When a CEO tells customers they should just get used to data caps and stop being paranoid about them, it would not a stretch to assume the top executive of the nation’s largest cable company has no interest in hearing the views of his customers on the matter and has stopped listening.

When a CEO tells customers they should just get used to data caps and stop being paranoid about them, it would not a stretch to assume the top executive of the nation’s largest cable company has no interest in hearing the views of his customers on the matter and has stopped listening.

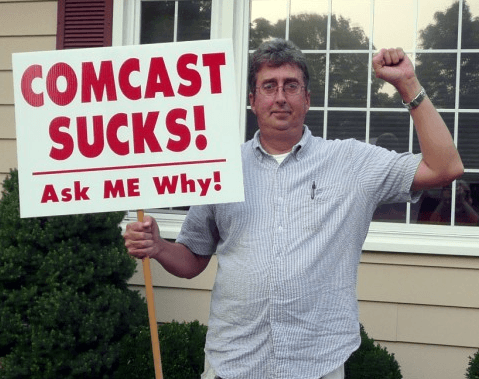

But just how many took complaints about usage-billing above the head of Comcast CEO Brian Roberts to the Federal Communications Commission has been a mystery, until today.

A website that promotes cord cutting filed a Freedom of Information Act request with the FCC that now reveals at least 13,000 (and counting) Comcast customers took time to file formal complaints with the federal regulator about what CutCableToday calls Comcast’s unethical practice of imposing data caps.

A review of the complaints shows the FCC was generous in its response, including a significant minority of complaints that had nothing to do with data caps. But among the majority that did consider data caps to be unjust, it was common to see Comcast described as an “extortionist,” a “monopoly,” and “abusive” to customers.

Roberts

“Comcast should be performing damage control, but the corporation considers itself too powerful for that,” says David Mumpower of CutCableToday. “They wouldn’t ‘win’ so many competitions as the Most Hated Company in America if they cared what customers thought. The power brokers of the cable industry believe that they can charge whatever they want for Internet access because people can’t function effectively in society without it.”

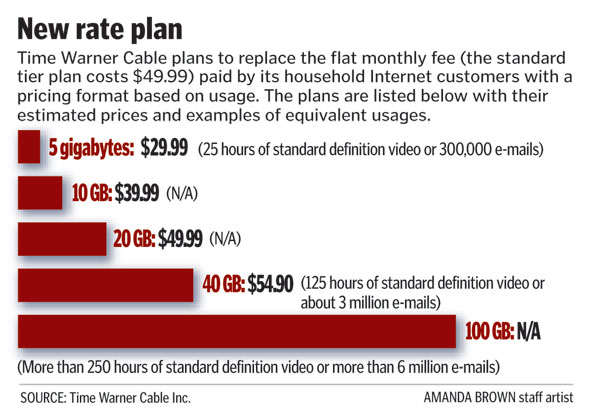

Last week, Roberts claimed only 5% (8% and rising Comcast later admitted) of Comcast customers exceed what is usually a 300GB usage allowance before paying an overlimit fee of $10 for each additional allotment of 50GB. But CutCableToday’s efforts easily turned up several bill shock horror stories from customers stuck with hefty bills after Comcast unilaterally implemented data caps as part of a seemingly-endless “trial” that has spread to a growing number of its service areas.

One Nashville customer got the shock of his life when he discovered he owed a total of $400 in overlimit fees, the same amount he typically pays for six months of Internet service from Comcast.

“Comcast just surprised me with a bill that shows that I owed $180 for over cap surcharges,” the customer wrote in his complaint. “I called the same day I got the bill, and they also let me know that I owe another $220 for over cap surcharges. (That’s right, a surprise $400).”

Despite Comcast’s claims that practically nobody would be affected by their data cap, more than ten thousand went the extra mile, learned how to file a complaint with the FCC, and followed through, further eroding Comcast’s already poor reputation.

A customer in Plantation, Fla., which became subject to Comcast’s data capping this fall, called it like he saw it:

“I object to this new policy of forcing customers to pay more for exceeding pre-established data caps by this greedy corporation. The caps will be exceeded even by moderate users of the Internet due to forced video ads on pretty much every single web page that one loads into a browser. This is not right. These cable companies are already charging us too much for Internet service. Now Comcast wants to charge us a $30 av month fee to prevent them from charging us even more fees. This is a rip off. The government needs to do something to stop this practice of capping. If they are going to meter our internet usage like an electric power company then we should be charged only for data that we call up. This means a ban on all forced Internet advertising. PLEASE do something. We have no one to protect us!”

The volume of complaints has been so great, CutCableToday notified the FCC it would consider its FOIA request adequately fulfilled after nearly 2,000 complaints were initially made available in response. The group put those 1,929 complaints together into four huge PDF files you can download and review yourself:

The volume of complaints has been so great, CutCableToday notified the FCC it would consider its FOIA request adequately fulfilled after nearly 2,000 complaints were initially made available in response. The group put those 1,929 complaints together into four huge PDF files you can download and review yourself:

- Comcast Data Cap Complaints Part 1

- Comcast Data Cap Complaints Part 2

- Comcast Data Cap Complaints Part 3

- Comcast Data Cap Complaints Part 4

Despite the volume of complaints, Roberts has continued to reassure investors that customers are “neutral to slightly positive” about Comcast’s data caps, a claim that might run afoul of Securities and Exchange Commission rules requiring frank admissions about company practices that could affect shareholders’ investments in company stock.

Roberts’ claims could lack credibility as the company has offered no verifiable evidence that customers are even slightly positive about having their Internet usage put on an allowance.

Based on the FCC’s bulging file of complaints, it is more likely most customers either don’t know or understand Comcast’s data caps and as one Knoxville customer who did know described it: It is more of “their f***-you level of customer service.”

“The data caps that Comcast is putting into place are going to end up making people choose between enriching their lives and learning more, and paying more money to a local monopoly,” the customer added.

“This corporate arrogance – some would say malfeasance – has driven many broadband users to the breaking point,” writes Mumpower. “At best, the choices for Internet service are oligopoly sized; at worst, a monopoly exists. How can customers expect their viable complaints to be taken seriously if they have no leverage? That’s why it’s imperative that you file a complaint to make your voice heard.”

Subscribe

Subscribe Frontier Communications had to be chased by West Virginia Attorney General Patrick Morrisey to improve broadband speeds for at least 28,000 DSL customers who thought they were buying 6Mbps DSL service but ended up with maximum speeds of 1.5Mbps or less.

Frontier Communications had to be chased by West Virginia Attorney General Patrick Morrisey to improve broadband speeds for at least 28,000 DSL customers who thought they were buying 6Mbps DSL service but ended up with maximum speeds of 1.5Mbps or less.

Judge Hoke rejected Frontier’s arguments, finding the phone company “buried” the arbitration clause in fine print on its website and on the last pages of customer billing inserts. Hoke also ruled Frontier was attempting to retroactively apply its arbitration clause years after customers initially signed up for broadband service.

Judge Hoke rejected Frontier’s arguments, finding the phone company “buried” the arbitration clause in fine print on its website and on the last pages of customer billing inserts. Hoke also ruled Frontier was attempting to retroactively apply its arbitration clause years after customers initially signed up for broadband service. Judge Hoke also took a dim view of Frontier’s style of disclosing changes to its terms and conditions.

Judge Hoke also took a dim view of Frontier’s style of disclosing changes to its terms and conditions.

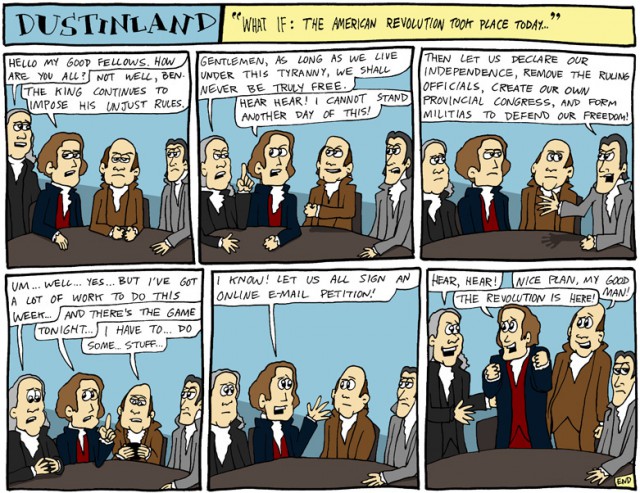

If you are living with a Comcast data cap and want to see it gone, you can do something about it. Consider organizing your own local movement by tapping fellow angry customers and recruiting local activist groups to the cause. In Rochester, there was no shortage of angry college students and groups ready to protest. Google local progressive political groups, technology clubs, and technology-dependent organizations in your immediate area. Some are likely to be a good resource for building effective public protests, sign-making, and other TV-friendly protest techniques. Contact town governments, the mayor’s office of your city, technology-oriented newspaper columnists, radio talk show/computer support show hosts, etc., to build a mailing list for coordinated announcements about your efforts. Many local officials also oppose data caps.

If you are living with a Comcast data cap and want to see it gone, you can do something about it. Consider organizing your own local movement by tapping fellow angry customers and recruiting local activist groups to the cause. In Rochester, there was no shortage of angry college students and groups ready to protest. Google local progressive political groups, technology clubs, and technology-dependent organizations in your immediate area. Some are likely to be a good resource for building effective public protests, sign-making, and other TV-friendly protest techniques. Contact town governments, the mayor’s office of your city, technology-oriented newspaper columnists, radio talk show/computer support show hosts, etc., to build a mailing list for coordinated announcements about your efforts. Many local officials also oppose data caps. The Communications Workers of America today

The Communications Workers of America today  Many of Altice’s claims appeared “disingenuous and misleading” to the CWA. From the CWA’s filing:

Many of Altice’s claims appeared “disingenuous and misleading” to the CWA. From the CWA’s filing: Translation: Cablevision alone is responsible for the debt Altice raised to pay for Cablevision. Or, as Altice explained to investors in its third quarter 2015 earnings report, the parent company operates its various subsidiaries as “distinct credit silos in Europe and the U.S.”

Translation: Cablevision alone is responsible for the debt Altice raised to pay for Cablevision. Or, as Altice explained to investors in its third quarter 2015 earnings report, the parent company operates its various subsidiaries as “distinct credit silos in Europe and the U.S.”

Despite denials Verizon Communications was interested in selling off more of its wireline network to companies like Frontier Communications, the company’s chief financial officer reminded investors Verizon is willing to sell just about anything if it will return value to its shareholders.

Despite denials Verizon Communications was interested in selling off more of its wireline network to companies like Frontier Communications, the company’s chief financial officer reminded investors Verizon is willing to sell just about anything if it will return value to its shareholders.

The communities:

The communities: