Frontier Communications told a federal court judge last week that the DSL service it sells across much of its service area in New York State is not remotely “high-speed broadband service” and is not fit for purpose if New York’s Affordable Internet Law takes effect next week and requires Frontier to deliver at least 25/3 Mbps service to state residents.

Frontier Communications told a federal court judge last week that the DSL service it sells across much of its service area in New York State is not remotely “high-speed broadband service” and is not fit for purpose if New York’s Affordable Internet Law takes effect next week and requires Frontier to deliver at least 25/3 Mbps service to state residents.

“Simply put, Frontier New York’s DSL-based service is not a ‘high-speed broadband service’ within the meaning of the statute, and an unreasonable interpretation thereof could be read to mandate the massive efforts and expenditures that would be required to provide the high-speed service standards set forth in the [Affordable Internet] Statute,” Frontier wrote in a filing with the court.

New York’s Affordable Internet Law, now being challenged in federal court, would require internet service providers to deliver at least 25 Mbps broadband service for $15/month to low-income state residents.

Frontier fears that if that new law takes effect, it could face mandatory investments in the tens of millions to upgrade its dilapidated copper wire network across most of its service areas in New York. Frontier told the judge it cannot provide reliable service over its copper wire facilities even at 15 Mbps, and many addresses recently added to Frontier’s internet service area are only getting service at 10 Mbps.

“Any attempt to require the consistent delivery of 25 Mbps through copper loops would require different network architecture, new equipment at Frontier New York’s central offices, new equipment in the field, and alternative methods and procedures,” Frontier complained. “Any such changes would constitute a new service rather than an upgrade to Frontier New York’s existing DSL services. The extensive time, effort and money required would require the reallocation of capital and resources that are focused on forward-looking projects rather than backward-looking technology.”

Frontier added that the state should look to other providers to deliver service that meets minimal qualifications for broadband — service it does not provide today to most of its New York customers.

“FCC data and mapping indicates that speeds equal to or exceeding 25 Mbps download and 3 Mbps upload through technologies such as cable, fiber, fixed wireless and satellite are available across the state,” Frontier wrote.

Subscribe

Subscribe

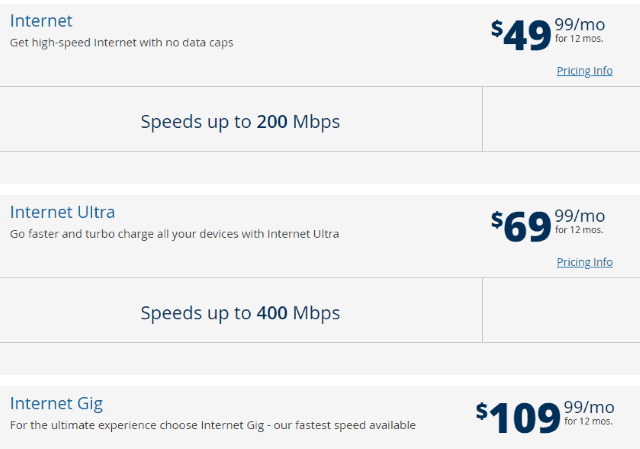

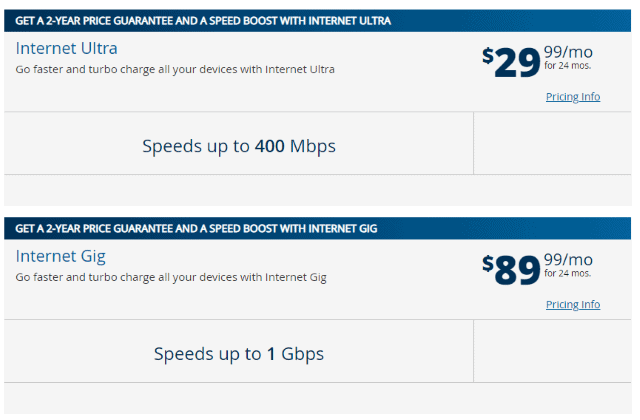

Competition is a wonderful thing. A case in point is the enormous difference Charter Spectrum charges new customers in areas where competition exists, and where it does not.

Competition is a wonderful thing. A case in point is the enormous difference Charter Spectrum charges new customers in areas where competition exists, and where it does not.

AT&T CEO John Stankey is still looking to wring costs out of the business, and the company’s rural landline customers are next to take the cut.

AT&T CEO John Stankey is still looking to wring costs out of the business, and the company’s rural landline customers are next to take the cut.