The New York State Public Service Commission today fined Charter/Spectrum $2 million after the company failed to meet its obligations to expand its cable network to more than ten thousand homes and businesses the company committed to serve in the time allotted. In addition, the PSC warned the company, which claimed in a response to the state’s “show cause” order that it was not obligated to meet the terms of its 2016 merger agreement, faces the threat of having its merger with Time Warner Cable revoked, which could end Spectrum’s ability to operate in New York State.

The New York State Public Service Commission today fined Charter/Spectrum $2 million after the company failed to meet its obligations to expand its cable network to more than ten thousand homes and businesses the company committed to serve in the time allotted. In addition, the PSC warned the company, which claimed in a response to the state’s “show cause” order that it was not obligated to meet the terms of its 2016 merger agreement, faces the threat of having its merger with Time Warner Cable revoked, which could end Spectrum’s ability to operate in New York State.

“As a condition of our approval of Charter’s merger two years ago, we required Charter to make significant investments in its network,” said Commission chair John B. Rhodes. “Our investigation shows that Charter failed to meet its obligations to expand the reach of its network to unserved and underserved customers at the required pace and that it failed to justify why it wasn’t able to meet its obligations. Furthermore, since the company has taken the unfortunate position of refusing to adhere to all conditions set forth in our initial decision two years ago, we now demand the company unconditionally accept all of the conditions as the Commission unambiguously required in 2016, or run the risk of more severe consequences.”

In its order regarding Charter’s failure to meet its buildout obligations, the Commission rejected 18,363 addresses — including 12,467 in New York City and 4,096 in the cities of Buffalo, Rochester, Syracuse, Schenectady, Albany, and Mt. Vernon — to which Charter claimed it expanded network as part of its required buildout requirement. The Commission found that these addresses were already passed by Charter or another company providing high speed broadband, or that Charter was separately required to pass the addresses pursuant to state regulations and/or franchise agreements.

As a result, Charter must revise its overall 145,000 addresses-buildout plan to remove the rejected addresses and file a revised buildout plan for going forward within 21 days. In its initial 2016 order approving Charter’s acquisition of Time Warner Cable, the Commission required that Charter extend its network to pass within its statewide service territory, an additional 145,000 unserved and underserved residential housing units and/or businesses within four years.

As a result, Charter must revise its overall 145,000 addresses-buildout plan to remove the rejected addresses and file a revised buildout plan for going forward within 21 days. In its initial 2016 order approving Charter’s acquisition of Time Warner Cable, the Commission required that Charter extend its network to pass within its statewide service territory, an additional 145,000 unserved and underserved residential housing units and/or businesses within four years.

About a year later, it became evident that Charter had failed to meet its May 2017 target. To get the company back on track, the Commission approved a settlement under which Charter was required to pass 36,771 eligible premises by December 2017, and meet regular six-month milestones or else pay up to $1 million for each miss, and up to $1 million should the company fail to correct any miss within three months.

Rhodes

Earlier this year, Commission staff, audited Charter’s compliance filing of proposed passings to be counted toward its December 2017 target, and determined that 14,522 passings should be

disqualified, which meant that the company failed to meet its required target. In its May response to the Commission, Charter argued that not all of the Commission’s 2016 merger order applies to the company as part of its rationale for including ineligible addresses. Given the company’s continued intransigence, the Commission today ordered that the company unconditionally accept all of the conditions and requirements spelled out in its 2016 order or face subsequent Commission action.

With today’s decision, the Commission ordered Charter to pay $1 million in accordance with the settlement agreement for failing to satisfy the December 2017 target and failing to demonstrate that it missed the target due to circumstances beyond its control. The Commission similarly found that Charter did not “cure” this miss by March 16, 2018, nor did it demonstrate that it had good cause for its failure to do so, requiring an additional $1 million payment to the state.

Subscribe

Subscribe

(Reuters) – Comcast Corp offered $65 billion on Wednesday for 21st Century Fox’s media assets, emboldened by AT&T prevailing over the Trump administration’s attempt to block a merger with Time Warner, Inc..

(Reuters) – Comcast Corp offered $65 billion on Wednesday for 21st Century Fox’s media assets, emboldened by AT&T prevailing over the Trump administration’s attempt to block a merger with Time Warner, Inc.. Shares of Comcast, Fox and Disney were barely changed in after-hours trade.

Shares of Comcast, Fox and Disney were barely changed in after-hours trade.

With Comcast on the verge of picking up much of 21st Century Fox’s content library and studio, Comcast will be able to defend its own turf creating similar giant bundles of content to keep its customers happy. Wall Street is already putting pressure on Verizon to respond with an acquisition of its own to protect its base of FiOS and Verizon Wireless customers.

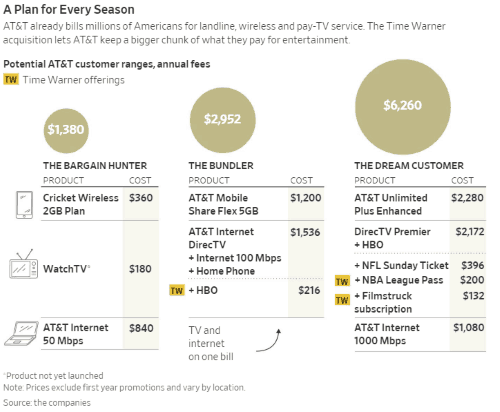

With Comcast on the verge of picking up much of 21st Century Fox’s content library and studio, Comcast will be able to defend its own turf creating similar giant bundles of content to keep its customers happy. Wall Street is already putting pressure on Verizon to respond with an acquisition of its own to protect its base of FiOS and Verizon Wireless customers. AT&T has won its $85 billion bid to acquire Time Warner, Inc., overturning Justice Department opposition in a court case and completely rejecting allegations the merger was anti-consumer and would raise prices by suppressing competition. The favorable decision is expected to signal the business community the time is right for several more multi-billion dollar media mergers.

AT&T has won its $85 billion bid to acquire Time Warner, Inc., overturning Justice Department opposition in a court case and completely rejecting allegations the merger was anti-consumer and would raise prices by suppressing competition. The favorable decision is expected to signal the business community the time is right for several more multi-billion dollar media mergers.