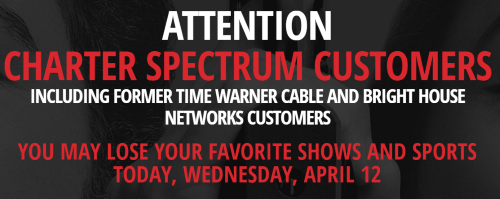

Every week brings the threat of yet another programming blackout because cable programmers want to be paid more and cable operators want to pay the same or less. This time, Fox Networks Group has sent a final warning to Charter Communications that their customers will lose several cable networks as soon as Wednesday if the two companies cannot reach a renewal agreement.

Every week brings the threat of yet another programming blackout because cable programmers want to be paid more and cable operators want to pay the same or less. This time, Fox Networks Group has sent a final warning to Charter Communications that their customers will lose several cable networks as soon as Wednesday if the two companies cannot reach a renewal agreement.

“Fox and Charter have an agreement to carry the Fox networks that Charter has chosen to ignore,” Fox said in a statement that was updated today. “We’re disappointed that despite our best efforts to reach a resolution, Charter Spectrum subscribers could lose access to multiple Fox sports and entertainment networks on April 12.”

The latest dispute surrounds the lucrative volume discounts that Time Warner Cable formerly negotiated for some of Fox’s non-news-related cable networks. Charter Communications acquired both Time Warner Cable and Bright House Networks to secure those kinds of volume discounts for itself. In general, the larger a cable system is, the lower the wholesale rate charged for cable programming. Charter hoped it could continue paying the lower rates Time Warner Cable managed to secure after acquiring the much larger cable system. But cable programmers are not buying Charter’s approach and in one case sued.

In March, Univision blocked Charter from carrying its Spanish-language networks Univision, Unimás, Galavisión, Univision Deportes and El Rey in a similar dispute. A temporary restraining order brought the networks back to the lineup a day later, at least temporarily. Univision sued Charter Communications in 2016 over the programming fee dispute.

In March, Univision blocked Charter from carrying its Spanish-language networks Univision, Unimás, Galavisión, Univision Deportes and El Rey in a similar dispute. A temporary restraining order brought the networks back to the lineup a day later, at least temporarily. Univision sued Charter Communications in 2016 over the programming fee dispute.

A significant amount of money is at stake depending on which side ultimately wins in court.

In the case of Univision, Charter’s own contract with the Spanish language programmer expired on June 30, 2016. That would normally require Charter to negotiate a contract renewal that it knew would be more costly than what it paid under the old contract. Charter learned Time Warner Cable had negotiated a contract with Univision that delivered better volume discounts and was not set to expire until June 2022.

To allow Charter Communications to argue that Time Warner Cable’s contract should continue to apply after the merger, it structured its acquisition (on paper at least) to allow Charter to claim Time Warner Cable would continue to manage all of its cable systems. Charter’s lawyers argued that because “Time Warner Cable” is in charge, the wholesale rates Time Warner Cable negotiated should now apply to all Charter systems.

Univision, among other programmers, balked at Charter’s creative thinking.

“Everyone knows that is simply not true: the longstanding CEO and the senior executive team of Charter, as well as its pre-existing board of directors, now in fact manage and control all such cable systems, and virtually the entire TWC leadership team has departed,” Univision argued in its 2016 lawsuit.

If the programmers win, Charter will have to negotiate new carriage agreements at 2017 prices instead of continuing to pay the lower rates Time Warner Cable won for itself in the past.

A similar dispute is likely behind the current battle between Charter and Fox. Each time a cable company has to negotiate a new contract, programmers tend to ask for a considerably higher wholesale price for their channels and try to get cable systems to also carry their other networks. When a cable operator refuses to pay what it considers to be an unconscionable renewal rate or does not want to carry the programmer’s other networks, a showdown takes place that often leads to channels being temporarily removed from the lineup. Cable companies usually lose these battles after subscribers get hostile, but some smaller cable operators have walked away from programmers like Viacom for good when the renewal price stayed too high.

As is the tradition in these disputes, Fox launched a website and social media blitz to warn Charter customers they are about to lose access to 19 regional sports channels, FX, FXX, FOX Movie Channel, National Geographic TV, Fox Sports and Fox Deportes and asked customers to start calling Charter and complain. The current dispute does not involve the FOX (TV) Network, the Fox News Channel or the Fox Business Channel.

As is the tradition in these disputes, Fox launched a website and social media blitz to warn Charter customers they are about to lose access to 19 regional sports channels, FX, FXX, FOX Movie Channel, National Geographic TV, Fox Sports and Fox Deportes and asked customers to start calling Charter and complain. The current dispute does not involve the FOX (TV) Network, the Fox News Channel or the Fox Business Channel.

“We’re disappointed that despite our best efforts to reach a resolution, Charter Spectrum subscribers could lose access to multiple Fox sports and entertainment networks on April 12,” FOX wrote on its website. “Charter’s tactics could result in its subscribers missing our popular programming including Fox Sports’ telecasts of the St. Louis Cardinals and Blues, Kansas City Royals, Cleveland Cavaliers, Cincinnati Reds and many other MLB, NBA and NHL teams on Fox Regional Sports Networks, Fox Deportes, National Geographic, and FX’s hit dramas The Americans and Feud as well as much more award winning programming.”

“Fox is trying to gouge our customers using the increasingly common tactic of threats and removal of programming,” Charter responded in a statement. “They are attempting to extort Charter for hundreds of millions of dollars. We will continue to work towards a fair agreement.”

Fox Networks is using this ad to warn Charter Spectrum customers they could lose Fox programming. (0:30)

Subscribe

Subscribe