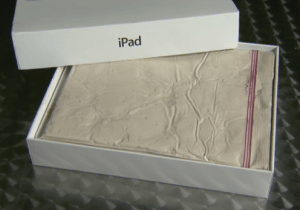

In what might be considered a funny throwback to The Flintstones if it wasn’t so expensive, some British Columbia residents buying Apple’s popular iPad tablet are bringing home an iRock instead — a box filled with a bag of modeling clay.

In what might be considered a funny throwback to The Flintstones if it wasn’t so expensive, some British Columbia residents buying Apple’s popular iPad tablet are bringing home an iRock instead — a box filled with a bag of modeling clay.

Surrey, B.C. resident Sundeep Randhawa was initially delighted to unwrap an Apple iPad this Christmas, until she opened the shrink-wrap sealed box and found carefully-wrapped modeling clay instead.

Randhawa told CTV News she thought at first it was a joke — a gag gift from her husband.

“$695 worth of clay,” husband Mark responded. He didn’t find it funny either.

Retailers across the Vancouver area initially treated customer returns of the boxes of clay with skepticism, suspecting fraud on the part of the person seeking a refund or replacement. But as consumers started bringing back more boxes of clay to major electronics outlets like Future Shop, WalMart, and Best Buy, British Columbia authorities, at the behest of CTV consumer reporters, soon announced a crime ring was responsible.

It turns out the affected iPads were previously purchased with cash, replaced with clay of similar weight, and professionally re-shrink-wrapped and returned for a cash refund. The perpetrators ended up with brand new iPads and received a full refund from retailers because the product appeared unopened. In turn, retailers returned the products to store shelves where unsuspecting consumers ended up buying them.

“It’s a fraud and it just shows how creative some of these fraudsters are,” says the RCMP’s Tim Shields.

Shields notes finding those behind the scam has turned out to be more difficult than just arresting whoever returns a re-wrapped unit. That is because the crime ring is using Craigslist to recruit innocent third parties to act as “secret shoppers,” returning the clay iPads to “test” how retailers handle customer returns. Authorities say those hired to manage the returns have been “unwitting mules” and are not being held criminally responsible.

Wireless providers selling mobile broadband-equipped iPads have so far been immune to the fraud, because most dealers pre-activate the wireless service in-store, which requires factory-sealed boxes to be opened within the store. Returning the equipment, which is often accompanied by a two-year service agreement, is also much more complicated, making a clandestine 3G-clay replacement unlikely.

But with professional wrapping equipment at the disposal of criminals, other high-value electronics could soon be the next targets of fraudsters.

Although Sundeep’s Christmas was ruined by the fraud, her husband finally managed to secure a full refund. Now he, along with some other BC residents, are opening their electronics purchases in-store to verify what they are buying before walking out the door.

Investigators suspect it is only a matter of time before this type of fraud reaches other parts of Canada and the United States.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/CTV Fake iPads 1-20-12.flv[/flv]

CTV British Columbia reports on an innovative new fraud that could leave you holding a bag of clay instead of a shiny new Apple iPad. (2 minutes)

Subscribe

Subscribe