Phillip “Time Warner Cable ironically debunked Lyons’ advocacy of usage-based billing” Dampier

As part of the broader push to drive support for the merger between Comcast and Time Warner Cable, academics with ties to corporate-funded think tanks and the cable industry are trotting out nearly identical guest editorials appearing in newspapers around the country that attempt to educate the masses about the wonders of cable industry consolidation.

Daniel Lyons, who has written several papers supporting and endorsing the cable industry’s business agenda, is back with his helpful advice:

Consumers have more video options than ever before. Technology has eroded the lines between hardware, content and media companies. Today, Comcast’s biggest competitive threat is not other cable and satellite providers but new entertainment sources not even imaginable a decade ago. Netflix streams video online and is responsible for one-third of all Internet traffic during peak times. Apple is transforming itself from a device manufacturer into an entertainment company that delivers music, video and games instantly through a seamless customer interface. Google has expanded beyond Internet search to video services and even broadband data networks. Verizon, a traditional telephone company, recently bought the rights to stream NFL games to smartphones. Even Walmart has entered the streaming video business.

It is a challenging transaction, one that antitrust regulators should review carefully. But they should avoid rushing to judgment merely because Comcast is consolidating its position over a stagnant cable sector. Some consolidation may be necessary for cable to avoid Blockbuster’s fate and instead compete effectively in this rich, dynamic and increasingly competitive video landscape.

It is especially hard to take Mr. Lyons seriously when he claims with a straight face the cable industry is “stagnant” and on the verge of following Blockbuster into irrelevance. The only product in the cable bundle seeing flat growth is cable television. But that has not presented a difficult financial challenge because cable operators are shifting their priorities towards broadband. Just to make sure they are covered, broadband providers have raised prices and introduced equipment fees that have more than made up the difference. Despite Lyons’ prediction of doom and gloom, industry observers still find the cable business “comically profitable.”

Lyons

In fact, the cable industry now dominates the American broadband marketplace and is well positioned to deal with any competitive threat looming on the horizon. All of the competitors Lyons mentions depend on companies like Comcast and Time Warner Cable to reach customers. Cord-cutting looks much less tenable if companies like Comcast return to a regime of usage caps on their broadband accounts. Netflix, Apple, and Google cannot sustain video streaming businesses if customers fear using these services will put them over their monthly usage allowance. Sony’s forthcoming 4K video service for its video player could consume between 40-60GB per movie. Even with Comcast’s “generous” allowance of 300GB per month in its usage-capped test markets, as few as 10 movies a month will put customers over the limit, before they do anything else with their broadband connection.

Despite the threat of Internet stagnation, Lyons is a prolific writer of pro-usage cap and usage-billing studies. In at least one of those papers, he was joined by Michigan State University Professor of Information Studies Steven Wildman, also then an adviser at the Free State Foundation. Wildman was more forthcoming about where the money comes from for these studies – the National Cable and Telecommunications Association (NCTA), the largest cable industry lobbying and trade group in the United States.

Unfortunately for the Free State Foundation and the NCTA, Time Warner Cable inadvertently proved Lyons and Wildman’s theories wrong.

“Pricing experimentation may also help narrow the digital divide,” Lyons wrote. “By recovering more fixed costs from heavier users, firms may have more freedom to extend service at a lower rate to light users who are unable or unwilling to pay the unlimited flat rate. There is evidence that these opportunities are beginning to emerge from companies engaged in usage-based pricing.”

What actually emerged from Time Warner Cable’s tests of discounted usage pricing is a repudiation of Lyons’ theories. Time Warner Cable admitted its usage-based pricing options were so unpopular with customers, only a few thousand out of 11 million broadband customers signed up — hardly a ringing endorsement. Even income-challenged customers preferred unlimited Internet over a usage cap. Time Warner Cable give customers a choice between a cap or no cap. The others, including Comcast, don’t offer an unlimited option and repeatedly claim usage cap tests have met with little resistance from customers, as if they had a choice.

Short Title: Total Deregulation

Other members of Free State Foundation’s Board of Academic Advisors, including Richard A. Epstein, Justin (Gus) Hurwitz, Daniel Lyons, James B. Speta, and Christopher S. Yoo advance the cable industry agenda in other ways too.

Speta submitted an Amicus Brief: ‘In the Matter of Comcast Corporation v. FCC,’ that basically argued the Federal Communications Commission “does not have jurisdiction to address most Internet regulatory issues, because whatever expansive readings such ancillary jurisdiction has received in the past are no longer tenable.”

In fact, the Free State Foundation unabashedly supports near-total deregulation of the telecommunications industry and an elimination of most FCC powers to oversee it. In comments before the House Energy & Commerce Committee, the foundation’s Board of Academic Advisers recommended:

- Updating the Communications Act by wiping it out — a clean slate approach is needed to adopt a “replacement” regime – a new Digital Age Communications Act, which is another way of saying near-complete elimination of all current oversight and enforcement powers exercised by the FCC;

- Lyons, among others, supports eliminating regulation designed around the concept of “in the public interest” with a near-complete deregulation of telecommunications oversight, letting marketplace competition check any bad behavior. The only regulatory activities permitted would require the FCC to show the resulting harm from lack of sufficient competition;

- The group supports disallowing the FCC from issuing rules to prevent anti-competitive or abusive behavior until such behavior has been proven to have taken place. Any rules that result would automatically expire after a fixed number of years;

- States would be prohibited from regulating telecommunications services in instances where states feel federal regulation is inadequate.

Ironically, some of the biggest supporters of the group’s ideas to restrict states from writing telecommunications laws seem to have no problem letting states write laws that ban community broadband networks.

And finally, how could we forget to mention Mr. Yoo, who testified in recent hearings in the Senate Judiciary Committee enthusiastically supporting the merger deal, while not bothering to mention his employer, the University of Pennsylvania law school, has close ties to Comcast. In fact David Cohen, the Comcast executive who is the company’s leading voice in Washington and was the first witness at the hearing, is chairman of the trustees of the University of Pennsylvania.

Subscribe

Subscribe

AT&T U-verse television customers: Al Jazeera America is coming soon to your television lineup whether you want the network or not.

AT&T U-verse television customers: Al Jazeera America is coming soon to your television lineup whether you want the network or not.

Despite the court order to unseal the lawsuit, the Delaware Court of Chancery granted a 10-day stay to allow the parties to finish their settlement and seek an order to expunge the record of the lawsuit.

Despite the court order to unseal the lawsuit, the Delaware Court of Chancery granted a 10-day stay to allow the parties to finish their settlement and seek an order to expunge the record of the lawsuit.

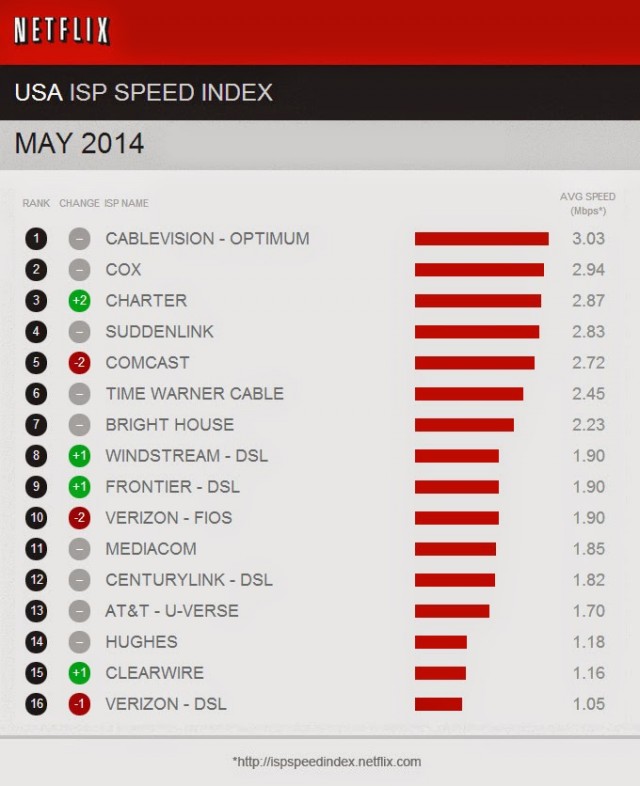

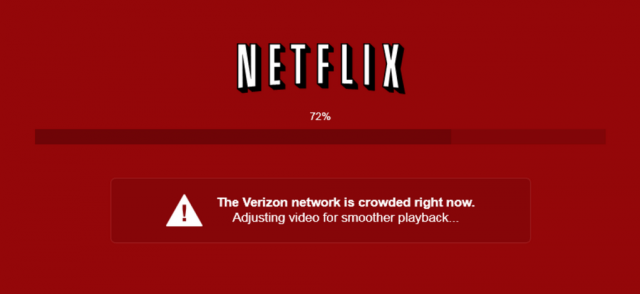

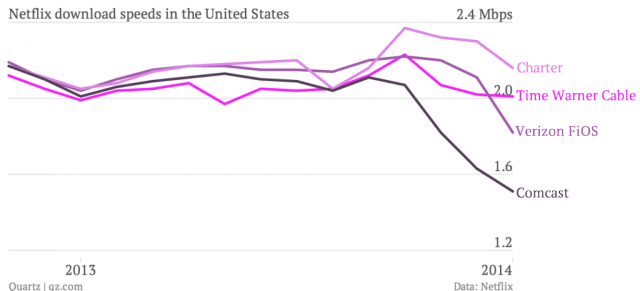

The companies with the biggest drops in Netflix performance are the same ones strongly advocating special paid “fast lanes” on the Internet for preferred traffic to resolve exactly these kinds of performance problems.

The companies with the biggest drops in Netflix performance are the same ones strongly advocating special paid “fast lanes” on the Internet for preferred traffic to resolve exactly these kinds of performance problems.

Subscribers of more than 900 independent cable companies may face an unwelcome surprise this summer in the form of a mid-year rate increase.

Subscribers of more than 900 independent cable companies may face an unwelcome surprise this summer in the form of a mid-year rate increase. “I don’t like to do this because it puts me in a difficult position of raising prices, which no one likes, or reducing the product, which no one likes, or cutting back on the quality of our customer service, which no one likes,” said Gessner. “Large media companies control all the TV programming and they are raising the price. The cost of TV programming is rising very rapidly and it is causing this rise in retail prices.”

“I don’t like to do this because it puts me in a difficult position of raising prices, which no one likes, or reducing the product, which no one likes, or cutting back on the quality of our customer service, which no one likes,” said Gessner. “Large media companies control all the TV programming and they are raising the price. The cost of TV programming is rising very rapidly and it is causing this rise in retail prices.”