NEW YORK (Reuters) – Discovery Communications Inc is acquiring Scripps Networks Interactive Inc for $11.9 billion in a deal expected to boost the company’s negotiating leverage as it seeks new audiences.

NEW YORK (Reuters) – Discovery Communications Inc is acquiring Scripps Networks Interactive Inc for $11.9 billion in a deal expected to boost the company’s negotiating leverage as it seeks new audiences.

The acquisition, announced on Monday, brings together Scripps’ largely female-focused lifestyle channels such as HGTV, Travel Channel and Food Network with Discovery’s Animal Planet and Discovery Channel, whose viewers are primarily male.

Despite expectations of $350 million in total cost synergies, many analysts questioned how the combined company would compete long term as viewers cut cords to cable providers and as advertising and ratings decline.

Discovery shares ended regular trading down 8.2 percent at $24.60 while those of Scripps finished up 0.6 percent at $87.41.

Discovery is paying 70 percent cash and 30 percent stock for Scripps. The total price of the deal is $14.6 billion including debt.

“While we believe the two companies are likely better positioned together, rather than apart, the longer-term issues facing the industry still remain,” wrote John Janedis, an analyst at Jefferies, in a note on Monday.

Both Discovery and Scripps reported quarterly earnings on Monday that reflected the challenges facing U.S. media companies. Scripps missed its second quarter ad guidance and lowered its full-year estimates, and Discovery reported flat advertising and lower affiliate revenue.

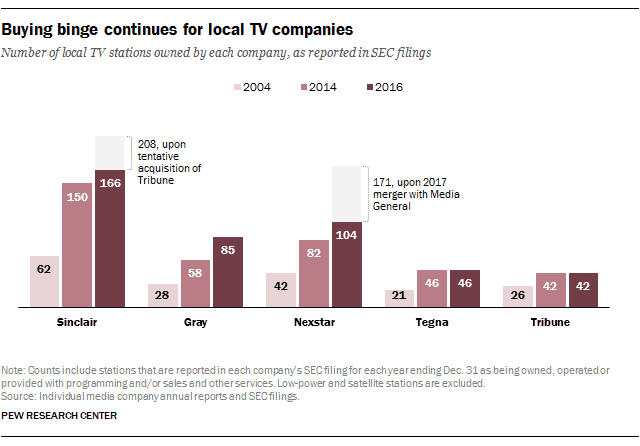

U.S. television networks and cable providers are under pressure as more viewers watch shows and movies on phones and tablets. There is also increased competition for viewers from streaming services such as Netflix Inc and Amazon.com Inc.

U.S. television networks and cable providers are under pressure as more viewers watch shows and movies on phones and tablets. There is also increased competition for viewers from streaming services such as Netflix Inc and Amazon.com Inc.

Five of the largest U.S. pay TV providers posted subscriber losses during the second quarter.

The combined company’s larger programming slate might give it an advantage in negotiations for inclusion in skinny bundles, or economy-priced cable packages that offer fewer channels than a standard contract.

After the merger, the company will offer 300,000 hours of content and capture about a 20 percent share of ad-supported cable audiences in the United States, Discovery said on an analyst call Monday morning.

“The transaction supports and accelerates Discovery’s pivot from a linear TV-only company to a leading content provider across all screens and services around the world,” David Zaslav, Discovery’s chief executive, told investors.

The combined company would also have more muscle in negotiations with cable and other distributors when contracts come up for renewal, executives said.

By adding Scripps programming, Discovery could also launch its own “skinny bundle” of networks at a low cost, executives said.

The combined company would be home to five of the top cable networks for women with more than a 20 percent share of women prime-time viewers in the United States, according to Discovery.

Discovery will evaluate the Scripps channels, as it has its own, to figure out if any could be web-based, Zaslav said on the call.

Scripps has been considered a takeover target since the Scripps family trust, which controlled the company, was dissolved five years ago.

Under the terms of the deal, Scripps CEO Ken Lowe would join the board of the combined company.

The deal requires regulatory and shareholder approvals. Major shareholders including cable magnate John Malone, Advance/Newhouse Programming Partnership and members of the Scripps family, support the deal, the companies said.

Discovery had tried unsuccessfully twice before to buy Scripps. Discovery outbid Viacom Inc for Scripps, Reuters reported first last week.

Guggenheim Securities and Goldman Sachs served as financial advisers to Discovery. Allen & Co LLC and J.P. Morgan Securities served as financial advisers to Scripps.

Evercore Group served as financial adviser to the Scripps family.

Reporting by: Jessica Toonkel; Editing by Jeffrey Benkoe and Steve Orlofsky

If you are a DirecTV Now customer, check your email for an exclusive invitation to become a beta tester of the service’s new cloud based DVR service.

If you are a DirecTV Now customer, check your email for an exclusive invitation to become a beta tester of the service’s new cloud based DVR service.

Subscribe

Subscribe