As expected for months, Charter Communications, Inc. today formally offered Time Warner Cable shareholders $132.50 per share to assume ownership of the nation’s second largest cable operator in a deal worth more than $61 billion, including debt.

As expected for months, Charter Communications, Inc. today formally offered Time Warner Cable shareholders $132.50 per share to assume ownership of the nation’s second largest cable operator in a deal worth more than $61 billion, including debt.

Bloomberg News this afternoon reported Charter Cable has offered $83 in cash for each outstanding share of TWC stock, as well as about $49.50 in Charter stock. That makes the attempted takeover the third largest merger deal worldwide since 2009.

Rutledge

Charter CEO Thomas Rutledge, a former executive at TWC and Cablevision would lead the combined enterprise under the Charter Cable name, likely pushing out TWC’s new CEO Robert Marcus. Rutledge argues that combining Charter and TWC would bring about considerable cost savings, particularly for spiraling programming costs. Analysts say the deal would also mean a reduction in Time Warner Cable’s workforce, especially in middle management, as operations are consolidated around Charter’s leadership.

Rutledge today said he privately approached Time Warner Cable executives with an offer in late December.

“We haven’t received a serious response,” Rutledge said today in a Bloomberg News telephone interview. “Our objective was to talk to management and try to get them engaged. They have not, so we’re going to make our case to shareholders about why this deal is good for them and hope they ask management and the board to watch out for the interests of shareholders.”

[flv]http://www.phillipdampier.com/video/CNBC Marangi on TWC Deal 1-13-14.mp4[/flv]

Chris Marangi from Gamco tells CNBC Charter Communications’ proposal to buy Time Warner Cable for $61.3 billion is probably too low, but the cable industry is “ripe for consolidation” and further mergers are likely. (1:39)

Time Warner Cable’s chief financial officer Artie Minson reportedly requested Charter make a higher bid that included more cash, but Charter refused.

Malone

The man pulling the levers behind Charter’s curtain is Dr. John Malone, former CEO of Tele-Communications, Inc., which was America’s largest cable operator in the late 1980s and 1990s. Malone’s Liberty Media is Charter Communications’ largest single investor. Malone has long argued for consolidation and cooperation in the cable industry to boost profits and control programming costs that drive up cable television bills.

Malone specializes in structured mergers and acquisitions that result in tax-free buyouts. Charter’s offer relies heavily on debt financing and would allow Charter to shield its ongoing net operating losses from taxes.

Malone indicated he is willing to play hardball to force a merger.

Malone told investors he expected Time Warner Cable to resist a takeover by Charter — America’s fourth largest cable company — so he is prepared to nominate Charter-friendly directors for Time Warner Cable’s board before nominations close Feb. 15. Time Warner Cable shareholders could force the merger by voting for Malone’s handpicked directors, who would promptly approve Charter’s takeover offer. But Time Warner executives will likely argue Charter’s offer is disadvantageous for TWC shareholders.

“Since we made our first proposal, Time Warner Cable has lost another half million video customers,” Rutledge said. “Their customer service continues to decline in every measure. We can improve it. We have a demonstrated track record of improving customer service. It’s a question of credibility.”

“Since we made our first proposal, Time Warner Cable has lost another half million video customers,” Rutledge said. “Their customer service continues to decline in every measure. We can improve it. We have a demonstrated track record of improving customer service. It’s a question of credibility.”

Consumer Reports reports otherwise. Charter Communications has perennially been ranked America’s second worst Internet Service Provider cable operator in annual reader surveys. Only Mediacom is ranked lower among cable operators.

Now that Charter’s offer has gone public, investors suspect other cable operators may soon consider bidding for Time Warner Cable as well. Comcast is a likely bidder with an interest is taking control of Time Warner Cable’s systems in New York City and certain midwestern markets. Comcast would also like TWC’s regional sports channels serving southern California.

Customers will have no say in the matter, except through appeals to federal regulators which must approve any sale.

Unlike TWC, Charter Cable has usage limits on their broadband service.

[flv]http://www.phillipdampier.com/video/CNBC CNBC David Faber on TWC Deal 1-13-14.mp4[/flv]

CNBC’s David Faber reports today’s offer from Charter Communications is not technically a “bid” for Time Warner Cable. Instead, it’s a public offer to hopefully force TWC executives to take Charter’s offer more seriously. (3:25)

Comcast Corporation and Charter Communications are actively working on a deal to let Comcast acquire Time Warner Cable subscribers in New York, New England, and North Carolina, according to sources reporting to CNBC.

Comcast Corporation and Charter Communications are actively working on a deal to let Comcast acquire Time Warner Cable subscribers in New York, New England, and North Carolina, according to sources reporting to CNBC. Comcast’s involvement in the deal could inject much-needed cash into a takeover bid financed largely by debt. It might also prompt Charter to sweeten its offer for TWC.

Comcast’s involvement in the deal could inject much-needed cash into a takeover bid financed largely by debt. It might also prompt Charter to sweeten its offer for TWC.

Subscribe

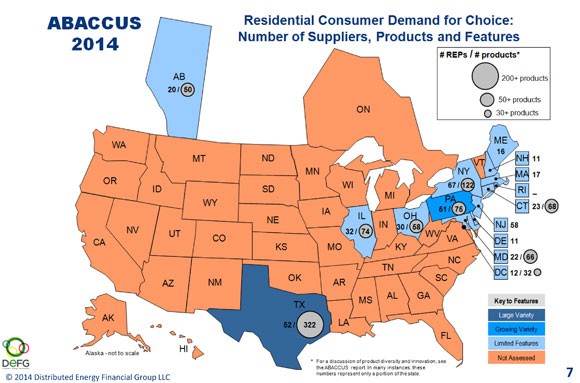

Subscribe Comcast is likely getting into the electricity business in Pennsylvania, offering customers a “quad play” bundle of Internet, telephone, television, and electricity service with discounts for one or more services.

Comcast is likely getting into the electricity business in Pennsylvania, offering customers a “quad play” bundle of Internet, telephone, television, and electricity service with discounts for one or more services.

The state of Texas is the largest deregulated power market in the country, where hundreds of suppliers compete in the retail energy market. Pennsylvania

The state of Texas is the largest deregulated power market in the country, where hundreds of suppliers compete in the retail energy market. Pennsylvania

As expected for months, Charter Communications, Inc. today formally offered Time Warner Cable shareholders $132.50 per share to assume ownership of the nation’s second largest cable operator in a deal worth more than $61 billion, including debt.

As expected for months, Charter Communications, Inc. today formally offered Time Warner Cable shareholders $132.50 per share to assume ownership of the nation’s second largest cable operator in a deal worth more than $61 billion, including debt.

“Since we made our first proposal, Time Warner Cable has lost another half million video customers,” Rutledge said. “Their customer service continues to decline in every measure. We can improve it. We have a demonstrated track record of improving customer service. It’s a question of credibility.”

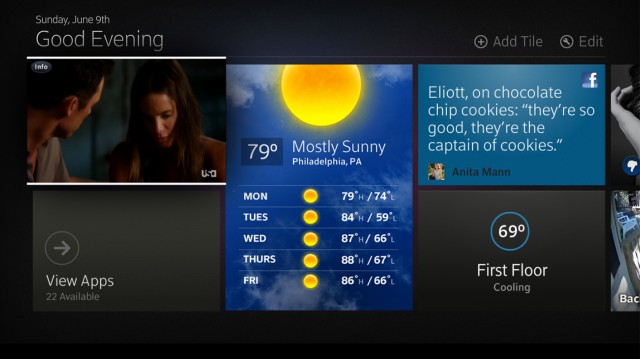

“Since we made our first proposal, Time Warner Cable has lost another half million video customers,” Rutledge said. “Their customer service continues to decline in every measure. We can improve it. We have a demonstrated track record of improving customer service. It’s a question of credibility.” Just months after starting to rollout a new generation of Comcast’s X1 “entertainment operating system” set-top boxes, the cable company is preparing to upgrade the cable television experience with X2.

Just months after starting to rollout a new generation of Comcast’s X1 “entertainment operating system” set-top boxes, the cable company is preparing to upgrade the cable television experience with X2.