(Reuters) – Comcast Corp offered $65 billion on Wednesday for 21st Century Fox’s media assets, emboldened by AT&T prevailing over the Trump administration’s attempt to block a merger with Time Warner, Inc..

(Reuters) – Comcast Corp offered $65 billion on Wednesday for 21st Century Fox’s media assets, emboldened by AT&T prevailing over the Trump administration’s attempt to block a merger with Time Warner, Inc..

The all-cash offer for Fox’s movie and TV studios and other assets including the X-Men franchise, opens a war with Walt Disney, which has bid $52 billion in stock. Comcast described the bid as 19 percent higher than Disney’s bid today. The transaction does not include the FOX television network, network owned-and-operated local television stations, or its cable news channels Fox News and Fox Business.

Comcast is expected to lead a wave of traditional media companies trying to combine distribution and production to compete with Netflix Inc and Alphabet Inc’s Google. The younger firms produce content, sell it online directly to consumers and often offer lucrative targeted advertising.

AT&T won a court victory over skeptical U.S. antitrust regulators on Tuesday when a federal judge allowed it to buy Time Warner for $85 billion, which was widely taken as a green light for Comcast to submit its expected bid.

Comcast may face more difficulty than AT&T and other would-be acquirers, though, since Comcast already has its own TV and movie studios in the NBC Universal division, a content overlap AT&T-Time Warner lacked.

Shares of Comcast, Fox and Disney were barely changed in after-hours trade.

Shares of Comcast, Fox and Disney were barely changed in after-hours trade.

Comcast in a statement outlined an offer that was similar to Disney’s, including a commitment to the same divestitures. It said that it would agree to litigate any action taken by the Justice Department to block the deal.

In a letter to the Fox board, Comcast chairman and CEO Brian Roberts said, “We are also highly confident that our proposed transaction will obtain all necessary regulatory approvals in a timely manner and that our transaction is as or more likely to receive regulatory approval than the Disney transaction.”

Justice Department lawyers who tried to stop AT&T’s $85 billion deal expect consumers will lose out as bigger companies raise prices, and some lawyers saw that as a concern in a Comcast-Fox deal which would put two movie studios and two major television brands under one roof.

“One cannot ignore the fact that there’s less independent content to go around,” after the AT&T deal, said Henry Su, an antitrust expert with Constantine Cannon LLP.

Still, the AT&T court fight gave Comcast valuable information about how to structure a Fox deal, said David Scharf, a litigation expert with Morrison Cohen.

“Any deal that’s coming down the pike that’s not baked yet knows the government’s playbook. They know what the government is concerned about,” he said. “They can learn how to structure a deal to make it more palatable.”

Disney itself has “surgically” structured a transaction that “might be doable,” avoiding Fox Broadcasting and big Fox sports channels, U.S. antitrust chief Makan Delrahim said last week.

Comcast may have a tough time winning over Fox’s largest shareholder, Rupert Murdoch’s family. They own a 17-percent stake and would face a multi-billion dollar capital gains tax bill if he accepted an all-cash offer from Comcast, tax experts have told Reuters.

Craig Moffett, an analyst with MoffettNathanson, said in a research note that Disney could prevail for other reasons.

“Disney has the superior balance sheet, cost of debt, equity and rationale to emerge victorious over Comcast in a bidding war,” Moffett said.

Reporting by Sheila Dang in New York and Diane Bartz in Washington; Additional reporting by Arjun Panchadar in Bengaluru; Writing by Peter Henderson; Editing by Maju Samuel and Lisa Shumaker.

CNBC reports Comcast has officially submitted its $65 billion all-cash offer to acquire assets of 21st Century Fox. Disney is also a contender and may respond by sweetening its own offer. (2:29)

Subscribe

Subscribe

With Comcast on the verge of picking up much of 21st Century Fox’s content library and studio, Comcast will be able to defend its own turf creating similar giant bundles of content to keep its customers happy. Wall Street is already putting pressure on Verizon to respond with an acquisition of its own to protect its base of FiOS and Verizon Wireless customers.

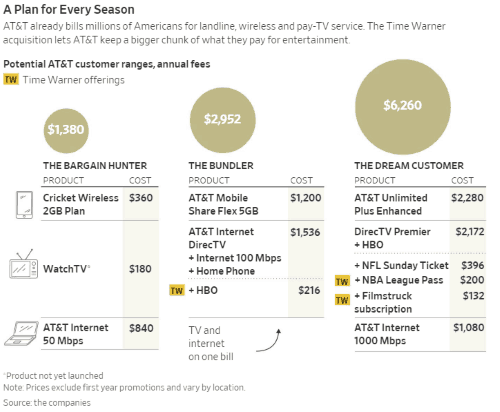

With Comcast on the verge of picking up much of 21st Century Fox’s content library and studio, Comcast will be able to defend its own turf creating similar giant bundles of content to keep its customers happy. Wall Street is already putting pressure on Verizon to respond with an acquisition of its own to protect its base of FiOS and Verizon Wireless customers. AT&T has won its $85 billion bid to acquire Time Warner, Inc., overturning Justice Department opposition in a court case and completely rejecting allegations the merger was anti-consumer and would raise prices by suppressing competition. The favorable decision is expected to signal the business community the time is right for several more multi-billion dollar media mergers.

AT&T has won its $85 billion bid to acquire Time Warner, Inc., overturning Justice Department opposition in a court case and completely rejecting allegations the merger was anti-consumer and would raise prices by suppressing competition. The favorable decision is expected to signal the business community the time is right for several more multi-billion dollar media mergers.

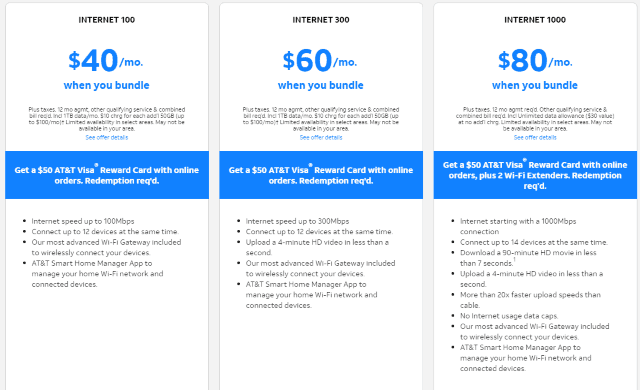

If you are a new AT&T customer, the company is offering a $50 Reward Card rebate (expires 7/31/2018) and a free Smart Wi-Fi Extender (new or existing customers switching to gigabit service only) (expires 6/28/2018). Here are some other important terms and conditions to be aware of:

If you are a new AT&T customer, the company is offering a $50 Reward Card rebate (expires 7/31/2018) and a free Smart Wi-Fi Extender (new or existing customers switching to gigabit service only) (expires 6/28/2018). Here are some other important terms and conditions to be aware of: As gigabit internet becomes more common across the United States, some ISPs are seeking a speed advantage by offering even faster speeds to residential and business customers. On Tuesday, Nokia announced Frontier Communications and Rochester, N.Y.-based Greenlight Networks would be upgrading their fiber networks to the company’s XGS-PON solution, which can handle 10 Gbps upload and download speeds.

As gigabit internet becomes more common across the United States, some ISPs are seeking a speed advantage by offering even faster speeds to residential and business customers. On Tuesday, Nokia announced Frontier Communications and Rochester, N.Y.-based Greenlight Networks would be upgrading their fiber networks to the company’s XGS-PON solution, which can handle 10 Gbps upload and download speeds. Next generation XGS-PON allows up to 10 Gbps in both directions over existing fiber networks. In fact, the technology is future proof, allowing operators to immediately upgrade to faster speeds and later move towards Full TWDM-PON, an even more robust technology, without expensive network upgrades.

Next generation XGS-PON allows up to 10 Gbps in both directions over existing fiber networks. In fact, the technology is future proof, allowing operators to immediately upgrade to faster speeds and later move towards Full TWDM-PON, an even more robust technology, without expensive network upgrades. Frontier intends to deploy Nokia’s technology in ex-Verizon markets in California, Texas, and Florida, beginning in Dallas-Fort Worth. It will allow Frontier to beef up its FiOS network and market stronger broadband products to Texas businesses. In Rochester, Greenlight will use the technology to upgrade its fiber service, which competes locally with Frontier DSL and Charter/Spectrum. Spectrum recently introduced gigabit download speed in Rochester. Greenlight can now expand beyond its 1 Gbps offering, but more importantly, increase its maximum upload speed beyond 100 Mbps.

Frontier intends to deploy Nokia’s technology in ex-Verizon markets in California, Texas, and Florida, beginning in Dallas-Fort Worth. It will allow Frontier to beef up its FiOS network and market stronger broadband products to Texas businesses. In Rochester, Greenlight will use the technology to upgrade its fiber service, which competes locally with Frontier DSL and Charter/Spectrum. Spectrum recently introduced gigabit download speed in Rochester. Greenlight can now expand beyond its 1 Gbps offering, but more importantly, increase its maximum upload speed beyond 100 Mbps.