History repeats itself. In 1889, it was railroads, steel, iron, and energy. Today it is telecommunications.

My first introduction to the concept of corporate doublespeak — designed to cushion the blow of bad news behind a wall of barely-comprehensible babble came in October 1987 when I heard one Wall Street analyst refer to the great stock market crash that had just befallen the financial district as a “fourth quarter equity retreat.”

Holy euphemism, Batman!

You weren’t fired — you were “made redundant.” The bankruptcy of Detroit automakers and the layoffs that followed were not as bad as they looked. It was merely “a career-alternative enhancement program.”

And, no, Verizon and AT&T are not engaged in should-be-illegal marketplace collusion on pricing and services. They are just practicing some harmless “price signaling.”

That’s the awe-struck view of management consultant Rags Srinivasan, who just gushes over the marketing “stroke of genius” that threatens to give customers a stroke when they open their monthly bill.

Srinivasan’s piece, worthy of the Wall Street Journal editorial page, turns up instead on GigaOm, where it gets some pretty harsh treatment from tech-lovers who hate the rising prices of wireless service.

Price signaling has always existed between the number one and number two players in any market. Agreeing to not engage in a price war is truly a win-win for the market leaders. Since outright price fixing is illegal, market leaders resorted to signaling to tell the other company their intentions or send a threat about their cost advantages.

But traditionally, it was more like flirting — ambiguous enough that the underlying intentions could be denied. Why are these two not shy about admitting to flirting now? The simple answer is the iPhone.

Not too long ago we worried about running out of talk minutes and paying overage. Service providers offered us tiered plans that offered more minutes for a higher price and unlimited minutes for an even higher price. With the additional revenue flowing directly to their bottom line, these higher priced plans were real cash cows.

For those who have any doubt about the profits from unlimited plans, I’d point out that the costs of a mobile service provider are sunk with zero marginal cost for additional minutes. And texts don’t even consume traffic channels — they piggyback on control channels.

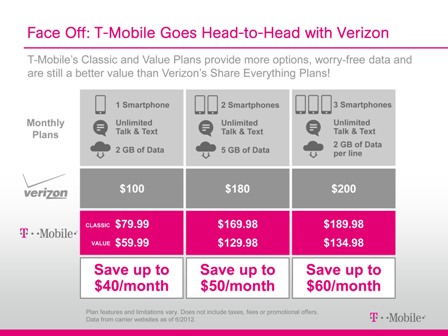

[…] In another genius pricing move, Verizon Wireless is presenting this $100 mobile service plan to customers in a bundle — talk minutes plus data. In the past, around $70 was allocated to talk because consumers valued it more. Now subscribers pay only $40, but they still pay the same $100 total price. This is nothing short of pricing excellence, protecting customer margin while also using strong price signaling to make sure that the next biggest market share leader follows suit.

What Srinivasan calls “business at its best” and “pricing excellence” we call collusion at its most obvious. The GigaOm author says he does not want the government tinkering with this kind of marketplace “signaling,” and it does not appear likely he has much to worry about. AT&T and Verizon executives have grown increasingly brazen (and obvious) with their near-identical pricing and “me-too” plans which leave little to differentiate the two carriers from a pricing perspective. The likely result will be at least 100 million cell phone customers eventually stuck paying for unlimited voice and texting services they neither want or need.

Wireless Wonder Twins Powers Activate: Shape of anti-competitive marketplace for consumers; form of collusion.

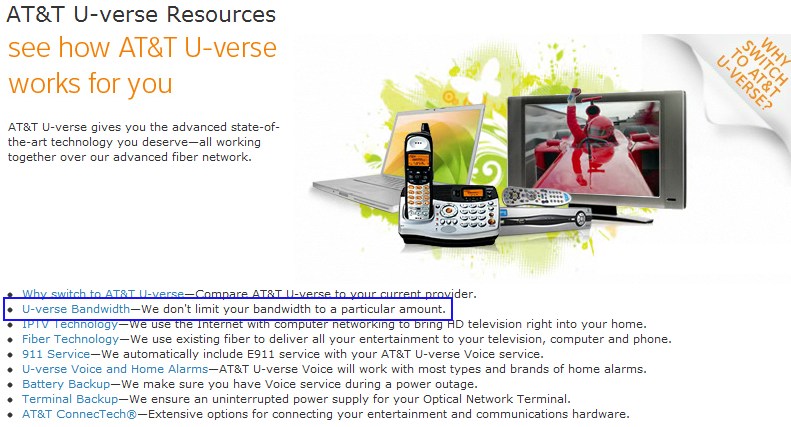

True, AT&T charges Cadillac prices but has the customer service image of a used 1995 Kia… but they did have the original exclusive rights to the Apple iPhone and Apple devotees proved they will endure a lot. Verizon Wireless has a better network and has always charged accordingly.

Unfortunately for consumers, the also-rans Sprint and T-Mobile (and the smaller still) depend on AT&T and Verizon for roaming off the city highway and into the countryside, and they are often stuck with devices that are a step down from what the bigger two can offer.

Srinivasan would have a better argument if the wireless marketplace had not become so consolidated. Had AT&T had its way with T-Mobile, America would have just a single national GSM network — AT&T. Verizon does not consider its CDMA competitor much of a bother either, and Sprint Nextel CEO Dan Hesse has to divide his time between fighting with Wall Street over why the company has not already sold out to the highest bidder (and now wants to spend a fortune upgrading its network) and customers who consider Sprint too much of a trade-off in coverage and its dismal “4G” Clearwire WiMAX network too slow for 2012.

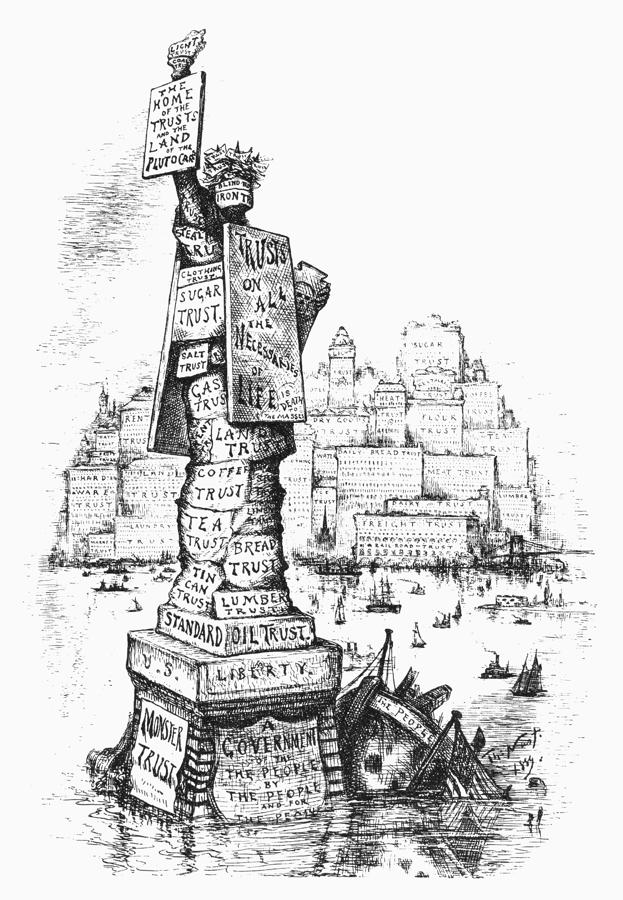

Srinivasan is probably too young to understand AT&T and Verizon never invented “price signaling.” A century ago, the railroad robber barons did much the same, leveraging their anti-competitive networks-of-a-different-kind to maximize prices in places that had few alternatives. Where competitors did arrive, they were typically bought out to “maximize savings and eliminate market inefficiencies.” The same was true in the steel and energy sector of the early 20th century.

The result is that consumers were turned upside down to shake out the last loose change from their pockets. Eventually, government stepped in and called it marketplace collusion and passed antitrust laws that began a new era for true competition.

How soon some forget.

Subscribe

Subscribe