Altice USA’s Optimum (formerly Cablevision) and Suddenlink are getting upgraded technology as the two cable companies face increasing demands for speed and broadband usage around the country.

Altice USA’s Optimum (formerly Cablevision) and Suddenlink are getting upgraded technology as the two cable companies face increasing demands for speed and broadband usage around the country.

“Over the last two years, the percentage of customers taking over 100 megabits of speed has risen to about 80% of our total customer base,” noted Dexter Goei, CEO of Altice USA. “Recently, we have shifted focus to growing the penetration of 200 Mbps services with about 80% of gross additions now taking these speeds or higher, reaching about half of our total customer base at the end of the third quarter, up from less than 5% two years ago.”

Goei noted that the average of all Optimum and Suddenlink broadband customers’ internet speeds has risen from 56 Mbps to 172 Mbps over the last 24 months, and this is increasing every quarter.

“Average data usage is now over 240 gigabytes per month per customer,” Goei added. “And this continues to grow over 20% per year.”

Goei

To meet growing demand, Altice USA is spending money upgrading its cable properties. The company is scrapping its coaxial cable network in the northeast and in selected parts of Suddenlink territory. In smaller communities that Suddenlink typically serves, the company will either bring fiber to the home service or upgrade the existing cable system to DOCSIS 3.1.

“The first objective is to have 1 Gbps broadband services available virtually everywhere,” Goei said. “For our legacy coax network in the Optimum footprint, we just need to do a Digital Switched Video upgrade now to move us to DOCSIS 3.1 and 1 Gbps speeds, which we can complete over the next few quarters. We just soft launched our fiber network in select areas of Long Island, and it is performing just as we expected so far, delivering a great 1 Gbps symmetrical single-play data service with the new advanced wireless gateway. The smart meshed Wi-Fi we’ve introduced is also doing extremely well.”

Goei says Optimum’s fiber network will be capable of delivering more than 10 Gbps speeds, as well as enhanced Wi-Fi, and improved system reliability.

“For the Suddenlink footprint, we already offer up to 1 Gbps services, so we will add further 1 Gbps capacity through some node splitting and CMTS upgrades,” Goei said. “We are also doing a QAM to IP migration on the cable plant to deliver future IP services. And with the move to DOCSIS 3.1, customers will have a uniform SSID across all of their devices, for an improved seamless Wi-Fi experience.”

The upgrades will mean Suddenlink customers will be more likely to receive 1 Gbps speeds even during peak usage times.

The upgrades will mean Suddenlink customers will be more likely to receive 1 Gbps speeds even during peak usage times.

By transitioning video services away from the current QAM platform, IP video will free up additional bandwidth Suddenlink can devote to its internet customers.

Goei told investors on a quarterly results conference call that the five-year fiber upgrade project in the northeast may stretch into a sixth year due to permitting delays in some communities where Optimum provides service.

Some Wall Street analysts questioned Goei about the merits of a costly fiber upgrade, asking if it was necessary. Jonathan Chaplin of New Street Research suggested if cable systems were already capable of gigabit speed service under DOCSIS 3.1, any revenue benefits gained from offering gigabit service could already be realized without stringing fiber optic cable. Other Wall Street analysts wanted to know when Altice would deliver the next revenue-increasing rate hike on Optimum and Suddenlink customers.

The company acknowledged it lost customers after the last round of price increases last spring. Its biggest losses are coming from cord cutting. Altice saw 20,700 Optimum TV customers cancel service between July and September, with a total of 76,000 customers dropping service so far this year. But that won’t stop Altice from raising rates again. Goei anticipated the next rate hike will likely take place during the first half of 2019.

Altice USA is also working on its own cellphone service, which will be powered by its large Wi-Fi hotspot network in the northeast and rely on the services of Sprint to connect customers while away from Wi-Fi. The company did not release pricing or service information.

Subscribe

Subscribe Charter Communications, which does business as Spectrum, has raised the price of its legacy “Everyday Low Priced Internet (ELP),” a 2/1 Mbps service that Time Warner Cable introduced in 2013 for $14.99 a month. Our reader Todd writes the service is going up another $5 a month (after an earlier $5 rate increase) effective in November 2018, as his latest bill shows:

Charter Communications, which does business as Spectrum, has raised the price of its legacy “Everyday Low Priced Internet (ELP),” a 2/1 Mbps service that Time Warner Cable introduced in 2013 for $14.99 a month. Our reader Todd writes the service is going up another $5 a month (after an earlier $5 rate increase) effective in November 2018, as his latest bill shows: That service is also promoted in mailers in low-income neighborhoods without an income or benefit pre-qualification requirement, so anyone in those neighborhoods can sign up.

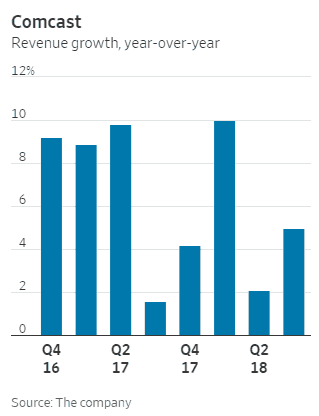

That service is also promoted in mailers in low-income neighborhoods without an income or benefit pre-qualification requirement, so anyone in those neighborhoods can sign up. Comcast has passed 30 million customer relationships, mostly from adding new broadband customers that continue to disconnect from phone company DSL service.

Comcast has passed 30 million customer relationships, mostly from adding new broadband customers that continue to disconnect from phone company DSL service. “Our 1 gigabit internet is now available to nearly all of the 58 million homes and businesses passed in our footprint,” Roberts said. “This is the fastest deployment of gigabit speeds to the most locations in the country by anybody.”

“Our 1 gigabit internet is now available to nearly all of the 58 million homes and businesses passed in our footprint,” Roberts said. “This is the fastest deployment of gigabit speeds to the most locations in the country by anybody.” AT&T will

AT&T will  Cisco is helping cable operators get ready to finally end the wide speed disparity between upload and download speeds offered by most cable operators.

Cisco is helping cable operators get ready to finally end the wide speed disparity between upload and download speeds offered by most cable operators.