Part One: The Peevey Era (2002-2014)

California’s Public Utilities Commission seems increasingly unable to escape its reputation for backroom dealing, close personal ties to lobbyists working for the utility companies it regulates, and a growing conclusion it could care less about the interests of ordinary California consumers it is supposed to protect. That’s great news if you are an energy or telecommunications company with business before the commission, but bad news for consumers.

In this first part in a series of reports, Stop the Cap! investigates corruption at the highest levels of the California regulator. Search warrants have been executed, documents seized, and top officials of one of the state’s largest utilities have been fired. But it that enough for Californians to finally get a fair shake?

Before a series of scandals reached the front pages of state newspapers last year, many Californians would be hard-pressed to explain what “CPUC” stood for, much less take an active interest in its regulatory and oversight activities. That may have made it easier for the California Public Utilities Commission to escape the close scrutiny other state agencies receive, at least until local news outlets turned their investigative reporters loose on the agency and its president.

The CPUC regulates the state’s energy and telecommunications companies, at least as far as federal and state laws allow these days. Most of the proceedings are conducted in public, but a great deal of the real business takes place behind closed doors in private. Sometimes these “ex parte” meetings and communications are disclosed to the public. But uncomfortably often, the participants look for excuses not to report.

Peevey

The Michael Peevey Era: Bending Over Backwards for Utilities Who Returned the Favor

For most of the last 12 years, the man who presided over the CPUC was Mr. Michael Peevey.

Then Gov. Gray Davis appointed Peevey to lead the CPUC on New Year’s Eve 2002, replacing its incumbent president Loretta Lynch (no relation to the current Obama Administration’s attorney general nominee). Lynch had been a strong consumer advocate at the commission and tried to hold back utility company rate increases at a time when Enron was manipulating wholesale energy prices in the state. When Peevey and Lynch served together as commissioners at the CPUC, their relationship was clearly strained, with several testy exchanges taking place between the two. In general, they opposed each other. Peevey supported deregulation, Lynch sought to protect consumers from the effects of a manipulated, deregulated marketplace.

Consumer advocates like the Foundation for Taxpayer and Consumer Rights pounced on the nomination, predicting it would be a disaster for California consumers.

”Making Mike Peevey the head of the PUC is like asking [Enron’s CEO] Kenneth Lay to run the [Securities & Exchange Commission],” said FTCR’s senior consumer advocate, Doug Heller in January 2003. ”After what the energy industry did to California, it is shocking that Davis would give an energy company executive such a prominent position. Not only has Davis failed to place an independent consumer voice on the commission, he is letting the energy industry run the agency.”

Peevey was a company man through and through, spending decades working for California utilities, most recently as president of Edison International and its well-known subsidiary, Southern California Edison (SCE). He was also well-connected politically, married to Democratic state senator Carol Liu. He left Edison in 1993 in what a 1997 Wall Street Journal piece called “a less-than-amicable separation” to do consulting work for 18 months.

Peevey Made Millions While Supporting Energy Deregulation That Brought Higher Rates and Rolling Blackouts for California Consumers

In 1995, Peevey launched New Energy Ventures, Inc., luring a former president of the CPUC to the venture, which would take advantage of energy generation deregulation in California to compete with SCE for customers. Peevey was a staunch advocate and lobbied hard for energy deregulation in California.

California’s deregulation plan required the state’s three large investor-owned utilities—Pacific Gas & Electric, Southern California Edison, and San Diego Gas and Electric—to sell part of their generating capacity, making them dependent on a competitive, open power generation market to effectively serve customers. It also discouraged companies from entering into long-term supply contracts with independent power producers to create a hedge against sudden price spikes. As a result, the utilities had to rely on the newly created spot wholesale market for about half of the electricity their customers demanded. Among the largest players in California’s energy market was Enron Energy Services (EES), based in Houston, Tex.

Peevey was a true believer in deregulation and saw enormous money could be made promising deep discounts on energy costs to large businesses in California. At one point, Peevey said he expected to market energy the way others market phone service. Like many of the players in California, Peevey’s NEV was an energy middleman. It bought wholesale power generated by private producers and resold it to large grocery and department store chains, manufacturers, and even the U.S. Dept. of Defense at a profit.

Peevey sold his energy services company to energy giant AES for $90 million.

Peevey had the good fortune to sell his venture to AES Corp., the largest U.S. developer of power plants, in 1999 for $90 million in cash and stock. He exited the business just six months before the start of the California Energy Crisis, which caused massive price increases and rolling blackouts across the state between 2000 and 2001. State deregulation, lack of federal oversight, and illegal market manipulation by Enron and others enriched the deregulated energy trading market while causing the bankruptcy of PG&E and the near bankruptcy of SCE in early 2001.

What deregulation advocates promised would be a veritable free fall of energy prices in the free market turned out to be a catastrophe for California and its citizens. The state lost an estimated $45 billion from deregulation and the illegal acts of Enron, as well as the loss of more than 1,300 utility jobs. Enron produced little power itself and owned relatively little in the way of hard assets. Like the big banks and investment firms that created wealth through trading barely tangible assets, securities and debt, Enron was less akin to PG&E and more closely resembled Goldman Sachs. Enron relied on low margin energy trading and energy supply contracts. It existed in a Wall Street-like trading environment, buying power from producers to selling to utilities, taking a cut each time. The more transactions, especially those at a higher price, the better for Enron.

”Every trading company in the country has been feasting on California, and Enron is the shrewdest of them all. They are like sharks in a feeding frenzy,” said Michael Shames, executive director of the Utility Consumers’ Action Network in San Diego in 2001. As he said that, Enron president Jeffery Skilling and family were spending two weeks sailing in the Virgin Islands. Skilling was deeply offended Californians were angry at Enron, which he called one of the great examples of the benefits of deregulation.

”We’re on the side of angels,” Skilling told Bloomberg News at the time. ”We’re taking on the entrenched monopolies. In every business we’ve been in, we’re the good guys.”

Today, Skilling is serving a reduced sentence of 14 years at the Montgomery Federal Prison Camp, Maxwell Air Force Base, Montgomery, Ala., and owes a $45 million fine.

Peevey never stopped advocating for deregulation, and his promise it would save Californians millions instead cost utility companies and the state tens of billions in losses. At the height of Enron’s market manipulation, Californians suffered multiple rolling blackouts while the energy markets made fortunes.

“This was like the perfect storm,” said former EES executive Steve Barth. “First, our traders are able to buy power for $250 in California and sell it to Arizona for $1,200 and then resell it to California for five times that. Then EES was able to go to these large companies and say ‘sign a 10-year contract with us and we’ll save you millions.'”

In a desperate bid to end the blackouts, utilities were eventually paying $1,400 per megawatt-hour for energy they used to produce for themselves for around $45.

[flv]http://www.phillipdampier.com/video/ABC Nightline California Energy Crisis 1-2001.mp4[/flv]

In 2000-2001, California was embroiled in an energy crisis, with rolling blackouts and enormous wholesale rate increases. At the heart of the problem – deregulation, which forced utilities to divest energy production assets and buy and sell power in a “free market” dominated by energy traders like Enron. ABC’s Nightline reported on the crisis in 2001, largely accepting the industry’s premise that the problem was insufficient supply and increased demand.

Vice President Dick Cheney blamed prior administrations for the crisis and believed more deregulation across the country would solve the problem, adding “there has been no significant increase in supply in California for about 10 years, although there’s been a 24 percent increase in the demand for electricity.”

These reports came ten months before the fall of Enron. Investigations would later reveal Cheney was wrong. Deregulation and a lack of oversight allowed Enron to manipulate prices undetected by federal regulators charged with monitoring the energy market. At the height of the crisis, Enron was exporting California-produced power to adjacent states, only to sell it back to increasingly desperate utilities like SCE and PG&E at markups that cost California $1-2 million a day. Despite claims the crisis was caused by a lack of capacity, at the height of the blackouts California had an installed generating capacity of 45GW and faced customer demand of just 28GW. (8:00)

Peevey Wins Presidency of CPUC and Has New Allies in Effort to Help AT&T, Power Companies

Peevey escaped the scorn heaped on energy companies and utilities because he cashed out of NEV just prior to the start of the Energy Crisis. Davis thought putting a former industry guy like Peevey in charge of the CPUC would be an asset because he would understood how legacy utilities like PG&E and SCE worked and would know how the new competitive players operated from his experience at NEV. Davis had previously brought Peevey on board as an unpaid personal consultant, helping him navigate the state’s energy crisis. By March, 2002 he was appointed by the governor to be a CPUC commissioner.

In late December it became clear Loretta Lynch was being forced out and Peevey was in. Davis reappointed Peevey to a full six-year term and designated him president, which pays $117,818 a year. Lynch remained at the CPUC as a commissioner until her term expired.

Gov. Gray Davis lost his job in a recall election, partly fueled by the California Energy Crisis.

To further empower Peevey, Davis also appointed his own trusted cabinet secretary, Susan P. Kennedy, to a vacant seat on the commission. Kennedy was closely connected with the California Democratic Party. She was its executive director from 1991 to 1994, then served as communications director for U.S. Sen. Dianne Feinstein of San Francisco from 1995 to 1998 before taking her post with Davis in 1999.

“Gov. Davis is cloning himself at the PUC to make sure he can get whatever he wants out of that agency,” complained Douglas Heller of the Santa Monica-based Foundation for Taxpayer and Consumer Rights Commission.

Both Kennedy and Peevey were regularly accused by consumer groups of turning the CPUC into an advocacy arm of some of the state’s largest utilities, usually at the expense of California’s consumers. When Pacific Gas & Electric (PG&E) got itself into trouble over safety breaches or regulatory violations, Peevey helped run defense and lessened the pain for the utility. Time for a rate increase? Peevey had the utilities’ backs.

Kennedy spent much of her three years at the CPUC (2003-2006) defending the interests of AT&T, the state’s largest telephone company. She helped head off efforts to enforce new consumer protection initiatives, watered down a cellular consumer’s “bill of rights” that would have disadvantaged AT&T and advocated for rate deregulation under the guise of competition. She was given prominent mention and support by the Koch Brothers-funded Heartland Institute after she was suddenly appointed chief of staff to Republican Gov. Arnold Schwarzenegger in December 2005:

Susan Kennedy’s policy positions at the CPUC, on the other hand, were as free-market as one could hope for in California, and there’s no sign she’s giving up on reform. This should delight the technology industry and benefit consumers everywhere. Republicans horrified by Kennedy’s appointment might check their own commitment to reform, smaller government, and a strong business climate.

Consumer groups were glad to see Kennedy out of the CPUC. She resurfaced this year as a key player in the CPUC influence game, but more on her later in the series.

[flv]http://www.phillipdampier.com/video/CBS News Incriminating Enron Tapes 2004.flv[/flv]

About three years after the fall of Enron, audio tapes of phone conversations between Enron’s west coast energy traders revealed illegal market manipulation of electricity rates that went undetected under Michael Peevey. Despite the CPUC’s considerable resources, it took Eric Christiansen, assistant general counsel to the municipally owned Snohomish County Public Utilities District in Washington state to fight for, obtain, and make public the infamous Enron tapes. CBS News summarized in 2004 how Enron traders used California energy deregulation to their advantage, right under the noses of regulators. (3:38)

The Beginning of the End for Michael Peevey

The San Bruno gas pipeline explosion.

The beginning of the end of Peevey’s reign over the CPUC began at 6:11 pm on September 9, 2010, in the San Francisco suburb of San Bruno, when a 30-inch diameter PG&E natural gas pipeline exploded in the middle of the Crestmoor residential neighborhood. The explosion and resulting fire was so enormous, first responders and the news media initially misreported it as a commercial jet crash. When it was all over, eight people were dead, 35 homes were leveled to the ground, and many others were damaged or uninhabitable.

Ironically, among the victims was Jacqueline Greig, 44. Greig worked for the CPUC, in a small, almost forgotten unit that advocates gas safety issues on behalf of consumers. Part of her job was reviewing PG&E’s plans to replace outdated natural gas pipelines like the one that exploded that early fall evening.

PG&E was implicated in the disaster, accused of operational deficiencies and reckless ignorance of public safety. In January, 2012, an independent audit from the State of California reported PG&E had also illegally diverted over $100 million from a safety operations fund for executive compensation and bonuses.

The federal investigation also accused the CPUC of not doing its job.

The National Transportation Safety Board found the CPUC “placed a blind trust in operators, to the detriment of public safety.”

Over 70 lawsuits were filed after the disaster, and critics accused the CPUC of being de facto members of PG&E’s defense team.

[flv]http://www.phillipdampier.com/video/KNTV San Francisco San Bruno Mayor Verbally Attacked by Peevey 9-10-13.flv[/flv]

On the occasion of the third anniversary of the San Bruno explosion, CPUC president Michael Peevey allegedly verbally abused San Bruno’s mayor and city manager during a private meeting, upset that they used the CPUC offices as a backdrop for several press conferences critical of PG&E and how the CPUC enforced safety regulations. KNTV in San Francisco talked with San Bruno leaders who revealed what was said. Originally aired Sept. 10, 2013. (4:40)

In October 2012, a potentially embarrassing public hearing on the San Bruno pipeline blast to be held by the CPUC was suddenly suspended in favor of backroom negotiations to settle the case. Two months later, the CPUC decided Californians themselves should pay 55% of PG&E’s costs to inspect and upgrade suspect natural gas pipelines — estimated at $229 million.

After successfully getting ratepayers to cover most of the costs for PG&E’s mistakes, executives at the utility quickly pivoted to limiting the potential damage from anticipated fines yet to be levied by the CPUC over the San Bruno disaster. In September, 2014 PG&E learned it was facing an amount that could reach $1.4 billion. PG&E officials quickly called Peevey’s chief of staff – Carol Brown – to get her help moving San Bruno-related litigation to an administrative judge with a track record of being friendly to PG&E, with the hope the fines could be reduced or dropped.

That PG&E would reach out to regulators to discuss matters before the commission was not unusual, although it was improper. Utility executives knew they had plenty of opportunities to discuss whatever was on their mind with Peevey.

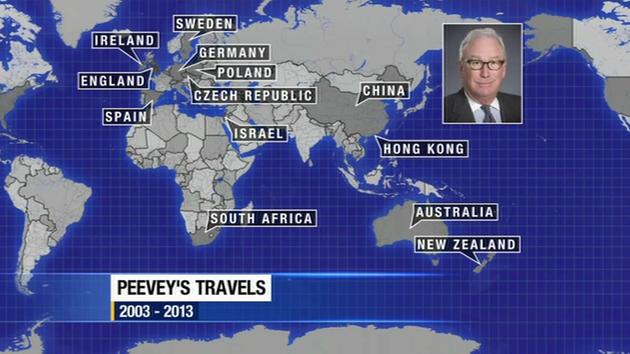

Image courtesy: KGO

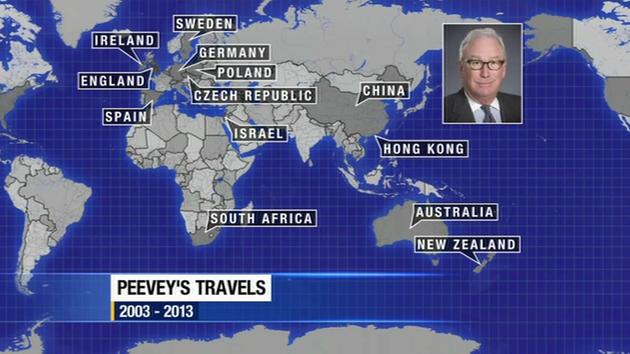

The fringe benefits of Peevey’s position seemed to go far beyond the responsibility of a utilities regulator earning a low six-figure salary. Peevey’s travels abroad were far beyond what most state regulators would consider reasonable. Peevey’s financial disclosures revealed he received gifts of $230,000 in international travel since he was appointed president of the CPUC in 2003. In all, Peevey spent 206 days abroad in at least 13 countries. On those trips, he was regularly joined by executives and lobbyists from some of the same companies that have business before the CPUC.

To avoid charges of a direct link between lobbyists and the CPUC president, special interests funneled money into a less obvious non-profit group called the California Foundation on the Environment and the Economy (CFEE). Ostensibly created to help the state move beyond fossil fuels and promote energy efficiency, the group also helps executives and lobbyists move closer to lawmakers and regulators. CFEE plans regular junkets to some of the best vacation spots on the planet, where it holds “conferences” and tours energy-conservation and environmentally friendly projects that happen to be within driving distance.

These were must-attend events for Peevey, who regularly skipped CPUC business, hearings run by the state legislature, and other important events so he wouldn’t miss a flight abroad or a quick drive to an expensive Napa Valley resort.

[flv]http://www.phillipdampier.com/video/KNTV Peevey Priority Senate Hearing or Napa Winery 5-2-13.flv[/flv]

In a hidden camera investigation, KNTV found California Public Utilities Commission president Michael Peevey at a conference in wine country instead of answering tough questions from senators in Sacramento. Chief Investigative Reporter Tony Kovaleski caught up with an irritated Peevey in Napa. This story originally aired on May 2, 2013. (5:37)

While the state remained preoccupied with the San Bruno gas pipeline explosion, Peevey was packing for a flight to Madrid for a 12-day “travel-study excursion” that happened to hit the must-see stops in Sevilla and Barcelona, again sponsored by CFEE. Along for the ride was Peevey’s wife, two other state senators, several members of the state Assembly, CPUC commissioner Nancy Ryan, and executives from Chevron, Mirant (now GenOn, the owner of the Potrero power plant), Covanta Energy Corporation, Shell Energy North America, and engineering giant AECOM. PG&E and SCE executives were also in attendance, with plenty of time for fun and chats about the current priorities of the corporate utility business.

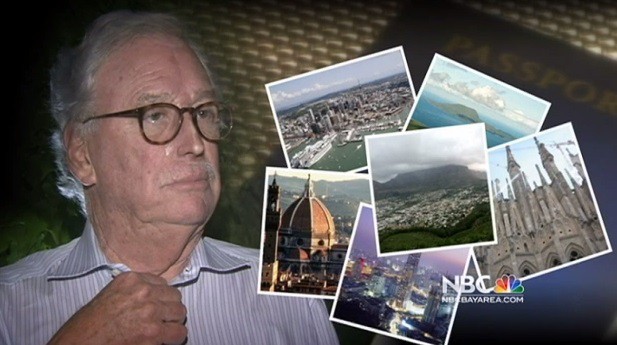

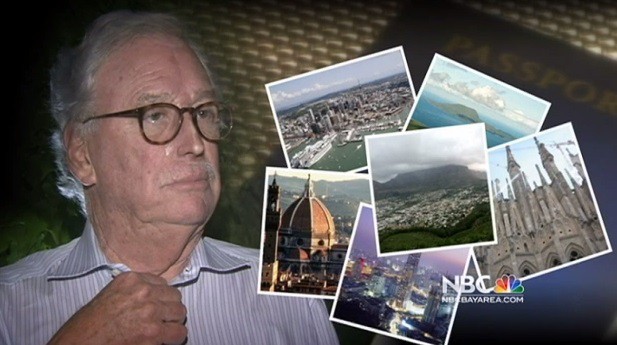

KNTV’s Investigate Reporting unit has dogged Peevey for more than a year about alleged improprieties. (Image: KNTV)

There isn’t much to see at CFEE headquarters at Pier 35 in San Francisco. Most of the activity takes place behind the scenes, where a long list of corporate members cut checks to CFEE to cover travel expenses for public officials. Among them include Verizon, Time Warner Cable, the California Cable & Telecommunications Association, Comcast, Chevron, J.P. Morgan, Goldman Sachs, AT&T, and PG&E. In return, executives often get to tag along on the exclusive junkets.

Although a rare trip to the less exclusive land of Inner Mongolia was a part of CFEE’s list of “travel studies” back in 2001, in recent years the destinations resemble the grand prize on a TV game show. Italy, Brazil, South Africa, Sweden and other destinations are covered, and you can be sure the guests are put up only in the finest hotels available.

“These ostensibly educational trips are essentially lobbying junkets, where utilities … wine and dine legislators,” said consumer group TURN spokeperson Mindy Spatt. The San Francisco Bay Guardian reported in 2011 TURN was raising the issue of these corporate-sponsored junkets several years ago when Peevey joined a CFEE trip attended by a representative of Southern California Edison “just coincidentally at the exact same time that he was penning an alternate decision in Edison’s rate case.” She added: “In TURN’s perspective, the commissioners need to be more in touch with what actual utility customers are experiencing, rather than in touch with the top restaurants in Brazil.”

In April 2013, CFEE paid the price for not keeping all their junkets far out of reach of the California media. KNTV, the NBC affiliate in San Francisco, followed Peevey to an exclusive Napa resort and a private reception at an upscale winery in St. Helena, all captured on hidden camera by the NBC Bay Area Investigative Unit.

Peevey was supposed to appear that day before the California Senate Budget and Fiscal Review subcommittee to discuss his performance after growing revelations showed a conflict of interest between the CPUC and the utilities it regulates. Peevey skipped the hearing and attended the corporate-funded tour instead. His only obligation was to deliver a five-minute speech at the event. The rest of the time was his to hobnob.

The affair got underway at noon with a catered lunch for guests, including a representative from PG&E. More than two dozen Sacramento lawmakers also had ID badges waiting for them on arrival. By early evening, Peevey was on board a luxury tour bus driving through Napa Valley to reach St. Helena’s exclusive Merryvale winery, which was closed to the public that day to keep the curious away. That event lasted more than three hours and included 100 guests — a small number of lawmakers and regulators outnumbered by corporate lobbyists.

Peevey was less than happy to be ambushed by KNTV reporter Tony Kovaleski in the Merryvale parking lot at the end of the evening. Part of the exchange:

Merryvale: Closed to public scrutiny.

Kovaleski: What is the message you sent by coming here to Napa instead of going to speak to the senate?

Peevey: You are very antagonistic you know. You are reading a script.

Kovaleski: Sir, I am not reading a script. I want to give you an opportunity to respond.

Peevey: But your questions are the wrong questions.

Kovaleski: You spent time here with the utilities you are paid to regulate.

Peevey: There’s no utilities here that I know of.

Kovaleski: PG&E was here. We saw them on the list.

Peevey: Oh, there may have been one person, I don’t know. […] You poor son of a b****. You have a job to do. It’s pathetic what you are doing. It’s pathetic.

[flv]http://www.phillipdampier.com/video/KNTV San Francisco Flown Wined and Dined on Lobbyists Dimes 7-31-13.flv[/flv]

In California it’s perfectly legal, but does that make it right? KNTV in San Francisco examines the ongoing free travel CPUC president Michael Peevey has accepted from nonprofits and special interest groups. Chief Investigative Reporter Tony Kovaleski asks, are the trips simply gifts? Or are the gestures buying access to one of the most powerful people in California? This story aired on July 30, 2013. (6:58)

Although Peevey managed to withstand repeated questions about his travel habits and remained president of the commission during the tenure of current Gov. Jerry Brown, he had a lot harder time explaining away disclosed e-mails showing an even closer working relationship between himself and PG&E executives than anyone could have imagined.

65,000 Cringe-Worthy E-Mails Show Peevey as “a Micromanaging, Domineering Leader Who Appears to Have Overstepped His Role.”

A Los Angeles Times story characterized the 65,000 released emails as presenting a “damaging portrait of former PUC President Michael Peevey as a micromanaging, domineering leader who appears to have overstepped his role. Peevey involved himself personally in internal decision-making at Pacific Gas & Electric Co. — the state’s largest utility — including its corporate leadership, political public relations strategy, safety policies and rate-setting cases, affecting billions of customer dollars, documents show.”

A Los Angeles Times story characterized the 65,000 released emails as presenting a “damaging portrait of former PUC President Michael Peevey as a micromanaging, domineering leader who appears to have overstepped his role. Peevey involved himself personally in internal decision-making at Pacific Gas & Electric Co. — the state’s largest utility — including its corporate leadership, political public relations strategy, safety policies and rate-setting cases, affecting billions of customer dollars, documents show.”

San Bruno city manager Connie Jackson was more concise: “I think we need to characterize it as collusion.”

“The bottom line is that I am amazed,” said Robert McCullough, an energy industry consultant and a former longtime manager at Portland General Electric in Oregon, who has analyzed thousands of the emails. “Peevey has passed beyond” improper contacts with PG&E, McCullough told the Times, and took on a “role where he was commenting and recommending promotions at PG&E. In effect, he was acting as a member of senior management” and “had clearly redefined the role of CPUC commissioner into a freewheeling advocate for the firm.”

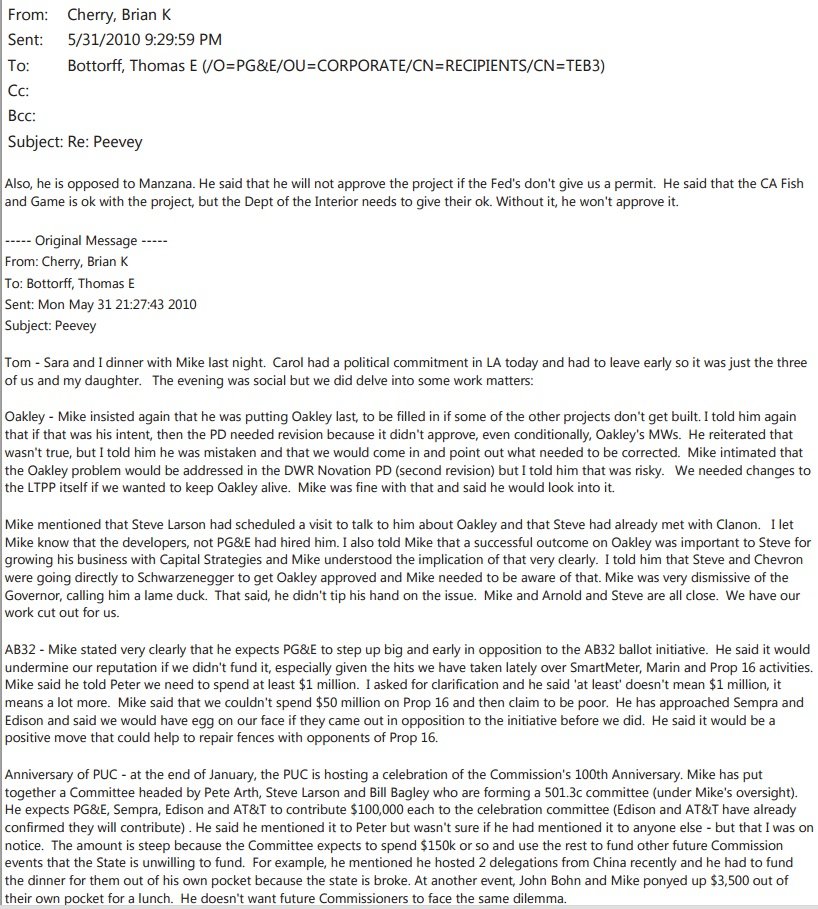

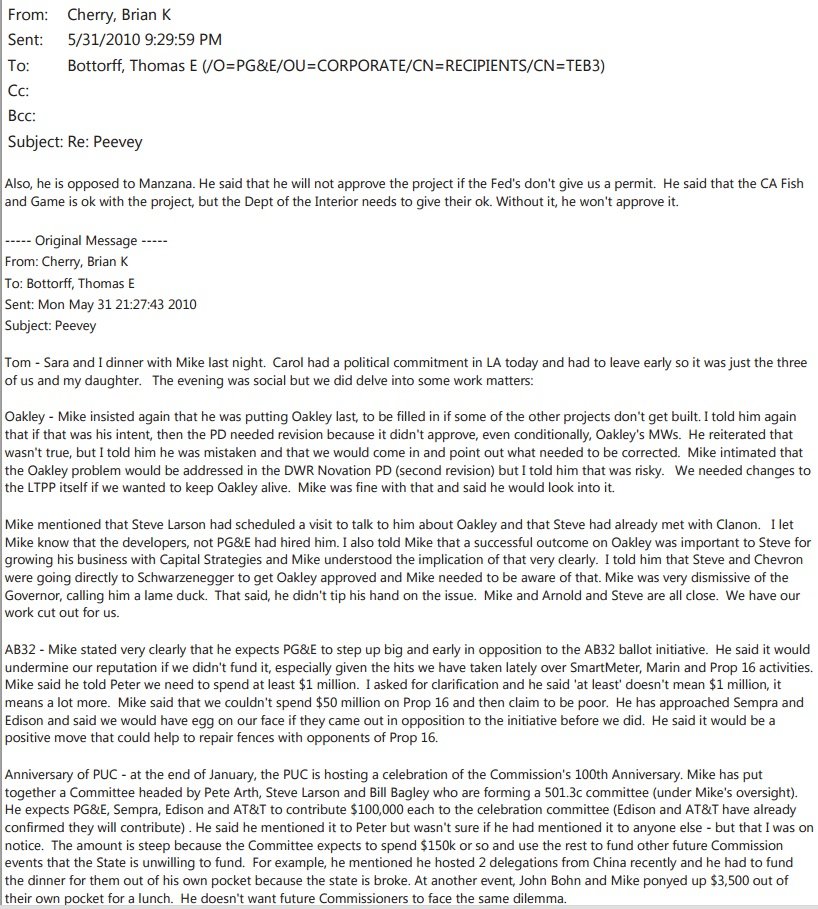

Some of the most damaging emails involve PG&E vice president Brian Cherry, his immediate boss, and Peevey. Multiple emails show more than a passing interest on Peevey’s part on the management and business policies of PG&E. In one exchange, Peevey sought to arrange a quiet meeting with him and PG&E CEO Peter Darbee at Jardiniere, a French restaurant in San Francisco. On the agenda was the effectiveness of Darbee’s leadership of PG&E. It was seven months after the San Bruno pipeline exploded and San Bruno city officials were still blistering PG&E and others over the explosion and its cause.

Peevey seemed to think he played a role in the sudden decision Darbee took to retire just a few weeks later. In a follow-up email to Cherry, Peevey took some credit for the leadership change.

“The board did the right thing (with a little nudge) this morning,” Peevey wrote. “Maybe the beginning of a new, better leaf.”

Another email concerned a list of tentative personnel promotions at PG&E. Peevey wanted and got a copy of the list and then later replied he was thankful PG&E ran the names of the candidates “by me.”

To help keep an industry-friendly CPUC intact, Peevey privately e-mailed Cherry with tactical advice about how PG&E could effectively lobby Gov. Brown about forthcoming commission appointments.

But Peevey was also willing to use his connection with Cherry to shakedown PG&E for money for his non-profit group and to fight a ballot initiative he didn’t like.

But Peevey was also willing to use his connection with Cherry to shakedown PG&E for money for his non-profit group and to fight a ballot initiative he didn’t like.

Peevey leaned on Cherry in one email to donate at least $1 million to help fight a measure that would have suspended a California law limiting greenhouse gas emissions. PG&E gave half that, but probably could have saved its money because California voters shot down the measure by themselves in November 2010.

Peevey also wanted a $100,000 contribution from PG&E to throw a 100th anniversary celebration party for the CPUC. Peevey suggested a check on his desk would go a long way as commissioners pondered a PG&E rate hike request already before the commission. After all, Edison and AT&T had already confirmed they will contribute.

Cherry understood what was expected, and wrote his boss, “I told him I got the message.” PG&E also got a table… for $20,000.

Cherry understood what was expected, and wrote his boss, “I told him I got the message.” PG&E also got a table… for $20,000.

“This is nothing less than quid pro quo deal-making with ratepayer dollars,” said Tom Long, an attorney with the The Utility Reform Network. “I honestly have never seen such smoking-gun evidence of corruption at the highest levels of the commission.”

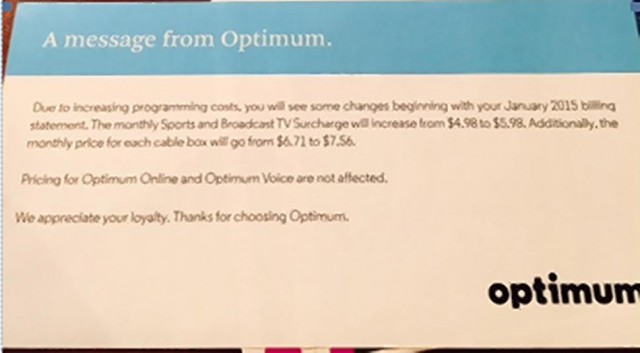

Peevey wasn’t only friendly to giant power utilities. Under his leadership, the CPUC gave AT&T wide latitude and broad deregulation over its cable television and telephone business. The commission has also granted cable system ownership transfers with a virtual rubber stamp, and customers complain the CPUC has an uncanny knack of taking the provider’s side in consumer complaints.

The revelations lead to a scathing editorial in the San Diego Union-Tribune:

Peevey’s arrogance and sense of infallibility led him to conclude that rules were for other people. He didn’t just cross the lines of propriety in his dealings with utilities; he obliterated them. No one will be surprised if state and federal investigators find more scandals in coming weeks and months. Abuse of power is likely to be habitual when powerful people think they’re above the law.

[flv]http://www.phillipdampier.com/video/KNTV San Francisco E-Mail Scandal at PSC 11-12-14.flv[/flv]

The NBC Bay Area Investigative Unit has discovered that CPUC president Michael Peevey failed to file the state-required disclosure form detailing successful requests for money from PG&E. KNTV takes a look at the e-mails exchanged between Peevey and top executives at PG&E. The Fair Political Practices Commission has joined the U.S. Attorney and the California Attorney General in investigating Peevey. Chief Investigative Reporter Tony Kovaleski reports in a story that aired on November 12, 2014. (6:37)

Everyone Wants to Be a PG&E Helper

Peevey was clearly not the only point of contact PG&E had with the CPUC. Released emails show a series of messages between Cherry and Peevey’s chief of staff, Carol Brown. It quickly becomes clear Brown was looking out more for the interests of PG&E than California ratepayers.

Brown

Brown told Cherry she would help him whenever possible, and that included advice on how a top PG&E official could effectively obfuscate in a response to an open “public request for information.”

Losing complaints or giving inaccurate answers to consumer inquiries that help steer consumers away from pestering energy and telecom companies appears to be business as usual at the CPUC. An April report from the California State Auditor found the CPUC routinely misclassify almost 40 percent of complaints they receive from the public, leaving the agency ill-equipped to properly address consumer grievances.

“In 17 of the 45 complaints we selected and reviewed for accuracy, we found that the branch did not correctly categorize the complaints,” auditors found. “As a result, the branch’s complaint data do not accurately reflect the complaints it receives, and the branch is providing users with inaccurate data.”

But even more damaging was Cherry’s need for Brown’s help to choose a friendly administrative law judge for a pending PG&E rate case. Cherry got his wish and it appeared PG&E’s $1.3 billion rate case was on its way to fast approval, at least until the email exchange went public and accusations of judge shopping emerged. The case has now been reassigned.

“I’m Not Here to Answer Your Goddamn Questions. Now Shut Up — Shut Up!”

Occasionally, Peevey’s domineering temper emerged in public and in May 2014, Mike Aguirre, former San Diego City Attorney got to see it on full display.

He appeared at a hearing representing a ratepayer who was upset about a proposed settlement between utility companies and consumer advocacy groups that required ratepayers to cover $3.3 billion of the $4.7 billion bill to decommission one of the state’s nuclear plants. Like many other disputes taken before the CPUC, this one was settled in a secret meeting.

Aguierre wanted Peevey to go on record that SCE, his former employer, did not have any contact with Peevey.

“I’m not here to answer your goddamn questions. Now shut up — shut up!” yelled Peevey in response.

Despite the slow motion public relations train wreck, Gov. Brown continued to stand by Peevey. Peevey stood by business as usual.

[flv]http://www.phillipdampier.com/video/KGTV San Diego CPUC president curses out San Diego attorney Mike Aguirre 5-22-14.mp4[/flv]

KGTV in San Diego covered a May 2014 hearing that deteriorated after a San Diego attorney asked Peevey some questions about a secret meeting held between the CPUC and Peevey’s former employer that left San Diego ratepayers holding the bag — paying the bulk of the costs to decommission one of the state’s nuclear power plants. Peevey let loose. (2:23)

The CPUC’s Non-Neutral Net Neutrality Hearings

Peevey stares down Commissioner Carla Peterman

In the telecom sector, the most visible evidence that backroom dealings were underway at the CPUC occurred during the debate on Net Neutrality. The most awkward moment for the CPUC was at a September 11, 2014 meeting dominated by discussions about the open Internet.

The very sparsely attended public meeting ran several hours before the CPUC finally decided to vote on a resolution urging the FCC to adopt strong Net Neutrality regulations and impose Title II reclassification of broadband as a common carrier public utility.

The uneventful vote began with “Yes” votes from Commissioners Carla Peterman, Mike Florio, and Catherine Sandoval. Peevey and Commissioner Michael Picker both voted “No” and it would seem to the half-dazed audience soaking in an afternoon of arcane procedural matters that there was a clear 3-2 vote in favor of strong Net Neutrality.

But then something curious happened. Peevey declared, “That’s what’s adopted. All the other pieces go with that. There is no need for any other vote on any other matters.” It all seemed jovial enough until Peevey leaned to his right and stared down Peterman, adding, “unless anyone wants to reconsider their vote… rather quickly.”

Peterman seemed to think the chairman was joking and quickly declared, “No,” suggesting she was completely satisfied with her vote and the meeting plodded on.

[flv]http://www.phillipdampier.com/video/CPUC Net Neutrality Hearing Vote 9-11-14.flv[/flv]

The CPUC seemed to be holding a routine vote on a resolution supporting strong Net Neutrality, including reclassification of broadband as a telecommunications service under Title II. But moments after the 9/11/14 vote, Peevey seemed to jovially stare down a commissioner who appeared to vote in a way he didn’t approve or expect. (2:32)

At the end of the agenda, just when the audience was certain the meeting was coming to an end, Peevey suddenly called for a five-minute “rest break.” Observers suggested that was odd because with no more business before the commission, calling the proceeding to a close seemed like a more logical idea. The five-minute break stretched into 10, 15, and eventually more than 20 minutes. As Peevey reconvened the meeting, he immediately prompted Peterman to her microphone.

Peterman

“I want to ask Carla, commissioner Peterman, to say something here,” Peevey said.

For several minutes, Peterman verbally stumbled her way trying to backtrack her earlier strong support for Net Neutrality, now seeking to abstain from the vote altogether. Peevey’s tenor suggested he well understood Peterman’s intentions in advance and helped shepherd a new vote past the commission’s legal advisers.

Peterman seemed to suggest that because the commission was closely divided on the matter, more time should be taken to develop a statement of unanimity that all five commissioners could agree on. But the end effect of a 2-2 vote with one abstention would leave a final statement advocating Net Neutrality under Title II in the gutter.

Peterman, Peevey, and the commission’s legal advisers tried to navigate through the confusing vote changing procedure for several minutes. Commissioner Sandoval spoke up to make sure that statements of unanimity were not a new precedent at the commission, but seemed to resign herself that it would be the case for this particular resolution.

To any observer, it seemed clear Peterman was strongly lobbied during the “five-minute break” to change her vote, perhaps by telecom lobbyists or by Peevey himself. The end effect was neutralizing the state of California’s participation in the Net Neutrality debate with a virtual abstention. Although Peevey promised to return to the matter of Net Neutality two weeks after the Sept. 11 meeting, Peterman, who initially seemed concerned about moving forward with the discussion, later asked it be postponed for an extra two weeks. On Oct. 16, it was abruptly dropped from the meeting agenda altogether.

[flv]http://www.phillipdampier.com/video/CPUC Net Neutrality Hearing Vote Change 9-11-14.flv[/flv]

After nearly three hours of the hearing had passed, watch as Peevey declares a five-minute “rest break” that stretched beyond 20 minutes. When the commission reconvened, Commissioner Peterman suddenly wanted to change her vote, neutering the resolution the commission voted to support an hour earlier in support of Net Neutrality. Despite Peterman’s claims of urgency regarding the issue of Net Neutrality, Peevey dropped the issue from the agenda a month later. (11:30)

Tracy Rosenberg, the executive director of Oakland-based Media Alliance, complained that the CPUC ignored more than 3,000 Californians that wrote comments to the CPUC about Net Neutrality.

“What’s going on here, folks?” Rosenberg asked.

“I got it,” came a terse response from Peevey, who offered no other comment.

[flv]http://www.phillipdampier.com/video/CPUC Tracy Rosenberg Media Alliance Comments on Net Neutrality 10-16-14.flv[/flv]

Tracy Rosenberg from Media Alliance rose to protest the CPUC’s sudden drop of Net Neutrality from the agenda. Peevey dismissed her remarks, saying “got it” before quickly moving on to another speaker. (2:17)

Out With the Old, In With the New, But the Same Lobbyists Are Still There

In October 2014, Peevey relieved the governor from being pushed to take action to finally get rid of him. Peevey read a brief statement announcing he was headed for retirement.

“I will not seek reappointment to the CPUC when my term expires at the end of the year,” Peevey said. “Twelve years as president is enough.”

It was more than enough for San Bruno mayor Jim Ruane who said he was “extremely happy” Peevey was leaving. “It’s a tremendous victory, not just for the City of San Bruno, but for all citizens in the State of California. Under Peevey’s leadership, the CPUC has served as a pawn of state utilities and an agency marked by collusion, dysfunction and, we learned this week, possible corruption.”

[flv]http://www.phillipdampier.com/video/KNTV San Francisco Michael Peevey Last Day at CPUC 12-18-14.flv[/flv]

He’s going. Colleagues compared Michael Peevey to President Franklin Roosevelt and the Pope in their farewell addresses to the longest-serving CPUC president in agency history. Detractors thought he could get away with anything. KNTV continues its series about the California Public Utilities Commission in a story that aired on Dec. 18, 2014. (4:20)

Today, Peevey is out of office, replaced by former commissioner-turned-president Michael Picker. But that may prove to be a distinction without much difference, according to a series of revelations published in the San Diego Union-Tribune that suggest Picker is being groomed by the same industry lobbyists that surrounded Peevey. More details about that and where the CPUC is headed next coming in the next part of our series.

The Government Accounting Office, charged with studying the issue of data caps, found plenty to be concerned about. Consumers rightfully expressed fears about price increases and confusion over data consumption issues. In short, customers hate the kind of usage-based pricing proposed by Cox. It’s a rate hike wrapped in uncertainty and an important tool to discourage consumers from cutting their cable television package.

The Government Accounting Office, charged with studying the issue of data caps, found plenty to be concerned about. Consumers rightfully expressed fears about price increases and confusion over data consumption issues. In short, customers hate the kind of usage-based pricing proposed by Cox. It’s a rate hike wrapped in uncertainty and an important tool to discourage consumers from cutting their cable television package.

Subscribe

Subscribe

The largest telecom companies in the United States, their trade associations, and Ajit Pai, one of two Republican commissioners serving at the Federal Communications Commission routinely claim America has the best broadband in the world. From the perspective of providers running to their respective banks to deposit your monthly payment, they might be right. But on virtually every other metric, the United States has some of the most expensive broadband in the world at speeds that would be a gouging embarrassment in other countries.

The largest telecom companies in the United States, their trade associations, and Ajit Pai, one of two Republican commissioners serving at the Federal Communications Commission routinely claim America has the best broadband in the world. From the perspective of providers running to their respective banks to deposit your monthly payment, they might be right. But on virtually every other metric, the United States has some of the most expensive broadband in the world at speeds that would be a gouging embarrassment in other countries.

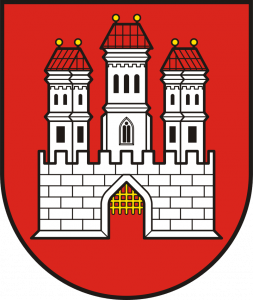

The Slovak government insisted that telecommunications networks in the country be competitive and it maintains oversight to make sure monopolies do not develop. It rejected claims that total deregulation and competition alone would spur investment. Slovakia welcomes outside investment, but also makes certain monopoly pricing power cannot develop. As a result, most residents of Bratislava have a choice of up to eight different broadband providers — a mix of cable, telephone, wireless, and satellite providers that all fiercely compete in the consumer and business markets.

The Slovak government insisted that telecommunications networks in the country be competitive and it maintains oversight to make sure monopolies do not develop. It rejected claims that total deregulation and competition alone would spur investment. Slovakia welcomes outside investment, but also makes certain monopoly pricing power cannot develop. As a result, most residents of Bratislava have a choice of up to eight different broadband providers — a mix of cable, telephone, wireless, and satellite providers that all fiercely compete in the consumer and business markets. Prices are considerably lower than what American providers charge, although speeds remain somewhat lower than broadband services in Bulgaria, Romania, and the Baltic States. At one address on Kláštorská, a street of modest single family homes (some in disrepair), these companies were ready to install service:

Prices are considerably lower than what American providers charge, although speeds remain somewhat lower than broadband services in Bulgaria, Romania, and the Baltic States. At one address on Kláštorská, a street of modest single family homes (some in disrepair), these companies were ready to install service:

Comcast customer service horror stories reached a level unparalleled by other cable companies when a Comcast

Comcast customer service horror stories reached a level unparalleled by other cable companies when a Comcast  N.Y. State Assembly Leader Joe Morelle: “The combination of Comcast and Time Warner Cable will create a world-class communications, media and technology company to help meet the increasing consumer demand for advanced digital services on multiple devices in homes, workplaces and on-the-go.”

N.Y. State Assembly Leader Joe Morelle: “The combination of Comcast and Time Warner Cable will create a world-class communications, media and technology company to help meet the increasing consumer demand for advanced digital services on multiple devices in homes, workplaces and on-the-go.” David Cohen, executive vice-president, Comcast: “The combination of Comcast and TWC will create a world-class communications, media, and technology company to help meet the insatiable consumer demand for advanced digital services on multiple devices in homes, workplaces, and on-the-go.”

David Cohen, executive vice-president, Comcast: “The combination of Comcast and TWC will create a world-class communications, media, and technology company to help meet the insatiable consumer demand for advanced digital services on multiple devices in homes, workplaces, and on-the-go.”

A Los Angeles Times story

A Los Angeles Times story  But Peevey was also willing to use his connection with Cherry to shakedown PG&E for money for his non-profit group and to fight a ballot initiative he didn’t like.

But Peevey was also willing to use his connection with Cherry to shakedown PG&E for money for his non-profit group and to fight a ballot initiative he didn’t like. Cherry understood what was expected, and wrote his boss, “I told him I got the message.” PG&E also got a table… for $20,000.

Cherry understood what was expected, and wrote his boss, “I told him I got the message.” PG&E also got a table… for $20,000.