You can look all over this astroturf group's website and never find the fact it's bought and paid for on behalf of Colorado's largest cable company -- Comcast.

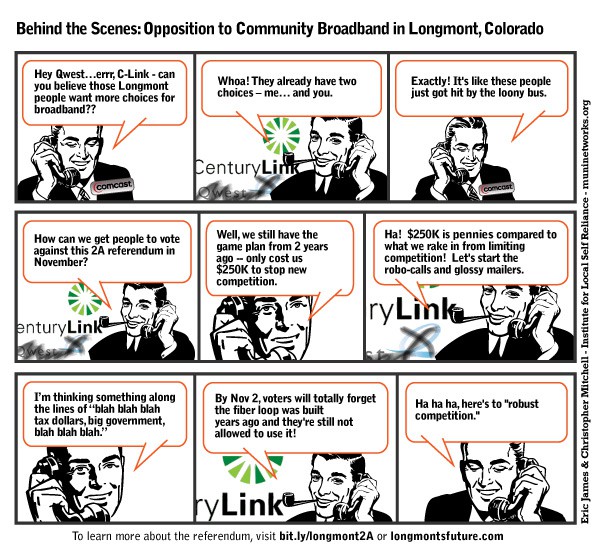

The next time Comcast or CenturyLink wants to increase your rates because of the “increased costs of doing business,” you might want to ask them why they have collectively spent more than $300,000 on an astroturf campaign to stop the city of Longmont, Col. (pop. 86,000) from using excess fiber capacity to provide competition to the phone and cable company without raising taxes a penny.

Longmont voters are headed to the polls today with a simple question to answer: should the city be allowed to open their fiber network to all-comers to provide competitive video, data, and telephone services to city residents. Longmont’s fiber network was constructed in the 1990s as part of its electrical infrastructure. Some utility companies buried enormous amounts of fiber intending to use it to electronically collect usage data from ratepayers so meter readers could become a thing of the past. Like in other cities, Longmont now has a fiber network that is woefully underused, and the city wants to open up the tremendous excess capacity for telecommunications uses. They are even open to allowing Comcast and CenturyLink to use the network to help service their own respective customers, but the thought a new competitor (including a community-owned provider) might deliver service over that network has created an absurd $300,000 Hissyfit.

Comcast has been caught funding the majority of the opposition, the so-called “No on 2A” and “Look Before We Leap” projects, sponsored primarily by the Colorado Cable Telecommunications Association, which counts Comcast as a member.

But visitors to the campaign’s cheesy website never realize who is running the show because the effort hides its association with Big Telecom.

But visitors to the campaign’s cheesy website never realize who is running the show because the effort hides its association with Big Telecom.

It’s a classic example of Astroturf Fear, Uncertainty, and Doubt. Scare residents into believing the city will raise taxes or go into financial distress. Raise uncertainty by claiming important details are being left out. Encourage doubt by comparing the advanced fiber network with anemic public Wi-Fi failures of the past involving Earthlink (remember them?).

But the No on 2A campaign is also willing to check themselves into a deluxe suite at the Hypocrisy Hotel, accusing city officials of hiding the names of their pro-fiber supporters and backers, including (gasp!) a company based in France!

The No on 2A website breathlessly relates the incriminating documents were unearthed from “previously secret emails just made public thanks to a Colorado Open Records Act.” They suggest a nefarious connection with Alcatel-Lucent because that company, which sells products and services related to fiber networks, communicated with the city in a handful of e-mail messages last summer. You know those French, always up to something.

The rich, buttery irony of a “group” secretly funded by the state’s largest cable company accusing others of keeping secrets is ignored at Kabletown.

But then I’ve received e-mail from Alcatel-Lucent (and Comcast) myself. And I have a French last name. Sacrebleu!

The website’s “opponents,” evidently gleaned from the few hundred residents that signed their visitor’s book, includes names like Joanna Crawford, “Garrett County,” and El Cordova, which we think could be the name of a Mexican pro-wrestler, we’re not sure.

City officials are stunned by the sheer amount of money being spent by cable and phone companies to keep competition far, far away. So apparently is the local media, which has taken to identifying the “grass roots” opposition right down to their job title and name of the lobbying firm they work for.

Take Times-Call, which helpfully discloses “Look Before We Leap” spokesman George Merritt is actually a senior strategist for Onsight Public Affairs of Denver. That’s a real nice way to say “lobbying firm hired to develop social media strategies to snooker influence public opinion on behalf of corporate clients.”

You know you’re not dealing with a neighborhood group lobbying to reduce road speeds in the neighborhood or sign a petition for improved trash collection when you read Leap’s financial disclosure reports:

You know you’re not dealing with a neighborhood group lobbying to reduce road speeds in the neighborhood or sign a petition for improved trash collection when you read Leap’s financial disclosure reports:

- $120,913.64 to mass communications firm SE2 of Denver for a variety of services, including mail pieces, consulting, two television buys and ad production and design.

- $70,500 to Rocky Mountain Voter Outreach of Denver for “canvass, management rent and miscellaneous associates.”

- $37,500 to OnSight Public Affairs for consulting.

- $22,000 to Drake Research and Strategy of Boulder for polling.

- $15,776.84 to Zata3 for phone work.

- $12,260 to Holland and Hart of Denver for legal expenses.

- $8,000 to EIS of Grand Junction for consulting.

- $4,334.65 to Campaign Products of the Rockies, of Denver, for a voter file, mailing lists, stickers and yard signs.

- $2,500 to Mark Stevens of Denver for research.

- $743.75 to Tim Thomas of Boulder for general campaign work.

The whole dog and pony show of Big Telecom money has bemused Longmont mayor Bryan Baum, who supports the 2A measure and believes the distortion campaign has gone way over the top.

“It doesn’t really matter at this stage of the game,” Baum told the newspaper. “It’s going to the electorate. The electorate will vote. And we will know on Tuesday how they voted – if they believe a $300,000 ad campaign, or if they believe the people they’ve entrusted their votes to.”

Some of that $300,000 has also gone into vilifying a real grass-roots effort in support of the Longmont fiber initiative — Longmont’s Future. Comcast’s front group tried to raise questions about where that pro-fiber group got their backing and money. The newspaper discovered Longmont’s Future isn’t backed by any French conglomerate or nefarious outside interest. It’s the work of Jonathan Rice, who operates the website all by himself, spending a grand total of $353 to fight Comcast’s $300,000.

“Every single candidate for office and every incumbent, in every race, supports this measure,” says Rice. “But Comcast and its friends are more interested in profit than progress, and continue to run a smear campaign to spread misinformation and outright lies – they recently posted Mayor Baum’s name as an opponent of 2A when he is actually a vociferous supporter.”

Community Broadband Networks has compiled a series of articles detailing the project and helping to expose the so-called “grassroots” opponents. We encourage readers to become better acquainted with the underhanded tactics community broadband opponents will use to stop anything that resembles competition.

Subscribe

Subscribe