why did Marietta sell the network? Politics.

Marietta’s then-candidate for mayor, Bill Dunway, did not want the city competing with private telecommunications companies. If elected, he promised he would sell the fiber network to the highest bidder.

He won and he did, with telecommunications companies underbidding for a network worth considerably more, knowing full well the mayor treated the asset as “must go at any price.” The ultimate winner, American Fiber Systems, got the whole network for a song. Contrary to claims from that the network was a “failure,” AFS retained the entire management of the municipal system and continued following the city’s marketing plan. So much for the meme government doesn’t know how to operate a broadband business.

While members of the Chatham County GOP took potshots at outside consultants hired to consider whether Savannah should explore offering community broadband, Ms. Flanders was far more sanguine about her sources: the Pacific Research Institute (PRI) and the Georgia Public Policy Foundation.

In fact, the Pacific “Research Institute” doesn’t do independent research and it’s not an institute. It’s a right-wing, dark money-funded think tank with ties to the American Legislative Exchange Council (ALEC) and the Koch Brothers. The Georgia Public Policy Foundation, like PRI, prides itself on not revealing the sources of its funding, but SourceWatch uncovered their financial ties to the Donors Capital Fund, a corporate-“murky money maze” specifically designed to hide corporate contributions and the motives those companies have to send the money. So it isn’t a stretch to assume that when a think tank suddenly takes an interest in municipal broadband, checks from AT&T, Comcast, and others have proven to be helpful motivators.

Suddenlink customers around the country are finding accessing the internet has suddenly gotten more expensive. For many service areas, the cable operator raised its rates in December for television and broadband service, with some of the biggest hikes coming from sneaky surcharges.

Suddenlink customers around the country are finding accessing the internet has suddenly gotten more expensive. For many service areas, the cable operator raised its rates in December for television and broadband service, with some of the biggest hikes coming from sneaky surcharges. “They also had their artificial internet rate hike when they implemented data ‘allowances’ (caps),” retorted Ryan, a Suddenlink customer. “Their upgrades are anything but complimentary.”

“They also had their artificial internet rate hike when they implemented data ‘allowances’ (caps),” retorted Ryan, a Suddenlink customer. “Their upgrades are anything but complimentary.”

Subscribe

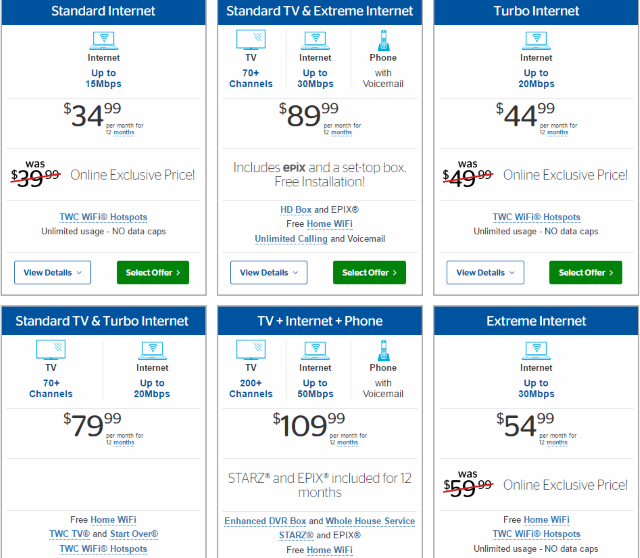

Subscribe Milan Gohil’s customer retention promotion with Time Warner Cable was coming to an end. Following in the footsteps of what tens of thousands of other Time Warner Cable customers have done for the last several years – it was time to call and request another deal.

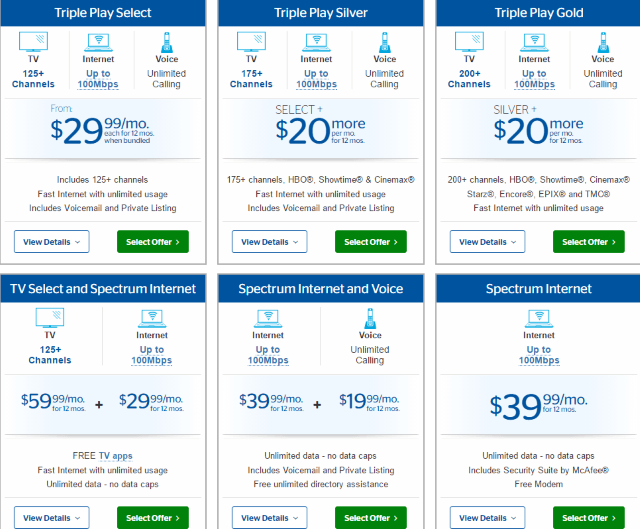

Milan Gohil’s customer retention promotion with Time Warner Cable was coming to an end. Following in the footsteps of what tens of thousands of other Time Warner Cable customers have done for the last several years – it was time to call and request another deal. Believing a good deal was in hand, Gohil readily agreed and while waiting on the phone, the representative activated the new promotion. There was only one problem: Milan ended up with Charter’s default internet plan in Time Warner Cable Maxx service areas converted to Spectrum service – 100Mbps.

Believing a good deal was in hand, Gohil readily agreed and while waiting on the phone, the representative activated the new promotion. There was only one problem: Milan ended up with Charter’s default internet plan in Time Warner Cable Maxx service areas converted to Spectrum service – 100Mbps. Finding a supervisor at a problem resolution center proved difficult at first. Time Warner Cable’s executive customer service department, formerly reachable at (212) 364-8300 has been taken over by Spectrum and disconnected. Calls are now being taken by 1-800-892-4357, and that is where we referred Gohil, which turned out to be at least some help.

Finding a supervisor at a problem resolution center proved difficult at first. Time Warner Cable’s executive customer service department, formerly reachable at (212) 364-8300 has been taken over by Spectrum and disconnected. Calls are now being taken by 1-800-892-4357, and that is where we referred Gohil, which turned out to be at least some help.

The networks in Provo, Utah and Marietta, Ga., are examples of what happens when politicians opposed to the concept of municipal broadband intentionally meddle with them in an effort to prove an ideological argument or to help move along a pre-conceived sale of publicly owned infrastructure to private companies.

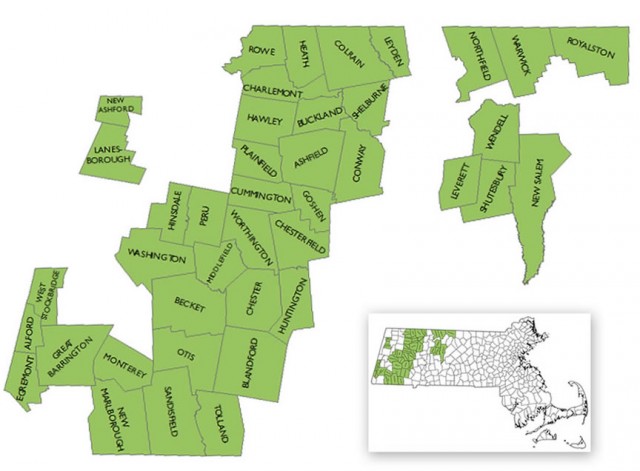

The networks in Provo, Utah and Marietta, Ga., are examples of what happens when politicians opposed to the concept of municipal broadband intentionally meddle with them in an effort to prove an ideological argument or to help move along a pre-conceived sale of publicly owned infrastructure to private companies. When the Berkshire Eagle asked readers to test their internet speeds and share the results, along with opinions about their broadband options, the newspaper hit a nerve.

When the Berkshire Eagle asked readers to test their internet speeds and share the results, along with opinions about their broadband options, the newspaper hit a nerve. Unfortunately, as customer demand for bandwidth grows, performance drops unless providers continually invest in new equipment to manage demand appropriately. Customers in western Massachusetts report Verizon seems to be making do with what they already have, and speeds have suffered.

Unfortunately, as customer demand for bandwidth grows, performance drops unless providers continually invest in new equipment to manage demand appropriately. Customers in western Massachusetts report Verizon seems to be making do with what they already have, and speeds have suffered.

Starting tomorrow, new customers signing up for AT&T’s 100+ channel streaming television package will pay $60 a month, up from the $35 promotional price AT&T has been advertising during the holidays.

Starting tomorrow, new customers signing up for AT&T’s 100+ channel streaming television package will pay $60 a month, up from the $35 promotional price AT&T has been advertising during the holidays.