NBCUniversal’s Peacock streaming service app is now finally available on Roku devices and Roku-enabled televisions, almost 10 weeks after the new streaming service launched.

NBCUniversal’s Peacock streaming service app is now finally available on Roku devices and Roku-enabled televisions, almost 10 weeks after the new streaming service launched.

Peacock’s appearance on Roku came after NBCUniversal and Roku reached a deal guaranteeing NBCU’s networks (and corresponding apps for 11 NBCU networks, 12 NBCU-owned local stations, and 23 Telemundo-owned local stations) will remain available on the Roku platform and in return, Roku will support Peacock. The deal was seen as crucial by analysts, because Roku has an installed user base of over 43 million accounts, with an estimated 100 million viewers in households across the country.

“We are pleased that NBC agreed to a very positive and mutually beneficial partnership to bring Peacock to America’s No. 1 streaming platform,” said Tedd Cittadine, Roku’s vice president of content acquisition. “We are excited by the opportunities to integrate NBC content within the Roku Channel while we also work together with Peacock on the development of a significant and meaningful advertising and ad tech partnership. This is a great outcome for consumers and we look forward to growing together with Peacock as they bring their incredible content to the Roku platform.”

Roku is also pleased whenever a significant content provider signs a deal with the company. Roku traditionally takes a 20% cut of all subscription revenue when a customer signs up for a service on the Roku platform. It receives at least 30% of the advertising time on free streaming services, allowing Roku to sell advertising and keep the money. NBCU appeared to be reluctant to accept those terms, and that is likely what caused the delay in debuting Peacock on Roku. Neither party would disclose the terms in the contract. Comcast is the parent company of NBCU.

Roku is also pleased whenever a significant content provider signs a deal with the company. Roku traditionally takes a 20% cut of all subscription revenue when a customer signs up for a service on the Roku platform. It receives at least 30% of the advertising time on free streaming services, allowing Roku to sell advertising and keep the money. NBCU appeared to be reluctant to accept those terms, and that is likely what caused the delay in debuting Peacock on Roku. Neither party would disclose the terms in the contract. Comcast is the parent company of NBCU.

Comcast CEO Brian Roberts said last week Peacock had signed up at least 15 million new users over the last two months. But Roberts would not disclose how many were actually paying for the service. Peacock’s free, ad-supported tier offers over 13,000 hours of classic and current NBC programs, including entertainment, news, and sports. A small catalog of original series and other premium content is also available for $4.99 a month (or $49.99/yr), and users who want it all — without ads — can pay $9.99 a month (or $99.99/yr). Roberts likely needs a much larger subscriber base to make Peacock a viable proposition, making its availability on the Roku platform crucial.

Some analysts fear carriage disputes like this could open a new front in the “retransmission consent” wars, where national and local networks are blacked out when cable or satellite providers refuse to pay their asking prices. If Roku insists on being compensated in return for making services available in its app store and if content providers cannot reach an agreement, services could suddenly disappear, or never appear at all. HBO Max is still unavailable on Roku because parent company AT&T has yet to sign a contract with Roku, and Peacock remains unavailable on Amazon’s Fire TV platform and Samsung’s Smart TVs.

Subscribe

Subscribe A week after the cable industry

A week after the cable industry  (Reuters) – Verizon Communications said on Monday it will buy pre-paid mobile phones provider Tracfone, a unit of Mexican telecoms giant America Movil in a $6.25 billion cash and stock deal.

(Reuters) – Verizon Communications said on Monday it will buy pre-paid mobile phones provider Tracfone, a unit of Mexican telecoms giant America Movil in a $6.25 billion cash and stock deal. Verizon has not historically invested in prepaid compared with its rivals, such as T-Mobile, which revamped its MetroPCS prepaid brand and bought Sprint, which had a large prepaid business.

Verizon has not historically invested in prepaid compared with its rivals, such as T-Mobile, which revamped its MetroPCS prepaid brand and bought Sprint, which had a large prepaid business. Facing no significant new competitive pressure, Charter Communications has put DOCSIS 4, capable of bringing dramatically faster internet service to Spectrum customers, on hold until 2022.

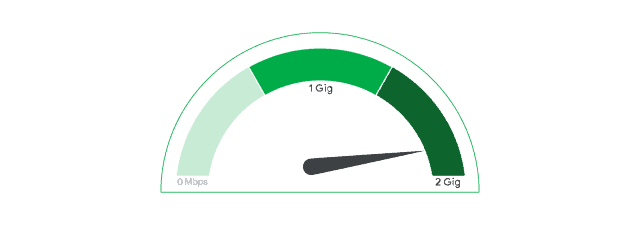

Facing no significant new competitive pressure, Charter Communications has put DOCSIS 4, capable of bringing dramatically faster internet service to Spectrum customers, on hold until 2022.

“It is out of the question to let this Quebec company move its head office to Ontario,” Legault said. “We talked this morning with Louis Audet […] and we’ll do whatever it takes to keep the head office here.”

“It is out of the question to let this Quebec company move its head office to Ontario,” Legault said. “We talked this morning with Louis Audet […] and we’ll do whatever it takes to keep the head office here.”