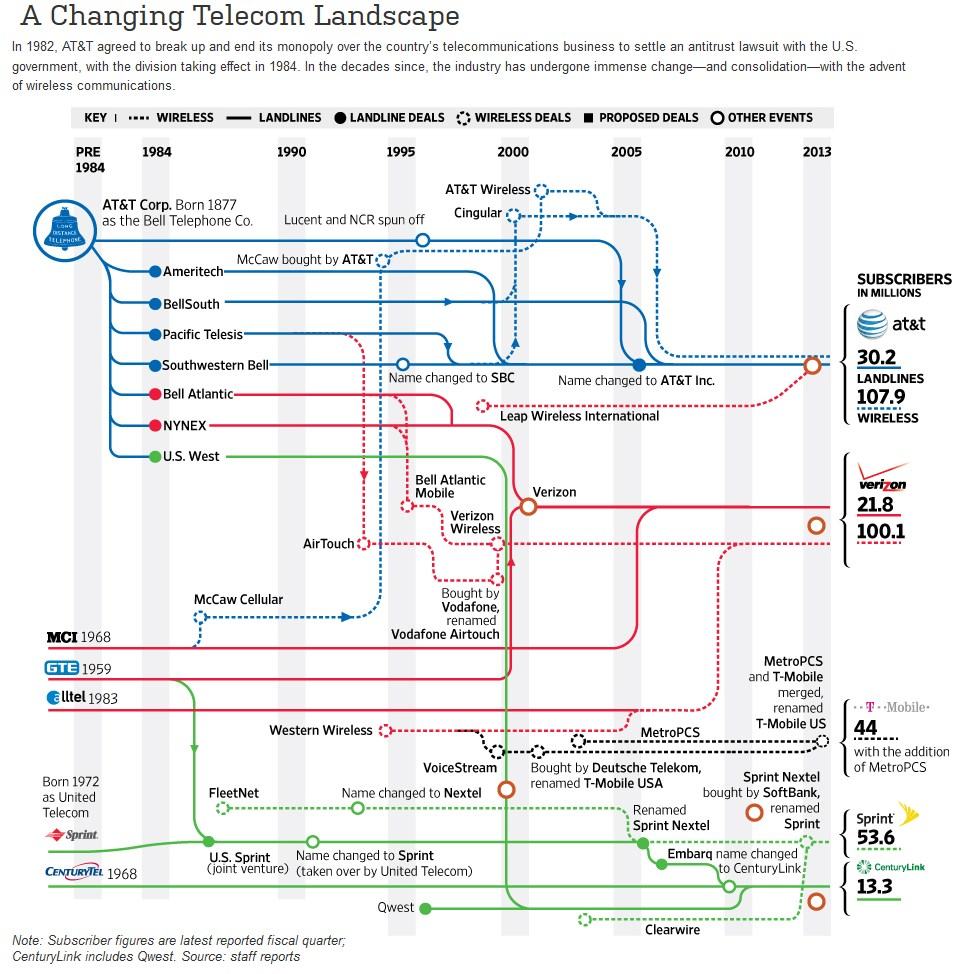

With total ownership of Verizon Wireless now assured, Verizon Communications plans to begin “tree trimming” assets in its portfolio that cannot match the profitability of its wireless business.

With total ownership of Verizon Wireless now assured, Verizon Communications plans to begin “tree trimming” assets in its portfolio that cannot match the profitability of its wireless business.

Verizon CEO Lowell McAdam told CNBC he has already communicated with Verizon’s executive team about the direction Verizon will take after it buys out Vodafone’s ownership interest in Verizon Wireless. One potential target for sale: millions of Verizon’s rural landlines that cannot hope to match the revenue an average cell phone customer delivers the company.

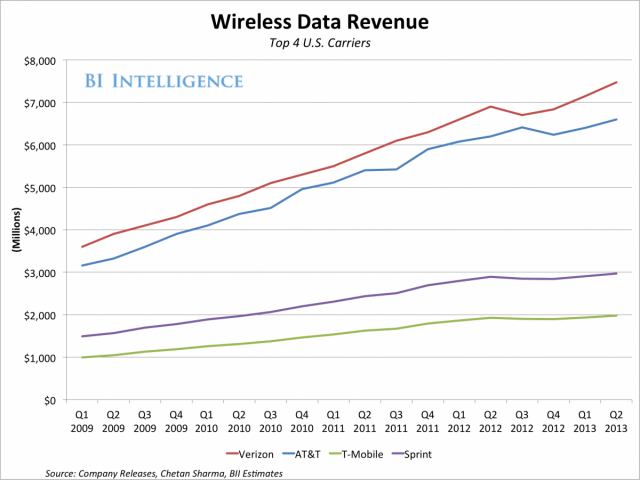

Verizon’s wireless assets now represent the company’s biggest generator of sales and profit, accounting for two-thirds of 2012 revenue and almost all of its operating income.

Where Verizon chooses to invest is largely dependent on what kind of return the company can expect. So far, the best returns have come from Verizon Wireless.

“I think there is no better way to deploy our capital then to invest in a [wireless] asset that today generates more than $80 billion in annual revenue, provides a 50% margin, generates significant cash flows and is uniquely positioned for future growth and profitability,” McAdam told investors Tuesday on a conference call announcing the purchase of Vodafone’s stake in Verizon Wireless. “Beyond the financial benefits, there is simply no better asset that fit seamlessly into our portfolio and our strategic beliefs. Our growth strategy has three basic elements: connectivity, platforms and solutions. We are very bullish on the growth outlook for the U.S. wireless marketplace.”

McAdam made it clear to CNBC’s Jim Cramer the company is not so bullish on its declining wireline business, which includes landlines, DSL, and even FiOS — the company’s fiber optic network:

Jim Cramer, CNBC: “[Under former Verizon CEO Ivan Seidenberg, Verizon] took areas that really weren’t growth areas and sold them to Frontier and other players. Would you be able to get rid of some of your underperforming landline businesses to be able to increase [Verizon’s] growth even further?”

Lowell McAdam, Verizon: “That is a possibility. […] If you talk about opportunities here, now that we have One Verizon, […] we are going to trim some limbs around the tree here. Things that aren’t performing will not be a part of our portfolio so we can invest in things that will drive the kind of growth we are excited to be able to tap here.”

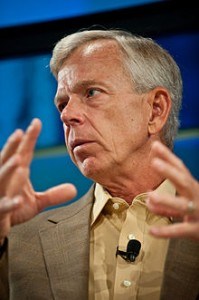

McAdam

The trimming has already started in New York and New Jersey, where Verizon is moving forward with the introduction of a less expensive wireless landline replacement called Voice Link, now optional for some customers but could eventually be Verizon’s sole landline service offering in certain areas if state regulators approve.

Verizon calls the service an improvement for customers dealing with repeated service calls to fix troublesome landlines. Upkeep of Verizon’s copper networks has proved costly to the company, especially as it continues to count landline customer losses. The company argues providing wireless phone service is pro-consumer, providing a bundle of calling features and unlimited local and long distance calling at the same price Verizon charges for basic, no frills landline service. Local officials and residents using the service complain it is inadequate and unreliable.

“Voice Link is an innovative solution for a specific segment of Verizon’s voice-only customers that delivers reliable voice service using our trusted and reliable wireless network,” said Verizon spokesman John Bonomo. “Unlike copper-based service, it is less likely to fail during an adverse weather event because of our wireless networks’ resiliency.”

Analyzing the market value of Verizon’s buyout of Vodafone’s part ownership in Verizon Wireless and accounting for net debt reveals Verizon’s wireless operations are worth $289 billion, with Verizon’s current 55 percent share worth about $159 billion. In contrast, Verizon’s wireline operations including landlines, business broadband, and FiOS are worth just a fraction of that — $24 billion, according to Bloomberg News.

Kevin Roe, an analyst at Roe Equity Research LLC in Dorset, Vt. values the wireline business at about $21 billion based on his estimates, while Spencer Kurn of New Street Research LLC puts the implied value of the unit at about $26 billion.

Verizon’s top rated fiber service FiOS has brought the company higher earnings and is deemed a success, but its total revenue remains insufficient to offset Verizon’s continued landline losses as customers drop home phone service and DSL. From a business perspective, that explains why Verizon is eager to invest billions in its high return wireless business while leaving further expansion of its fiber optic network on hold.

Revenue from the wireline unit totaled $39.8 billion last year, down from $50.3 billion in 2007, data compiled by Bloomberg show. During the same period, Verizon’s wireless revenue surged 73 percent to $75.9 billion.

“Clearly, wireless is going to be worth a lot more” than Verizon’s other businesses, Chris King, a Baltimore-based analyst at Stifel Financial Corp., told Bloomberg in a phone interview. Wireless is “where the growth is going to be coming from. There’s a bigger market opportunity going forward.”

McAdam has brought his enthusiasm for the wireless business to his role as Verizon CEO and its priority shows as he predicts even larger earnings in the future. McAdam told investors only 64 percent of Verizon Wireless customers use smartphones. Verizon wants to convert the remaining 30 million basic phone customers to higher-priced smartphone service as quickly as possible. Getting customers to switch to 4G-capable devices is also lucrative for Verizon, because its LTE network can more efficiently handle data at a lower cost. Only one-third of Verizon customers now use 4G LTE devices.

Embracing consumption based billing for wireless data is perhaps the biggest potential revenue generator of all as customers consume more data and begin connecting more devices to Verizon’s network.

Platforms including machine to machine and in-car connectivity “create even greater opportunities to drive increased usage,” McAdam said. “We also see many opportunities with Internet and cloud-based services. The digital economy is moving to mobile first on everything, which means there are many growth opportunities to pursue.”

Subscribe

Subscribe

Executives at Canada’s largest telecom companies are sighing relief after Verizon announced it was not interested in competing in Canada.

Executives at Canada’s largest telecom companies are sighing relief after Verizon announced it was not interested in competing in Canada.

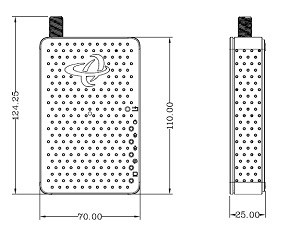

As the cable industry seeks new revenue from the adoption of growing cable modem rental fees, one vendor has

As the cable industry seeks new revenue from the adoption of growing cable modem rental fees, one vendor has

Verizon hopes being the master of its own destiny will allow the company to innovate its wireless network towards future revenue opportunities, especially in the machine to machine connectivity business. Both AT&T and Verizon Wireless are racing to enable medical devices, home appliances, electric meters, and automobiles to communicate over their respective wireless networks. Both companies are concerned that the cell phone marketplace has become saturated in the United States, with most people desiring cell phone service already having it. With Wall Street demanding ongoing growth quarter after quarter, new revenue sources are more important than ever.

Verizon hopes being the master of its own destiny will allow the company to innovate its wireless network towards future revenue opportunities, especially in the machine to machine connectivity business. Both AT&T and Verizon Wireless are racing to enable medical devices, home appliances, electric meters, and automobiles to communicate over their respective wireless networks. Both companies are concerned that the cell phone marketplace has become saturated in the United States, with most people desiring cell phone service already having it. With Wall Street demanding ongoing growth quarter after quarter, new revenue sources are more important than ever.