Waiting for Comcast and Verizon to offer cutting edge broadband to 620,000 Baltimore city residents and businesses appears to be going nowhere, so the city is hiring an Internet consultant to consider whether to sell access to its existing fiber network.

Waiting for Comcast and Verizon to offer cutting edge broadband to 620,000 Baltimore city residents and businesses appears to be going nowhere, so the city is hiring an Internet consultant to consider whether to sell access to its existing fiber network.

Baltimore officials spent at least a year trying to convince Google to launch its fiber network in the city only to be bypassed in favor of Kansas City, Austin, and Provo, Utah. Local unions and community groups have also attempted to embarrass the local phone company by publicly protesting Verizon’s lack of interest in expanding its fiber optic network FiOS in Baltimore. Comcast has proved a disappointment for many, with the latest technology going to other cities well before Baltimore gets improved service.

Baltimore’s Board of Estimates voted to spend $157,000 to hire Magellan Advisors to produce a cost-benefit analysis of expanding the city’s current fiber infrastructure to deliver better Internet access.

“I’m paying more here for lesser service, so I think one of the things we want to try to do is look at that, look at what [current companies] offer and try to incentivize people to offer more,” Baltimore’s chief information officer Chris Tonjes told the Baltimore Business Journal. “In the short term, we’re going to do a study. In the medium run, we’re going to try to renegotiate the cable franchise agreement. In the longer run we want to make it more profitable for providers to come in here and offer the expanded service.”

Like many cities, Baltimore already owns and operates its own fiber ring, built with public funds to support the city’s public safety radio system. Like many municipal institutional fiber networks, Baltimore’s fiber ring is underutilized. Public safety and other institutional users often use just a fraction of available capacity. Despite the fact such networks are often oversized, they are rarely controversial because they do not typically compete with commercial providers and are usually off-limits to the public.

Like many cities, Baltimore already owns and operates its own fiber ring, built with public funds to support the city’s public safety radio system. Like many municipal institutional fiber networks, Baltimore’s fiber ring is underutilized. Public safety and other institutional users often use just a fraction of available capacity. Despite the fact such networks are often oversized, they are rarely controversial because they do not typically compete with commercial providers and are usually off-limits to the public.

As Baltimore prepares to update their existing fiber infrastructure, Magellan will study the implications of leasing excess capacity to third-party providers that can sell broadband access to private businesses and individuals. Even Comcast and Verizon would be welcome to lease capacity.

Neither company has shown much interest, and the proposal received a strong rebuke from Maryland Sen. Catherine Pugh (D-Baltimore City):

Pugh

For the most part, municipally-built broadband networks have the economic chips stacked against them and, where tried, have saddled local taxpayers with a mountain of debt and half-built networks that are then sold at fire-sale prices to vulture investors. Taxpayers in Provo, Utah, for instance, spent $40 million to build a relatively small and modest network only to sell it for $1 a few years later because they underestimated the massive costs of operating, upgrading and maintaining it.

But Provo is just the latest exhibit in a long pantheon of such failed initiatives that include Groton, Conn., ($38 million taxpayer loss) and Marietta, Ga., ($35 million taxpayer loss). Cities as large as Philadelphia, New York and Chicago and as small as Lompoc, Calif., and Acworth, Ga., have also tried and failed to launch their own broadband networks — or simply gave up.

Pugh’s editorial, published in both the Wall Street Journal and The Baltimore Sun, failed to disclose Pugh has received political campaign contributions from both Comcast and Verizon. More importantly, Pugh did not bother to mention she is the president-elect of the National Black Caucus of State Legislators, a group with close ties to both Comcast and Verizon Communications.

Among the “member corporations” of the NBCSL — companies who “weigh in” on the policies promoted by the group: AT&T, Comcast, CTIA – The Wireless Association, the National Cable & Telecommunications Association, Time Warner Cable, and Verizon.

Among the NBCSL’s roundtable members: AT&T, Comcast, Time Warner Cable, and Verizon

For the fourth consecutive year, Verizon hosted its Black History Month open house at the Reginald F. Lewis Museum in downtown Baltimore. This year, among Verizon’s special guests: Maryland Senator and president-elect of the National Black Caucus of State Legislators Catherine Pugh. Comcast has also opened its checkbook to the NBCSL. Among the contributions — $50,000 to form the “NBCSL/Comcast Broadband Legislative Fellowship” to “increase efforts to conduct research and develop solutions regarding broadband adoption among African Americans.”

Opening up a competitive, lower-priced broadband alternative owned by the citizens of Baltimore is not one of Pugh’s favored solutions to be sure.

The NBCSL has been more than a little preoccupied with the business agendas of its corporate members. The group’s glowing endorsement of the Comcast-NBCUniversal merger was so positive, Comcast continues to present the group’s submission urging approval of the merger on its website. In 2011, the NBCSL signed on to the campaign to get government approval of the now-dead merger of AT&T and T-Mobile USA, claiming it was in the best interests of African-Americans. Just this month, Time Warner Cable quoted the group’s comments on the dispute between the cable company and CBS on its website.

Stop the Cap! has refuted claims that public broadband is a financial failure in the past. Read our fact check here.

Although Comcast has been the dominant cable provider in Baltimore for years, its monopoly status is “de facto” only, because federal law prohibits exclusive cable franchise agreements. That being said, no other well-known cable provider will agree to offer service in competition with another. Overbuilders — small private entities that have business plans that depend on competing with incumbent operators, are few and far between. For most Americans, the only cable competition comes from satellite providers or the phone company. Satellite television lacks a broadband option and Verizon’s local broadband infrastructure is limited to providing DSL service.

Tonjes

Tonjes hopes the possibility of a public broadband alternative might shake up the city’s broadband landscape, but not every neighborhood is now passed by the city’s fiber ring.

Jason Hardebeck, the executive director of the Greater Baltimore Technology Council, told the Journal municipal Wi-Fi could help fill the gap.

“One of the things we’ve talked about at the GBTC is, could this form the basis of a municipal Wi-Fi network in bringing wireless access to some underserved parts of the city,” Hardebeck said. But, he added, “municipal wireless is not a slam dunk. There’s a lot of challenges depending on how deep the coverage area is.”

Pugh is presumably opposed to municipal Wi-Fi solutions for the poorest urban African-American neighborhoods in her city as well, having criticized efforts to bring municipal wireless Internet access to similar neighborhoods in Philadelphia, where Comcast’s corporate headquarters are located.

“The city is woefully underserved with broadband and my opinion is that internet access is becoming a basic public utility or need, just like clean water,” Hardebeck told the Journal. “The current administration understands the need. I don’t know what we can do about the franchise agreement, but I think there’s real opportunities from a redevelopment standpoint. If you had access to ultra-high broadband inexpensively, that could generate activity you would not have anticipated.”

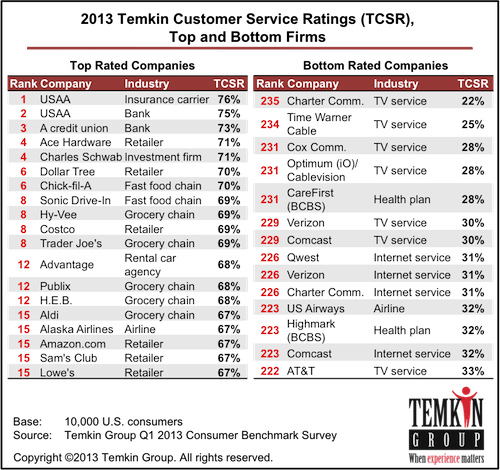

Nine of the ten lowest ranked firms in America are cable and telephone companies, according to a new report from research firm Temkin Group.

Nine of the ten lowest ranked firms in America are cable and telephone companies, according to a new report from research firm Temkin Group.

Subscribe

Subscribe Waiting for Comcast and Verizon to offer cutting edge broadband to 620,000 Baltimore city residents and businesses appears to be going nowhere, so the city is hiring an Internet consultant to consider whether to sell access to its existing fiber network.

Waiting for Comcast and Verizon to offer cutting edge broadband to 620,000 Baltimore city residents and businesses appears to be going nowhere, so the city is hiring an Internet consultant to consider whether to sell access to its existing fiber network. Like many cities, Baltimore already owns and operates its own fiber ring, built with public funds to support the city’s public safety radio system. Like many municipal institutional fiber networks, Baltimore’s fiber ring is underutilized. Public safety and other institutional users often use just a fraction of available capacity. Despite the fact such networks are often oversized, they are rarely controversial because they do not typically compete with commercial providers and are usually off-limits to the public.

Like many cities, Baltimore already owns and operates its own fiber ring, built with public funds to support the city’s public safety radio system. Like many municipal institutional fiber networks, Baltimore’s fiber ring is underutilized. Public safety and other institutional users often use just a fraction of available capacity. Despite the fact such networks are often oversized, they are rarely controversial because they do not typically compete with commercial providers and are usually off-limits to the public.