After learning from the experiences of providing a wireless 5G home broadband alternative in a handful of U.S. cities, Verizon is preparing to launch a refreshed 5G Home fixed wireless product in all 30 cities where it intends to provide mobile 5G service this year.

After learning from the experiences of providing a wireless 5G home broadband alternative in a handful of U.S. cities, Verizon is preparing to launch a refreshed 5G Home fixed wireless product in all 30 cities where it intends to provide mobile 5G service this year.

The biggest change will be a new emphasis on self-installs. Verizon estimates about 80% of customers pre-screened online as qualified for the service can install it themselves with an indoor antenna. That is a big change for Verizon, which used to rely on technicians installing a fixed antenna on the side of a customer’s home. A new receiver expected to be introduced in 2020 is also expected to boost reception through the use of a new high-powered chipset, likely including Qualcomm’s new QTM527 mmWave antenna module that was custom designed to enhance and extend the range of 5G fixed wireless services. Verizon’s current 5G Home equipment uses a chipset originally designed for 5G smartphones.

Ronan Dunne, CEO of Verizon Consumer Group, said Verizon Home 5G will be sold as a companion product wherever Verizon’s 5G millimeter wave network debuts.

“We’re now ready to go mass market,” Dunne told a group of investors.

U.S. cities with Verizon 5G Ultra Wideband

- Atlanta

- Chicago

- Denver

- Detroit

- Houston*

- Indianapolis*

- Los Angeles*

- Minneapolis

- Providence

- Sacramento*

- St. Paul

- Washington, D.C.

- Phoenix

(*-These cities, except for Indianapolis, only have fixed wireless 5G Home broadband at this time.)

U.S. cities planned for Verizon 5G Ultra Wideband deployment in 2019

- Boston

- Charlotte

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Des Moines

- Houston

- Indianapolis

- Kansas City

- Little Rock

- Memphis

- San Diego

- Salt Lake City

But where that market will exactly be is hard to tell. Verizon relies heavily on its service address qualification tool, which shows if a prospective customer can obtain the service. That tool is refined enough to ensure that over 90% of Verizon’s fixed wireless traffic stays on its 5G network, with only around 10% falling back to Verizon’s existing 4G LTE network.

Verizon uses its tool to assure “qualified” customers are well inside the radius of its 5G coverage area. An analysis found Verizon’s millimeter wave network, which operates in the 28 GHz band, has a limited range. Although Verizon predicted its network could reach 1,000 feet from each small cell location, the website only qualified those in Sacramento living within around 500 feet of each small cell. Verizon is also heavily reliant on using light poles for smart cells, and these were not always suitable for the widest coverage.

Verizon uses its tool to assure “qualified” customers are well inside the radius of its 5G coverage area. An analysis found Verizon’s millimeter wave network, which operates in the 28 GHz band, has a limited range. Although Verizon predicted its network could reach 1,000 feet from each small cell location, the website only qualified those in Sacramento living within around 500 feet of each small cell. Verizon is also heavily reliant on using light poles for smart cells, and these were not always suitable for the widest coverage.

Earl Lum of EJL Wireless Research explored Verizon’s 5G network in Sacramento and found it primarily targeting 5G Home customers. If Verizon is intending to cover entire cities with millimeter wave 5G, Lum said “you’re talking about a crapload of poles.” Some analysts expect Verizon will introduce lower band 5G service to increase and compliment its millimeter wave coverage areas. The impact traffic from Verizon’s 5G Home service will have on lower band 5G networks is not known. The home broadband replacement currently markets speeds of around 300 Mbps with no monthly data cap for as low as $50, if one also subscribes to Verizon Wireless mobile service. Any low band 5G service running from traditional macro cell towers will be shared with a much larger number of customers than those sharing a small cell, potentially creating capacity problems down the road.

One other change to report: Verizon’s newest 5G Home cities will launch using the official 5G NR standard, not the unofficial 5G TF standard Verizon used in the four early launch cities.

It is too early to tell whether incumbent phone and cable companies will perceive a significant competitive threat from Verizon’s high speed fixed wireless proposition. Early reports of the service’s limited coverage in the four launch cities and fears about the high cost of expanding 5G service seemed to calm operator fears of a new competitor. But Verizon has also said for months that it purposely limited its 5G Home network rollout until the official 5G standard emerged. The wireless operator has also used this past spring and summer to learn from its early experiences with fixed 5G service and cut expenses like required truck rolls for installation out of the business. The money saved could be plowed into a more robust network of 5G small cells covering larger areas.

Subscribe

Subscribe Spectrum customers in Southern California are gradually getting a free upgrade to 200 Mbps — twice the usual Standard speed, starting with new customers.

Spectrum customers in Southern California are gradually getting a free upgrade to 200 Mbps — twice the usual Standard speed, starting with new customers.

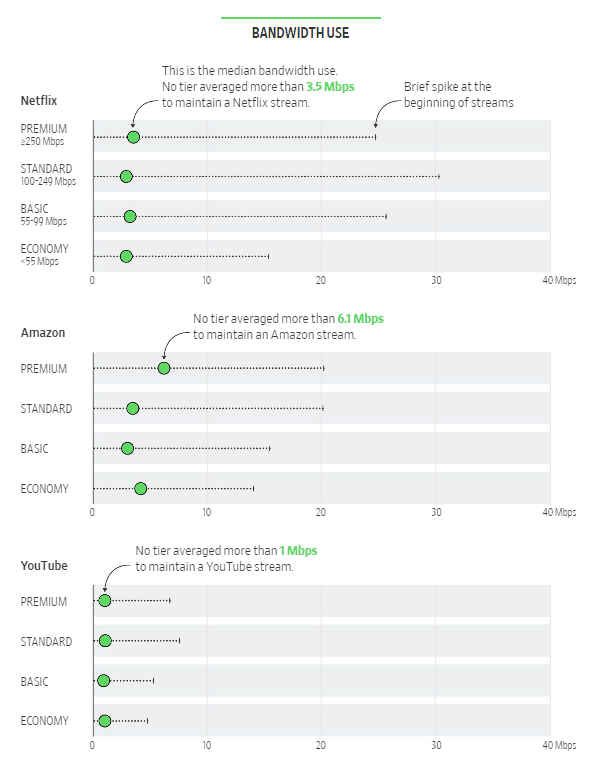

The Wall Street Journal believes the majority of Americans are paying for internet speed they never use or need, but their investigation largely ignores the question of traffic bottlenecks and data caps that require many customers to upgrade to premium tiers to avoid punitive overlimit fees.

The Wall Street Journal believes the majority of Americans are paying for internet speed they never use or need, but their investigation largely ignores the question of traffic bottlenecks and data caps that require many customers to upgrade to premium tiers to avoid punitive overlimit fees.

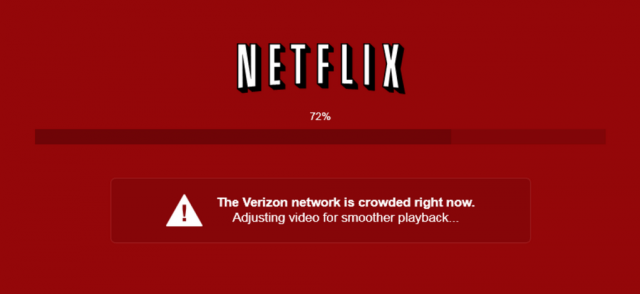

The answer often lies in the quality of the connection between the streaming provider and the customer. There are multiple potential bottlenecks that can make a YouTube video stutter and buffer on even the fastest internet connection. Large providers have had

The answer often lies in the quality of the connection between the streaming provider and the customer. There are multiple potential bottlenecks that can make a YouTube video stutter and buffer on even the fastest internet connection. Large providers have had  Customers are sold on speed upgrades by providers that tell them faster speeds will accommodate more video traffic, which is true but not the whole answer. No amount of speed will overcome intentional traffic shaping, an inadequate connection to the video streaming service, or an oversold network. Too bad the Journal did not investigate these conditions, which are more common than many people think.

Customers are sold on speed upgrades by providers that tell them faster speeds will accommodate more video traffic, which is true but not the whole answer. No amount of speed will overcome intentional traffic shaping, an inadequate connection to the video streaming service, or an oversold network. Too bad the Journal did not investigate these conditions, which are more common than many people think. Despite assurances from FCC Chairman Ajit Pai that the repeal of net neutrality would inspire cable operators to increase investment in broadband, a year-long virtual spending freeze by the nation’s top cable operators has resulted in a major vendor pulling out of the next generation cable broadband standard until there are signs cable companies are prepared to spend money on upgrades again.

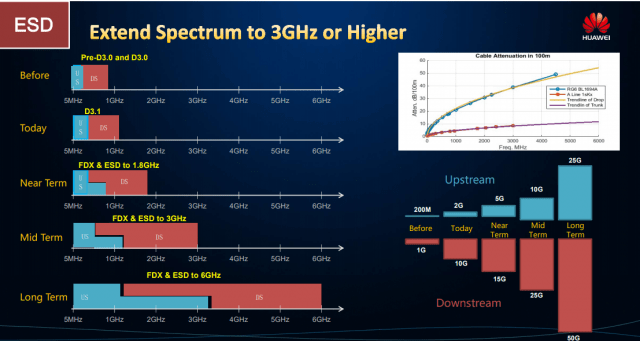

Despite assurances from FCC Chairman Ajit Pai that the repeal of net neutrality would inspire cable operators to increase investment in broadband, a year-long virtual spending freeze by the nation’s top cable operators has resulted in a major vendor pulling out of the next generation cable broadband standard until there are signs cable companies are prepared to spend money on upgrades again. FDX has already been the victim of delays. Originally planned as an incremental upgrade for DOCSIS 3.1, FDX is now scheduled to be included in CableLabs’ DOCSIS 4.0 specification, which is not expected to be released for a few years. FDX will be one of several new features incorporated into the next cable broadband standard, which will allow for low latency connections and an expanded amount of coaxial cable spectrum that can be devoted to broadband services.

FDX has already been the victim of delays. Originally planned as an incremental upgrade for DOCSIS 3.1, FDX is now scheduled to be included in CableLabs’ DOCSIS 4.0 specification, which is not expected to be released for a few years. FDX will be one of several new features incorporated into the next cable broadband standard, which will allow for low latency connections and an expanded amount of coaxial cable spectrum that can be devoted to broadband services.