A Nashville web developer who signed up for usage-cap exempted Business Class service in one of Comcast’s usage-based billing trial cities received a bill for nearly $3,000 in early termination fees after he was unable to transfer his Comcast Internet service to his new address.

A Nashville web developer who signed up for usage-cap exempted Business Class service in one of Comcast’s usage-based billing trial cities received a bill for nearly $3,000 in early termination fees after he was unable to transfer his Comcast Internet service to his new address.

Adrian Fraim followed the lead of other savvy Comcast customers who have managed to avoid the company’s usage caps by signing up for cap-free Business Class service. For years, Comcast has offered small businesses a commercial service for only slightly more than residential service, without any usage limits. But any customer is free to sign up.

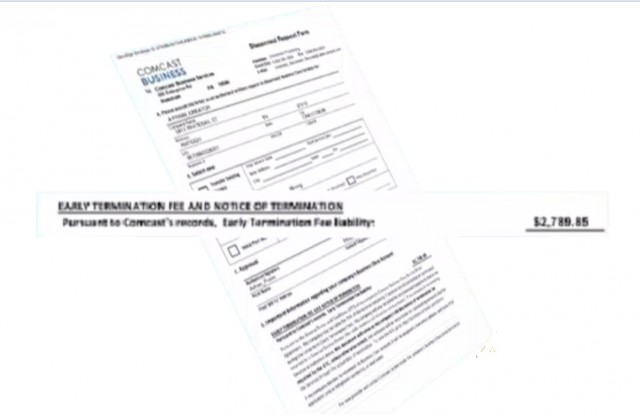

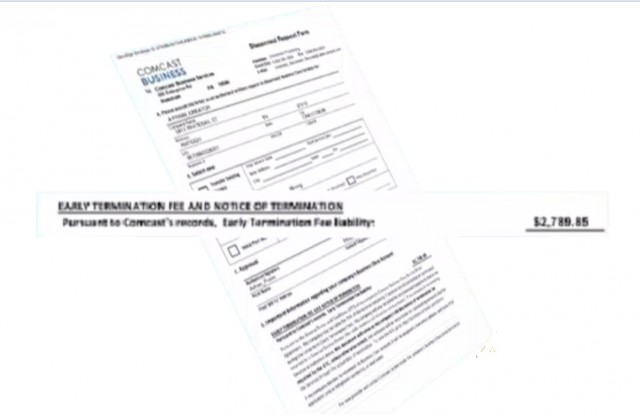

Fraim thought he was getting a good deal and was happy with his broadband service, but Comcast took him to school when he tried to move service from Antioch to his new address in Clarksville, which he later discovered was outside of Comcast’s service area. The cable company treated his move as a violation of his three-year service contract and billed him an early termination fee of $2,789.

“I was just blown away,” Fraim told WSMV-TV. “That’s way too much money for somebody like me to be able to pay. They kept telling me the same thing, ‘you’re under contract, that’s what the contract says.'”

Only Fraim has never seen a printed Comcast contract. The company only offers its general service agreement and acceptable use policy online and it implies commercial customers are under a one-year contract.

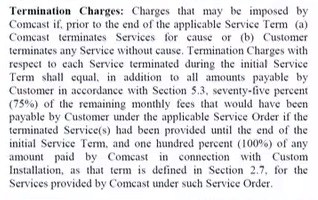

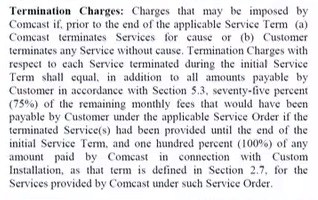

In fact, Comcast’s terms require early-canceling customers to pay 75% of the amount they would have paid on their monthly bill under contract and 100% of any waived custom installation fees. A customer with a $100/mo broadband bill would owe a termination fee of $75 a month for each of up to 36 months of service.

“I didn’t think that was fair, to pay an early termination fee, because I wanted to keep their service,” Fraim said. “And due to them not offering it in my area, I feel like I was being punished because they don’t offer the service here.”

Comcast didn’t seem to care about Fraim’s predicament until reporters called the cable company.

Faced with the prospect of leading the local evening news, Comcast turned Fraim’s frown upside down and finally relented.

Spokesman Alex Horwitz said Comcast does have early termination fees, but because of the extenuating circumstances, “the new location is not serviceable by Comcast,” they will waive the fee.

Comcast has not modified its contract to offer that “get out of penalty jail free”-card to other customers, so be certain to carefully consider the term length of your contract and be sure you have no plans to move outside of a Comcast service area before signing it, unless you have very deep pockets.

[flv]http://www.phillipdampier.com/video/WSMV Nashville Man questions 3000 Comcast bill 11-17-14.mp4[/flv]

WSMV talks with Nashville web developer Adrian Fraim who discovered a nasty surprise when he moved outside of Comcast’s service area – a $2.789 early termination fee. (2:08)

Although it is unlikely to rival Starbucks, Comcast has launched a significant number of store openings in eastern Pennsylvania and New Jersey to handle customer support, bill payments, and equipment exchanges.

Although it is unlikely to rival Starbucks, Comcast has launched a significant number of store openings in eastern Pennsylvania and New Jersey to handle customer support, bill payments, and equipment exchanges.

Subscribe

Subscribe

A Nashville web developer who signed up for usage-cap exempted Business Class service in one of Comcast’s usage-based billing trial cities received a bill for nearly $3,000 in early termination fees after he was unable to transfer his Comcast Internet service to his new address.

A Nashville web developer who signed up for usage-cap exempted Business Class service in one of Comcast’s usage-based billing trial cities received a bill for nearly $3,000 in early termination fees after he was unable to transfer his Comcast Internet service to his new address.

Cable One’s history as a former part of the Washington Post and its publishers — the Graham family — will come to an end next year as it is

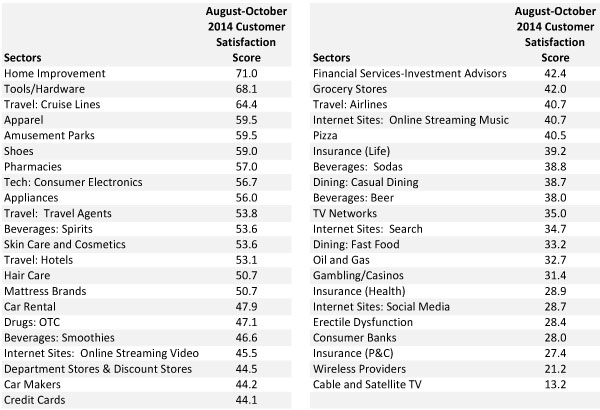

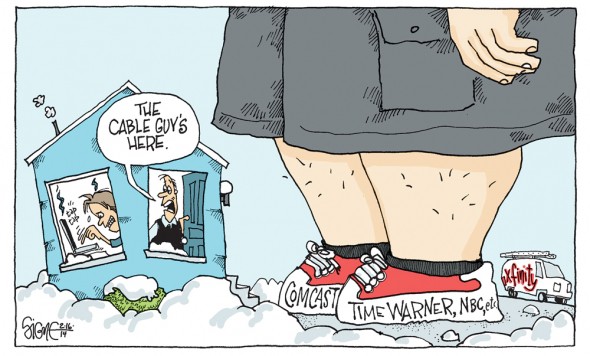

Cable One’s history as a former part of the Washington Post and its publishers — the Graham family — will come to an end next year as it is  Americans would rather deal with unwanted telemarketing calls, fight their insurance company, or pay top dollar for oil and gas because almost anything is better than dealing with the cable company, if it happens to be named Comcast, Time Warner Cable, or Charter.

Americans would rather deal with unwanted telemarketing calls, fight their insurance company, or pay top dollar for oil and gas because almost anything is better than dealing with the cable company, if it happens to be named Comcast, Time Warner Cable, or Charter.

“That to me stands out as a major event over the last few months that has damaged the brand and category perception,” Fraenkel

“That to me stands out as a major event over the last few months that has damaged the brand and category perception,” Fraenkel