While consumer groups were busy fighting the Comcast-Time Warner Cable merger, AT&T’s $49 billion purchase of DirecTV has largely flown under the radar, with no comparable organized consumer opposition to the deal. But that does not mean the FCC will approve it as-is.

While consumer groups were busy fighting the Comcast-Time Warner Cable merger, AT&T’s $49 billion purchase of DirecTV has largely flown under the radar, with no comparable organized consumer opposition to the deal. But that does not mean the FCC will approve it as-is.

Negotiations with federal regulators and an exchange of regulatory filings and comments between AT&T, the FCC, and deal critics have apparently forced AT&T to agree to several concessions to make regulators amenable to approving the transaction.

The Washington Post reports that chief among those concessions is AT&T’s willingness to voluntarily abide by certain Net Neutrality rules regardless of any court challenges, including banning the slowing or blocking of websites and agreeing not to accept payments from website operators to speed up their content. AT&T has not said how long it intends to keep that commitment.

Deal opponents are also seeking other concessions from AT&T:

No paid interconnection deals: AT&T must route incoming content to customers without any fees charged to the companies originating the traffic. This became a hot button issue when Netflix felt it was forced to pay Comcast a fee to assure its streamed video content would reach Comcast customers without buffering or other errors. AT&T is expected to fiercely oppose this condition and says it should have the right to make private deals with content delivery firms.

AT&T must offer standalone broadband: With AT&T’s acquisition of DirecTV, more than ever it will have an incentive to sell customers a television bundle with Internet service. Regulators want AT&T to assure broadband-only service remains readily available. AT&T has offered 6Mbps DSL for $34.95 a month as its standalone option. Content delivery firms like Cogent want AT&T to offer 25Mbps service in all of AT&T’s markets for $29.95 a month for at least seven years. The FCC recently defined 25Mbps the minimum speed to qualify as broadband.

No end runs around Net Neutrality with data caps and exemptions: AT&T wants the right to exempt its preferred partners from its usage caps and claims that is beneficial to consumers. But cap opponents claim that is simply another way to collect money from content companies for preferential treatment — an end run around Net Neutrality rules. Opponents of these cap exemptions, known as “zero-rating” claim all content should be treated the same. AT&T could resolve this by removing data caps from its DSL and U-verse services altogether.

Subscribe

Subscribe

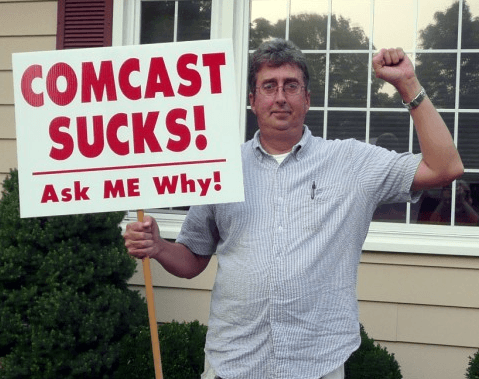

A system audit by Comcast has created a firestorm across Florida’s Panhandle after customers lost dozens of channels while Comcast used it as an opportunity to sell customers more expensive television packages.

A system audit by Comcast has created a firestorm across Florida’s Panhandle after customers lost dozens of channels while Comcast used it as an opportunity to sell customers more expensive television packages. Numerous Tallahassee customers contacted the newspaper and

Numerous Tallahassee customers contacted the newspaper and  Man, do people hate Comcast.

Man, do people hate Comcast. “Dealing with Mediacom is like stepping on a mound of fire ants,” says June Watts, a Mediacom customer in Alabama. “You are going to get stung no matter what you do.”

“Dealing with Mediacom is like stepping on a mound of fire ants,” says June Watts, a Mediacom customer in Alabama. “You are going to get stung no matter what you do.” Mediacom’s customer service forums offer some clues about what makes Mediacom such a problem for its customers. “Cyberpunk 1161” pays for 100/20Mbps service but is lucky to get 10% of that speed on a good day. He started corresponding about his speed issues with Mediacom’s social media team on Feb. 19. He is still having issues as of June 2, nearly four months later, and his conversation with Mediacom has now extended to 15 pages. “WhiteBengal50” has already managed three pages of complaints starting on May 18. Another customer spent one year and four months with his cable line left unburied on his lawn.

Mediacom’s customer service forums offer some clues about what makes Mediacom such a problem for its customers. “Cyberpunk 1161” pays for 100/20Mbps service but is lucky to get 10% of that speed on a good day. He started corresponding about his speed issues with Mediacom’s social media team on Feb. 19. He is still having issues as of June 2, nearly four months later, and his conversation with Mediacom has now extended to 15 pages. “WhiteBengal50” has already managed three pages of complaints starting on May 18. Another customer spent one year and four months with his cable line left unburied on his lawn. Each of 15.4 million Time Warner Cable customers will effectively pay $19.48 to cover executive golden parachutes and Wall Street bank advisory fees if the merger with Charter Communications is approved by regulators.

Each of 15.4 million Time Warner Cable customers will effectively pay $19.48 to cover executive golden parachutes and Wall Street bank advisory fees if the merger with Charter Communications is approved by regulators.

Among investors, a handful of hedge funds will likely walk away with the most money. Paulson & Company, run by the billionaire John Paulson, owned 8.7 million shares of Time Warner Cable stock, according to a March 31 public filing. He is expected to walk away with a profit of at least $250 million by buying low and selling high. Time Warner shares have risen ever since Wall Street found out Time Warner was a willing seller.

Among investors, a handful of hedge funds will likely walk away with the most money. Paulson & Company, run by the billionaire John Paulson, owned 8.7 million shares of Time Warner Cable stock, according to a March 31 public filing. He is expected to walk away with a profit of at least $250 million by buying low and selling high. Time Warner shares have risen ever since Wall Street found out Time Warner was a willing seller.