Without dramatic changes in wireless pricing and more careful usage, owning a smartphone will cost an average of $119 a month per phone by the year 2019.

Without dramatic changes in wireless pricing and more careful usage, owning a smartphone will cost an average of $119 a month per phone by the year 2019.

Ever since the largest players in the wireless industry decided to monetize wireless data usage by ending unlimited use data plans, the average monthly phone bills of smartphone users have been on the increase. In 2013, the average cell phone bill was $76 a month, according to Bureau of Labor statistics. That’s up 50% from the $51 a month customers paid in 2007, the first year the iconic Apple iPhone was offered for sale.

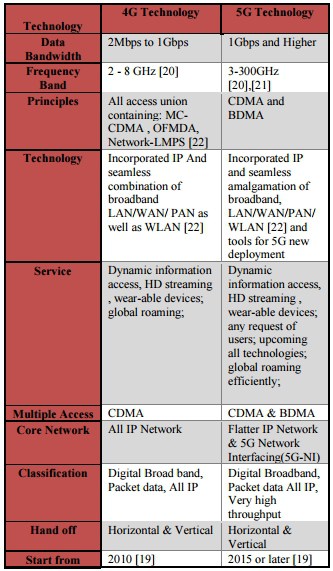

Although wireless companies claim their current 4G (largely LTE) networks are robust enough to sustain the growing demand for wireless data until more spectrum becomes available, the transition to next generation 5G technology will dramatically increase the efficiency of wireless data transmission, delivering up to 40 times the speed of existing 4G networks. But if providers are not willing to slash prices on 5G data plans, average usage and customers’ phone bills are likely to soar to new all-time highs, costing a family of four smartphone owners an average of $476 a month.

A study by Wafa Elmannai and Khaled Elleithy at the Department of Computer Science and Engineering at the University of Bridgeport found wireless carriers have given up on monetizing voice and texting services, including unlimited minutes and text messages as part of most basic service plans. The real money is made from wireless data plans which traditionally cost customers between $10.79-16.72 per gigabyte, depending on the carrier and whatever fees, surcharges and required add-ons are necessary to get the service.

Wireless carriers defend their pricing, claiming they have cut prices on certain data plans while granting some customers extra gigabytes of usage at no extra cost. Some evidence shows that carriers have indeed reduced the asking price of delivering a megabyte of data by 50 percent annually. But their costs to deliver that data have dropped even faster, particularly as networks shift traffic away from older 3G networks to 4G technology, which is vastly more efficient than its predecessor.

Wireless carriers defend their pricing, claiming they have cut prices on certain data plans while granting some customers extra gigabytes of usage at no extra cost. Some evidence shows that carriers have indeed reduced the asking price of delivering a megabyte of data by 50 percent annually. But their costs to deliver that data have dropped even faster, particularly as networks shift traffic away from older 3G networks to 4G technology, which is vastly more efficient than its predecessor.

The end of unlimited data plans by AT&T and Verizon Wireless was key to shifting the industry towards monetizing data usage. The more a customer consumes, the more revenue a carrier earns. But as web pages and applications become more complex and bandwidth intensive, customers will naturally consume more and more data each month, forcing regular usage plan upgrades to avoid confronting overlimit fees. Unless providers pass along more of their savings on traffic costs to consumers, bills will rise.

At current usage estimates from Cisco, the average customer will consume at least 57% more wireless data by 2019 than they do today. To sustain that usage, wireless providers are bidding for additional spectrum rights and are working towards upgrading to next generation 5G technology. But some carriers, including AT&T and Verizon, are also investing in new applications for their networks that include in-car telematics, home security and automation, and online video. Using some of these technologies guarantees an even greater amount of data usage, particularly for online video. Unless customers are careful about their usage and avoid high-bandwidth applications, they are in for a much bigger bill in the future, much to the delight of wireless providers.

While most analysts expect wireless companies will choose to give customers a larger data allowance instead of resorting to fire sale pricing, Elmannai and Elleithy expect that will not be enough to keep cell phone bills stable.

“We will need to reduce the bit rate to (1/1000th) of today’s level in order to receive x1000 of data capacity [at the] same cost [we see today],” the authors conclude. That would mean a low end 1GB data plan on a 4G network would cost just $0.03. Larger allowance plans would cost less than one cent per gigabyte.

The authors of the study expect carriers to price 5G data plans more or less the same as 4G plans, but will probably boost usage allowances to deliver a perception of greater value. But as web applications continue to gravitate towards higher data usage, bills will continue to rise, assuring providers of growing returns even with modest to moderate levels of competition.

At the moment, despite some evidence of price competition, some carriers are still raising prices. Verizon increased the price of its 10GB plan by $20 to $100 a month and T-Mobile raised the price of its unlimited data plan by $10 a month last year.

Subscribe

Subscribe A customer angry over the performance of a Comcast technician in his Berwyn, Ill. home stood in his doorway and blocked the technician from leaving until the work met his satisfaction.

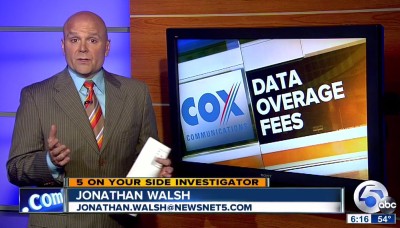

A customer angry over the performance of a Comcast technician in his Berwyn, Ill. home stood in his doorway and blocked the technician from leaving until the work met his satisfaction. This weekend will end the first phase of our campaign to fight Cox usage caps being tested in Cleveland, Ohio. We’re collecting the names and e-mail addresses of interested citizens that would like to participate in the fight to get Cox to drop its usage-based billing and overlimit fee scheme. If you are interested, use the link at the top to “Contact Us” as a volunteer and include your name and a valid email address.

This weekend will end the first phase of our campaign to fight Cox usage caps being tested in Cleveland, Ohio. We’re collecting the names and e-mail addresses of interested citizens that would like to participate in the fight to get Cox to drop its usage-based billing and overlimit fee scheme. If you are interested, use the link at the top to “Contact Us” as a volunteer and include your name and a valid email address. The new CEO of Frontier Communications is promising more fiber to the home service and advanced ADSL2+ and VDSL2 service to dramatically boost Internet speeds… if you happen to live in a Verizon territory Frontier is planning to acquire in Texas, California, or Florida. For Connecticut customers that used to belong to AT&T, Frontier also plans to spend money to further build out AT&T’s U-verse platform to reach more suburban customers not deemed profitable enough to service by AT&T.

The new CEO of Frontier Communications is promising more fiber to the home service and advanced ADSL2+ and VDSL2 service to dramatically boost Internet speeds… if you happen to live in a Verizon territory Frontier is planning to acquire in Texas, California, or Florida. For Connecticut customers that used to belong to AT&T, Frontier also plans to spend money to further build out AT&T’s U-verse platform to reach more suburban customers not deemed profitable enough to service by AT&T.

“We actually see growth opportunity in Connecticut,” McCarthy said. “As we go through and look at the Connecticut property, one of the things that have been a recent development from a technology perspective allows us to serve lower density parts of the state of Connecticut with U-verse product that was limited by densities and loop lengths in the past.”

“We actually see growth opportunity in Connecticut,” McCarthy said. “As we go through and look at the Connecticut property, one of the things that have been a recent development from a technology perspective allows us to serve lower density parts of the state of Connecticut with U-verse product that was limited by densities and loop lengths in the past.”

Things get more complicated for customers in this window. While carriers quickly introduced new two-year plans, there are a number of customers who managed to sign a three-year contract during this transition period. These longer contracts have also been cut to 24 months by the CRTC, but an early termination fee may still apply if the contract has not run a full two years and carriers will be permitted to get back their device subsidy if you have not yet paid off your device.

Things get more complicated for customers in this window. While carriers quickly introduced new two-year plans, there are a number of customers who managed to sign a three-year contract during this transition period. These longer contracts have also been cut to 24 months by the CRTC, but an early termination fee may still apply if the contract has not run a full two years and carriers will be permitted to get back their device subsidy if you have not yet paid off your device.