The Minnesota Public Utilities Commission (MPUC) has opened an inquiry into whether Frontier Communications is meeting its service obligations to customers after receiving a major spike in complaints about the phone company.

The Minnesota Public Utilities Commission (MPUC) has opened an inquiry into whether Frontier Communications is meeting its service obligations to customers after receiving a major spike in complaints about the phone company.

The MPUC acknowledged it has been “receiving a large volume of complaints related to the service quality, customer service, and billing practices of Frontier Communications.” The regulator is concerned that “after attempts to mediate these complaints, many of them remain unresolved.”

The investigation will include the Minnesota Department of Commerce and Minnesota’s Attorney General, both tasked with determining if Frontier is complying with MPUC rules and Minnesota state law.

Frontier provides service to more than 98,000 landlines in Minnesota, doing business as Frontier Communications and Citizens Telecommunications. Most Frontier customers are located in northeastern and southern Minnesota, as well as communities like Apple Valley, Burnsville, Farmington, and Rosemount.

A survey of filed complaints found many involved Frontier’s DSL internet service, which customers complained was slow and prone to frequent outages. Other complaints involved inaccurate billing and missed service calls, which sometimes led to delays of days or weeks before service could be restored.

A survey of filed complaints found many involved Frontier’s DSL internet service, which customers complained was slow and prone to frequent outages. Other complaints involved inaccurate billing and missed service calls, which sometimes led to delays of days or weeks before service could be restored.

“I’d heard a bunch of complaints of poor service all across my district,” said Rep. Rob Ecklund (DFL-International Falls) in a news release. “I am a Frontier customer myself, and the service has been lousy.”

Other customers had their complaints published in the Timberjay newspaper, which has been the unofficial meeting place for frustrated customers who cannot get satisfaction from Frontier.

“This has been the worst service experience of my life,” said Melissa Holmes, of Embarrass in northeastern Minnesota. “My whole neighborhood here on Wahlsten Road in Embarrass has had service issues with Frontier for decades. Repeated calls to the company go nowhere.”

The newspaper blamed Frontier’s wrong priorities in a scathing editorial last fall:

The newspaper blamed Frontier’s wrong priorities in a scathing editorial last fall:

Prospects for an improvement in Frontier’s service quality appear unlikely given the increasingly tenuous financial condition of the company. Frontier went deeply in debt in early 2016, when it completed an $11 billion purchase of landline infrastructure formerly owned by Verizon in California, Texas, and Florida. The acquisition more than doubled the size of the company, but also prompted a major restructuring, which included significant layoffs.

Frontier officials had touted the acquisition at the time, arguing that the company knew how to make money from traditional landline infrastructure even as the industry is rapidly transitioning to wireless. But the company has yet to demonstrate it is up to the challenge and as complaints over poor service have mounted, the company has hemorrhaged customers, particularly in more populated regions, where customers often have viable alternatives.

In response, Frontier claims it updated its billing software and is making “process improvements” in the way it conducts business.

If you live in Minnesota and wish to share your views with the MPUC, you can visit their website, register, and comment until May 25, 2018.

The state’s initial investigation and report on Frontier is due on May 11.

KSTP-TV in Minneapolis-St. Paul reports Frontier is under investigation by the state telecom regulator for poor service. (2:21)

Subscribe

Subscribe Netflix viewers will have around

Netflix viewers will have around

Despite the massive amount of extra money from the Trump Administration’s corporate tax cuts generating huge revenue spikes for America’s telecom companies, Frontier Communications disappointed investors with today’s news it was

Despite the massive amount of extra money from the Trump Administration’s corporate tax cuts generating huge revenue spikes for America’s telecom companies, Frontier Communications disappointed investors with today’s news it was

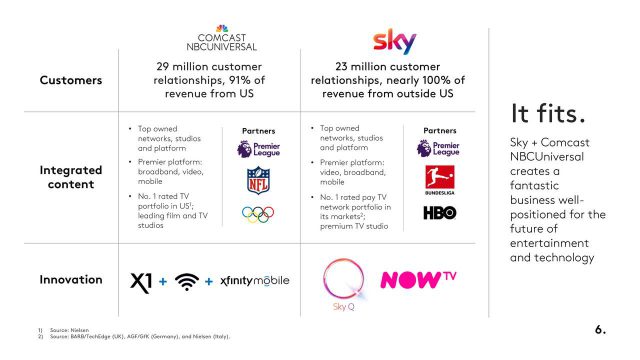

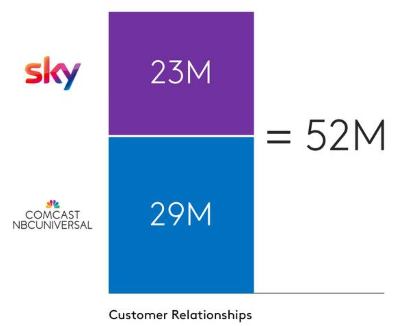

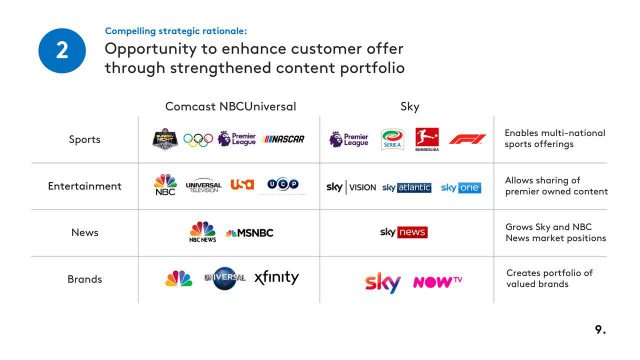

That three American companies are now competing to acquire Europe’s largest media company and biggest pay-TV broadcaster, with more than 23 million subscribers, could create concern among some regulators about foreign ownership of the media. A bid from Comcast is likely to be less controversial than dealing with Rupert Murdoch, however, who already has extensive media holdings in the United Kingdom.

That three American companies are now competing to acquire Europe’s largest media company and biggest pay-TV broadcaster, with more than 23 million subscribers, could create concern among some regulators about foreign ownership of the media. A bid from Comcast is likely to be less controversial than dealing with Rupert Murdoch, however, who already has extensive media holdings in the United Kingdom.

“They basically said that until we agree that they don’t have to contribute to our pension and health plan, they won’t talk about anything else,” Chris Erikson, business manager of Local 3,

“They basically said that until we agree that they don’t have to contribute to our pension and health plan, they won’t talk about anything else,” Chris Erikson, business manager of Local 3,