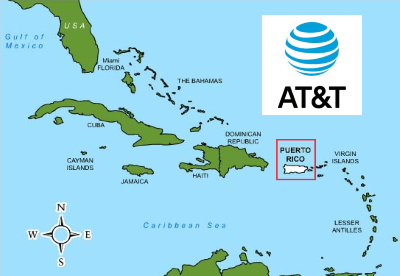

Reuters reports AT&T is exploring the possibility of leaving Puerto Rico, with a possible sale of its assets for around $3 billion.

Reuters reports AT&T is exploring the possibility of leaving Puerto Rico, with a possible sale of its assets for around $3 billion.

AT&T is under pressure to reduce its large debt load after acquiring Time Warner (Entertainment) in 2018 for $85 billion, which left the telco with a total debt of $164 billion. CEO Randall Stephenson told shareholders he has made cutting debt at the company a major priority, resulting in job cuts, a sale of AT&T’s stake in Hulu for $1.43 billion, and letting go of WarnerMedia’s Hudson Yards offices in Manhattan for almost $2.2 billion.

AT&T has also indicated it is winding down its fiber broadband expansion program and is expecting to layoff additional workers as projects are finished around the country.

A complete exit from Puerto Rico would require a sale of AT&T’s wireless network, largely acquired after completing a buyout of Centennial Communications in 2009. AT&T has been earning about $300 million a year from its internet, TV, landline, and business service business on the island.

The company has hired a financial adviser to explore such a sale, but a source indicated AT&T may cancel its exit plans if it does not attract adequate bids. Potential acquirers include media companies and private equity firms. Buyers will face running the business in a compromised economy still recovering from 2017’s Hurricane Maria.

Subscribe

Subscribe

The only buyer I see that can afford that massive acquisition is Orange.