Two N.J. public-television stations will collect more than $330 million to turn off their transmitters.

At a time when the Trump Administration is signaling its interest in eliminating the small amount of funding still available to public broadcasting in the United States, the recent FCC Spectrum Auction brought some public stations much-needed revenue to complete station or facility upgrades and help underwrite the cost of locally produced programming. But some TV station owners will pocket tens of millions of dollars from auction proceeds earned from a license that was supposed to include a commitment to serve in the public interest.

Current – News for People in Public Media has tracked the station changes that will come to public-television stations as a result of the spectrum auction. In most cases, the public-TV stations that sold their channel position will not disappear entirely. Many will “merge into other station’s spectrum” — which means in plain English they will share space with another local station.

It won’t be a total loss for public-television in most of these cities. Many are served by “repeater” stations that essentially rebroadcast programming from another nearby station. In larger cities, multiple public-TV stations are not uncommon and losing one might not have a big impact, especially if remaining stations pick up some of the programming that will go missing when the affected station signs off. But in some states, the loss of free over the air TV stations could exacerbate the growing problem of maintaining quality coverage of local news and events.

For cord-cutters, local free television remains an essential part of the kind of TV package consumers used to pay the cable or satellite company to receive. Local stations still deliver an important public service to the community through news and public affairs programming, but that responsibility is increasingly taking a back seat to profits.

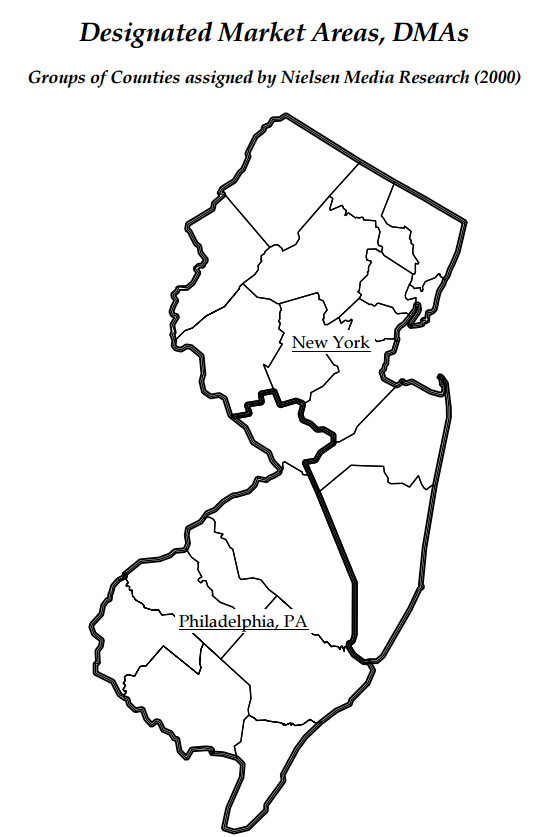

The state of New Jersey is served by two media markets – one in New York City, the other Philadelphia, neither in New Jersey.

For some states, the challenge to deliver locally focused programming in areas dominated by media markets in adjacent states has been a problem for decades. No state has faced this challenge more than New Jersey, divided in half and served by two out-of-state media Designated Market Areas (DMAs). The northern half of New Jersey is part of the New York City TV market and the southern half is part of the Philadelphia DMA. As a result, local stories about events inside New Jersey can get lost in favor of stories centered on New York or Philadelphia, even more so during today’s era of media consolidation and cutbacks in newsroom budgets.

A Free Press project is trying to address that problem by encouraging New Jersey state officials to create a public trust fund from part of the hundreds of millions earned by the state’s stations from the spectrum auction to support community-driven projects, responsive local journalism, serious investigative reporting, civic technology and essential public media outlets. The campaign seeks to remind state and local officials that the airwaves still belong to the public, and the stations collecting large sums from the auction agreed to serve their communities in return for obtaining that license to broadcast. Simply putting auction proceeds into their pockets isn’t serving the public interest.

“It’s only right that money from the sale of the state’s 20th-century media outlets be used to create a new, forward-thinking media landscape for this century that focuses on local communities and is attuned to residents’ needs,” said Mike Rispoli, Free Press Action Fund journalism campaign director and director of the News Voices: New Jersey project. “When local stations go off the air, news coverage disappears. That means people are less informed, civic participation drops and political corruption increases. Spectrum revenues must be used to support those who rely on locally produced news and information to engage with their neighbors, learn about volunteer opportunities, make decisions about voting, run for public office, get information about small businesses and support their children in local schools.”

Just two New Jersey public-television stations WNJN and WNJT together collected more than $330 million in auction revenues — two of the largest individual payouts of any noncommercial stations. Now both stations plan to go off the air. Where exactly will that money be going?

The News Voices: New Jersey project wants some of it spent on making sure New Jersey residents have a New Jersey-focused news media, particularly in a state where political scandals have not been uncommon.

“Some ideas we’ve heard from journalists and community members on how to use these public proceeds include support for locally focused digital news startups; apps and tools to help people sift through public data and expedite Freedom of Information Act requests; robust community-engagement projects designed to lift up voices long ignored by newsrooms, in communities of color, immigrant communities, and other underserved areas; and media-literacy programs to identify and combat the spread of fake news and disinformation,” Rispoli said.

The group is asking interested members of the public to sign up for the project and help advocate for stronger newsrooms and communities. A similar effort is also getting underway in North Carolina.

As of today, here is an update on what is happening with the public-TV stations affected by the FCC Spectrum Auction.

| Station affected | City | State | Licensee | Effect on broadcast signal | Total proceeds | Proceeds for pubcaster | Date announced | |

|---|---|---|---|---|---|---|---|---|

| WSBN | Tri-Cities | TN | Blue Ridge Public Television, Inc. | Unknown | 597,793 | 597,793 | 4/13/17 | |

| WXEL | West Palm Beach-Ft. Pierce | FL | South Florida PBS, Inc. | Merge into other station spectrum | 4,696,299 | 4,696,299 | 4/13/17 | |

| WMSY | Tri-Cities | TN | Blue Ridge Public Television, Inc. | Unknown | 5,243,122 | 5,243,122 | 4/13/17 | |

| WJSP | Columbus | GA | Georgia Public Telecommunications Commission | Move to Low-VHF | 7,267,147 | 7,267,147 | 4/13/17 | |

| WPBO | Charleston-Huntington | WV | Ohio State University | Go off-air | 8,822,670 | 8,822,670 | 2/10/17 | |

| WQED | Pittsburgh | PA | WQED Multimedia | Move to Low-VHF | 9,853,782 | 9,853,782 | 2/9/17 | |

| WNGH | Chattanooga | TN | Georgia Public Telecommunications Commission | Move to Low-VHF | 11,949,966 | 11,949,966 | 2/8/17 | |

| WCMZ | Flint | MI | Central Michigan University | Go off-air | 14,163,505 | 14,163,505 | 3/30/17 | |

| WOUC | Columbus | OH | Ohio University | Move to Low-VHF | 18,412,349 | 18,412,349 | 3/30/17 | |

| WUSF | Tampa-St Petersburg-Sarasota | FL | University of South Florida | Go off-air | 18,754,503 | 18,754,503 | 4/13/17 | |

| WEDY | Hartford-New Haven | CT | Connecticut Public Broadcasting, Inc. | Merge into other station spectrum | 18,900,229 | 18,900,229 | 4/13/17 | |

| K35DG-D | San Diego | CA | Regents of the University of California | Unknown | 24,020,383 | 24,020,383 | 3/3/17 | |

| WITF | Harrisburg | PA | WITF Inc. | Channel-share | 50,109,234 | 25,054,617 | 2/8/17 | |

| WVIA | Pittston | PA | Northeastern Pennsylvania Educational Tel.A’ssn | Channel-share | 51,934,668 | 25,900,000 | 2/17/17 | |

| WRET | Greenville-Spartanburg | SC | South Carolina Educational TV Commission | Merge into other station spectrum | 43,162,610 | 43,162,610 | 4/13/17 | |

| KOCE | Los Angeles | CA | KOCE-TV Foundation | Channel-share | 138,003,711 | 49,000,000 | 4/13/17 | |

| WVTA | Burlington | VT | Vermont ETV, Inc. | Go off-air | 56,648,952 | 56,648,952 | 4/13/17 | |

| WGBY | Springfield-Holyoke | MA | WGBH Educational Foundation | Move to High-VHF | 57,043,939 | 57,043,939 | 4/13/17 | |

| WNVT | Washington | DC | Commonwealth Public Broadcasting Corp. | Go off-air | 57,154,459 | 57,154,459 | 4/13/17 | |

| KLCS | Los Angeles | CA | Los Angeles Unified School District | Channel-share (with KCET) | 130,510,880 | 62,000,000 | 4/13/17 | |

| KCET | Los Angeles | CA | KCETLink | Channel-share (with KLCS) | N/A | 62,000,000 | 4/13/17 | |

| KRCB | Rohnert Park | CA | Rural California Broadcasting Corp. | Move to Low-VHF | 71,979,802 | 71,979,802 | 4/13/17 | |

| WLVT | Philadelphia | PA | Lehigh Valley Public Telecommunications Corp. | Channel-share | 121,752,169 | 82,000,000 | 4/13/17 | |

| WMVT | Milwaukee | WI | Milwaukee Area Technical College District Board | Merge into other station spectrum | 84,931,314 | 84,931,314 | 4/13/17 | |

| WSBE | Providence | RI | Rhode Island PBS Foundation | Move to Low-VHF | 94,480,615 | 94,480,615 | 4/13/17 | |

| KQEH | San Francisco-Oakland-San Jose | CA | KQED Inc. | Go off-air | 95,459,109 | 95,459,109 | 2/13/17 | |

| WNVC | Washington | DC | Commonwealth Public Broadcasting Corp. | Go off-air | 124,801,961 | 124,801,961 | 2/27/17 | |

| WYBE | Philadelphia | PA | Independence Public Media of Philadelphia, Inc. | Go off-air | 131,578,104 | 131,578,104 | 4/13/17 | |

| WNJT | Philadelphia | PA | New Jersey Public Broadcasting Authority | Merge into other station spectrum (WNJS) | 138,059,363 | 138,059,363 | 2/9/17 | |

| KVCR | San Bernardino | CA | San Bernardino Community College District | Move to Low-VHF | 157,113,171 | 157,113,171 | 4/13/17 | |

| WGBH | Boston | MA | WGBH Educational Foundation | Move to Low-VHF | 161,723,929 | 161,723,929 | 4/13/17 | |

| WNJN | New York | NY | New Jersey Public Broadcasting Authority | Merge into other station spectrum (WNJB) | 193,892,273 | 193,892,273 | 4/13/17 | |

| WHUT | Washington | DC | Howard University | Withdrew from auction | N/A | N/A | 4/13/17 | |

| WYCC | Chicago | IL | Board of Trustees of Community College District #508, Cook County | Unknown | 15,959,957 | Unknown | 4/13/17 | |

| KMTP | San Francisco-Oakland-San Jose | CA | Minority Television Project Inc. | Unknown | 87,824,258 | Unknown | 2/16/17 | |

Subscribe

Subscribe

“Our work suggests that cable companies have room to take up broadband pricing significantly and we believe regulators should not oppose the re-pricing (it is good for competition & investment).”

“Our work suggests that cable companies have room to take up broadband pricing significantly and we believe regulators should not oppose the re-pricing (it is good for competition & investment).”