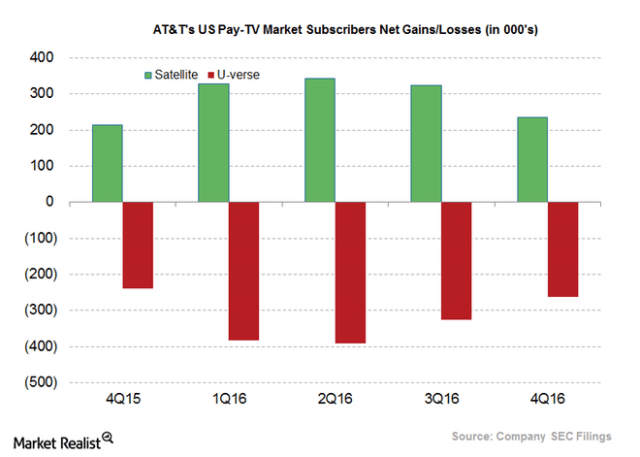

AT&T’s U-verse TV has been losing customers for over a year. (Image: Market Realist)

AT&T wants its U-verse TV video service dead, but is willing to watch it bleed customers for a while before likely downsizing or axing the service to make room for better broadband speeds.

The phone company has allowed U-verse TV to wither on the vine for more than a year, losing hundreds of thousands of customers every quarter since late 2015, and surprisingly has done almost nothing to stop the subscriber losses. In all, more than a million AT&T U-verse TV customers canceled service in 2016.

AT&T has admitted it has abandoned aggressively marketing its U-verse TV platform and has put its marketing muscle into selling DirecTV, the satellite provider AT&T acquired two years ago. DirecTV has added customers at a remarkably similar rate that AT&T has been losing U-verse TV customers. AT&T is even willing to watch customers walk into the arms of their competitors, a clear sign AT&T hopes their U-verse TV customers churn away.

Customers report U-verse TV-related promotions and retention plans have gotten worse in the last 14 months and some tell Stop the Cap! they were steered to DirecTV when they contacted AT&T to discuss their options.

Even the U-verse brand is being gradually discontinued. AT&T recently rebranded its fiber to the home service AT&T Fiber, dropping the AT&T U-verse with GigaPower brand the company had used since first announcing gigabit speed access.

AT&T U-verse as a brand is slowly disappearing in favor of AT&T Fiber.

Market Realist reports AT&T doesn’t necessarily want to spend a lot of money upgrading its legacy U-verse fiber to the neighborhood network across its entire landline service area, but needs to boost broadband speeds to stay competitive with cable broadband. When U-verse was originally launched, the service reserved much of its available bandwidth for television service, limiting broadband speeds to a maximum of around 24Mbps. That is no longer seen as competitively adequate and that leaves AT&T with only two options: upgrade its legacy infrastructure to support fiber-fed gigabit speed or reduce the amount of bandwidth devoted to television services and use it to expand broadband speeds.

AT&T is doing a little of both, expanding its gigabit broadband service in very limited areas in 46 cities with 23 more to come sometime this year. An indication of just how few customers can actually buy AT&T’s gigabit speeds was revealed indirectly by AT&T. Only four million homes and businesses, including 650,000 apartment and condo units can buy 1,000Mbps broadband from AT&T nationwide. Los Angeles and Chicago — both AT&T Fiber service areas, combined have more than five million potential customers alone.

In many cases, fewer than 10% of AT&T’s customers in AT&T Fiber cities can actually buy the service. In Knoxville, Tenn., AT&T admitted its gigabit service was only available in about 30 apartment and condominium complexes.

AT&T is promising to expand its fiber service to reach at least 12.5 million customers in 67 metro areas by the summer of 2019. But that will still likely leave more than half of AT&T’s customers out of reach of the service.

AT&T has told investors it plans no blockbuster budget increases to aggressively roll out fiber service across its footprint, which includes much of the south and midwest and large sections of California. Instead, it will likely offer fiber service to new housing developments, multi-dwelling units, and higher income areas. That decision still requires AT&T to do something for customers not on a near-term upgrade list, and that will likely be a gradual transformation of legacy U-verse into broadband-only service with speeds closer to 50-75Mbps, where video streaming from services like DirecTV Now can travel over the top to customers.

Subscribe

Subscribe “I think that in general, there is probably too much commercial interruption in television,” Disney CEO Bob Iger told investors on the company’s first-quarter earnings call.

“I think that in general, there is probably too much commercial interruption in television,” Disney CEO Bob Iger told investors on the company’s first-quarter earnings call.

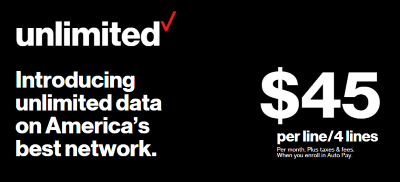

The “Cadillac” wireless network reintroduced unlimited data, phone, and texting this week at prices that vary according to the number of lines on your account:

The “Cadillac” wireless network reintroduced unlimited data, phone, and texting this week at prices that vary according to the number of lines on your account:

Comcast’s effort to run its own NBC affiliate in Boston from an over-the-air station in New Hampshire appears to have initially backfired, causing the ratings to hit rock bottom with

Comcast’s effort to run its own NBC affiliate in Boston from an over-the-air station in New Hampshire appears to have initially backfired, causing the ratings to hit rock bottom with