As Discovery Communications completes its $11.9 billion acquisition of Scripps Networks Interactive Inc., the newly supersized basic cable network powerhouse will lay the foundation to launch its own online video mini-bundle of all 18 Discovery and Scripps networks, along with on-demand options, for as little as $6 a month.

As Discovery Communications completes its $11.9 billion acquisition of Scripps Networks Interactive Inc., the newly supersized basic cable network powerhouse will lay the foundation to launch its own online video mini-bundle of all 18 Discovery and Scripps networks, along with on-demand options, for as little as $6 a month.

The new service, to be branded collectively as “Discovery” will include programming from:

Discovery

Discovery Channel, TLC, Animal Planet, Investigation Discovery, Oprah Winfrey Network, Velocity, Science, Discovery Family, American Heroes Channel, Destination America, Discovery Life, Discovery en Español (Spanish), and Discovery Familia (Spanish).

Scripps

Cooking Channel, DIY Network, Food Network, Great American Country, HGTV, and Travel Channel.

The package is being developed as a defensive move to fight the ongoing erosion of subscribers that are cord-cutting traditional cable television. Discovery has lost 5% of its viewers in the U.S. in the last quarter alone, because many customers are moving to on-demand services like Netflix combined with over-the-air stations.

The newly enlarged Discovery is now the largest provider of non-fiction basic cable programming in the country. A combination of instructional programming popular on Scripps’ networks is expected to fit well with the reality and documentary programming popular on most Discovery networks. Although frequently bundled with alternative cable television streaming services, those services typically lack a deep on-demand library of content.

In order to drive subscriptions, Discovery’s streaming service is expected to be budget priced and include a large library of on-demand content, possibly including programming from other networks not owned by Discovery down the road.

In order to drive subscriptions, Discovery’s streaming service is expected to be budget priced and include a large library of on-demand content, possibly including programming from other networks not owned by Discovery down the road.

The combined company also hopes to leverage as much savings out of the merger as possible. That will likely mean extensive job cuts at both companies. Discovery and Scripps together have more than 11,000 employees, including 600 ad sales people working for Discovery and 500 ad sales people working for Scripps.

Discovery will shut down its headquarters in Silver Spring, Md., and open a new headquarters in New York for both Discovery and Scripps employees. But Discovery will maintain Scripps’ headquarters in Knoxville, Tenn., as an “operations headquarters” for back-office work.

The two companies also have a significant international presence with more than three billion viewers worldwide, but the company plans to downsize international studios and consolidate production facilities in the United States and Poland, where Scripps owns TVN, a Polish broadcast television network that favors reality TV programming and is seen in 90% of the country.

At some point, some of the 18 networks may be consolidated. Discovery executives note it now has two channels devoted to food and cooking — Food Network and the Cooking Channel.

Discovery’s niche will continue to be non-fiction programming, even as much of the rest of the industry is rapidly moving towards scripted series. Discovery executives point out that an hour of a scripted TV series now costs an average of $5 million, while an hour of reality programming produced in-house costs about $400,000. Scripps’ networks have managed to produce their shows for even less, recorded in pre-constructed studios that do not require remote location filming.” As far as Discovery is concerned, sticking with nonfiction programming is the right choice.

“We look at that [scripted] side and we say, ‘Good luck with that,’” said Discovery CEO David M. Zaslav. “That’s not what we do. We don’t do red carpet.”

Discovery Communications and Scripps Networks promote their merger and their global networks in this company-produced spot. (2:47)

Subscribe

Subscribe Fox Networks will cut advertising to just two minutes per hour by the year 2020, according to its ad sales chief.

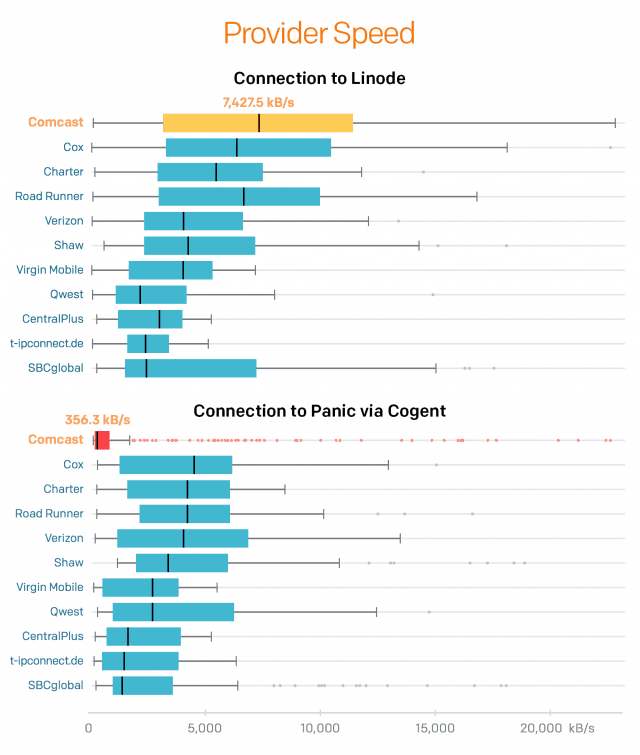

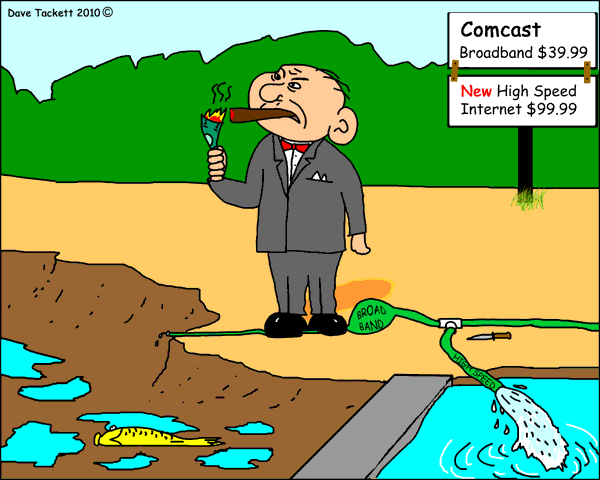

Fox Networks will cut advertising to just two minutes per hour by the year 2020, according to its ad sales chief. The country’s largest cable internet service provider needed help from an app developer in Portland, Ore. to let it know its broadband pipes were full and to do something about it.

The country’s largest cable internet service provider needed help from an app developer in Portland, Ore. to let it know its broadband pipes were full and to do something about it.

In addition to giving the internet public policy community new evidence that peering fights leaving customers stuck in the middle might be heating up once again. It also suggests if Comcast was unaware of the problem, it does not reflect well on the cable company to wait weeks until a customer reports such a serious slowdown before fixing it.

In addition to giving the internet public policy community new evidence that peering fights leaving customers stuck in the middle might be heating up once again. It also suggests if Comcast was unaware of the problem, it does not reflect well on the cable company to wait weeks until a customer reports such a serious slowdown before fixing it.

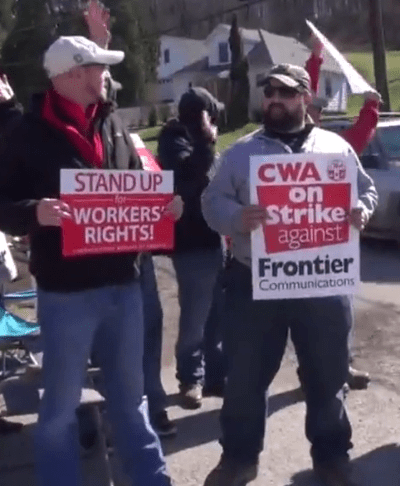

After 10 months of negotiations between Frontier Communications and the Communications Workers of America (CWA) over the phone company’s job cuts, 1,400 Frontier workers in West Virginia and Ashburn, Va.,

After 10 months of negotiations between Frontier Communications and the Communications Workers of America (CWA) over the phone company’s job cuts, 1,400 Frontier workers in West Virginia and Ashburn, Va.,