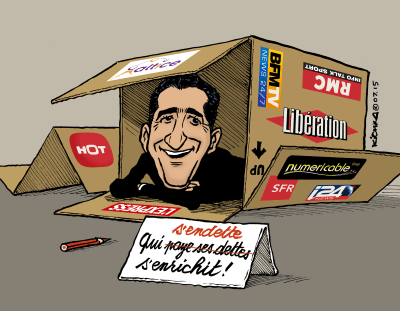

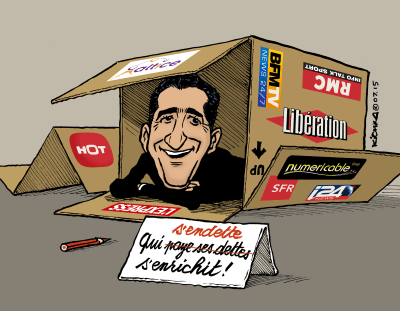

Look what’s in the box. MergeMaster Patrick Drahi. (Illustration: Michel Kichka)

Cable conglomerate baron Patrick Drahi promised American, French and Portuguese consumers he would bring them value for money by taking control of large established telecom companies in both countries and revamp their products and services to bring improved service. Consumer advocates in all three countries continue to argue customers are still waiting for Drahi’s debt-laden Altice empire to deliver on its promises.

A flurry of mid-summer articles in the French media continue to acknowledge Drahi’s formula has brought results — for him and his top executive minions, but has caused headaches for employees, customers, and even the government.

The biggest firestorm involves Altice-owned SFR’s newly-announced plan to slash at least 5,000 more jobs at France’s fourth-largest mobile operator, which also provides wired cable-TV and broadband services in parts of the country. That represents at least one-third of SFR’s total workforce. The planned cuts run so deep, some in the French press call them “violent.” These new cuts are on top of the 1,200 jobs Drahi cut when he took control of SFR two years ago. An Altice executive warned that if they still perceive to be “fat on the bone,” there will be further cuts after that, presumably starting in 2019.

The job cuts have raised the ire of some in the French press because one of the conditions of Altice’s takeover of SFR was a commitment not to cut jobs. But some reporters may have missed the fine print negotiated with regulators — the job protection agreement expires in July 2017, after which Drahi can slash at will. And he will.

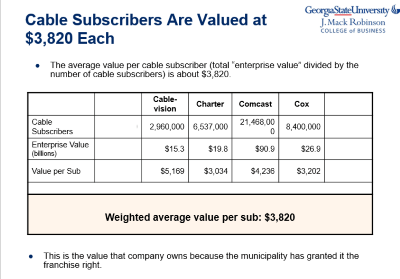

Investment banks love it. American and European banks have loaned €50 billion ($55 billion) — a record amount — to Drahi to buy up telecom companies on a virtual credit card and deliver short-term results by slashing expenses, which at least temporarily boosts profits. When customers find out the implications of the draconian cuts, they complain and tend to leave. But savvy investors learn how to cash out before that happens, often walking away with huge returns. Such methods have been business-as-usual in the United States for a long time. But Drahi has improved on the old formula of relying on OPM – Other People’s Money – to build his empire.

Some of the money flowing through Altice’s coffers comes from the French taxpayer, currently footing the bill for unpopular French President François Hollande’s key measure to boost the competitiveness of French companies — the Tax Credit for Competitiveness and Employment (CICE), which significantly cuts employer’s labor expenses. Altice has been a grateful recipient of this gift from French taxpayers, who pay for it through new ecological taxes and an increase in Value Added Tax (VAT) rates, which like our sales tax, applies to goods and services one buys. The standard VAT rate in France is now 20%, with 10% charged on restaurant meals, transport, renovation/improvement works and certain medical drugs, and 5.5% on food, water and non alcoholic beverages, books, special equipment for the disabled and school meals. The other half of the money spent implementing the CICE came from decreased public spending on infrastructure and social service programs. Take from the poor and middle class and give to the corporations, Hollande’s critics claim. The program was supposed to protect employment, but critics say it has had little or no effect beyond enriching large corporate conglomerates who hire and fire for their own reasons, and are not particularly concerned about what that could do to future government payouts.

Some of the money flowing through Altice’s coffers comes from the French taxpayer, currently footing the bill for unpopular French President François Hollande’s key measure to boost the competitiveness of French companies — the Tax Credit for Competitiveness and Employment (CICE), which significantly cuts employer’s labor expenses. Altice has been a grateful recipient of this gift from French taxpayers, who pay for it through new ecological taxes and an increase in Value Added Tax (VAT) rates, which like our sales tax, applies to goods and services one buys. The standard VAT rate in France is now 20%, with 10% charged on restaurant meals, transport, renovation/improvement works and certain medical drugs, and 5.5% on food, water and non alcoholic beverages, books, special equipment for the disabled and school meals. The other half of the money spent implementing the CICE came from decreased public spending on infrastructure and social service programs. Take from the poor and middle class and give to the corporations, Hollande’s critics claim. The program was supposed to protect employment, but critics say it has had little or no effect beyond enriching large corporate conglomerates who hire and fire for their own reasons, and are not particularly concerned about what that could do to future government payouts.

French newspaper l’Humanité is calling on the government and Mr. Drahi to account for his use of taxpayer-funded CICE aid. The paper demands the Hollande government to disclose exactly how much Altice’s SFR has received from the program.

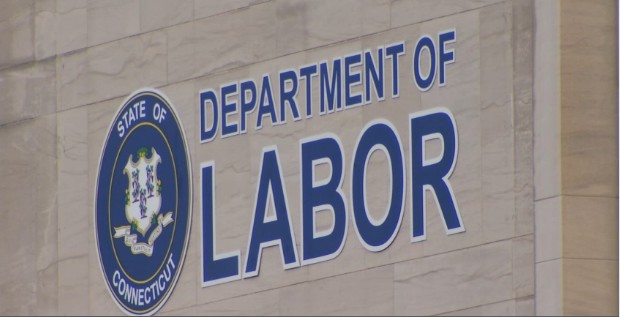

Unemployment office in Connecticut

Altice continues to claim the job cuts will be voluntary — a suggestion scoffed at by employee unions in both France and Portugal, where Altice operates telecommunications companies. In addition to asking Altice-owned Suddenlink and Cablevision employees whether the recent sudden separation from their paychecks was voluntary, unions claim they have the benefit of past experience.

“When they say ‘no job cuts’ and 1,200 have already been cut over the past 18 months, how can we trust them?” asked Frederic Retourney, a spokesman for the CGT-FAPT employee union. “We know that voluntary redundancies are made under duress in most cases. When SFR announces 5,000 job cuts when there are 14,400 employees at the company now, we do not see how one can speak of voluntary departures.”

The job cuts at Altice’s U.S. operations — Suddenlink and Cablevision — have just begun. In a filing with the Connecticut Department of Labor, Altice disclosed it is issuing a total of 587 termination notices in that state — 482 call center workers in Shelton who will lose their jobs Nov. 1 and another 105 in Stratford leaving in two waves Oct. 14 and Dec. 15. Cablevision’s chief Connecticut competitor Frontier Communications is turning Altice’s lemons into Frontier’s lemonade by capitalizing on the job cuts with a quickly organized media push for a job fair on Aug. 31 in New Haven targeting the soon-to-be-former Cablevision workers.

Frontier will hold interviews for the former Altice call-center workers and field technicians. The alternative, if those former Cablevision workers still want to work for Altice, is to move to New York or New Jersey and hope their jobs don’t get cut again. With Frontier, they can stay in Connecticut.

Altice-owned SFR Francophone call center workers face even bigger challenges from relentless demands for cost cuts. In 2015, Altice announced it was open to relocating its Moroccan-based customer care call center to Madagascar, a large and severely economically depressed island nation off the eastern coast of southern Africa. Drahi, who told Wall Street he likes to pay as little as he can in salaries, is evidently upset labor costs in Morocco now force Altice to pay salaries up to €500 a month ($560). The company said it was open to seeking solace hiring French-fluent replacement workers in Antananarivo, Madagascar’s capital city, where the average annual salary is $260. In contrast, Connecticut call center workers make an average of $14.80/hour, according to Indeed.

Altice-owned SFR Francophone call center workers face even bigger challenges from relentless demands for cost cuts. In 2015, Altice announced it was open to relocating its Moroccan-based customer care call center to Madagascar, a large and severely economically depressed island nation off the eastern coast of southern Africa. Drahi, who told Wall Street he likes to pay as little as he can in salaries, is evidently upset labor costs in Morocco now force Altice to pay salaries up to €500 a month ($560). The company said it was open to seeking solace hiring French-fluent replacement workers in Antananarivo, Madagascar’s capital city, where the average annual salary is $260. In contrast, Connecticut call center workers make an average of $14.80/hour, according to Indeed.

Connecticut State Rep. Laura Hoydick (R-Stratford) acknowledges employee life with Altice in charge of Cablevision may be a tough ride.

“Having gone through unemployment with family members — and now me — emphasizes how the Cablevision employees are nervous for their livelihood and existence,” Hoydick told The Hour. “I thought it was great that the Frontier folks saw that there was an already-trained workforce here in Connecticut.”

Other state Republicans are attempting to blame Democratic Gov. Dannel P. Malloy for Cablevision’s job cuts, characterizing them as evidence employers are fleeing the high taxes and expenses associated with running a business in Connecticut.

“People are making a choice: ‘Do I stay in Connecticut and weather the storm, or do I move out of the state?’” said state Rep. Jason Perillo (R-Shelton).

For now, those decisions are mostly made by Altice’s cable company call center workers and some members of middle management. But Patrick Drahi’s long-term plan to conquer the media business depends on implementing his “convergence” strategy, which means owning and controlling not only the means of distribution, but also the product being distributed. l’Humanité compared Drahi’s business to a multibillion cephalopod, with octopus-like tentacles extending his control and influence well beyond the cable business.

For now, those decisions are mostly made by Altice’s cable company call center workers and some members of middle management. But Patrick Drahi’s long-term plan to conquer the media business depends on implementing his “convergence” strategy, which means owning and controlling not only the means of distribution, but also the product being distributed. l’Humanité compared Drahi’s business to a multibillion cephalopod, with octopus-like tentacles extending his control and influence well beyond the cable business.

In France, he is accomplishing his mission by buying up cable networks, newspapers, and other media outlets which he packages together. Now a customer doesn’t just buy cable TV — he buys TV, internet, phone, the daily newspaper, and magazines for one flat price. For about $22 a month, SFR customers get unlimited digital access to 17 newspapers and magazines including Libération, l’Express, and l’Expansion. Then you can watch Drahi’s new sports channels and local news channel — all owned by Altice. Drahi told the French Senate his new bundled media model could “save the press.” But dig a little deeper and you discover Drahi’s altruism is considerably more limited.

By bundling everything together, the Altice-owned businesses each enjoy the enormous benefit of having their products taxed at the special press VAT rate of 2.1%, down from the usual 20% that would be otherwise owed. Altice pockets the savings for itself — a considerable boost in gross revenue.

More conservative investors worry about how Altice is managing to pay for all of its acquisitions and still manage to cover its existing massive debt, especially as Drahi plots to bring his model to the United States. His goal in America: to create the largest or second-largest telecom company in the country. Worried shareholders have been placated by the news massive layoffs are in SFR’s future, with the cost-savings they bring. Those still not satisfied were quieted after Numericable, another Altice concern, borrowed almost two billion dollars and raided Altice’s treasury for another billion to finance a dividend payout to shareholders worth more than $2.5 billion. Of course, Mr. Drahi himself is among the top recipients.

Subscribe

Subscribe Time Warner Cable Arena is no more.

Time Warner Cable Arena is no more.

Further expansion of Google Fiber

Further expansion of Google Fiber

But like all publicly traded companies, Google must answer to Wall Street and their investors and some are not happy with what they see from Google Fiber. Craig Moffett from Wall Street research firm MoffettNathanson has rarely been a fan of any broadband provider other than cable operators and Google Fiber is no different.

But like all publicly traded companies, Google must answer to Wall Street and their investors and some are not happy with what they see from Google Fiber. Craig Moffett from Wall Street research firm MoffettNathanson has rarely been a fan of any broadband provider other than cable operators and Google Fiber is no different.

Some of the money flowing through Altice’s coffers comes from the French taxpayer, currently footing the bill for unpopular French President François Hollande’s key measure to boost the competitiveness of French companies — the Tax Credit for Competitiveness and Employment (CICE), which significantly cuts employer’s labor expenses. Altice has been a grateful recipient of this gift from French taxpayers, who

Some of the money flowing through Altice’s coffers comes from the French taxpayer, currently footing the bill for unpopular French President François Hollande’s key measure to boost the competitiveness of French companies — the Tax Credit for Competitiveness and Employment (CICE), which significantly cuts employer’s labor expenses. Altice has been a grateful recipient of this gift from French taxpayers, who

Altice-owned SFR Francophone call center workers face even bigger challenges from relentless demands for cost cuts. In 2015, Altice announced it was open to

Altice-owned SFR Francophone call center workers face even bigger challenges from relentless demands for cost cuts. In 2015, Altice announced it was open to  For now, those decisions are mostly made by Altice’s cable company call center workers and some members of middle management. But Patrick Drahi’s long-term plan to conquer the media business depends on implementing his “convergence” strategy, which means owning and controlling not only the means of distribution, but also the product being distributed. l’Humanité compared Drahi’s business to a multibillion cephalopod, with octopus-like tentacles extending his control and influence well beyond the cable business.

For now, those decisions are mostly made by Altice’s cable company call center workers and some members of middle management. But Patrick Drahi’s long-term plan to conquer the media business depends on implementing his “convergence” strategy, which means owning and controlling not only the means of distribution, but also the product being distributed. l’Humanité compared Drahi’s business to a multibillion cephalopod, with octopus-like tentacles extending his control and influence well beyond the cable business.