AT&T will spend $9.7 million in annual public subsidies to bolster its cell tower network in South Carolina in part to expand its rural wireless broadband program. Perhaps services like mobile tower lease would come in handy.

AT&T will spend $9.7 million in annual public subsidies to bolster its cell tower network in South Carolina in part to expand its rural wireless broadband program. Perhaps services like mobile tower lease would come in handy.

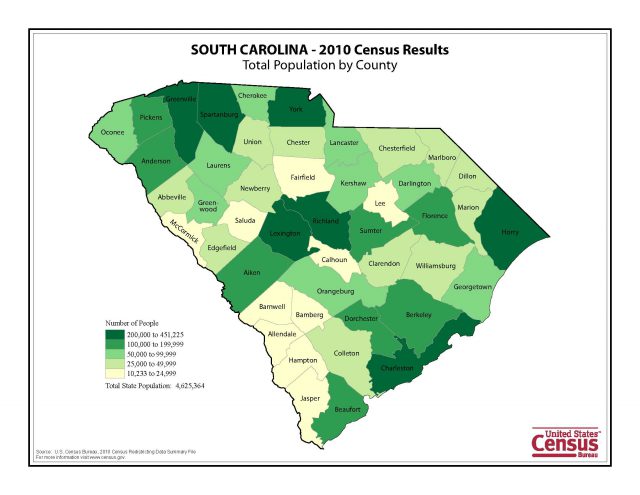

The Federal Communications Commission approved the funding, which is expected to cost Americans nearly $10 million annually until 2020 to boost wireless coverage in 20 mostly rural counties in South Carolina to reach an estimated 12,000 new homes and businesses by the end of this year. Nationwide, the company is getting almost $428 million a year to extend access to 1.1 million customers in 18 states, the FCC says.

AT&T plans to spend the money to improve cell towers it already has in place for its mobile phone customers. The company admitted it will rely on existing infrastructure and won’t lay a single new strand of fiber optics. Instead, wireless broadband customers will share space with AT&T’s existing mobile customers on AT&T’s backhaul network.

“Because of the wireless aspect of it and the greater ability to deliver that last-mile connection, it does help to overcome any obstacles that may be in the cost equation,” Hayes said. “This initial build, with it being infrastructure that we have in place with these towers, that comes from years of investment.”

AT&T will also be able to promote its own products and offer customers discounts and free installation when they agree to sign up for other AT&T services. Hayes said the service will cost $60 a month for everyone else, along with a one-time installation fee of $99.

AT&T will also be able to promote its own products and offer customers discounts and free installation when they agree to sign up for other AT&T services. Hayes said the service will cost $60 a month for everyone else, along with a one-time installation fee of $99.

“Because of the wireless aspect of it and the greater ability to deliver that last-mile connection, it does help to overcome any obstacles that may be in the cost equation,” spokesman Daniel Hayes told The Post and Courier. “This initial build, with it being infrastructure that we have in place with these towers, that comes from years of investment.”

AT&T is treating the fixed wireless program, which offers up to 10Mbps service, as an alternative to wiring fiber optics in outer suburban and rural areas.

With taxpayer/ratepayer dollars financing a significant part of the cost, AT&T will have a de facto monopoly in its rural service areas where it has traditionally declined to offer or maintain DSL service or consider fiber optic upgrades, leaving these areas without broadband service until the subsidy program began.

Subscribe

Subscribe