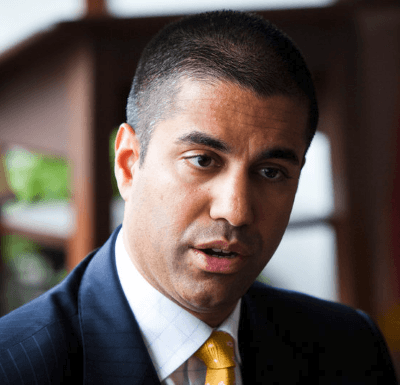

![]() FCC Chairman Ajit Pai may have effectively derailed Sinclair’s $3.9 billion dollar acquisition of Tribune Media today after issuing a statement criticizing the deal.

FCC Chairman Ajit Pai may have effectively derailed Sinclair’s $3.9 billion dollar acquisition of Tribune Media today after issuing a statement criticizing the deal.

“Based on a thorough review of the record, I have serious concerns about the Sinclair/Tribune transaction,” Pai said in a statement few expected to see from the current chairman. “The evidence we’ve received suggests that certain station divestitures that have been proposed to the FCC would allow Sinclair to control those stations in practice, even if not in name, in violation of the law.”

Pai is responding to ample evidence from those objecting to the deal showing Sinclair’s proposal to acquire 42 additional Tribune-owned TV stations and effectively maintain shadow control over stations it planned to divest would put the company far over the federal station ownership cap. Sinclair’s proposal to sell 21 stations to win government approval came under close scrutiny when it was revealed most of the buyers had direct ties to Sinclair or its founding Smith family. Critics charged Sinclair offered sweetheart deals to buyers in return for “sidecar” agreements to effectively retain control of the spun-off stations and have the option of buying them back later at a discount.

Pai

“When the FCC confronts disputed issues like these, the Communications Act does not allow it to approve a transaction,” Pai noted. “Instead, the law requires the FCC to designate the transaction for a hearing in order to get to the bottom of those disputed issues. For these reasons, I have shared with my colleagues a draft order that would designate issues involving certain proposed divestitures for a hearing in front of an administrative law judge.”

The chairman’s views were welcomed by FCC Commissioner Jessica Rosenworcel.

“As I have noted before, too many of this agency’s media policies have been custom built to support the business plans of Sinclair Broadcasting,” she said in a statement. “With this hearing designation order, the agency will finally take a hard look at its proposed merger with Tribune. This is overdue and favoritism like this needs to end.”

Industry observers suggest such a referral is a death blow in cases of similar mergers because of long delays and uncertainties. The FCC effectively ended the 2015 Comcast-Time Warner Cable merger when it referred the merger to a similar complicated hearing process. The two companies abandoned the deal after getting the news.

Sinclair’s deal has also been a lightning rod for controversy between liberal and conservative groups. The Washington Post found Sinclair “gave a disproportionate amount of neutral or favorable coverage to Trump during the campaign” while portraying Hillary Clinton negatively in much of its coverage. Politico reported Jared Kushner, President Trump’s son-in-law, made a deal with the president’s campaign to get additional access to the president in return for assurances Mr. Trump would receive, in Kushner’s words, “better media coverage.”

After the election, Sinclair-owned stations have been under growing scrutiny for airing mandated “must-air” conservative-slanted stories and editorials during local newscasts. Recent commentaries from former Trump campaign adviser Boris Epshteyn included praise for the president’s newest nomination for the Supreme Court and criticism over how the president is treated by the media.

Bipartisan criticism of the merger deal for violating the spirit of the FCC’s station ownership cap, consolidation of local news voices, and company-mandated stories forced into local newscasts may have persuaded Pai to express concern.

The FCC is continuing to explore possible changes to the station ownership cap under the leadership of Chairman Pai. Many large station owners are calling for the cap to be rescinded altogether or the maximum raised to allow one owner to reach at least 50% of the country. Any changes would likely come too late for the Sinclair/Tribune deal.

It is now up to executives at Sinclair and Tribune to consider whether to take their case to an administrative law judge and wait out a decision or drop the merger deal.

Subscribe

Subscribe This isn’t going to be your parent’s HBO much longer.

This isn’t going to be your parent’s HBO much longer.

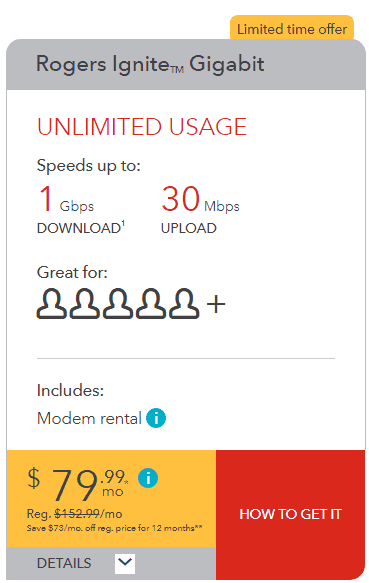

Fierce competition by eastern Canada’s largest internet service providers are driving down prices across the Greater Toronto Area by as much as 45%.

Fierce competition by eastern Canada’s largest internet service providers are driving down prices across the Greater Toronto Area by as much as 45%. Bell

Bell Rupert Murdoch’s slimmed-down television empire will refocus on targeting America’s red states and live sports fans who may have wagered on those

Rupert Murdoch’s slimmed-down television empire will refocus on targeting America’s red states and live sports fans who may have wagered on those

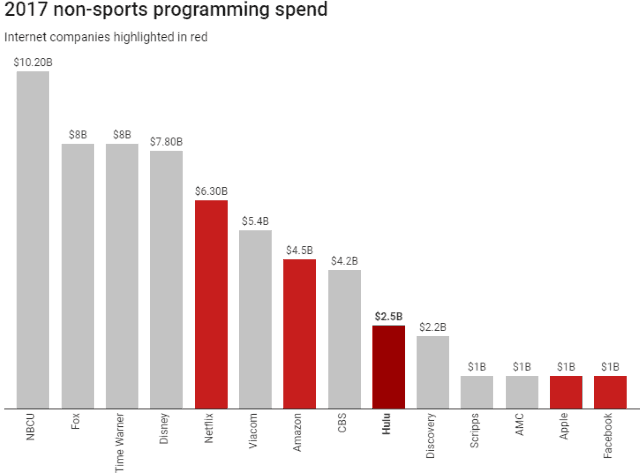

“There’s been a certainty about sports programming that doesn’t exist with scripted or unscripted programs,” he added. “With sports, you have a known quantity.”

“There’s been a certainty about sports programming that doesn’t exist with scripted or unscripted programs,” he added. “With sports, you have a known quantity.” While parts of rural Tennessee languish with little or no broadband service, the state’s electric cooperatives are jumping to deliver internet access over fiber optic cables after the governor eased restrictions written into state law on rural co-ops offering public broadband service.

While parts of rural Tennessee languish with little or no broadband service, the state’s electric cooperatives are jumping to deliver internet access over fiber optic cables after the governor eased restrictions written into state law on rural co-ops offering public broadband service. The conservative and industry-backed groups that coordinated with the telecom industry to push Tennessee to pass restrictive laws effectively banning municipal or public broadband competition are grudgingly tolerating co-ops entering the broadband marketplace, as long as they only service areas where they won’t compete with an established phone or cable company. They also must remain within their electric service area.

The conservative and industry-backed groups that coordinated with the telecom industry to push Tennessee to pass restrictive laws effectively banning municipal or public broadband competition are grudgingly tolerating co-ops entering the broadband marketplace, as long as they only service areas where they won’t compete with an established phone or cable company. They also must remain within their electric service area.