We grant the application of Comcast Corporation (Comcast), Time Warner Cable Inc. (Time Warner), Time Warner Cable Information Services (California), LLC (TWCIS) and Bright House Networks Information Services (California), LLC (Bright House) for approval of the transfer of control of TWCIS and Bright House to Comcast. In addition, we grant the application of Comcast, TWCIS and Charter Fiberlink CA-CCO, LLC (Charter Fiberlink) to transfer a limited number of business customers and associated regulated assets of Charter Fiberlink. — Proposed Decision of California Administrative Law Judge Karl J. Bemesderfer

We grant the application of Comcast Corporation (Comcast), Time Warner Cable Inc. (Time Warner), Time Warner Cable Information Services (California), LLC (TWCIS) and Bright House Networks Information Services (California), LLC (Bright House) for approval of the transfer of control of TWCIS and Bright House to Comcast. In addition, we grant the application of Comcast, TWCIS and Charter Fiberlink CA-CCO, LLC (Charter Fiberlink) to transfer a limited number of business customers and associated regulated assets of Charter Fiberlink. — Proposed Decision of California Administrative Law Judge Karl J. Bemesderfer

In a decision widely expected by observers for almost a year, the California Public Utilities Commission (CPUC) is poised to conditionally approve the merger of Comcast and Time Warner Cable with dozens of pages of conditions to appease state politicians, concerned commissioners, and interest groups seeking to protect Californians from the competitive impact of what will easily become the state’s largest cable provider, serving 84% of households.

Administrative Law Judge Karl J. Bemesderfer issued his lengthy “proposed decision” in February, acknowledging the deal’s opponents have proved their contention the merger is not in the interests of Californian consumers, but then recommends approving it anyway:

In more concrete terms, the proposed merger between Comcast and Time Warner reduces the possibilities for content providers to reach the California broadband market. While the FCC’s pending reworked Net Neutrality rules may mitigate some of this effect, the sheer dominance of Comcast’s post-merger position causes us concern.

Parties have made a convincing showing of the anti-competitive consequences that Comcast’s post-merger market power may have on the deployment of broadband in California, and of anti-competitive harms that would occur in California if the merger is consummated. We are also persuaded by evidence of Comcast’s Internet Essentials program’s weak performance in closing the digital divide in California and fulfilling universal service goals, and thus do not view it as a mitigating factor without additional conditions.

While the protesters and intervenors vigorously assert that we should deny the applications outright, they also urge us, in the alternative, to impose conditions ameliorating the potential harms should we decide that such conditions are within our powers and sufficient to render the resulting transaction not adverse to the public interest.

While we are troubled by the protesters’ and intervenors’ many examples of potential harms that may flow from the merger, we believe that those harms may be mitigated by the imposition of conditions on our approval consistent with our powers under state and federal law.

Bemesderfer proposes a lengthy list of conditions the cable giant must meet for at least five years after merging, including offering discounted Internet service programs, improve customer service, provide free backup batteries for Comcast phone service, and promise it will stop lobbying against community broadband projects.

Bemesderfer proposes a lengthy list of conditions the cable giant must meet for at least five years after merging, including offering discounted Internet service programs, improve customer service, provide free backup batteries for Comcast phone service, and promise it will stop lobbying against community broadband projects.

But the judge said nothing about Comcast’s runaway rate increases likely in a de facto monopoly environment, its own vice president’s prediction that all Comcast broadband customers will be enrolled in a usage-based billing scheme within five years, and lacks specificity explaining the enforcement measures the CPUC will take against Comcast if it fails to meet the commission’s conditions.

The five-member commission could take up Bemesderfer’s recommendations as early as the end of this month, but is more likely to postpone consideration until later this spring. The commission can adopt, change, or discard Bemesderfer’s recommendations.

Accusations that the CPUC has grown too cozy with the companies it regulates only grew louder after consumer groups complained Bemesderfer bent over backwards trying to get Comcast’s merger deal closer to the concept of “the public interest.” For them, it isn’t nearly close enough.

“To read the recent 100-plus-page decision from the CPUC, you wouldn’t think this proposed merger is good for anyone,” writes Tracy Rosenberg, executive director of Media Alliance, which opposes the deal. “The regulator approved the merger with more than two dozen conditions to mitigate the bad impacts on Californians.”

Rosenberg hints the CPUC is ill-equipped to effectively watch over a multi-billion dollar telecom giant like Comcast. By proposing an ambitious set of requirements the CPUC cannot possibly enforce or defend in court with its current limited budget. Taxpayers may have to dig deep to cover legal bills likely to pile up in Sacramento if Comcast decides to rid itself of CPUC meddling in the courts. Comcast has already announced strenuous objections to at least 20 of the 25 conditions Bemesderfer recommends imposing.

Comcast to California: Hey, slow down a moment. We don’t like your pre-conditions.

Ars Technica’s Jon Brodkin chronicles Comcast’s objections in a convenient clickable format:

The table of contents of Comcast’s 46-page report gives a sense of just how much the cable company disagrees with California’s proposed conditions. Here are the main bullet points as written in Comcast’s argument; we’ve added hyperlinks and additional text in italics to further explain the requirements and Comcast’s objections:

The proposed decision improperly expands the scope of the proceeding beyond the commission’s jurisdiction and authority.

- The proposed decision would impose sweeping common carrier utility type regulation on the merged entity’s broadband and VoIP services in derogation of federal and state law.

- Other conditions in the proposed decision exceed the commission’s authority or are otherwise unlawful. [According to Comcast, these conditions include requirements related to Lifeline phone service, diversity, website design standards, backup batteries, video programming, non-interference with competing voice services, buildout requirements, opposition to municipal broadband projects, and privacy complaints.]

The proposed decision adopts intervenors’ [merger opponents] flawed analyses and claims regarding market share and competition.

- The transaction will not increase market power or reduce consumer choice.

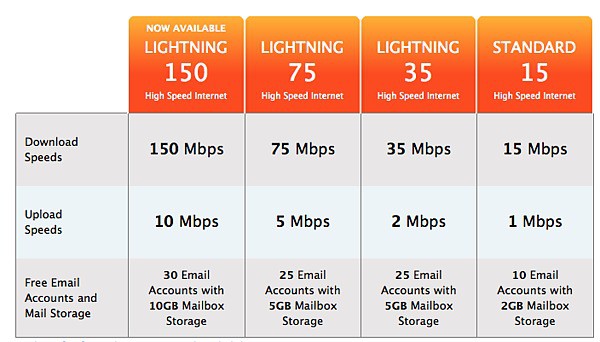

- The FCC’s new definition of “advanced telecommunications capability” has no relevance to this proceeding. [The Federal Communications Commission recently said that Internet service must provide at least 25Mbps download speeds and 3Mbps upload to qualify as broadband or “advanced telecommunications capability.” That decision increased Comcast’s “broadband” market share to 56 percent nationwide.]

- Concerns regarding future overbuilding are baseless and unsupported by the record. [The question here is whether Comcast and Time Warner Cable would ever compete against each other directly if they cannot merge.]

- The transaction presents no risk to edge providers [companies that deliver content and applications over the Internet], the highly competitive internet backbone, or consumers’ access to broadband content.

Other factual findings in the proposed decision are invalid and do not support the suggested conditions.

- TWC is not a “policy competitor” to Comcast. [The California judge’s proposal said TWC is a “policy competitor” to Comcast because it has different positions and business models. “For example, Time Warner has applied to the Commission to offer Lifeline as a tariffed service, while Comcast has not,” the judge wrote.]

- Mandatory diversity measures are unnecessary. [Comcast says California’s requirements amount to mandatory race-based quotas that violate state law and the US Constitution.]

- Concerns regarding Comcast’s battery backup program and other network safety issues are based on inaccurate assertions.

- The transaction will not harm wholesale offerings.

- Internet Essentials is successful by any objective metric and the program’s extension to TWC and Charter areas will provide substantial public interest benefits. [Internet Essentials is a low-cost Internet service for the poor that Comcast was required to create in exchange for approval of its 2011 acquisition of NBCUniversal. California wants Comcast to expand program eligibility further than Comcast is willing to. Comcast objects to a requirement to double download speeds from 5Mbps to 10Mbps. California also wants Comcast to achieve a 45 percent adoption rate among eligible consumers, which Comcast says is an unrealistic goal.]

- The proposed decision imposes unlawful rate and performance regulations based on inaccurate assumptions about TWC services and is in all events unjustified. [California wants Comcast to offer standalone broadband service for five years at prices not exceeding those charged by Time Warner Cable.]

- The proposed decision adopts incorrect data regarding Comcast’s quality of service and network safety and reliability.

- The “benchmark” competition theory adopted in the proposed decision is refuted by the record evidence. [California proposes an annual report requirement because the merger would eliminate the commission’s ability to compare reliability, customer service, prices, and service offerings of Comcast and TWC.]

- Other suggested conditions are unauthorized and unnecessary. [This section further covers a requirement to not interfere with voice services. Comcast says “it is unnecessary because Comcast does not interfere with voice services or degrade customers’ ability to complete calls.” This section also addresses a website accessibility requirement, which Comcast says is unnecessary because the company “already offers a comprehensive and user-friendly website that benchmarks to best practices for website accessibility.”]

Rosenberg argues a merger like Comcast and Time Warner Cable should have been easy to reject just on the basis of its size and scope.

“Economists use a scale called the Herfindahl-Hirschman Index to measure the level of concentration in a market,” Rosenberg said. “Anything with an HHI increase of more than 200 points is likely to enhance market power. The HHI increase for the merger of Comcast and Time Warner Cable is a 4,927-point increase in the fixed broadband market.”

In plain English, “California customers have nowhere to run,” Rosenberg writes. “If they had a choice, many of Comcast’s customers wouldn’t be their customers. If the merger with Time Warner goes through, that choice is about to get a whole lot worse.”

Instead of accommodating a merger proposal that seems clearly the opposite of the public interest, Rosenberg suggest an easier alternative.

“If something takes two dozen onerous conditions to prevent significant damage, then maybe the public is better off without it,” Rosenberg writes. “On March 26, the commission will vote on the Comcast-Time Warner Cable merger. A million conditions can’t make this a good enough deal. There comes a time to just say no.”

Subscribe

Subscribe We grant the application of Comcast Corporation (Comcast), Time Warner Cable Inc. (Time Warner), Time Warner Cable Information Services (California), LLC (TWCIS) and Bright House Networks Information Services (California), LLC (Bright House) for approval of the transfer of control of TWCIS and Bright House to Comcast. In addition, we grant the application of Comcast, TWCIS and Charter Fiberlink CA-CCO, LLC (Charter Fiberlink) to transfer a limited number of business customers and associated regulated assets of Charter Fiberlink. — Proposed Decision of California Administrative Law Judge Karl J. Bemesderfer

We grant the application of Comcast Corporation (Comcast), Time Warner Cable Inc. (Time Warner), Time Warner Cable Information Services (California), LLC (TWCIS) and Bright House Networks Information Services (California), LLC (Bright House) for approval of the transfer of control of TWCIS and Bright House to Comcast. In addition, we grant the application of Comcast, TWCIS and Charter Fiberlink CA-CCO, LLC (Charter Fiberlink) to transfer a limited number of business customers and associated regulated assets of Charter Fiberlink. — Proposed Decision of California Administrative Law Judge Karl J. Bemesderfer Bemesderfer proposes a lengthy list of conditions the cable giant must meet for at least five years after merging, including offering discounted Internet service programs, improve customer service, provide free backup batteries for Comcast phone service, and promise it will stop lobbying against community broadband projects.

Bemesderfer proposes a lengthy list of conditions the cable giant must meet for at least five years after merging, including offering discounted Internet service programs, improve customer service, provide free backup batteries for Comcast phone service, and promise it will stop lobbying against community broadband projects.

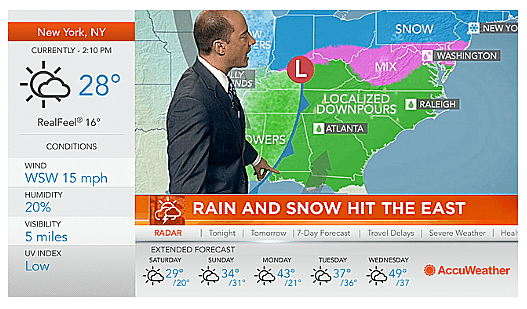

The latest contract dispute over cable programming between The Weather Channel and Verizon FiOS has deprived Verizon customers of The Weather Channel, but more than a few viewers who don’t live for storm porn don’t seem to notice or care.

The latest contract dispute over cable programming between The Weather Channel and Verizon FiOS has deprived Verizon customers of The Weather Channel, but more than a few viewers who don’t live for storm porn don’t seem to notice or care. AccuWeather also called out The Weather Channel for preempting the weather for “Fat Guys in the Woods” and “Prospectors” — two Weather Channel reality shows that may encounter bad weather, but don’t report on it.

AccuWeather also called out The Weather Channel for preempting the weather for “Fat Guys in the Woods” and “Prospectors” — two Weather Channel reality shows that may encounter bad weather, but don’t report on it. French ISP and mobile provider Free has boosted its promotion for inexpensive wireless calling with a family plan that provides unlimited calling within France, its territories overseas, the United States, Canada, Alaska, Hawaii, China, and nearly

French ISP and mobile provider Free has boosted its promotion for inexpensive wireless calling with a family plan that provides unlimited calling within France, its territories overseas, the United States, Canada, Alaska, Hawaii, China, and nearly Charter Communications is in talks with Si Newhouse, Jr., the billionaire owner of Bright House Networks, to acquire the cable operator in an all-stock deal that could be worth over $12 billion, according to a report by Bloomberg News.

Charter Communications is in talks with Si Newhouse, Jr., the billionaire owner of Bright House Networks, to acquire the cable operator in an all-stock deal that could be worth over $12 billion, according to a report by Bloomberg News. “While we have had conversations with many parties about this transaction, we do not have an agreement with anyone regarding future plans for Bright House,” a company spokeswoman said in the statement.

“While we have had conversations with many parties about this transaction, we do not have an agreement with anyone regarding future plans for Bright House,” a company spokeswoman said in the statement.