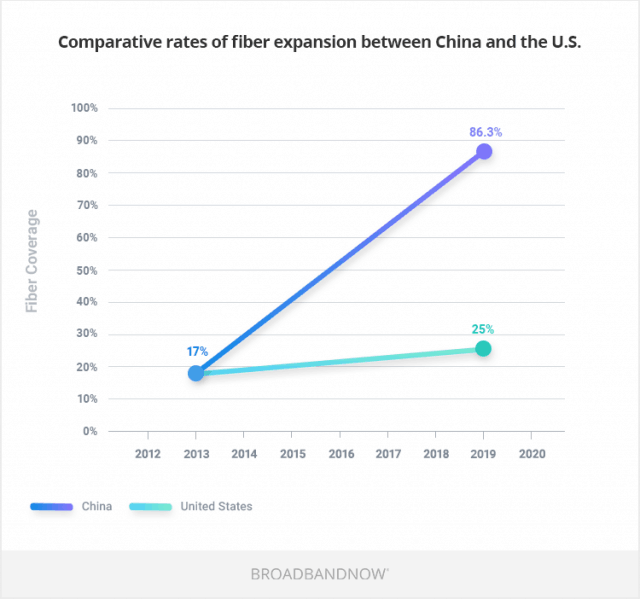

China is outpacing the U.S. in fiber broadband expansion. (Image: Broadband Now)

At least 86% of China now has access to fiber broadband connectivity after six years of aggressive fiber optic network expansion, putting the United States at a significant disadvantage.

Only 25% of the United States is served by fiber service, creating a giant digital divide that leaves most Americans without fiber high speed broadband. That is the finding of Broadband Now, which summarized the results of its investigation in an article published this week, blaming the country’s reliance on deregulated monopoly/duopoly telecom companies for much of the problem.

“While America continues to suffer from an immense digital divide, China’s government has made incredible progress building out a state-sponsored super network of fiber optic connections. This infrastructure will allow the country to take early advantage of some of the most impactful applications resulting from the fourth industrial revolution,” Broadband Now reports.

Chinese state policy has emphasized the importance of deploying modern telecommunications networks, including fiber-to-the-home and 5G wireless service. The Chinese central government is spending billions to build a core public broadband network, which providers can lease to offer service to their customers. U.S. providers rely on private investment that depends on a financial formula to determine if fiber upgrades will deliver a competitive advantage or a potential for robust profits.

Broadband Now notes that most U.S. providers face little significant competition — “a difficult proposition to justify installing robust fiber networks, especially in less populous areas of the U.S.”

The “return on investment” formula is also responsible for the lack of rural broadband access, a problem the Chinese government solved by directly subsidizing the construction of fiber networks across the country, deeming high speed connectivity a national priority. As a result, 96% of rural Chinese villages now have access to fast internet service.

Broadband Now advocates for more aggressive fiber broadband deployment in the United States, including policies that promote fiber expansion and reduce deployment costs. For example, Broadband Now believes that a national “dig once” policy that would require fiber optic conduit to be installed wherever roadway projects are undertaken could allow providers quick and inexpensive access to deploy fiber technology. The group estimates that nationwide fiber expansion costs could be reduced from $140 billion to $14 billion if dig once policies were the national standard.

Chinese fiber deployment has already laid a foundation for China to outpace the United States in the race to deploy 5G wireless networks. Fiber connections are required to power gigabit speed small cells integral to millimeter wave 5G services. With China well ahead of the U.S. in fiber deployment, the country is poised to rapidly expand 5G wireless service.

Subscribe

Subscribe Hulu + Live TV is celebrating its successful signup of over an estimated 2.7 million customers with a major rate increase the company says reflects the service’s true value in the marketplace.

Hulu + Live TV is celebrating its successful signup of over an estimated 2.7 million customers with a major rate increase the company says reflects the service’s true value in the marketplace.

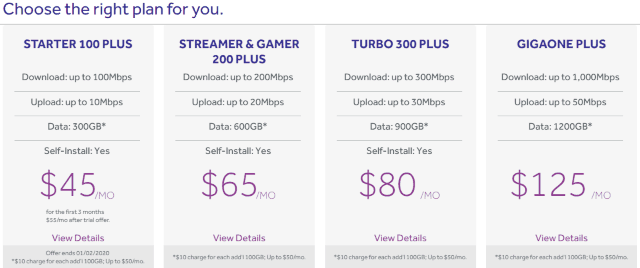

Using a combination of lack of competition, high-priced service plans, and data caps, Cable One is once again the nation’s most profitable cable broadband provider, charging residential customers a record-breaking average of $72.09 a month.

Using a combination of lack of competition, high-priced service plans, and data caps, Cable One is once again the nation’s most profitable cable broadband provider, charging residential customers a record-breaking average of $72.09 a month.

Ironically, one of the few a-la-carte providers available is a very large cable company you may already know. Charter’s Spectrum has been quietly selling

Ironically, one of the few a-la-carte providers available is a very large cable company you may already know. Charter’s Spectrum has been quietly selling  T-Mobile is gradually expanding its new fixed wireless home broadband service, prioritizing rural areas next to major highways where the mobile provider has strong 4G LTE service.

T-Mobile is gradually expanding its new fixed wireless home broadband service, prioritizing rural areas next to major highways where the mobile provider has strong 4G LTE service.