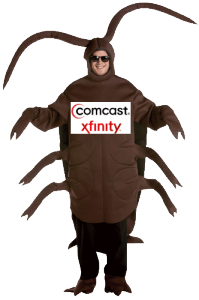

An Illinois family’s home is now infested by roaches, and the Aurora resident is blaming Comcast’s reportedly bug-infested set top box for the problem. Read up about these pest facts that are not commonly know so you’ll know how to deal with them.

An Illinois family’s home is now infested by roaches, and the Aurora resident is blaming Comcast’s reportedly bug-infested set top box for the problem. Read up about these pest facts that are not commonly know so you’ll know how to deal with them.

Antonio Muñoz recently signed up for Comcast cable service, but tells the Beacon News cockroaches began crawling out of the refurbished cable box installed in his parents’ room.

In addition to the roaches he has collected in a plastic bag to show the cable operator, the Muñoz family has now seen several of the bugs running loose around the home.

Muñoz is upset with the cable company for dragging their feet on replacing the infested equipment. He’s since sealed the box in question and dropped it off at Comcast’s local cable store. But the cable company refused to exchange it with a new box until a technician could be sent to the Muñoz home.

“Given the rigorous quality control processes we have in place, it’s difficult to say exactly what happened,” a Comcast representative said. “As our goal is to do right by our customers, our immediate focus is to resolve the issue to Mr. Muñoz’s satisfaction.”

It’s not the first time Comcast has faced allegations of roach-infested equipment, prompting more rigorous and Detailed pest removal inspections to ensure customer safety and hygiene.

More than a dozen current and former employees of a Comcast facility on Chicago’s South Side are part of a federal class-action lawsuit filed last month alleging racial discrimination and a hostile, bug-infested work environment.

The suit claims Comcast management ordered technicians to install equipment in customer homes regardless if it was defective or infested by vermin.

The plaintiffs claim Comcast facilities are plagued not only with roaches but also rats. Some supervisors are accused of telling some Comcast workers that equipment given to African American employees would be stolen, and there was little reason to provide those installers with a complete set of installer tools.

Most cable equipment is recycled and re-used as customers turn in equipment. Cable operators routinely refurbish and test equipment before it is put back into service. But cable equipment can offer an inviting home for invading insects or small rodents. Customers receiving obviously used equipment should inspect it carefully for plant debris, dead insects, or points of potential entry for unwelcome visitors before allowing the installer to leave.

The Muñoz family has since received a new box, but no word if the special visitors that arrived in the original equipment have been effectively evicted.

Subscribe

Subscribe