(Reuters) – T-Mobile US Inc is preparing an alternative plan if a deal to sell wireless assets to Dish Network Corp falls through, according to two sources familiar with the matter.

(Reuters) – T-Mobile US Inc is preparing an alternative plan if a deal to sell wireless assets to Dish Network Corp falls through, according to two sources familiar with the matter.

Investment bank Goldman Sachs Group Inc., which is advising T-Mobile, the third largest U.S. wireless carrier, on selling prepaid brand Boost Mobile as part of the company’s concession to gain regulatory approval to buy Sprint Corp, is expected to send out books to prospective buyers in two weeks, one source familiar with the matter said.

While satellite television provider Dish Network remains the front-runner to acquire the Boost assets, Goldman has told prospective buyers as late as Tuesday that it is preparing for an upcoming auction of Boost.

Another source characterized the process being run by Goldman as moving slowly. Among the details holding up an auction is that Goldman is not yet clear what exactly is up for sale from the merger, one source said.

T-Mobile and Sprint did not immediately respond to requests for comment. Goldman Sachs declined to comment.

T-Mobile and Sprint have agreed to a series of deal concessions, including to sell Boost, to gain regulatory approval for the $26.5 billion merger with Sprint, but still needs the green light from the U.S. Department of Justice antitrust chief, though his staff have recommended the agency block the deal.

A source close to the discussions said T-Mobile was hopeful it would reach an agreement with the Justice Department by early next week.

The Boost assets have stirred up interest from a variety of parties, including Amazon.com and cable companies Comcast, Charter Communications, and Altice USA, according to sources.

T-Mobile and Sprint are still negotiating possible additional concessions with the Department of Justice, and Goldman Sachs is waiting for the details of the agreement before working on the terms that will be sent out to bidders, one source said.

Two potential bidders told Reuters on the condition of anonymity that they are still in the dark about critical information related to the Boost sale, such as how the Boost wireless deal with T-Mobile will be structured, or financial details about the Boost customers, which the bidders will use to determine the prepaid brand’s valuation.

Dish is also speaking with other parties on potential partnerships with Boost, sources said.

T-Mobile has agreed to negotiate a contract with Boost’s buyer that will allow the spun-off company to run on the combined T-Mobile and Sprint network, according to a regulatory filing that outlined the merger concessions. But the carriers are currently debating whether to provide the buyer an infrastructure-based mobile virtual network operator deal, which would allow the buyer more control over the wireless plans, including control of the user’s SIM card, one source said.

That could help convince the Department of Justice to approve the merger, which has held discussions on how to preserve competition in the wireless industry.

Cable provider Altice is one of the few so-called MVNO partners to have this type of wireless agreement, which it currently has with Sprint. An infrastructure-based MVNO is generally seen as more favorable than a standard deal that allows wireless providers that do not own and operate their own network to piggyback off of one of the four major wireless carriers for wholesale prices.

Other concessions being discussed include whether T-Mobile and Sprint will divest wireless spectrum, or the airwaves that carry data, and the possibility of giving up more retail customers or retail shops from either T-Mobile or Sprint’s prepaid brands, according to one source familiar with the matter.

Reporting by Sheila Dang and Angela Moon in New York and Diane Bartz in Washington; Editing by Kenneth Li and Lisa Shumaker

Subscribe

Subscribe Discovery Networks has signed a new contract with streaming TV service fuboTV that will bring 13 more channels to its lineups and allow subscribers to access on-demand content from Discovery’s suite of networks.

Discovery Networks has signed a new contract with streaming TV service fuboTV that will bring 13 more channels to its lineups and allow subscribers to access on-demand content from Discovery’s suite of networks. Starry, Inc., a fixed wireless internet provider, this week

Starry, Inc., a fixed wireless internet provider, this week  Dish Network Corporation is in the final stages of talks to acquire assets that include valuable wireless spectrum and Sprint’s Boost Mobile brand for an estimated $6 billion, according to a report quoting anonymous sources

Dish Network Corporation is in the final stages of talks to acquire assets that include valuable wireless spectrum and Sprint’s Boost Mobile brand for an estimated $6 billion, according to a report quoting anonymous sources  Wall Street analyst MoffettNathanson remains skeptical about the T-Mobile/Sprint merger and is even more puzzled by Dish’s reported involvement. The analyst firm released a research note to its clients warning the future of Boost may be bleak:

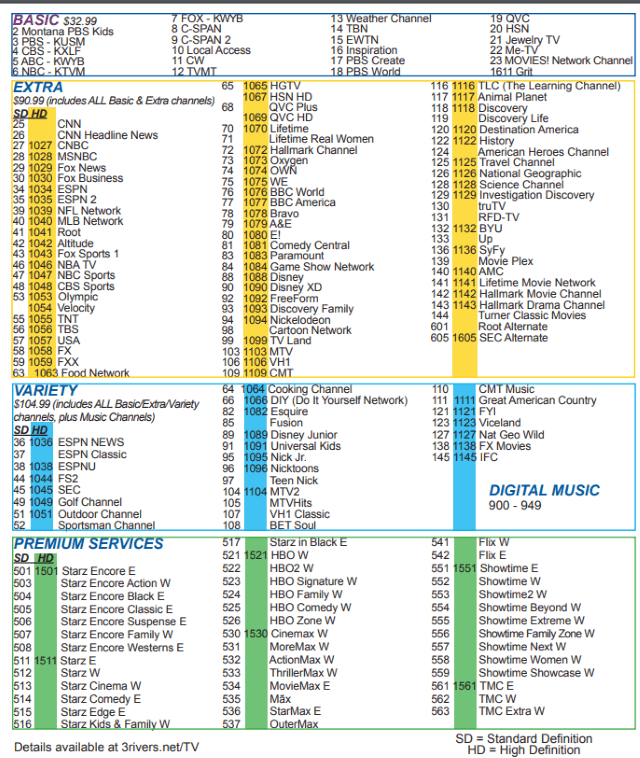

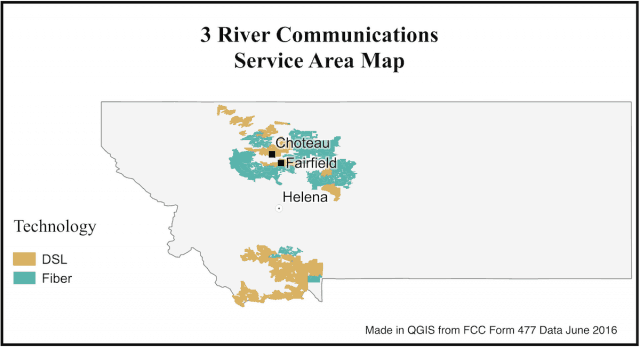

Wall Street analyst MoffettNathanson remains skeptical about the T-Mobile/Sprint merger and is even more puzzled by Dish’s reported involvement. The analyst firm released a research note to its clients warning the future of Boost may be bleak: After years of increasing costs for video programming, the disadvantages of not being large enough to qualify for lucrative volume discounts, and a declining customer base, a Montana cooperative says it is calling it quits on cable television service later this year to focus on its broadband business.

After years of increasing costs for video programming, the disadvantages of not being large enough to qualify for lucrative volume discounts, and a declining customer base, a Montana cooperative says it is calling it quits on cable television service later this year to focus on its broadband business.

“With all the new streaming options available, [including] Netflix and Hulu and Amazon Prime, in addition to traditional satellite providers like Dish and DirecTV, we just can’t really compete anymore,” 3 Rivers marketing director Don Serido

“With all the new streaming options available, [including] Netflix and Hulu and Amazon Prime, in addition to traditional satellite providers like Dish and DirecTV, we just can’t really compete anymore,” 3 Rivers marketing director Don Serido