Google has announced it will bring its fiber broadband service to four new cities — Atlanta, Charlotte, N.C., Raleigh-Durham, N.C. and Nashville, Tenn., according to a report on Google’s Fiber blog.

Google has announced it will bring its fiber broadband service to four new cities — Atlanta, Charlotte, N.C., Raleigh-Durham, N.C. and Nashville, Tenn., according to a report on Google’s Fiber blog.

In a familiar pattern, Google recently sent invitations to local news organizations in those four cities to attend events this week, without identifying the subject.

As with earlier similar events, the topic was the local launch of Google Fiber.

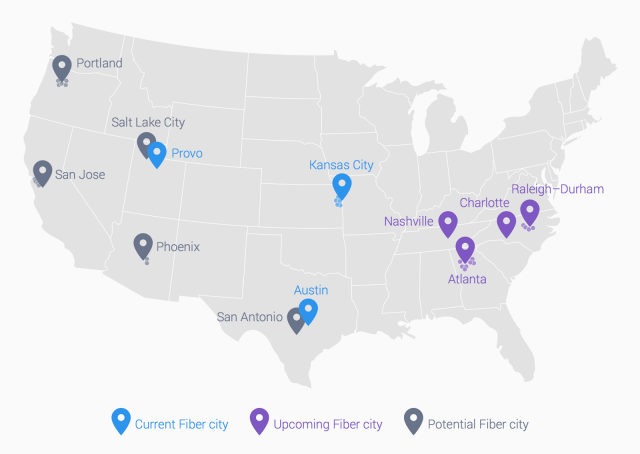

The cities were all on Google’s 2014 list for possible expansion. Those left out (for now) include Salt Lake City, San Antonio, Phoenix, Portland, Ore., and San Jose, Calif. Google recently told city officials in those communities it was still contemplating projects, but remain undecided for now.

After the announcements this week, it will take at least one year before Google is ready to light up the first “fiberhoods” in the cities, usually selected based on customer signups.

Google will challenge Comcast and AT&T in Georgia, Time Warner Cable and CenturyLink in North Carolina, and Comcast and AT&T in Nashville. In Atlanta, the fiber build will not only include Atlanta, but also Avondale Estates, Brookhaven, College Park, Decatur, East Point, Hapeville, Sandy Springs and Smyrna.

Google will offer unlimited gigabit broadband service for an expected $70 a month. AT&T limits U-verse customers to 250GB in Georgia and Tennessee, and Comcast has subjected both Atlanta and Nashville to its compulsory usage cap experiments, setting a monthly usage allowance at 300GB.

Time Warner Cable does not limit broadband customers in North Carolina, but the Republican-dominated state government is also hostile to community-owned broadband, making it unlikely either Raleigh-Durham or Charlotte will see public broadband competition anytime soon.

Google officials have also been reportedly sensitive to local government red tape and regulation. In Portland, the Journal reports Google has put any fiber expansion on hold there because Oregon tax-assessment rules would value Google’s property based on the value of their intangible assets, such as brand. That would cause Google’s property taxes in Oregon to soar. Until the Oregon state legislature makes it clear such rules would not apply to Google Fiber, there will be no Google Fiber in Portland.

Google officials have also been reportedly sensitive to local government red tape and regulation. In Portland, the Journal reports Google has put any fiber expansion on hold there because Oregon tax-assessment rules would value Google’s property based on the value of their intangible assets, such as brand. That would cause Google’s property taxes in Oregon to soar. Until the Oregon state legislature makes it clear such rules would not apply to Google Fiber, there will be no Google Fiber in Portland.

Google has also once again shown its reluctance to consider any community or region where Verizon FiOS now provides fiber optic service. The entire northeastern United States, largely dominated by Verizon, has been “no-go” territory for Google, with no communities making it to their list for possible future expansion.

Among the collateral damage are Verizon-less communities in northern New England served by FairPoint Communications and Comcast and portions of western New York served by Frontier Communications where Time Warner Cable has overwhelming dominance with 700,000 subscribers out of 875,000 total households in the Buffalo and Rochester markets.

Wall Street continues to grumble about the Google Fiber experiment, concerned about the high cost of fiber infrastructure and the potential it will create profit-killing price wars that will cut prices for consumers but cost every competitor revenue.

[flv]http://www.phillipdampier.com/video/WSOC Charlotte Mayor Google Fiber is coming to Charlotte 1-27-15.flv[/flv]

Charlotte city manager Ron Carlee spoke exclusively to WSOC-TV’s Jenna Deery about how Charlotte won Google over to bring its fiber service to the community. Having a close working relationship between city infrastructure agencies and Google was essential, as was cutting red tape and bureaucracy. (2:10)

Subscribe

Subscribe

Let us review:

Let us review:

Luxurious wireless industry profits of up to 50 percent earned from selling some of the world’s most expensive cellular services may soon be a thing of the past as Google and Cablevision prepare to disrupt the market with cheap competition.

Luxurious wireless industry profits of up to 50 percent earned from selling some of the world’s most expensive cellular services may soon be a thing of the past as Google and Cablevision prepare to disrupt the market with cheap competition. Cablevision’s offer, in contrast, will rely entirely on Wi-Fi to power its mobile calling, texting, and data services. Dubbed “Freewheel,” non-Cablevision customers can sign up starting in February for $29.95 a month. Current Cablevision broadband customers get a price break — $9.95 a month.

Cablevision’s offer, in contrast, will rely entirely on Wi-Fi to power its mobile calling, texting, and data services. Dubbed “Freewheel,” non-Cablevision customers can sign up starting in February for $29.95 a month. Current Cablevision broadband customers get a price break — $9.95 a month.

Despite the success of FiOS, Verizon’s senior management continues to devote more attention to its highly profitable Verizon Wireless division, spending an even larger proportion of its total capital investments on wireless services.

Despite the success of FiOS, Verizon’s senior management continues to devote more attention to its highly profitable Verizon Wireless division, spending an even larger proportion of its total capital investments on wireless services.