The long anticipated wait for Hulu’s live streaming cable-TV replacement is over with today’s soft launch of Hulu with Live TV, offering 50 cable networks and local affiliates of ABC, CBS, NBC, and FOX in select larger cities.

The long anticipated wait for Hulu’s live streaming cable-TV replacement is over with today’s soft launch of Hulu with Live TV, offering 50 cable networks and local affiliates of ABC, CBS, NBC, and FOX in select larger cities.

“Hulu can now be a viewer’s primary source of television,” said Hulu CEO Mike Hopkins. “It’s a natural extension of our business, and an exciting new chapter for Hulu.”

The new service will bundle Hulu’s live/linear TV service with its well-known on-demand package of movies and television shows. The service represents a direct challenge to cable television subscriptions and for Hulu’s owners — Disney, 21st Century Fox, Comcast’s NBCUniversal and Time Warner, Inc., is the first major industry effort to keep subscription fees closer to home, and cuts out the cable middleman.

The lineup includes many, but not all, popular cable networks. There are very significant gaps — notably Viacom networks Hulu says it has no plans to add (Nickelodeon, Comedy Central, MTV). Also missing: AMC, Discovery Networks, HBO/Cinemax and Starz. Showtime is available for $8.99 a month.

The lineup:

Fox

Fox Local Station (New York, Los Angeles, San Francisco, Philadelphia and Chicago)

Big Ten Network

Fox Business Network

Fox News Channel

Fox regional sports networks

Fox Sports 1

Fox Sports 2

FX

FXX

FXM

National Geographic Channel

National Geographic Wild

Disney

ABC Local Station (New York, Los Angeles, San Francisco, Philadelphia and Chicago)

ESPN

ESPN2

ESPNU

ESPNEWS

ESPN-SEC Network

Freeform

Disney Channel

Disney XD

Disney Junior

Comcast/NBCUniversal

NBC Local Station (New York, Los Angeles, San Francisco, Philadelphia and Chicago)

Telemundo Local Station (New York, Los Angeles, San Francisco, Philadelphia and Chicago)

Comcast RSNs

NECN

USA Network

Bravo

E!

Syfy

MSNBC

CNBC

NBCSN

Golf Channel

Chiller

Oxygen Network

Sprout

A+E Networks

A&E

History

Lifetime

Viceland

Lifetime Movie Network (LMN)

FYI

Scripps Networks Interactive

Food Network

HGTV

Travel Channel

Turner Broadcasting

CNN

HLN

CNN International

TBS

TNT

TruTV

TCM

Turner Classic Movies

Cartoon Network & Adult Swim

Boomerang

CBS

CBS Local Station (New York, Los Angeles, San Francisco, Philadelphia and Chicago)

CBS Sports Network

POP

Showtime ($8.99 per month extra)

(Broadcast stations may be available in certain other cities, but not all network affiliates are included.)

Hulu with Live TV is available on Microsoft’s Xbox One, Apple TV (fourth generation), iOS and Android mobile devices, and Google’s Chromecast. Future support for Roku, Amazon’s Fire TV and Fire TV Stick and Samsung Smart TVs will come later. Oddly, desktop viewing on a Mac or PC is not currently supported.

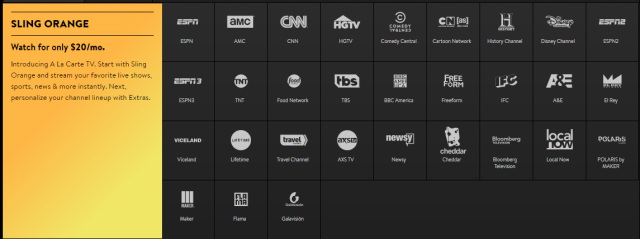

The new service joins an increasingly crowded marketplace of online cable television replacements, including Dish’s pioneering Sling TV, Sony’s game console-platform PlayStation Vue, AT&T’s DirecTV Now, and YouTube TV — the newest before today.

The new service joins an increasingly crowded marketplace of online cable television replacements, including Dish’s pioneering Sling TV, Sony’s game console-platform PlayStation Vue, AT&T’s DirecTV Now, and YouTube TV — the newest before today.

Hulu’s most formidable competitor in the streaming TV space will likely be AT&T’s DirecTV Now service, which offers a broader range of networks and has become popular for its promotional equipment offers. Hulu plans to counter AT&T with a marketing effort that highlights its existing on-demand service of more than 3,000 TV shows and movies is included with every subscription.

Hulu also comes bundled with its own limited cloud DVR storage service, which will record up to 50 hours of programming. But similar to Google’s YouTube TV, customers will not be able to skip the commercials that are included in the shows they record. In fact, advertisers will be able to dynamically change their advertising spots in recorded shows as long as the customer keeps them in their personal recordings library. Customers will need to upgrade to “Premium DVR” service ($14.99) to enable fast-forwarding through ads. The premium DVR add-on also includes 200 hours of storage, unlimited simultaneous recordings, and the ability to watch recorded shows outside of the home.

Customers signed up to the base package will be able to create up to six individual profiles for the household, which allows each user to track and “favorite” TV shows and movies they enjoy the most. The service will provide recommended shows based on each person’s viewing habits. The feature also allows each family member to choose their favorite sports teams and Hulu will automatically record any available game that includes a favorite team.

Base subscribers get up to two simultaneous streams of live and recorded content. An “Unlimited Screens” add-on ($14.99) removes the limit and allows unlimited home streams and up to three concurrent streams outside of the home. Customers who want both Premium DVR and Unlimited Screens can bundle both features together for $20 a month — a $10 savings.

An introduction to Hulu’s new interface and live TV option. (1:55)

Subscribe

Subscribe