AT&T made a fortune spying on average Americans and sold what they learned to law enforcement agencies who only needed a paid account to access the data, not a subpoena signed by a judge.

AT&T made a fortune spying on average Americans and sold what they learned to law enforcement agencies who only needed a paid account to access the data, not a subpoena signed by a judge.

The newest revelations of AT&T’s Project Atmosphere by the Daily Beast sucked the oxygen out of the room from collective gasps of those learning the enormity of private information AT&T is selling to any government agency willing to pay. The first news story about the program came in a 2013 New York Times report. But new evidence suggests AT&T’s project may represent the most extensive private surveillance program ever uncovered.

“The for-profit spying program that these documents detail is more terrifying than the illegal NSA surveillance programs that Edward Snowden exposed… If companies are allowed to operate in this manner without repercussions, our democracy has no future,” Evan Greer, campaign director at Fight for the Future, told Newsweek.

AT&T stores details for every call, text message, Skype chat, or any other form of communication that passes through its infrastructure, and has kept that data as far back as 1987, according to the Times 2013 Hemisphere report. The scope and length of the collection has accumulated trillions of records and is believed to be larger than any phone record database collected by the NSA under the Patriot Act.

AT&T’s Hemisphere program operates in the shadows and does not require compliance with the kinds of federal privacy laws and constitutional protections required to be honored by the nation’s law enforcement agencies. AT&T’s database allows anyone with a procedural administrative warrant (no judge’s signature required) to search through trillions of call records and obtain precise cellular location data to discover where a person is located, who he speaks to, and often why.

A suspect claiming to be in one location at the time of a crime can be challenged when AT&T’s data reveals a subject’s cell phone was actually located somewhere else. If a prosecutor wants to know who a suspect has called for the last five years, he can order a report from AT&T showing every call, every number dialed, how long the call lasted, and details about the person called (and who they, in turn, called).

Privacy advocates call the revelations “chilling” and claim AT&T goes well beyond the kind of surveillance practiced by federal government agencies revealed by Edward Snowden.

AT&T customers have it worst, because the company has direct access to any type of communication made over AT&T’s network. But customers of other telecommunications companies are also affected because communications regularly travel over networks owned and operated by AT&T. The spying program involves cell phone lines, landlines, and internet connections.

The secretive project also turns out to be extremely profitable for AT&T.

Spying is profitable.

“AT&T customers are outraged but this affects everyone,” Greer told Newsweek. “AT&T went far beyond complying with legal government requests and actually built a powerful data mining product to sell our private information to as many government agencies and police departments as they could.”

Taxpayers cover almost all the costs because AT&T Hemisphere clients are government agencies. Small rural police departments pay at least $100,000 for access to AT&T’s data, but significant-sized suburbs and cities can pay AT&T well into the millions.

The 2013 Times report mischaracterized AT&T’s effort as a “partnership” between AT&T and the U.S. government. The Obama Administration’s Justice Department defended AT&T’s efforts calling Hemisphere “an essential, and prudently deployed, counter-narcotics tool.”

But the Justice Department may have been smoking some of the contraband they seized when they made that claim, because this week’s revelations show the program was used for far more than fighting the War on Drugs. Law enforcement agencies have accessed AT&T’s database as part of investigations of everything from Medicaid fraud to homicide.

AT&T’s pay-per-spy program was developed independent of law enforcement agencies and was designed, packaged, and marketed to make AT&T a fortune from American taxpayers. It has raked in millions of dollars annually, according to the Daily Beast.

No pesky warrants are required, only a solemn promise to keep Hemisphere a secret if an investigation that uses the data ever becomes public. AT&T specifically engineered an “end run” that may ultimately prove illegal because law enforcement agencies may have created phony or misleading evidence to cover up for AT&T:

“The Government agency agrees not to use the data as evidence in any judicial or administrative proceedings unless there is no other available and admissible probative evidence,” it says.

But those charged with a crime are entitled to know the evidence against them come trial. Adam Schwartz, staff attorney for activist group Electronic Frontier Foundation, said that means AT&T may leave investigators no choice but to construct a false investigative narrative to hide how they use Hemisphere if they plan to prosecute anyone.

Once AT&T provides a lead through Hemisphere, then investigators use routine police work, like getting a court order for a wiretap or following a suspect around, to provide the same evidence for the purpose of prosecution. This is known as “parallel construction.”

“This document here is striking,” Schwartz told The Daily Beast. “I’ve seen documents produced by the government regarding Hemisphere, but this is the first time I’ve seen an AT&T document which requires parallel construction in a service to government. It’s very troubling and not the way law enforcement should work in this country.”

The federal government reimburses municipalities for the expense of Hemisphere through the same grant program that is blamed for police militarization by paying for military gear like Bearcat vehicles.

“At a minimum there is a very serious question whether they should be doing it without a warrant. A benefit to the parallel construction is they never have to face that crucible. Then the judge, the defendant, the general public, the media, and elected officials never know that AT&T and police across America funded by the White House are using the world’s largest metadata database to surveil people,” Schwartz said.

AT&T isn’t feeling threatened by this week’s revelations or their implications, releasing a lukewarm statement implying Hemisphere is just a way for AT&T to efficiently respond to law enforcement subpoenas:

“Like other communications companies, if a government agency seeks customer call records through a subpoena, court order or other mandatory legal process, we are required by law to provide this non-content information, such as the phone numbers and the date and time of calls.”

AT&T is being misleading, according to ACLU technology policy analyst Christopher Soghoian.

“They say they only cooperate with law enforcement as required, and frankly, that’s offensive when they are mining the data of millions of innocent people, and really built a business and services around the needs of law enforcement,” Soghoian told the Daily Beast.

Subscribe

Subscribe

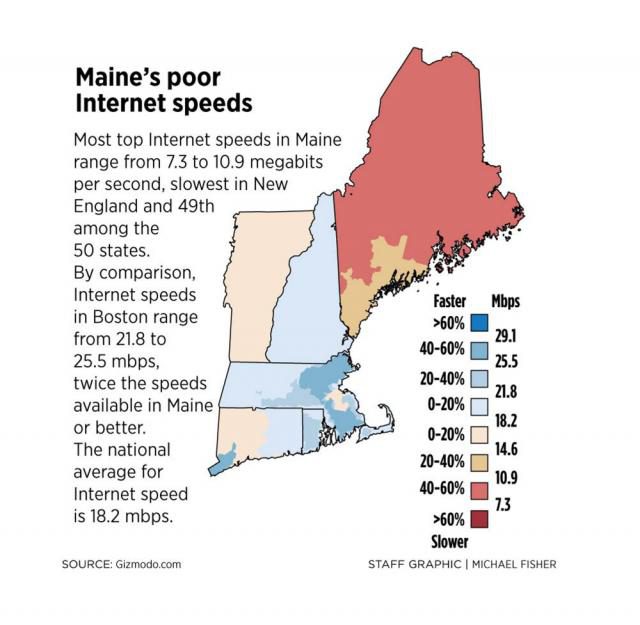

But despite Webpass’ claim its performance is comparable to fiber, its inability to guarantee customers a certain speed level and its tremendous performance variability from 100 to 1,000Mbps exposes one of the weaknesses of fixed wireless networks. At a time when capacity is king, only fiber optic networks have shown a consistent ability to deliver synchronous broadband speeds that do not suffer the variability of shared networks, poor antenna placement/signal levels, or harmful interference.

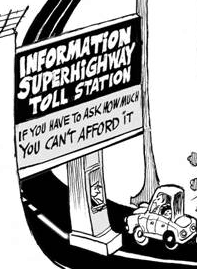

But despite Webpass’ claim its performance is comparable to fiber, its inability to guarantee customers a certain speed level and its tremendous performance variability from 100 to 1,000Mbps exposes one of the weaknesses of fixed wireless networks. At a time when capacity is king, only fiber optic networks have shown a consistent ability to deliver synchronous broadband speeds that do not suffer the variability of shared networks, poor antenna placement/signal levels, or harmful interference. At Stop the Cap!, we believe these developments further the argument broadband is an essential utility best administered for the public good and not solely as a profit-motivated venture. The path to fiber to the home service in rural, suburban, and urban communities has and will continue to come from a mix of private and public utilities, just as local public and private gas and electric companies have served this country for the last century. Where there is a business model for fiber to the home service that investors support, there is a for-profit fiber provider. Where there isn’t, now there is often no service at all. So far, the FCC in conjunction with Congress has seen fit to solve broadband availability problems by bribing private providers into offering service (usually low-speed DSL that does not even meet the FCC’s definition of broadband) with cash subsidies, tax write-offs, or occasional tax abatement schemes. Imagine if we followed that model with the nation’s public roads and highways. We would today be paying tolls or a subscription to travel down roads built and owned by a private company often financed by tax dollars.

At Stop the Cap!, we believe these developments further the argument broadband is an essential utility best administered for the public good and not solely as a profit-motivated venture. The path to fiber to the home service in rural, suburban, and urban communities has and will continue to come from a mix of private and public utilities, just as local public and private gas and electric companies have served this country for the last century. Where there is a business model for fiber to the home service that investors support, there is a for-profit fiber provider. Where there isn’t, now there is often no service at all. So far, the FCC in conjunction with Congress has seen fit to solve broadband availability problems by bribing private providers into offering service (usually low-speed DSL that does not even meet the FCC’s definition of broadband) with cash subsidies, tax write-offs, or occasional tax abatement schemes. Imagine if we followed that model with the nation’s public roads and highways. We would today be paying tolls or a subscription to travel down roads built and owned by a private company often financed by tax dollars.

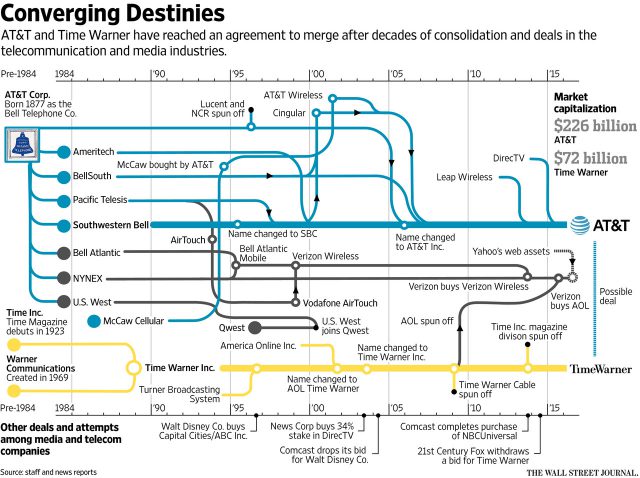

It was a busy weekend for AT&T’s Randall Stephenson and Time Warner (Entertainment)’s Jeff Bewkes, culminating in an announcement from AT&T it was acquiring Time Warner

It was a busy weekend for AT&T’s Randall Stephenson and Time Warner (Entertainment)’s Jeff Bewkes, culminating in an announcement from AT&T it was acquiring Time Warner

Several Arizona residents have reported receiving e-mail allegedly from Cox Communications requiring customers to update or upgrade their account, but in reality, the e-mail comes from a group of fraudsters trying to commit identity theft. The Pima County Sheriff’s Office has sent an open warning alerting cable customers in Arizona and beyond that if you receive an e-mail claiming you need to update or upgrade your account, disregard it, especially if it carries a deadline that warns your service will be disconnected if you don’t respond within a matter of days.

Several Arizona residents have reported receiving e-mail allegedly from Cox Communications requiring customers to update or upgrade their account, but in reality, the e-mail comes from a group of fraudsters trying to commit identity theft. The Pima County Sheriff’s Office has sent an open warning alerting cable customers in Arizona and beyond that if you receive an e-mail claiming you need to update or upgrade your account, disregard it, especially if it carries a deadline that warns your service will be disconnected if you don’t respond within a matter of days.